Asia-Pacific Veterinary Healthcare Market Research Report By Animal Type (Livestock Animals, Companion Animals), Product, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific) - Industry Analysis From 2025 to 2033

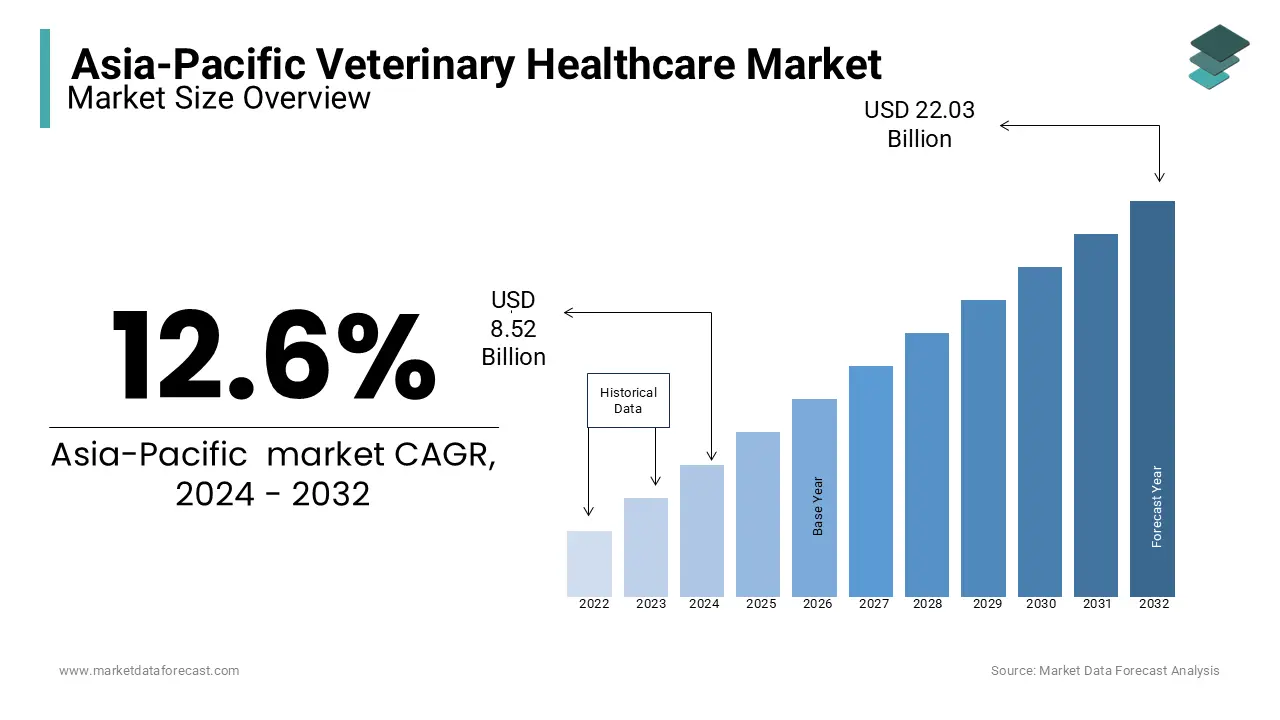

Asia-Pacific Veterinary Healthcare Market Size

The veterinary healthcare market size in the Asia-Pacific was worth USD 8.52 billion in 2024. The Asia-Pacific market is estimated to be valued at USD 24.78 billion by 2033 from USD 9.59 billion in 2025, growing at a tremendous CAGR of 12.6% from 2025 to 2033.

Veterinary healthcare includes services, pharmaceuticals, vaccines, and diagnostic tools aimed at improving the health and welfare of animals, ranging from livestock to companion animals. The Food and Agriculture Organization reports that Asia accounts for over 50% of global livestock production, with China and India being key contributors. This highlights the critical role of veterinary healthcare in ensuring food safety and supporting agricultural economies. Additionally, the World Health Organization emphasizes the growing threat of zoonotic diseases, such as avian influenza and leptospirosis, underscoring the importance of effective animal healthcare systems in mitigating health risks. Urbanization and rising disposable incomes have fueled a surge in pet ownership across the region, with countries like Japan, South Korea, and Australia witnessing significant increases in spending on companion animal care. According to the Australian Bureau of Statistics, over 61% of households in Australia own pets, driving demand for veterinary services and products.

MARKET DRIVERS

Rising Livestock Population and Demand for Animal-Based Products

The increasing livestock population in the Asia-Pacific region is a significant driver of the veterinary healthcare market. According to the Food and Agriculture Organization, the region accounts for over 50% of global livestock production, with India and China leading in cattle and poultry production. The rising demand for animal-based products, such as milk, meat, and eggs, has prompted farmers to prioritize animal health and productivity. This trend has fueled the adoption of veterinary pharmaceuticals, vaccines, and nutritional supplements. Additionally, government initiatives promoting food security and sustainable livestock farming, such as India’s National Livestock Mission, further boost the demand for veterinary healthcare services in the region.

Increasing Prevalence of Zoonotic Diseases

The growing prevalence of zoonotic diseases is driving the demand for veterinary healthcare solutions across Asia-Pacific. The World Health Organization highlights that approximately 60% of emerging infectious diseases globally are zoonotic, with the region frequently facing outbreaks like avian influenza and rabies. Countries with high human-animal interaction, such as Indonesia and Vietnam, are particularly vulnerable to these diseases. This has led to increased investments in vaccination programs, diagnostic tools, and surveillance systems to control and prevent disease transmission. Governments and global health organizations are working collaboratively to enhance veterinary infrastructure, making disease management a key growth driver in the veterinary healthcare market.

MARKET RESTRAINTS

High Cost of Veterinary Healthcare Services and Products

The high cost associated with veterinary healthcare services and products is a significant restraint in the Asia-Pacific market. The World Bank highlights that many low- and middle-income countries in the region, such as Bangladesh and Cambodia, face limited affordability for advanced animal healthcare services. Vaccines, diagnostic tools, and treatments often remain out of reach for small-scale farmers and pet owners due to high prices and limited subsidies. Additionally, the cost of importing veterinary pharmaceuticals and medical devices adds to the financial burden, particularly in nations reliant on external suppliers. This cost barrier restricts access to essential veterinary care and hampers market growth across economically constrained areas.

Shortage of Skilled Veterinary Professionals

The shortage of qualified veterinary professionals poses a major challenge in the Asia-Pacific veterinary healthcare market. The World Health Organization underscores the region's healthcare workforce gaps, which extend to veterinary services, especially in rural and underserved areas. For instance, India has an estimated shortfall of over 10,000 veterinarians, limiting the availability of critical animal healthcare. In countries like Indonesia and Vietnam, the lack of trained personnel for disease surveillance and treatment further exacerbates this issue. This workforce deficit hinders effective veterinary care delivery, resulting in lower animal productivity, uncontrolled disease outbreaks, and slower adoption of advanced veterinary solutions across the region.

MARKET OPPORTUNITIES

Adoption of Digital and Telemedicine Solutions in Veterinary Care

The growing integration of digital technologies and telemedicine presents a major opportunity for the Asia-Pacific veterinary healthcare market. According to the World Organization for Animal Health, digital platforms can address challenges in rural and underserved regions by providing remote consultations, diagnostics, and disease monitoring. Countries like India and China are increasingly adopting telemedicine services to improve access to veterinary care. For instance, India’s National Digital Livestock Mission incorporates data-driven tools to enhance animal health management. The availability of mobile apps for real-time health tracking and consultation has further bolstered the adoption of telemedicine, creating a pathway for expanded veterinary services and improved care efficiency across the region.

Rising Investment in Research and Development for Animal Health

Increasing investments in research and development for animal health offer significant growth potential in the Asia-Pacific veterinary healthcare market. Governments and organizations are prioritizing advancements in vaccine development, diagnostic tools, and innovative treatments to combat emerging diseases. According to the Food and Agriculture Organization, Asia has become a focal point for research initiatives targeting livestock productivity and disease prevention. For instance, Japan and Australia are leading in R&D for advanced veterinary pharmaceuticals and biologicals, such as novel vaccines for zoonotic diseases. These investments not only enhance animal welfare but also ensure sustainable agricultural practices, making R&D a critical driver of market expansion in the region.

MARKET CHALLENGES

Inadequate Veterinary Infrastructure in Rural Areas

The lack of veterinary infrastructure in rural areas is a significant challenge for the Asia-Pacific veterinary healthcare market. The Food and Agriculture Organization reports that over 70% of livestock in the region is reared in rural areas, where veterinary services are limited or inaccessible. In countries like Bangladesh, Nepal, and Myanmar, small-scale farmers often struggle to access essential veterinary care, including vaccinations and disease treatment. The shortage of clinics, diagnostic facilities, and trained professionals in these regions exacerbates the issue. This gap in infrastructure not only impacts animal health and productivity but also hampers efforts to control zoonotic diseases, highlighting the urgent need for investment in rural veterinary services.

Regulatory Barriers and Fragmented Policies

Regulatory barriers and inconsistent policies across Asia-Pacific countries create challenges for the veterinary healthcare market. The World Health Organization emphasizes the need for standardized regulations to ensure the quality and safety of veterinary pharmaceuticals and vaccines. However, fragmented policies and varying import/export regulations in nations like Indonesia, Vietnam, and India create complexities for manufacturers and distributors. These inconsistencies hinder the approval and availability of advanced veterinary products, delaying market growth. Additionally, limited enforcement of existing regulations allows counterfeit or substandard products to enter the market, affecting animal health outcomes and reducing trust in veterinary healthcare solutions. Addressing these regulatory hurdles is critical for market stability.

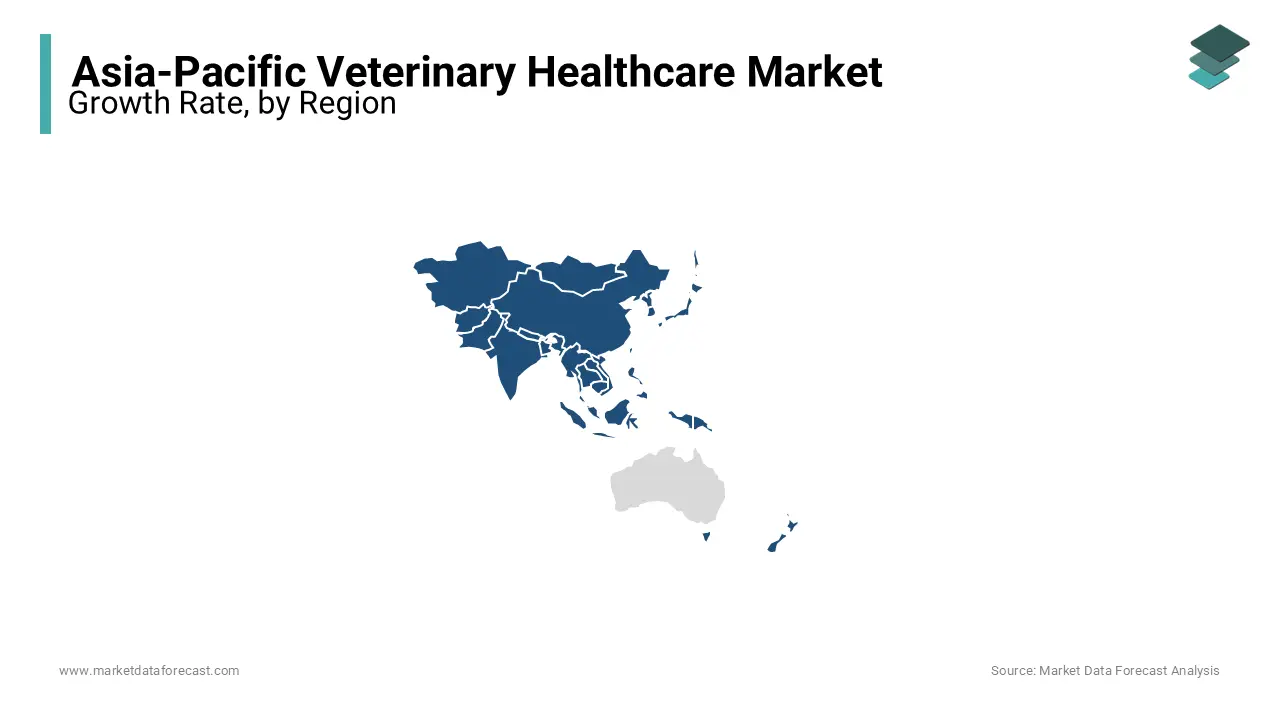

REGIONAL ANALYSIS

India dominates the veterinary healthcare market in Asia-Pacific due to its significant livestock population and increasing investments in animal health. According to the Food and Agriculture Organization, India is the largest global producer of milk, with over 192 million metric tons annually, supported by nearly 300 million cattle and buffaloes. The government’s National Livestock Mission promotes healthcare infrastructure, vaccination programs, and disease control initiatives for sustainable livestock productivity. Rising awareness of zoonotic diseases has also driven demand for advanced diagnostics and pharmaceuticals. These factors, combined with India’s focus on rural veterinary outreach, make it a key market in the region.

China is a major contributor to the Asia-Pacific veterinary healthcare market, driven by its robust livestock industry and growing pet ownership. According to the National Bureau of Statistics of China, the country produces over 47 million tons of pork annually, necessitating extensive disease management and veterinary care. The increasing urban population has also fueled pet ownership, with over 73 million urban residents owning pets, as reported by the China Pet Industry Association. Government programs aimed at improving animal health and food safety standards further bolster the market. These factors highlight China’s dual emphasis on livestock and companion animal healthcare.

Japan is estimated to play a key role in the Asia-Pacific veterinary healthcare market. The advanced infrastructure of Japan and significant investments in research and development are contributing to the expansion of the Japanese veterinary healthcare market. The Ministry of Agriculture, Forestry, and Fisheries reports that Japan allocates substantial funding to develop animal vaccines, diagnostics, and precision veterinary tools. Japan’s focus on high-value livestock, such as Wagyu beef, necessitates premium healthcare solutions. Additionally, its growing pet care market, driven by a rapidly aging population seeking companionship, has boosted demand for veterinary services and products. Japan’s commitment to innovation and animal welfare positions it as a key player in the region’s veterinary healthcare market.

Australia plays a vital role in the Asia-Pacific veterinary healthcare market due to its focus on sustainable livestock farming and export-driven agriculture. According to the Australian Bureau of Agricultural and Resource Economics and Sciences, the country has over 75 million livestock, including cattle, sheep, and goats, requiring extensive veterinary care to maintain productivity. Australia’s export-oriented meat industry emphasizes disease prevention and biosecurity, driving the demand for advanced veterinary products. Additionally, a rising pet ownership rate, with over 60% of households owning pets, as reported by the Australian Veterinary Association, contributes to the market’s growth in companion animal healthcare.

The veterinary healthcare market in South Korea is driven by high pet ownership rates and rapid technological advancements. The Korean Statistical Information Service reports that over 28% of households own pets, fueling demand for premium veterinary pharmaceuticals, diagnostics, and wellness products. The government’s focus on animal welfare, including regulations for pet health insurance and disease control, supports market expansion. South Korea also leads in adopting digital veterinary tools and telemedicine, catering to tech-savvy pet owners. Additionally, the livestock sector benefits from advanced veterinary solutions aimed at improving food safety and disease management, making South Korea a key player in the Asia-Pacific veterinary market.

KEY MARKET PARTICIPANTS

Companies playing a notable role in the Asia-Pacific veterinary healthcare market profiled in this report are Merck & Co., Inc., Bayer AG, Boehringer Ingelheim GmbH, Cargill, Inc., Ceva Santé Animale, Novasep, Eli Lilly and Company, Koninklijke DSM N.V, Novartis AG, Nutreco N.V., Sanofi S.A., SeQuent Scientific Ltd., Virbac S.A., Vétoquinol S.A., and Zoetis Inc.

MARKET SEGMENTATION

This research report on the Asia-Pacific veterinary healthcare market has been segmented and sub-segmented into the following categories.

By Animal Type

- Livestock Animals

- Companion Animals

By Product

- Pharmaceuticals

- Feed Additives

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

Which countries in the APAC region contribute significantly to the veterinary healthcare market share?

China, Japan, India, Australia, and South Korea are contributing majorly to the veterinary healthcare market in APAC.

What challenges does the APAC veterinary healthcare market face?

Regulatory complexities, the high cost of advanced veterinary treatments, and limited awareness in certain regions are some of the major challenges to the APAC veterinary healthcare market.

How has the COVID-19 pandemic impacted the veterinary healthcare market in the APAC region?

The pandemic has led to disruptions in the supply chain, reduced veterinary clinic visits, and an increased focus on telehealth solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]