Asia-Pacific Varicose Vein Treatment Market Size, Share, Trends & Growth Forecast Report By Treatment (Surgical Treatments, Non-Surgical Treatments, Radiofrequency Ablation), Product & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific), Industry Analysis From 2025 to 2033

Asia-Pacific Varicose Vein Treatment Market Size

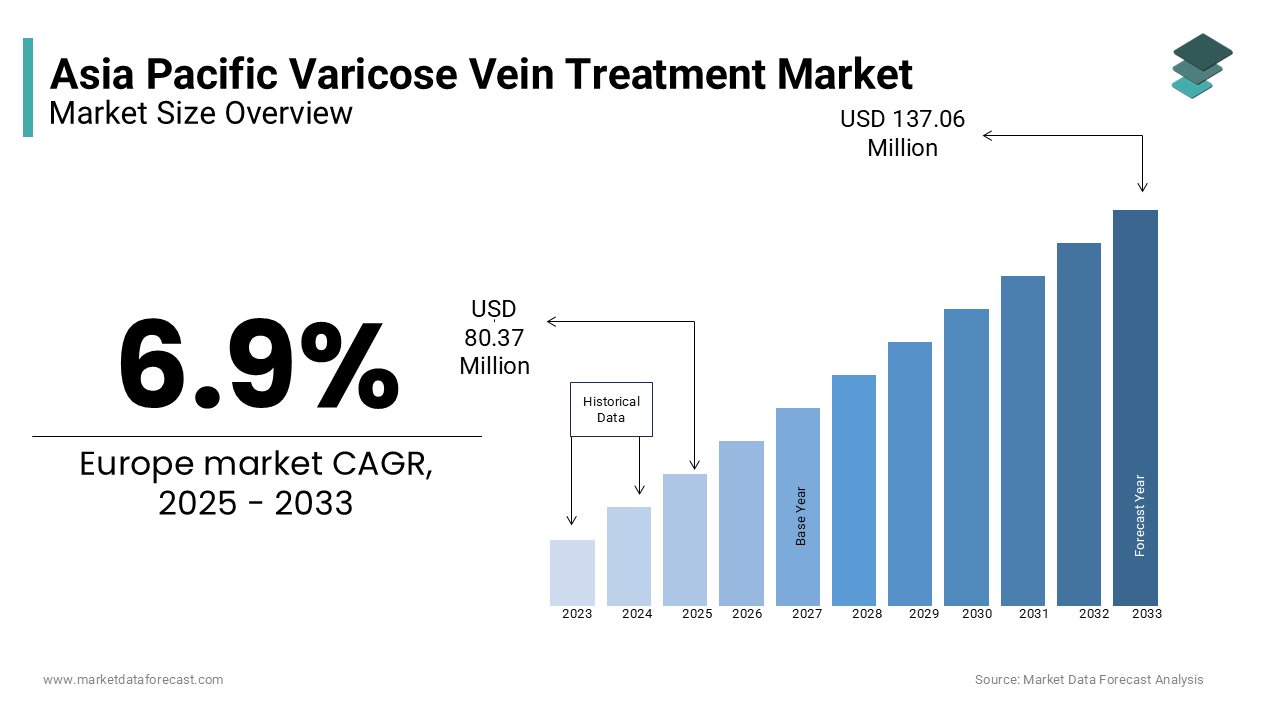

The Asia-Pacific varicose vein treatment market was worth USD 75.18 million in 2024. The Asia-Pacific market is further expected to grow at a CAGR of 6.9% from 2025 to 2033 and be worth USD 137.06 million by 2033 from USD 80.37 million in 2025.

The Asia-Pacific varicose vein treatment market is witnessing significant growth due to the growing regional aging population, increasing prevalence of venous disorders, and advancements in minimally invasive treatment technologies. Varicose veins is a condition characterized by enlarged, swollen, and twisted veins, predominantly affect the lower extremities and are often associated with chronic venous insufficiency (CVI). According to the World Health Organization, approximately 20% of adults worldwide suffer from varicose veins, with the prevalence rising to over 30% among individuals aged 50 and above. In the Asia-Pacific region, rapid urbanization, sedentary lifestyles, and obesity have contributed to a surge in cases, particularly in countries like China, India, and Japan. The growing awareness about advanced treatment options such as radiofrequency ablation, endovenous laser therapy, and sclerotherapy that offer reduced recovery times and improved outcomes compared to traditional surgical methods is boosting the adoption of varicose vein treatment in this region.

Government initiatives aimed at enhancing healthcare infrastructure and promoting medical tourism have also played a pivotal role in driving market expansion. For instance, countries like Thailand and Singapore have emerged as hubs for minimally invasive vascular treatments, attracting patients from across the globe. However, challenges such as high treatment costs, limited access to advanced healthcare facilities in rural areas, and a lack of skilled professionals hinder widespread adoption. Despite these barriers, opportunities abound in emerging markets, technological innovations, and the growing emphasis on patient-centric care.

MARKET DRIVERS

Increasing Prevalence of Chronic Venous Disorders in the Asia-Pacific

The rising prevalence of chronic venous disorders, including varicose veins is driving the growth of the Asia-Pacific varicose vein treatment market. According to the Asian Pacific Society of Cardiology, chronic venous insufficiency affects over 15% of the adult population in the Asia-Pacific region, with higher incidence rates observed in aging populations. Factors such as prolonged sitting or standing, obesity, and genetic predisposition contribute significantly to this trend. For instance, in China, the prevalence of varicose veins has increased by 25% over the past decade, as per the Chinese Medical Association, due to lifestyle changes and urbanization. Additionally, the economic burden of untreated varicose veins, which can lead to complications like venous ulcers and thrombophlebitis, underscores the need for effective treatment options. Governments across the region are investing in public health campaigns to raise awareness about early diagnosis and treatment. For example, Australia’s National Health and Medical Research Council has launched initiatives to educate the public about venous health, further propelling demand for advanced treatment modalities. As the prevalence of chronic venous disorders continues to rise, the Asia-Pacific varicose vein treatment market is poised for sustained growth.

Advancements in Minimally Invasive Technologies

Technological advancements in minimally invasive varicose vein treatments are boosting the market growth in the Asia-Pacific region. According to the Japanese Society of Phlebology, minimally invasive procedures such as radiofrequency ablation (RFA) and endovenous laser therapy (EVLT) now account for over 60% of all varicose vein treatments in Japan. These techniques offer several advantages over traditional surgery, including shorter recovery times, reduced postoperative pain, and improved cosmetic outcomes. For instance, a study by the Indian Association of Vascular Surgeons, RFA has a success rate of over 95% in treating saphenous vein reflux, which is making it a preferred choice for both patients and healthcare providers. Furthermore, the integration of artificial intelligence and robotics into treatment protocols has enhanced precision and efficiency, reducing procedural risks. Countries like South Korea and Singapore have adopted these technologies extensively, with South Korea reporting a 40% increase in the adoption of minimally invasive treatments over the past five years. As healthcare systems prioritize patient-centric care and cost-effective solutions, the demand for advanced varicose vein treatment technologies is expected to grow exponentially in this region.

MARKET RESTRAINTS

High Costs Associated with Advanced Treatments

The high costs associated with advanced varicose vein treatments is restraining the market growth in the Asia-Pacific region. According to the Asian Development Bank, the average cost of minimally invasive procedures such as radiofrequency ablation ranges from $2,000 to $5,000, depending on the complexity and location. This financial burden is particularly pronounced in low- and middle-income countries like India and Indonesia, where out-of-pocket healthcare expenses account for over 60% of total healthcare spending, as per the World Bank. Additionally, the initial investment required for state-of-the-art equipment, such as laser systems and ultrasound machines, further exacerbates the financial strain on healthcare providers. For instance, a single laser system used for endovenous laser therapy can cost upwards of $50,000, limiting accessibility in resource-constrained settings. While affluent urban centers may absorb these costs, smaller clinics and rural healthcare facilities often struggle to justify the expenditure. Consequently, the affordability barrier restricts market penetration, particularly in underfunded regions, thereby impeding the overall growth of the regional market.

Limited Awareness and Skilled Professionals

Limited awareness about varicose vein treatments and a shortage of skilled professionals are further hindering the Asia-Pacific varicose vein treatment market expansion. According to the Philippine College of Surgeons, over 70% of patients in Southeast Asia remain undiagnosed or untreated due to a lack of understanding about available treatment options. This knowledge gap is particularly prevalent in rural areas, where healthcare infrastructure is underdeveloped, and access to specialized care is limited. Additionally, the shortage of trained vascular surgeons and phlebologists further compounds the issue. For instance, the Indonesian Society of Vascular Surgery estimates that there are fewer than 500 qualified vascular specialists serving a population of over 270 million. This scarcity not only delays diagnosis and treatment but also increases the risk of complications, such as venous ulcers and deep vein thrombosis. Government initiatives aimed at improving medical education and training have been slow to address these gaps, leaving many patients without access to timely and effective care. As a result, the pace of market expansion is considerably slowed, particularly in emerging economies.

MARKET OPPORTUNITIES

Growing Demand for Minimally Invasive Procedures

The increasing demand for minimally invasive procedures is a lucrative opportunity for the Asia-Pacific varicose vein treatment market. According to the Korean Society of Interventional Radiology, the adoption of minimally invasive techniques such as sclerotherapy and endovenous laser therapy has grown by over 35% annually in South Korea, driven by their superior safety profiles and faster recovery times. These procedures are particularly appealing to working professionals and elderly patients who prioritize convenience and reduced downtime. For instance, a study by the Australian Vascular Society highlights that sclerotherapy, which involves injecting a solution directly into the affected vein, has a satisfaction rate exceeding 90% among patients due to its simplicity and effectiveness. Additionally, government initiatives aimed at promoting medical tourism have further bolstered demand. Countries like Thailand and Malaysia have positioned themselves as global leaders in affordable, high-quality healthcare, attracting international patients seeking varicose vein treatments. As awareness about these advanced yet accessible options grow, the market is expected to witness substantial expansion.

Rising Investments in Healthcare Infrastructure

Rising investments in healthcare infrastructure across the Asia-Pacific region is a promising opportunity for the varicose vein treatment market in this region. According to the Indian Ministry of Health and Family Welfare, India alone has allocated over $30 billion to enhance healthcare facilities and expand access to advanced medical technologies under its National Health Policy. This includes the establishment of specialized vascular centers equipped with state-of-the-art devices for minimally invasive treatments. Similarly, China’s Healthy China 2030 initiative aims to modernize healthcare delivery systems, with a focus on chronic disease management, including venous disorders. A report by the Japan External Trade Organization notes that foreign direct investments in Asia-Pacific healthcare have surged by 25% over the past five years, driven by the region’s growing medical needs. These investments not only improve accessibility to advanced treatments but also foster innovation through collaborations between local and international stakeholders. As governments and private entities continue to prioritize healthcare development, the varicose vein treatment market stands to benefit significantly from enhanced infrastructure and increased patient reach.

MARKET CHALLENGES

Limited Insurance Coverage for Varicose Vein Treatments

Limited insurance coverage for varicose vein treatments is a challenge to the Asia-Pacific market. According to the Malaysian Health Economics Association, less than 20% of private health insurance plans in Southeast Asia cover minimally invasive procedures such as radiofrequency ablation or sclerotherapy, classifying them as elective or cosmetic treatments rather than medical necessities. This lack of reimbursement forces patients to bear the full cost of treatment, which can be prohibitively expensive for many. For instance, in Vietnam, where public health insurance covers only basic medical services, over 80% of patients requiring varicose vein treatments opt for conservative management due to financial constraints, as reported by the Vietnamese Ministry of Health. Additionally, even in countries with robust healthcare systems like Japan, varicose vein treatments are often excluded from national insurance schemes unless complications arise. This financial barrier not only limits patient access but also stifles market growth, as many individuals delay or forego treatment altogether. Addressing this challenge requires policy reforms and greater advocacy for the inclusion of varicose vein treatments in insurance coverage.

Geographic Disparities in Healthcare Access

Geographic disparities in healthcare access represent another formidable challenge for the Asia-Pacific varicose vein treatment market. According to the Rural Doctors Association of Australia, over 60% of rural communities in the Asia-Pacific region lack access to specialized vascular care, with limited availability of advanced diagnostic tools and treatment facilities. For example, in Indonesia, the ratio of vascular specialists to the population is less than 1 per 1 million in rural areas, compared to 10 per 1 million in urban centers, as per the Indonesian Ministry of Health. This disparity is exacerbated by inadequate transportation infrastructure, which makes it difficult for patients in remote areas to access tertiary care centers. Additionally, the concentration of advanced technologies in metropolitan cities creates inequities in treatment availability. A study by the Thai Public Health Association reveals that over 70% of minimally invasive varicose vein procedures are performed in Bangkok, leaving peripheral regions underserved. These geographic inequalities not only hinder market expansion but also perpetuate disparities in healthcare outcomes, posing a significant challenge to equitable growth in the varicose vein treatment sector.

SEGMENTAL ANALYSIS

By Treatment Insights

The non-surgical treatments segment had 61.4% of the Asia-Pacific market share in 2024 due to their non-invasive nature, minimal recovery time, and high patient satisfaction rates. Techniques such as sclerotherapy and foam sclerotherapy are widely adopted due to their cost-effectiveness and ability to treat small to medium-sized varicose veins. For instance, the Korean Society of Interventional Radiology reports that sclerotherapy accounts for over 40% of all varicose vein treatments in South Korea, driven by its simplicity and accessibility. Additionally, advancements in imaging technologies, such as duplex ultrasound, have enhanced the precision and safety of non-surgical procedures, further boosting their adoption. The growing preference for outpatient treatments, particularly among working professionals, underscores the importance of this segment. As healthcare providers increasingly prioritize patient-centric care, the non-surgical treatments segment is expected to maintain their dominance in the Asia-Pacific market.

The radiofrequency ablation (RFA) segment is the fastest-growing segment in the Asia-Pacific varicose vein treatment market and is estimated to register a promising CAGR of 18.5% over the forecast period. Factors such as the superior efficacy and safety profile of RFA compared to traditional surgical methods is one of the major factors boosting the expansion of the RFA segment in the Asia-Pacific market. RFA uses heat generated by radiofrequency energy to seal off affected veins, offering a minimally invasive alternative with reduced postoperative pain and faster recovery times. According to the Indian Association of Vascular Surgeons, RFA has a success rate exceeding 95% in treating saphenous vein reflux, making it a preferred choice for both patients and healthcare providers. Additionally, the integration of real-time imaging and temperature monitoring has improved procedural accuracy, addressing previous limitations. For example, according to the study conducted by the Australian Vascular Society, RFA reduces hospital stays by up to 50% compared to conventional surgery. As demand for efficient and scalable treatment options rises, the RFA segment is expected to witness accelerated growth, particularly in urbanized regions with higher disposable incomes.

By Device Insights

The ablation devices segment occupied 57.4% of the Asia-Pacific market share in 2024 due to the widespread adoption of minimally invasive techniques such as radiofrequency ablation (RFA) and endovenous laser therapy (EVLT), which rely heavily on advanced ablation devices. For instance, the Japanese Society of Phlebology notes that over 60% of varicose vein treatments in Japan utilize ablation devices due to their ability to deliver precise and controlled energy, ensuring optimal outcomes. Additionally, the versatility of these devices allows for customization based on patient needs, enhancing their applicability across diverse clinical scenarios. The growing emphasis on outpatient care and reduced recovery times further reinforces the demand for ablation devices. As healthcare systems prioritize cost-effective and patient-centric solutions, the dominance of ablation devices in the market is expected to persist over the forecast period.

The venous closure products segment is expected to at the fastest CAGR of 20.3% over the forecast period due to their ability to provide long-term solutions for venous insufficiency with minimal invasiveness. Products such as venous stents and closure systems are increasingly adopted due to their durability and effectiveness in sealing off diseased veins. For example, according to the Indian Association of Vascular Surgeons, venous closure products have reduced recurrence rates by over 30% compared to traditional surgical methods. Additionally, advancements in material science have improved the biocompatibility and flexibility of these products, addressing previous concerns about patient discomfort. A study by the Australian Vascular Society notes that the adoption of venous closure products has surged by 40% in urban centers over the past three years, driven by their compatibility with minimally invasive techniques. As demand for durable and efficient treatment options rises, venous closure products are poised to witness exponential growth over the forecast period.

By End-User Insights

The hospitals segment captured 64.6% of the Asia-Pacific varicose vein treatment market share in 2024. The domination of the hospitals segment in the Asia-Pacific market is attributed to the comprehensive infrastructure and multidisciplinary expertise available in hospital settings to enable the delivery of advanced treatments such as radiofrequency ablation and endovenous laser therapy. For instance, the Korean Society of Interventional Radiology notes that over 70% of minimally invasive varicose vein procedures are performed in hospitals due to the availability of state-of-the-art equipment and specialized vascular teams. Additionally, hospitals serve as primary referral centers for complex cases, further amplifying their role in the market. The growing emphasis on integrated care models, which combine diagnostics, treatment, and postoperative rehabilitation under one roof, underscores the importance of this segment. As healthcare systems prioritize centralized and coordinated care, hospitals are expected to maintain their dominance during the forecast period.

The surgery centers segment is the fastest-growing end-user segment in the Asia-Pacific varicose vein treatment market and is expected to progress at a 19.8% over the forecast period. The ability of surgery centers to provide cost-effective and outpatient-based care with minimal waiting times is driving the expansion of the surgery centers segment in the regional market. For instance, the Australian Private Hospitals Association highlights that surgery centers have reduced procedure costs by up to 30% compared to traditional hospital settings, making them an attractive option for patients seeking minimally invasive treatments. Additionally, the streamlined workflows and specialized focus of surgery centers enhance operational efficiency, ensuring faster turnaround times. A study by the Chinese Medical Association notes that the adoption of surgery centers for varicose vein treatments has surged by 45% in urban areas over the past five years, driven by their accessibility and patient-centric approach. As demand for convenient and affordable care rises, surgery centers are expected to witness accelerated growth over the forecast period.

REGIONAL ANALYSIS

China led the varicose vein treatment market in the Asia-Pacific by commanding a market share of 30.5% in 2024. The dominance of China is primarily driven by the large aging population of China and increasing prevalence of chronic venous disorders. For instance, the prevalence of varicose veins in China has risen by 25% over the past decade owing to the urbanization and sedentary lifestyles. Additionally, government initiatives such as Healthy China 2030 have prioritized investments in healthcare infrastructure, fostering the adoption of advanced treatment technologies. The presence of leading manufacturers and research institutions further reinforces China’s leadership. As the demand for minimally invasive treatments grows, China’s influence in the varicose vein treatment market in this region is expected to strengthen.

Japan is another major player in the Asia-Pacific varicose vein treatment market. The advanced healthcare system of Japan and strong emphasis on technological innovation are driving the Japanese market growth. For example, Japan is a global leader in the adoption of radiofrequency ablation, with over 60% of treatments utilizing this technique. Additionally, government support for medical research and development has bolstered market growth. As Japan continues to invest in healthcare innovation, its role in shaping the varicose vein treatment market remains significant.

India is anticipated to account for a notable share of the Asia-Pacific market over the forecast period owing to the India’s growing medical tourism industry and increasing investments in healthcare infrastructure. For instance, India’s National Health Policy has allocated over $30 billion to enhance access to advanced medical technologies. The presence of skilled vascular specialists and affordable treatment options further reinforces India’s position.

Australia holds a considerable share of the Asia-Pacific varicose vein treatment market. The robust healthcare system of Australia and high awareness levels about advanced treatment options are contributing to the market growth in Australia. For example, over 70% of patients in Australia opt for minimally invasive procedures due to their superior outcomes. Additionally, government initiatives aimed at promoting medical tourism have further enhanced adoption.

South Korea is estimated to grow at a healthy CAGR in this regional market owing to the country’s advanced medical technology sector and strong emphasis on innovation. For instance, South Korea has witnessed a 35% annual growth in the adoption of minimally invasive treatments. Additionally, government funding for healthcare research has bolstered market expansion.

KEY MARKET PARTICIPANTS

Companies that are playing a prominent role in the Asia Pacific Varicose Vein Treatment Market profiled in the report are Medtronic plc (Ireland), AngioDynamics, Inc. (U.S.), biolitec AG (Austria), Syneron Medical Ltd. (Israel), Lumenis Ltd. (Israel), Dornier MedTech GmbH (Germany), Energist Group (U.K.), Eufoton s.r.l. (Italy), Vascular Solutions, Inc. (U.S.), Quanta System S.p.A. (Italy), Sciton, Inc. (U.S.), Fotona d.o.o. (Slovenia), BTG plc (U.K.), Merz Aesthetics (U.S.).

MARKET SEGMENTATION

This research report segmented and sub-segmented the Asia-Pacific Varicose Vein Treatment Market into the following categories.

By Treatment Type

- Surgical Treatments

- Vein Ligation and Stripping

- Phlebectomy

- Non-Surgical Treatments

- Laser Therapy

- Trans-Illuminated Powered Phlebectomy (Trivex)

- Radiofrequency Ablation

- Sclerotherapy

By Device

- Ablation devices

- Radiofrequency Ablation Devices

- Laser Ablation Devices

- Venous Closure Products

- Surgical Products

By End-User

- Surgery Centres

- Hospitals

- Specialty Hospitals

- Multispecialty Hospitals

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]