Global Aquafeed Market Size, Share, Trends & Growth Forecasts Report By Type (Fish, Crustaceans, Mollusks and Others), Ingredient (Soybean, Corn, Fishmeal, Fish Oil, Additives and Others), Application (Carp, Rainbow Trout, Salmon, Crustaceans, Tilapia, Catfish, Sea Bass, Grouper and Others), Additives (Antibiotics, Vitamins & Minerals, Antioxidants, Amino Acids, Enzymes, Probiotics, Prebiotics and Others), Form (Dry, Wet, Moist), Lifecycle (Starter Feed, Grower Feed, Finisher Feed, Brooder Feed), and Region (Asia Pacific, Europe, North America, Latin America, Middle East & Africa), Industry Analysis (2025 to 2033)

Global Aquafeed Market Size

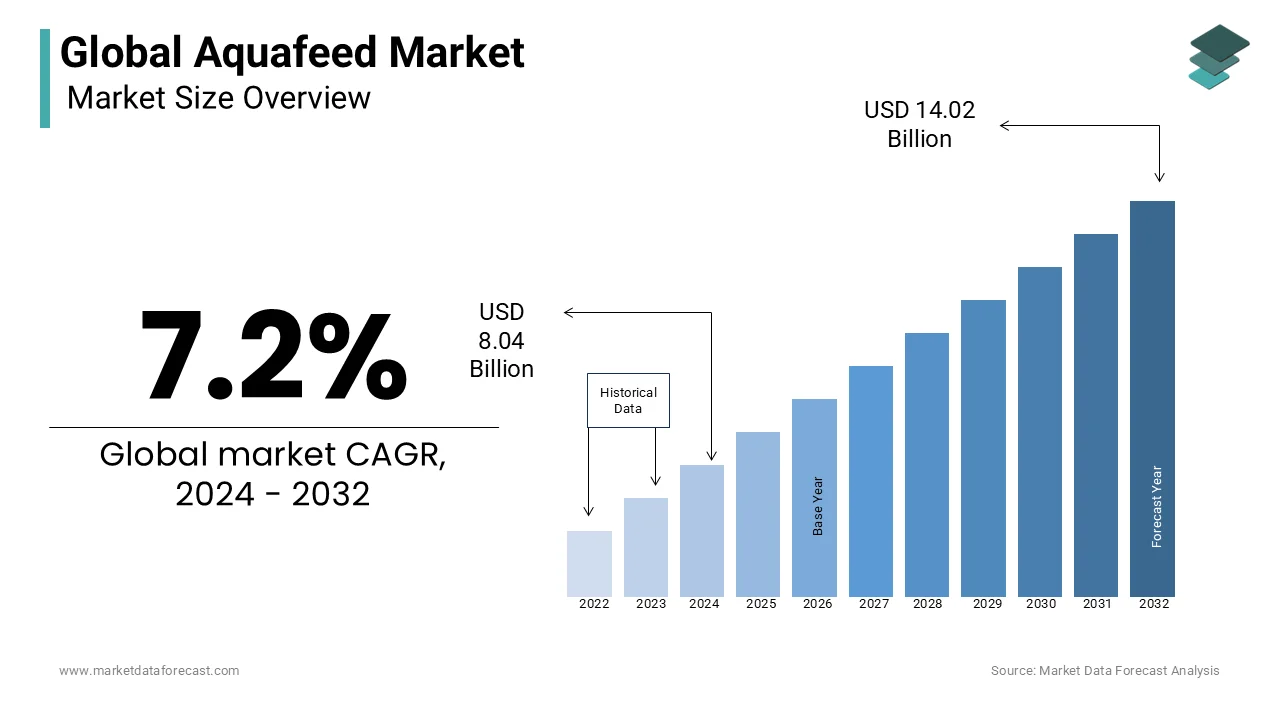

The size of the global aquafeed market was valued at USD 8.04 billion in 2024. The global market is anticipated to reach USD 8.62 billion in 2025 and USD 15.03 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033.

Investments in conducting R&D activities around aquafeed are on the rise. For instance, the Milkfish Aquafeeds Research, Development, and Extension Project started in Guluan in August 2020. The goal of this new project is to find ingredients for fish food that can be used instead of the expensive ingredients that are already on the market. Plant-based proteins can be used as a key ingredient in fish food, which is a new alternative.

MARKET DRIVERS

Aquafeeds are primarily said to be meals for aquatic animals made by mixing different raw materials and seasonings. These blends are made to meet the unique needs of each type of animal and its age. Aquafeed has become very important to aquaculture because it provides nutrients, protects against disease, and helps fish grow. In addition, because it is adjusted and made to meet specific needs, high-quality aquafeed is much better for fish, mollusks, crustaceans, and other aquatic animals than farm-made animals. The aquafeed market is growing because people eat more seafood and are more aware of the quality of seafood goods. Also, a rise in per-head income, specifically in developing countries, should keep the aquaculture and aquafeed industries growing. However, in the long term, rising prices of raw materials are expected to slow down the aquafeed market's growth because most high-quality feed is made from fish meal and fish oil.

The rise in seafood trade will be a key part of market growth. Aquaculture production is expected to rise, which is expected to help the market grow. This is because more people are eating seafood and spending more on fish and fish goods like fish oil, fish meal, and fish silage. In addition, the aquafeed market is also anticipated to grow in the coming years because there is more demand for animal protein in well-established Western economies and more trade of fish in many different economies around the world.

MARKET RESTRAINTS

Price changes in raw materials could slow market growth. The rise of the market can be slowed down by the high price volatility of the raw materials used to make feed. For example, a big rise in the price of soybeans, maize, or other raw materials can directly affect the end price of the product, which could hurt sales. Also, more and more people are choosing meatless diets that don’t include meat, which is expected to lower the demand for fish, which could hurt the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, Ingredient, Application, Additives, Form, Lifecycle and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC. PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill, Archer Daniels Midland Company, Altech, Purina Animal Nutrition, Nutreco N.V. and Ridley Corporation Ltd |

SEGMENT ANALYSIS

By Type Insights

In 2023, the fish segment made up the biggest part of the aquafeed market around the world. Fish feed sales should go up more because fish farming is growing a lot to meet the demand for fish that isn’t being met by the supply. Good quality fish feed is a good way to support the bottom of the food chain and keep a healthy fish community going. This could increase the need for fish food in the coming years. Some of the most well-known fishes that eat feed are tilapia and carp. Carps are a good source of energy, and they are also used a lot in fish farming and rice farming. Because of this, the desire for carp is likely to be growing in the coming years, which can drive the market for them,

Currently, the mollusks segment is next in leading the market share. People are eating more oysters and clams because they are a good source of protein. This has led to a rise in claim and oyster production, which is expected to increase the need for fish feed from mollusk farmers.

By Ingredient Insights

The soybean market segment will be the most important market segment during the forecast period. Soybeans are a good and cheap source of protein and omega-3 fatty acids that don’t come from fish. So, it is commonly used to make feed for marine species to help them grow and develop as a whole. Soy cake and meal are increasingly used to make organic feed, which is likely to increase the demand for soybeans in the business.

The area of the global market that is expected to grow at the fastest rate is the one for additives. Aquafeed additives, especially amino acids, are important proteins that are needed for aquaculture to grow, develop and stay healthy. Manufacturers will likely make more chemicals because fish growers are becoming more interested in using high-quality feed.

By Application Insights

In 2023, the carp application segment was the most important part of the global business. It made up more than 25% of the total revenue. The high share of this segment is because more and more people are eating this species because it is good for your health, boosts your immune system, makes your heart healthier, lowers your risk of getting chronic diseases, and protects the functions of the digestive system.

The catfish segment is anticipated to have the highest CAGR in the coming years. Catfish is high in vitamin D and omega-6 fatty acids, which are likely to make more people want to buy it. This will help the segment grow; Tilapia is a fish that lives in freshwater. It is raised in aquaculture because it grows quickly and can be fed cheap veggie food. It grows faster than fish that eat other animals. The rising production of tilapia species that grow quickly taste good, have a high protein content, and get big is likely to make aquafeed even more important in this application segment.

By Additives Insights

Among additives, the amino acids segment is expected to lead the aquafeed market over the next few years. Amino acids are crucial for animal nutrition as they act like the founding stone of protein in animals. Protein is a key part of aquatic animal growth, reproduction, and general health. Amino acids give muscles and bones the energy they need to grow, move, digest food, and move blood around the body. Because of all these factors, amino acids are the most popular additions to the aquafeed market.

By Form Insights

The demand for aquafeed market products in the dry form will be high until 2028. The dry version of the product has brought in a lot of money in the last few years, and this segment is projected to grow at a fast rate over the next few years. The aquaculture businesses all over the world have a high demand for pellet feed because it can help fish eat more of the food they eat. Fish feed that comes in a dry form is becoming more popular because it tastes great and works well to improve fish performance. Also, the product will likely sell well because it is easy to store and transport and because dry products have a longer shelf life than wet or moist goods.

By Lifecycle Insights

In 2023, grower feed was the most important part of the industry and made up more than 34.25% of the total income. It has a high share because more and more animals between the ages of 6 and 20 weeks are using it to meet their nutritional needs. The animal eats this kind of food until it is ready to start having babies and laying eggs. It is important to switch from starting feed to grower feed because too much protein can cause liver or kidney problems in the long run. Also, after grower feeds, finisher feeds are used quite a lot.

REGIONAL ANALYSIS

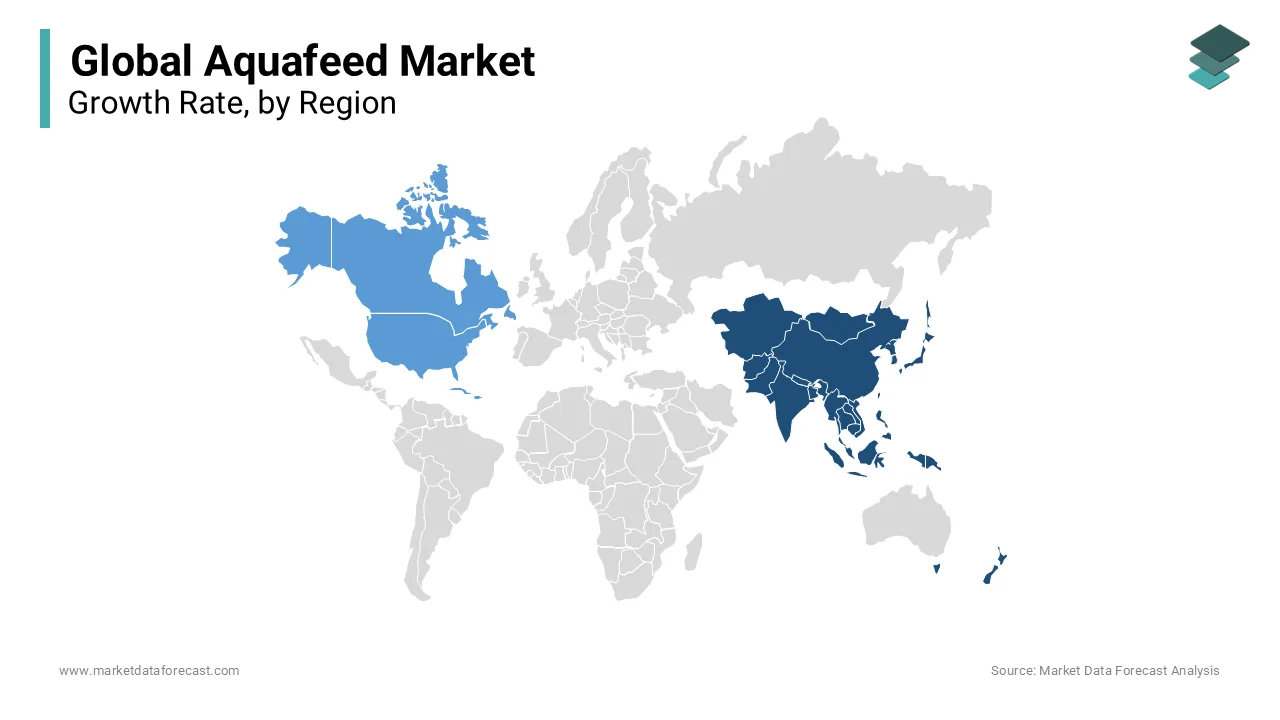

Asia Pacific is a big aquafeed market right now, and it is projected to hold a large share of the aquafeed market over the next few years. In the last ten years, the Asia Pacific market has grown quickly, with developing nations like China and India making up more than half of all sales in the area. An increase in the rate of fish production is escalating the demand for the aquafeed market in the Asia Pacific.

The North American aquafeed market is likely to hit the highest growth rate during the forecast period. The growing economy and rapid urbanization are fueling the growth rate of the market in North America.

KEY MARKET PLAYERS

Cargill, Archer Daniels Midland Company, Altech., Purina Animal Nutrition, Nutreco N.V., Ridley Corporation Ltd. Some of the market players dominate the global aquafeed market.

RECENT HAPPENINGS IN THIS MARKET

- In June 2021, The Aquaculture Stewardship Council (ASC) released a new standard to deal with any practices in the business that were not responsible or sustainable.

- In August 2021, The Central Institute of Fisheries Technology (CIFT) developed a new technology to mitigate the risk of fisheries refuse being converted into fish feeds and to create viable income opportunities.

- In February 2020, Aller Aqua A/S declared the introduction of a new line of functional aquafeeds containing ingredients that promote growth and survival in a variety of fish species.

MARKET SEGMENTATION

This research report on the global aquafeed market has been segmented and sub-segmented based on type, ingredient, application, additive, form, lifecycle and region.

By Type

- Fish

- Crustaceans

- Mollusks

- Others

By Ingredients

- Soybean

- Corn

- Fishmeal

- Fish Oil

- Additives

By Application

- Carp

- Rainbow Trout

- Salmon

- Crustaceans

- Tilapia

- Catfish

- Sea Bass

- Grouper

- Others

By Additives

- Antibiotics

- Vitamins & Minerals

- Antioxidants

- Amino Acids

- Enzymes

- Probiotics & Prebiotics

- Others

By Form

- Dry

- Wet

- Moist

By Lifecycle

- Starter Feed

- Grower Feed

- Finisher Feed

- Brooder Feed

By Region

- Asia Pacific

- Europe

- North America

- Latin America

- MEA

Frequently Asked Questions

what is the current market size of global aquafeed market?

The global aquafeed market size is expected to be valued at USD 8.04 billion in 2024.

Which regions are leading in terms of market share for aquafeed production?

Asia Pacific and Europe currently hold the largest market share for aquafeed production, driven by the significant aquaculture industry presence in countries like China, India, Norway, and Chile.

What are the key trends driving growth in the aquafeed market in Asia Pacific?

In Asia Pacific, the increasing consumption of seafood, rising aquaculture production, and advancements in aquafeed technology are driving the growth of the aquafeed market.

How is the adoption of alternative protein sources influencing the aquafeed market in North America?

In North America, the adoption of alternative protein sources such as insect meal, single-cell proteins, and algae-based ingredients in aquafeed formulations is driving innovation and market growth.

Who are the key players dominating the aquafeed market in Europe?

Companies such as Cargill, Archer Daniels Midland Company, and Nutreco N.V. are among the key players dominating the aquafeed market in Europe.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]