Global Aquarium Market Size, Share, Trends, & Growth Forecast Report Segmented By Material Type (Glass, Acrylic, Plastic), Application, Distribution Channel, And Region (Latin America, North America, Asia Pacific, Europe, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Aquarium Market Size

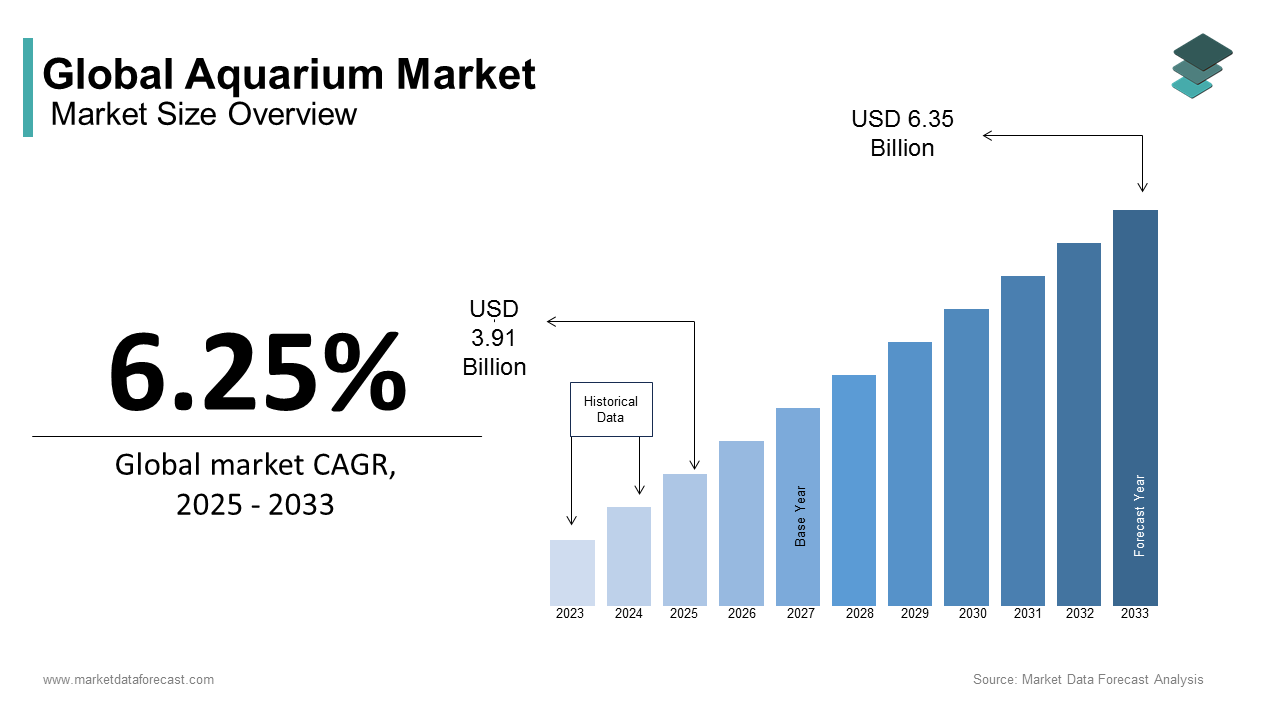

The global aquarium market size was valued at USD 3.68 billion in 2024 and is expected to reach USD 6.35 billion by 2033 from USD 3.91 billion in 2025. The market is projected to grow at a CAGR of 6.25%.

The global aquariums can be small tanks in homes or huge public exhibits in aquariums and zoos. People keep aquariums for decoration, relaxation, and education. Over the years, this hobby has grown a lot, thanks to new technology, creative designs, and increasing awareness about protecting marine life. In the United States, keeping fish as pets is very common. The American Pet Products Association (APPA) says that in 2023-2024, around 11.1 million U.S. households had freshwater fish, making them the third most popular pet after dogs and cats. This proves that aquariums play an important role in the pet industry and are loved by many people.

Large public aquariums also help people learn about marine life and how to protect it. For example, the Georgia Aquarium in Atlanta attracts over 2 million visitors every year. These places give people a chance to see marine animals up close, understand their world, and learn about conservation. New technology has made aquarium care much easier. There are now LED lights that save energy, smart filters, and automatic fish feeders. These features make aquarium keeping more fun and less time-consuming for beginners and experts alike. With growing awareness of eco-friendly practices, the aquarium market is expected to expand and continue influencing homes and public spaces worldwide.

MARKET DRIVERS

More People Owning Fish as Pets

More people are keeping fish as pets, which is helping the aquarium market grow. A report from the American Pet Products Association (APPA) for 2023-2024 states that about 11.1 million U.S. households own freshwater fish. This makes fish the third most popular pet, after dogs and cats. Many people choose fish because they require less daily care and bring a peaceful atmosphere to homes. Watching fish swim has been linked to lower stress levels and a relaxing environment. As more families want to bring nature inside their homes, they buy more aquariums and accessories, which helps the aquarium market grow.

Public Aquariums Help People Learn About Marine Life

Large public aquariums help people learn about marine animals and how to protect them. For example, the Georgia Aquarium in Atlanta attracts more than 2 million visitors every year. These places allow visitors to see sharks, dolphins, and colorful fish up close. They also educate people about the importance of ocean conservation. Many visitors become interested in keeping fish as pets after visiting these aquariums. Public aquariums also support research and breeding programs to help endangered species. Because of their influence, more people are learning to care for fish and the aquarium market continues to grow.

MARKET RESTRAINTS

Harm to Wild Fish and Coral Reefs

Catching wild fish for home aquariums can hurt the environment. The United Nations Environment Programme (UNEP) says that each year, more than 20 million tropical fish from 1,471 species are collected for aquariums. Also, about 12 million pieces of stony coral are removed from reefs. Some collectors use harmful methods like cyanide poisoning, which kills coral reefs and harms other sea animals. These practices reduce fish populations in the wild and damage ecosystems. As people become more aware of this issue, they may avoid buying wild-caught fish, which could slow down the aquarium market.

Strict Rules for Buying and Selling Fish

Many governments have created strict rules to protect fish and corals from being overharvested. The Convention on International Trade in Endangered Species (CITES) requires special permits for trading certain fish and corals. In the United Kingdom, the Department for Environment, Food & Rural Affairs (DEFRA) controls how these animals are imported and exported. Only certain airports and seaports allow these shipments, and approval can take up to 30 days. While these rules help protect nature, they also make it harder for businesses to sell fish and aquarium supplies across borders. The extra paperwork and waiting times can make fishkeeping more expensive.

MARKET OPPORTUNITIES

Teaching People About Oceans and Marine Life

Aquariums are important for teaching people about the ocean and marine animals. The Association of Zoos and Aquariums (AZA) reports that accredited aquariums in the U.S. receive over 183 million visitors annually. They also run educational programs that reach 12 million students every year. The National Marine Fisheries Service (NMFS), part of NOAA, found that visiting aquariums helps people understand marine ecosystems 50% better. The U.S. Department of Education states that hands-on learning, like touching sea creatures at aquariums, improves knowledge retention by 65%. As public aquariums expand their educational programs, more people will learn about fishkeeping, which will help the aquarium market grow.

New Technology Making Aquariums Easier to Maintain

Technology is improving the way people set up and care for aquariums. The U.S. Department of Energy says that LED aquarium lights can reduce electricity use by up to 75%. The Environmental Protection Agency (EPA) supports advanced water filtration systems that can recycle up to 90% of water, making fish tanks more eco-friendly. The Smithsonian Institution reports that interactive displays and virtual reality (VR) exhibits increase public engagement by 45% in aquariums. These new technologies help aquarium owners save money, reduce waste, and make fishkeeping easier, attracting more beginners and growing the market.

MARKET CHALLENGES

Aquariums Can Be Expensive and Hard to Maintain

Starting and maintaining an aquarium can be expensive. Setting up a fish tank requires buying a tank, filter, heater, lights, and decorations, which can cost a lot of money. Some fish also need specialized food, water treatments, and cleaning equipment. Even after setting up, running an aquarium can be costly, as owners have to pay for electricity and supplies regularly. Some tanks, especially saltwater aquariums, need extra care and regular monitoring. Many people who are looking for a low-maintenance pet may avoid aquariums, which reduces the number of new fishkeepers and slows down the aquarium market’s growth.

People Choosing Other Pets Over Fish

The aquarium market faces competition from other pets that are seen as easier to care for or more interactive. Many people prefer pets that they can play with or train, like dogs, cats, or small mammals. Even reptiles and birds have become popular choices for people looking for low-maintenance pets. Because fish require specific equipment, water care, and feeding schedules, some people find it easier to own other pets. This shift in pet ownership makes it harder for the aquarium market to attract new hobbyists. To stay competitive, aquarium businesses may need to offer beginner-friendly options that require less upkeep.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.25% |

|

Segments Covered |

By Material Type, Application, Distribution, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

EHEIM GmbH & Co. KG. (Germany), Aqua Design Amano Co., Ltd. (Japan), Tropical Marine Centre (TMC) (U.K.), Sensen Group Co., Ltd. (China), TSUNAMI AQUARIUMS (U.S.), Spectrum Brands, Inc. (U.S.), UWEL Aquarium AG & Co. KG. (Germany), Guangzhou Akaida Aquarium Co., Ltd. (China), Aquarium Design India (India), and JUWEL Aquarium AG & Co. KG. (Germany) |

SEGMENTAL ANALYSIS

By Material Type Insights

The glass segment held the major share of 60.12% of the global market share in 2024. The growth of the glass segment is primarily due to durability, transparency, and resistance to scratches, making it ideal for long-term use. The Environmental Protection Agency (EPA) highlights that glass is 100% recyclable, reducing environmental impact, which aligns with sustainability trends. According to the U.S. Environmental Protection Agency, over 80% of recovered glass is recycled into new products, minimizing waste. Additionally, the National Institute of Standards and Technology (NIST) notes that glass maintains structural integrity under varying temperatures, ensuring safety for aquatic life. Its affordability and widespread availability further solidify its dominance in the aquarium market.

The acrylic is the fastest-growing segment with a Compound Annual Growth Rate (CAGR) of 7.5% and is driven by its lightweight and durable properties. The U.S. Department of Energy states that acrylic’s manufacturing process consumes 30% less energy compared to glass, making it more sustainable. The National Institute of Standards and Technology (NIST) confirms that acrylic offers 92% light transmittance, enhancing visibility and aesthetic appeal. Its shatterproof nature reduces safety risks, particularly in households, as highlighted by the Consumer Product Safety Commission (CPSC), which reports a 40% reduction in breakage-related injuries with acrylic materials. Advancements in polymer technology have also reduced production costs, further boosting adoption. Acrylic’s versatility and alignment with modern consumer demands underscore its rapid growth trajectory.

By Application Insights

The residential segment led the market by holding a 65.1% of the global market share in 2024. The domination of residential segment is primarily driven by increasing disposable incomes and urbanization, with the U.S. Census Bureau reporting that over 83% of Americans live in urban areas, where space-efficient aquariums are popular. The Environmental Protection Agency (EPA) highlights that indoor plants and water features, including aquariums, improve indoor air quality by reducing carbon dioxide levels by up to 10%. Additionally, the Centers for Disease Control and Prevention (CDC) notes that engaging in hobbies like fishkeeping can reduce stress and anxiety by 20%. Residential aquariums cater to this demand for relaxation and aesthetic enhancement. Their affordability and ease of maintenance make them a preferred choice for homeowners, solidifying their position as the largest application segment.

The commercial segment is another major segment and is estimated to witness the highest CAGR of 8.2% over the forecast period owing to the rising investments in hospitality and retail spaces, as highlighted by the U.S. Department of Commerce, which reports a 12% annual increase in experiential retail designs incorporating interactive elements like aquariums. The Occupational Safety and Health Administration (OSHA) emphasizes that visually appealing environments, such as those with aquariums, improve workplace satisfaction and productivity by up to 15%. Furthermore, the National Oceanic and Atmospheric Administration (NOAA) states that businesses incorporating marine-themed attractions see a 30% increase in customer dwell time, boosting sales. Advancements in durable materials like acrylic have reduced installation costs, driving adoption. The commercial segment’s rapid expansion underscores its role in enhancing aesthetics and consumer experiences across industries.

By Distribution Channel Insights

The retail outlets segment commanded the aquarium market by holding a 60.8% of the global market share in 2024. Factor tactile shopping experience that retail outlets offer by allowing customers to inspect products before purchase is majorly propelling the expansion of the segment in the global market. The U.S. Census Bureau reports that 82% of consumers prefer in-store purchases for items requiring expert advice, such as aquariums, due to the availability of knowledgeable staff. Additionally, the National Retail Federation (NRF) highlights that offline channels account for 70% of customer trust in product authenticity, as physical stores provide immediate access to warranties and support. Retail outlets also enable instant gratification through immediate product availability. Their widespread presence and ability to offer hands-on demonstrations make them critical for driving sales, especially among first-time buyers.

The e-commerce segment is estimated to showcase the fastest CAGR of 12.5% over the forecast period. This growth is driven by increasing internet penetration, with the Federal Communications Commission (FCC) reporting that 94% of Americans now have access to high-speed internet. The U.S. Census Bureau states that e-commerce sales grew by 14.3% annually in 2022, driven by convenience and doorstep delivery. Furthermore, the Consumer Product Safety Commission (CPSC) notes that online platforms reduce overhead costs by 35%, enabling competitive pricing and wider product accessibility. Advancements in logistics, such as same-day delivery services, have further boosted adoption. E-commerce’s rapid expansion underscores its importance in reaching tech-savvy consumers and expanding market accessibility globally.

REGIONAL ANALYSIS

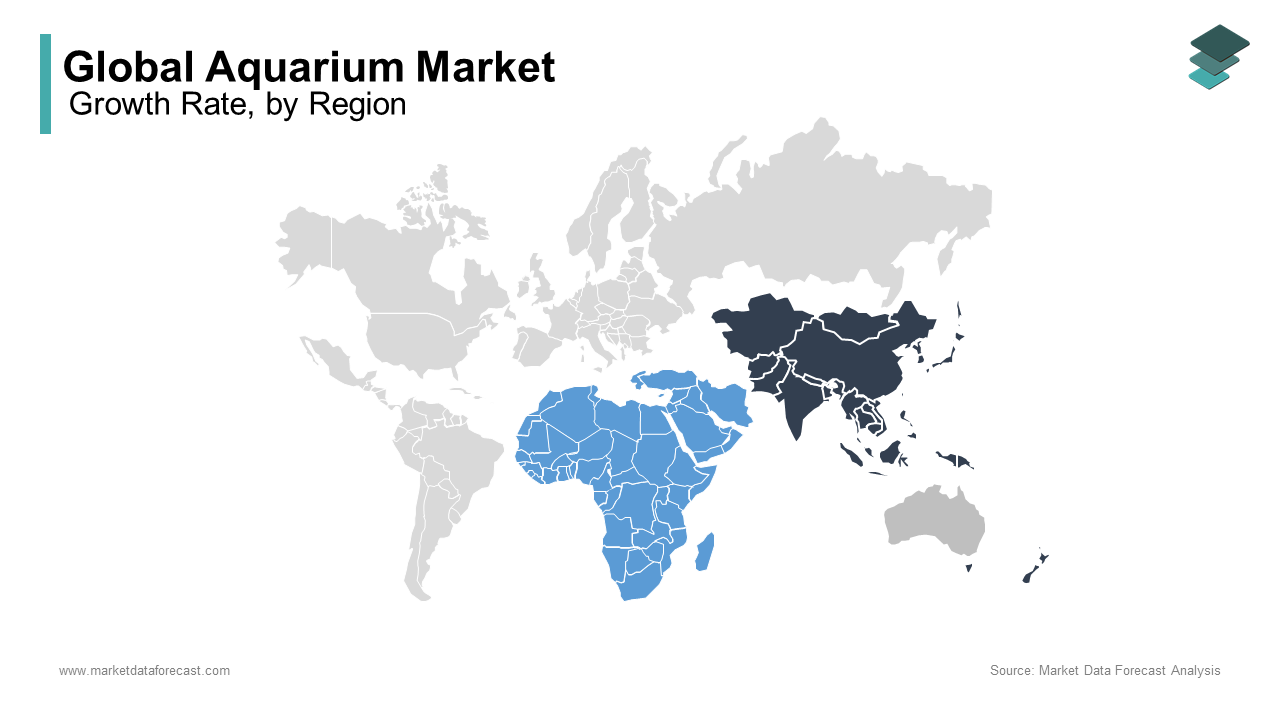

The Asia-Pacific region dominated the market aquarium market globally in 2024 by accounting for 40.2% of the global market share. The domination of the Asia-Pacific region in the global market is majorly due to fast-growing cities and higher spending on hobbies. The United Nations states that 60% of the world's urban growth is happening in this region. This means more people are moving to cities, leading to an increase in demand for decorative and relaxing indoor features like aquariums. The World Bank reports that household spending on leisure activities, including home aquariums, has risen by 20% over the past 10 years. Another important factor is fish farming. The Food and Agriculture Organization (FAO) states that 60% of the world’s fish farming happens in Asia, which supports the ornamental fish trade. Many Asian cultures also see aquariums as a symbol of peace and good luck, increasing demand. Because of these reasons, Asia-Pacific is the most important region for aquariums, influencing the future of design, production, and sales in the industry.

The Middle East and Africa is predicted to witness a CAGR of 9.8% over the forecast period owing to the luxury tourism and urbanization. The World Tourism Organization (UNWTO) states that luxury hotels and resorts in the region are installing more aquariums, with a 10% increase each year. The African Development Bank also reports that urbanization in Africa is rising at a rate of 3.5% per year, leading to more interest in home aquariums. Additionally, sustainability efforts in the region are boosting demand for eco-friendly aquarium designs. The United Nations Environment Programme (UNEP) states that many new aquariums use sustainable materials and energy-saving systems, making them more attractive to consumers. Another reason for growth is cheaper acrylic aquariums, which are now more widely available, making fishkeeping more affordable. These factors show that the Middle East and Africa have great potential for the aquarium market, offering new opportunities for growth and innovation.

North America is a major player in the aquarium market and the market growth in this region is driven by the high disposable incomes and a strong pet ownership culture. According to the American Pet Products Association (APPA), 67% of U.S. households own a pet, and fish are among the top five most popular choices. Many people like fish because they are easy to care for and require less space than other pets. Aquariums also provide health benefits. The U.S. Environmental Protection Agency (EPA) states that indoor water features, like fish tanks, help improve air quality by adding humidity, which is good for respiratory health. Another factor is urbanization. The U.S. Census Bureau reports that major cities like New York and Los Angeles are seeing higher demand for small, stylish aquariums as people look for modern indoor decorations. With a steady annual growth rate of 4-5%, North America will continue to focus on smart aquarium technology and sustainable designs, appealing to eco-conscious consumers.

Europe is a well-established and stable aquarium market, with steady growth driven by eco-friendly practices and energy-saving technology. The European Environment Agency (EEA) states that 60% of European consumers prefer energy-efficient products, including LED-lit aquariums that reduce energy use by up to 30%. This strong focus on sustainability influences both hobbyists and commercial aquarium owners. Additionally, household spending on leisure activities has increased. According to Eurostat, spending on hobbies, including aquariums, has grown by 2% every year over the past five years. Fishkeeping is also supported by trade and breeding industries. The Food and Agriculture Organization (FAO) reports that Europe accounts for 15% of the world’s ornamental fish trade, helping to sustain the market. With a predicted annual growth rate of 4%, Europe will continue to develop eco-friendly, modular, and recyclable aquarium products, keeping up with consumer demand for sustainable choices.

Latin America is an emerging market in the aquarium market, with growing demand due to urbanization and increasing incomes. The United Nations Economic Commission for Latin America and the Caribbean (ECLAC) reports that urban populations in Brazil and Mexico are increasing by 2% annually, leading to more interest in home aquariums. As the middle class expands, people are spending more on leisure and hobbies. The Inter-American Development Bank states that spending on leisure activities has risen by 10% over the past decade. Fishkeeping is also supported by local fish farming. The Food and Agriculture Organization (FAO) reports that aquaculture production in Latin America has increased by 5% annually, making fish more accessible for aquarium owners. With an expected growth rate of 5% per year, Latin America will focus on making aquariums more affordable and durable, meeting the needs of its expanding urban population and evolving consumer preferences.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the global aquarium market include EHEIM GmbH & Co. KG. (Germany), Aqua Design Amano Co., Ltd. (Japan), Tropical Marine Centre (TMC) (U.K.), Sensen Group Co., Ltd. (China), TSUNAMI AQUARIUMS (U.S.), Spectrum Brands, Inc. (U.S.), UWEL Aquarium AG & Co. KG. (Germany), Guangzhou Akaida Aquarium Co., Ltd. (China), Aquarium Design India (India), and JUWEL Aquarium AG & Co. KG. (Germany)

The global aquarium market is highly competitive, driven by technological advancements, sustainability efforts, and evolving consumer preferences. Key players, including Spectrum Brands Holdings, Mars, Incorporated, and Rolf C. Hagen Group, dominate the market with strong brand recognition, innovative product offerings, and extensive global distribution networks. These companies continuously invest in research and development to introduce advanced filtration systems, smart aquarium lighting, and eco-friendly water treatments, setting them apart from smaller competitors.

The market is also seeing increased competition from emerging regional players in Asia, particularly in China and India, where demand for affordable and customizable aquarium solutions is growing. Additionally, e-commerce platforms like Amazon, Walmart, and specialized pet retailers have intensified competition by providing a wider selection of aquarium products at competitive prices.

Sustainability has become a key differentiator, with companies focusing on reef-safe formulations, biodegradable packaging, and energy-efficient products to attract environmentally conscious consumers. Furthermore, the rise of smart technology in aquariums, including automated feeding, remote-controlled water quality monitoring, and AI-driven filtration systems, has led to innovation-driven competition.

Overall, the aquarium market remains dynamic and fragmented, with both established brands and new entrants vying for market share through product innovation, customer engagement, and global expansion strategies.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Technology Advancement – Spectrum Brands Holdings, Inc.

Spectrum Brands Holdings, Inc. continuously invests in research and development to create cutting-edge aquarium solutions. The company focuses on advanced filtration systems, smart aquarium lighting, and enhanced water treatment solutions to improve the fishkeeping experience. Brands like Tetra and Marineland have introduced energy-efficient LED lighting, bio-filtration technology, and smart water monitoring systems that allow aquarium owners to maintain optimal water conditions effortlessly. By integrating automation and sustainability features, Spectrum Brands stays ahead in the competitive market, catering to both beginner and experienced aquarium hobbyists.

Sustainability and Eco-Friendly Initiatives – Mars, Incorporated

Mars, Incorporated emphasizes sustainability as a core strategy in its aquarium business, particularly through Mars Fishcare’s API brand. The company develops eco-friendly water treatments, biodegradable packaging, and responsibly sourced fish food to minimize the environmental impact of aquarium keeping. By promoting reef-safe products and supporting marine conservation initiatives, Mars positions itself as a leader in sustainable aquatics. Additionally, its investment in research-backed water conditioners and filtration solutions helps reduce the need for excessive water changes, conserving resources while maintaining optimal fish health.

Global Expansion and Distribution Network Strengthening – Rolf C. Hagen Group

Rolf C. Hagen Group has aggressively expanded its global footprint by strengthening its supply chain, increasing partnerships with retailers, and enhancing online sales channels. The company’s Fluval and Marina brands are now widely available in North America, Europe, Asia, and Australia, catering to different consumer needs in both developed and emerging markets. Hagen’s strategic alliances with e-commerce platforms like Amazon, Walmart, and specialized pet retailers have significantly improved accessibility to its products. By expanding distribution and ensuring efficient logistics, Hagen continues to dominate the global aquarium market.

Brand Diversification and Product Line Expansion – Spectrum Brands Holdings, Inc.

Spectrum Brands strategically diversifies its product offerings by acquiring complementary brands and expanding into new categories. The Marineland and Instant Ocean brands cater to saltwater aquarium enthusiasts, while Tetra dominates the freshwater fish care segment. The company also offers advanced filtration solutions, automated feeders, and high-quality fish food to cover every aspect of aquarium care. By continuously expanding its product lines to meet the evolving demands of aquarium owners, Spectrum Brands strengthens its market leadership and attracts a broader customer base.

RECENT MARKET DEVELOPMENTS

- In January 2025, Mowi, a leading seafood company, agreed to acquire a majority stake in Nova Sea for approximately €625 million. This strategic move aims to enhance Mowi's position in the aquaculture sector.

- In December 2024, the European Commission's Joint Research Centre released the 2024 EU Industrial R&D Investment Scoreboard. This report monitors and benchmarks the performance of the EU's leading industrial R&D investors against their global peers, providing valuable insights into investment trends across various sectors, including aquaculture.

- In February 2024, the UK government reopened a £6 million fund to support the English fishing industry. The Fisheries and Seafood Scheme (FaSS) offers financial assistance for projects that enhance the sustainability and profitability of the seafood sector, which may indirectly benefit the aquarium market by promoting sustainable practices.

DETAILED SEGMENTATION OF GLOBAL AQUARIUM MARKET INCLUDED IN THIS REPORT

This research report on the global aquarium market has been segmented and sub-segmented based on material type, application, distribution channel, & region.

By Material Type

- Glass

- Acrylic

- Plastic

By Application

- Residential

- Commercial

By Distribution Channel

- Retail Outlets/Offline

- E-commerce/Online

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. Which factors influence the demand for aquariums?

Factors include pet ownership trends, disposable income, aquarium hobbyist communities, and technological advancements in aquarium equipment.

2. Who are the target customers for aquarium products?

Target customers include hobbyists, pet owners, commercial businesses (hotels, restaurants, offices), and educational institutions.

3. What challenges does the aquarium market face?

Challenges include high maintenance costs, environmental concerns, and regulations on the trade of exotic fish.

4. How is technology impacting the aquarium market?

Smart aquariums with automated lighting, temperature control, and water quality monitoring are gaining popularity.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]