Global API Management Market Size, Share, Trends, Growth Forecast Report Segmentation By Deployment Type (Cloud, On-Premises, and Hybrid), Services, Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global API Management Market Size

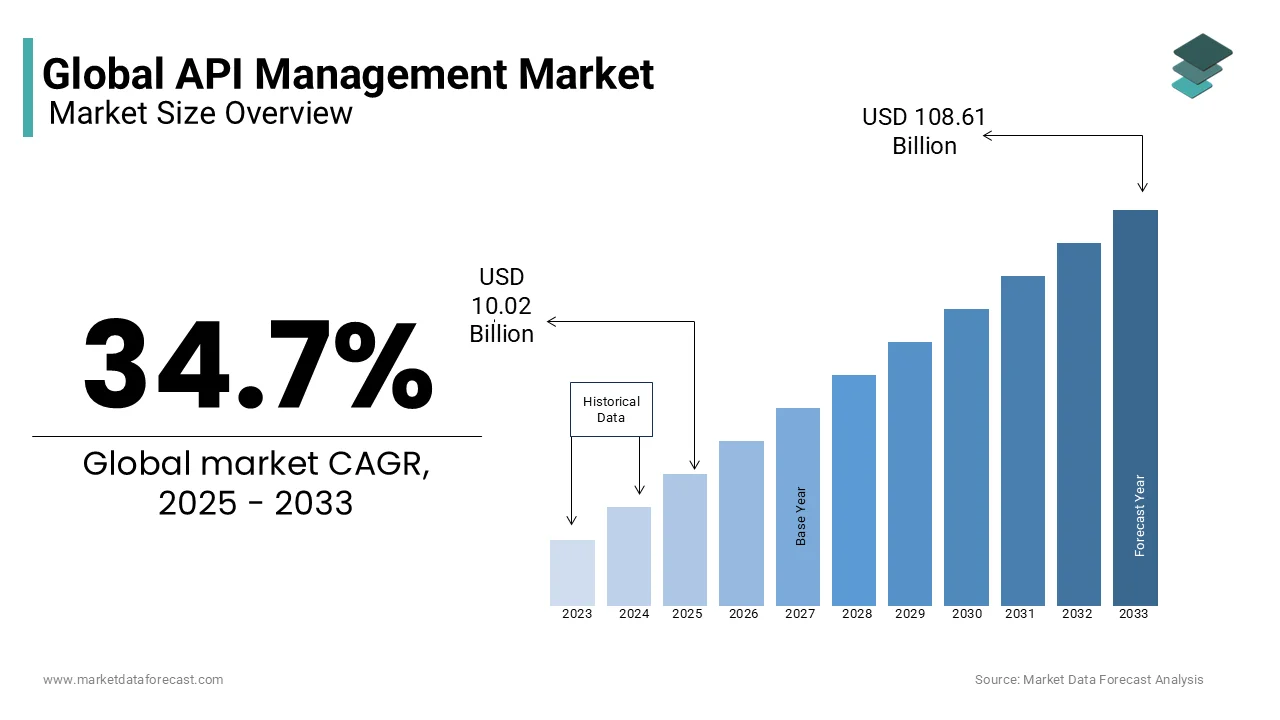

The size of the global application programming interface management (API) market was valued at USD 7.44 billion in 2024. The global market is anticipated to grow from USD 10.02 billion in 2025 to USD 108.61 billion by 2033, recording a CAGR of 34.7% from 2025 to 2033.

The API, in general, includes several protocols, tools, and subroutines that can be used to develop various applications. It acts as a major communication code between software and API management that enables any organization to track the performance of the interface and meet the needs of the developers. API management helps monitor traffic for individual applications and facilitates cache management to improve application performance. Because API management software can be created internally by an organization or imported from external suppliers, it has become an essential tool for many commercial suppliers to improve their customer experience. The API has been used as a tool to access data via mobile applications, the Internet of Things (IoT) and cloud platforms. APIs allow a company to securely expose its content or services inside and outside the company. API management solutions refer to the process of designing, distributing, publishing, controlling, and analyzing APIs. An API management solution typically includes a developer portal, API gateway, API lifecycle management, and analytics. API management consists of a set of processes through which organizations can gain control and visibility of the APIs used to connect data and applications to the cloud and businesses. API management provides businesses with an API gateway, developer portal, API lifecycle management, API monetization support, and API lifecycle management. To determine the full potential of their data services, organizations use API management, which publishes APIs to internal, external, and partner developers. It also helps to create, protect, manage, evolve, and analyze APIs.

The global API management market has experienced steady growth in the recent past and is expected to have a promising path ahead in the coming years. An increase in the number of digital transformation initiatives and rapid adoption of cloud computing and microservices architectures have been fueling the need for API management worldwide. APIs have become crucial to the companies in unlocking data and functionality, partnering with third-party integrations and delivering personalized and interconnected experience to the customers. Companies that operate in various industries are increasingly leveraging the potential of API to boost agility, innovation and connectivity, which is promoting the importance of API management and resulting in the growing demand of API management services. High usage of API management can be noticed in countries such as the United States, the United Kingdom, Germany, Australia and India as these countries have favorable regulations and a vibrant ecosystem of technology startups and enterprises. The global API management is progressing and is anticipated to register a prominent growth rate during the forecast period.

MARKET DRIVERS

The mobility and proliferation of applications are primarily driving the global API management market growth.

With the growing number of mobile subscribers, the rise of social media and the penetration of electronic commerce, suppliers from various industries are now able to interactively provide information to their consumers, thereby increasing their sales. For instance, there were approximately 8.6 billion mobile device subscribers worldwide in 2021, according to World Economic Forum. An estimated 3.6 billion social media users were reported in the 2020 and this number is likely to be 4.41 billion by 2025. The advancement of the Internet of Things and Big Data, as well as the cost benefits and features are promoting the demand for the services of API management. In addition, as API management contributes to the systematic application of policies and insightful analytical visualization, the demand should extend to several organizations wishing to increase their productivity.

The increased demand for API-based connectivity is contributing to the expansion of the global API management market.

Several companies worldwide have been focusing on the digital transformation from the last few years and increasingly depending on interconnected systems and applications to streamline their operations and provide enhanced customer experience. In that process, the need for secure and efficient management of APIs is increasing and leading to the growing demand for API management services. The rapid adoption of cloud computing and Software-as-a-Service (SaaS) solutions is also favoring the global market growth. Companies worldwide have been using technological solutions such as cloud computing and SaaS to leverage external APIs in order to promote their own offerings and boost innovation. The rise of mobile and web-based applications is also boosting the usage of API and is contributing to the global API management market expansion. Mobile and App developers have been using APIs to provide seamless user experiences by integrating various functionalities and data sources.

Additionally, companies around the world are implementing strategies to manage their application program interface to quickly respond to changing customer demands. This is an important factor that is expected to drive growth in the global API management market. Businesses in various industries focus on providing an enhanced store or store experience, as well as personalized recommendations, product support, and offers based on gender, location, and customer behavior through API Management Solutions. These factors are predicted to offer boost to the global API management market growth.

MARKET RESTRAINTS

Shortage of professionals

The shortage of professionals required to develop and implement API management solutions is a difficult factor that can hinder the growth of the global API management market. Concerns associated with security and data privacy, integration challenges with legacy systems, lack of standardized API protocols and scalability limitations of API management platforms are inhibiting the growth of the API management market. Limited interoperability between different API gateways and high costs associated with API management solutions are further hindering the growth of the global API management market.

MARKET OPPORTUNITIES

Artificial Intelligence

Integrating artificial intelligence (AI) will significantly transform API management. Application Programming Interfaces, currently, are the cornerstone of the digital revolution, providing communication between the two software. They serve as channels for the functionalities and data, making them available throughout the different digital infrastructures. The rising volume and complication of APIs have made effective management the biggest challenge. This is where the incorporation of AI into platforms for their management provides groundbreaking potential. According to the research, GenAI-integrated applications and APIs or models powered by Generative AI in a production environment will be utilized by over 80 percent of enterprises. This elevated from less than 5 percent in 2023. To automate the decision-making process, predict trends and identify patterns by analysing huge amounts of data gathered by API transactions. The main areas of opportunity for AI are anomaly detection and automated security for live identification and reducing potential security danger, improved performance maximization by lowering latency and enhancing the end-user experience, Smart API discovery and integration, personalized API experiences based on customer preferences and perspectives and predictive analytics for API management to detect possible monetization prospects.

MARKET CHALLENGES

High cost and time consumption

High cost and time consumption are the key challenges for the API management market. Most companies view these technologies as expenditures instead of investments. It is costly to incorporate it at the start. It can go beyond the financial constraints with rising recruitment, system servicing, and upgrade expenses. However, the current layoffs in the IT field are exerting further pressure on companies to reconsider their R&D efforts and investments and support for ongoing supply chain and client base. One of the reasons behind this is falling inflation which means prices are not increasing as quickly. Hence, this makes it difficult for industry players to elevate the service cost, as consumers, whose salaries are also prevented or curtailed by inflation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

34.7% |

|

Segments Covered |

By Deployment Type, Services, Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM (USA), Google (USA), Oracle (USA), Red Hat (United States), Software AG (Germany), Axway (United States), MuleSoft (United States), Microsoft (United States), SAP SE (Germany), AWS (United States), CA Technologies (United States), TIBCO (United States), Kony (United States), Rogue Wave Software (United States), Sensedia (Brazil), Torry Harris Business Solutions (United States), Tyk Technologies (England), WSO2 (United States), Osaango (Finland), Dell Boomi (United States), Postman (United States), and others. |

SEGMENTAL ANALYSIS

By Deployment Type Insights

The on-premises segment dominated the API management market in 2024 and is predicted to hold the leading spot in the global market throughout the forecast period. The growing demand for on-premise deployment for API management by organizations from various industry is driving the growth of he on-premises segment in the global market. Companies that operate in healthcare, banking and government have strict regulatory compliance requirements and data sovereignty concerns and majorly use on-premises deployment. On-premise deployment also offer specific customization and integration requirements or legacy IT infrastructure limitations and due to these reasons, some organizations are opting for on-premise deployment over other available deployment types, which is also boosting the segmental expansion.

The cloud segment is predicted to account for a substantial share of the global API management market share during the forecast period. The demand for cloud-based implementation is expected to increase significantly in the forecast period due to the high flexibility and scalable implementation provided by the cloud at a low cost. The scalability, flexibility and cost-efficiency that cloud-based deployment offers compared to other deployment modes is majorly propelling the boosting the expansion of the cloud segment. Popular cloud-based API management service providers such as Amazon Web Services (AWS), Google Cloud Platform (GCP) and Microsoft Azure have been offering a wide range of services that range from API gateways, security and analytics. Several organizations that operate in e-commerce, healthcare finance industries have been migrating their API management infrastructure to cloud and this trend is estimated to grow further in the coming years and promote the expansion of the cloud segment.

The hybrid segment is predicted to grow at a healthy CAGR during the forecast period. Organizations sometimes are being keen about leveraging the benefits of both cloud and on-premises deployments such as flexibility and control over their API management infrastructure, which is a key factor propelling the growth of the hybrid segment in the global market.

By Services Insights

The analytics segment is a lucrative segment and had a substantial share of the global market in 2024 and is predicted to register a healthy CAGR during the forecast period. The rising need for real-time monitoring and optimization, and the growing focus on data-driven decision-making are primarily driving the growth of the analytics segment in the global market. Several organizations worldwide have been leveraging the potential of analytics tools to track API usage patterns, identify bottlenecks, and optimize API performance in order to improve user experience and drive better outcomes to the organizations.

The portal segment is predicted to hold a considerable share of the worldwide market during the forecast period.

By Industry Insights

The banking and finance segment held 26.2% of the global market share in 2024 and emerged as the leading performer in the worldwide. The banking & finance segment is a key adopter of API management solutions. The rise of fintech startups, changing consumer preferences for digital banking services and regulatory mandates such as PSD2 (Payment Services Directive 2) in Europe are majorly boosting the growth of the banking and finance segment in the global market. Popular banks such as JPMorgan Chase, HSBC and Bank of America have been investing significant amounts in API management platforms to enable collaboration with fintech partners and comply with open banking regulations.

REGIONAL ANALYSIS

North America dominated the global api managemnet market in 2024 with the market share of USD 2.51 billion. This dominance is due to the presence of leading vendors in api management and tech gaints. Asia Pacific is the fastest growing market with a CAGR of 35.67% during the forecast period. The significant increase in the e-commerce and mobile based platforms fueling the market growth.

KEY MARKET PLAYERS

Companies playing a dominating role in the global API management market include IBM (USA), Google (USA), Oracle (USA), Red Hat (United States), Software AG (Germany), Axway (United States), MuleSoft (United States), Microsoft (United States), SAP SE (Germany), AWS (United States), CA Technologies (United States), TIBCO (United States), Kony (United States), Rogue Wave Software (United States), Sensedia (Brazil), Torry Harris Business Solutions (United States), Tyk Technologies (England), WSO2 (United States), Osaango (Finland), Dell Boomi (United States) and Postman (United States).

A leader in providing a complete suite of API management solutions and services, IBM meets the needs of organizations around the world. The company offers IBM API Connect to its global customers to take advantage of API management. The IBM Connect API addresses the critical API life cycle process in the cloud and on-premises platforms. The Enterprise API Management Solution helps businesses create, manage, run, and protect APIs. IBM has created strong brand value in the technology space, targeting customers in all industries. The company is stepping up its focus on innovation and stands out for the quality of its products. It also continually invests in R&D activities to strengthen its solutions. IBM has a widely integrated supply chain and has optimized inventory over time, allowing IBM to reduce risk during market changes.

RECENT HAPPENINGS IN THE MARKET

-

In July, Microsoft (United States) announced the launch of the integration of Azure API Management (APIM) with Azure Application Insights (AI). This functionality enables customers to implement APIM telemetry to artificial intelligence and employ the full set of AI features to manage and troubleshoot their APIs.

-

Microsoft (USA) in March introduced a novel Custom Vision service on Azure. This is utilized as cloud-hosted APIs that can assist developers to combine artificial intelligence abilities for speech, language, vision, knowledge, and research.

-

IBM Corp developed IBM API Connect to integrate APIs directly from SwaggerHub, this solution will help ensure and provide stability and improve performance.

-

IBM sponsored conferences on the application programming interface (API) worldwide, where the main initiative of the company was to provide professionals with the opportunity to solve real business problems.

MARKET SEGMENTATION

This research report on the global API management market has been segmented and sub-segmented based on deployment type, services, industry and region.

By Deployment Type

- Cloud

- On-Premises

- Hybrid

By Services

- Analytics

- Portal

- Gateway

- Governance

- Security

- Others

By Industry

- Aerospace & Defense

- Banking & Finance

- Automotive & Transportation

- Public Sector & Government

- Retail & Consumer

- Healthcare & Life Sciences

- Technology & Media

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global API management market?

The global API management market size was worth USD 10.02 billion in 2025.

Which industries contribute the most to the global API management market share?

Industries such as IT and telecommunications, BFSI (Banking, Financial Services, and Insurance), healthcare, and retail are among the major contributors to the global API management market share.

Which regions contribute the most to the global API management market share?

Major contributors to the global API management market share include North America, Europe, Asia-Pacific, and regions experiencing rapid digital transformation and increased adoption of cloud technologies.

What are the key factors driving the growth of the global API management market?

Growth in the global API management market is driven by factors such as the proliferation of mobile devices, the rise of cloud computing, increased demand for API-led connectivity, and the expanding ecosystem of digital applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]