Asia Pacific Frozen Processed Food Market Research Report - Segmented By Product, and Region(India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends And Forecasts 2025 to 2033

Asia Pacific Frozen Processed Food Market Size

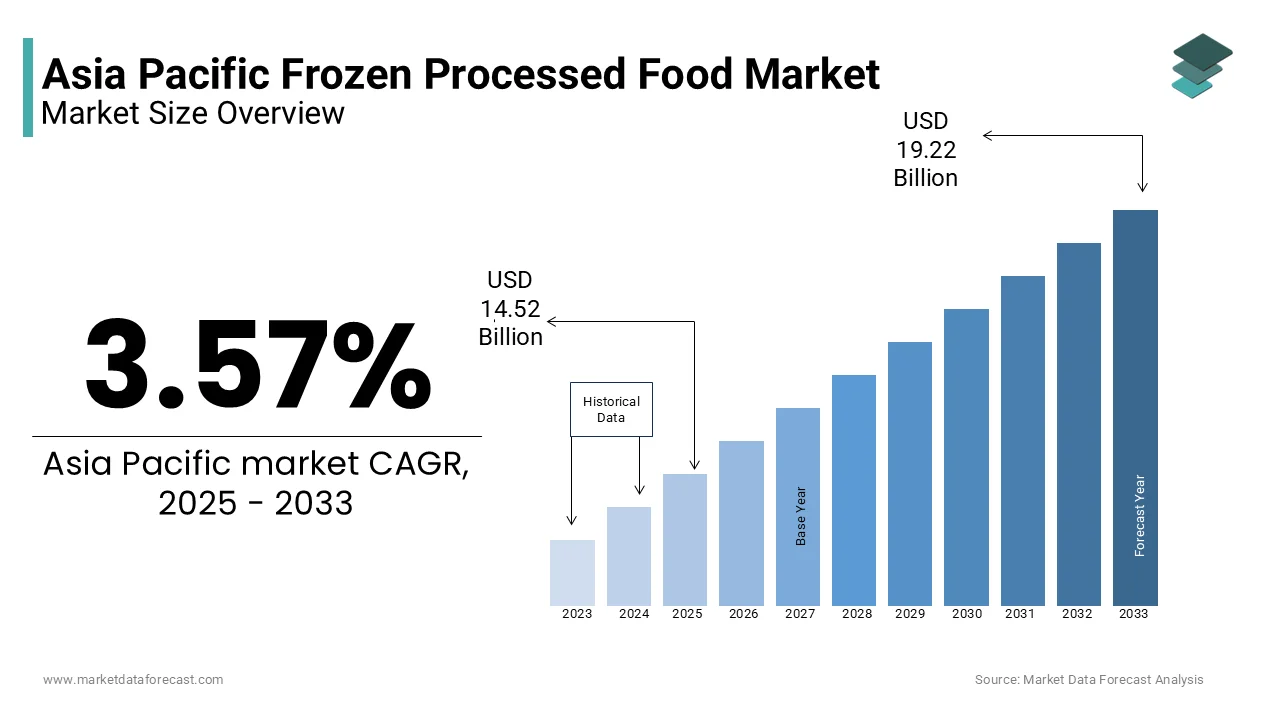

The Asia Pacific Frozen Processed Food market size was worth USD 14.02 billion in 2024. The Asia Pacific market is estimated to be worth USD 19.22 billion by 2033 from USD 14.52 billion in 2025, growing at a CAGR of 3.57% from 2025 to 2033

MARKET OVERVIEW

Due to busy lifestyles coupled with changing preferences among consumers towards ready-to-cook meals due to conveniences and hygiene is anticipated to remain a main driving factor for the overall industry. Compared to the fresh ones, these products contain maximum vitamins and minerals because freezing preserves the products for prolonged periods without any preservatives and deters any microbial growth that causes food spoilage. Frozen processed food items are perceived as healthy as natural food item among consumers across the world, more consumers are gradually shifting towards the consumption of frozen processed food in order to maintain a healthier lifestyle is one of the major drivers for the frozen processed food market. Moreover, due to the rise in health awareness among consumers, they are looking to reduce the consumption of ready-to-eat food items and are shifting towards the consumption of frozen processed food as they are seen as a healthier alternative. Furthermore, the vast product range of frozen processed food products due to product innovation is commenced by the manufacturers operating in the global frozen processed foods market is another factor driving the market. In addition, due to the busy lifestyle of the consumers in the developing regions including Asia Pacific and the Middle East, they are looking for the consumption of food items that would address their health requirements and are convenient at the same time. This factor is also fuelling the demand for the global processed food market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.57% |

|

Segments Covered |

By Product, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

China, Japan, India, Australia, and South Korea |

|

Market Leaders Profiled |

ConAgra Foods, Inc, Nestle S.A, Tyson Foods Inc, Unilever plc, BRF S.A, General Mills Inc, Ajinomoto Co. Inc, Unilever Plc, Allens, Inc, Heinz, Amy’s Kitchen Inc, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The frozen processed poultry held the largest market share followed by the frozen processed sea food segment. However, the frozen processed sea food segment is expected to surpass the frozen processed poultry segment in terms of revenue share. The frozen processed red meat segment held the largest market share and is projected to remain the market leader during the forecast period.

REGIONAL ANALYSIS

Asia Pacific is anticipated to register the highest growth rate. Consumer preference toward hygiene-related frozen products coupled with the new trend of online grocery purchases is expected to have a positive impact on the regional growth over the forecast period. Asia Pacific is expected to witness significant growth over the coming years due to swift expansion in fast food outlets in countries such as India, Singapore, Indonesia, Malaysia, and China. Growth in urbanization coupled with a rise in disposable income is the key factors in these countries, which have augmented consumers’ preference for fast food.

KEY MARKET PLAYERS

Key Players In Asia Pacific Frozen Processed Food Market are ConAgra Foods, Inc, Nestle S.A, Tyson Foods Inc, Unilever plc, BRF S.A, General Mills Inc, Ajinomoto Co. Inc, Unilever Plc, Allens, Inc, Heinz, Amy’s Kitchen Inc, and others.

MARKET SEGMENTATION

This Research Report on Asia Pacific Frozen Processed Food Market is segmented and sub segmented into following categories

By Product

- Frozen Fruits & Vegetables

- Frozen Potatoes

- Frozen Ready Meals

- Frozen Meat

- Frozen Fish/Seafood

- Frozen Soup

By Region

- India

- China

- Japan

- Australia

- South Korea.

Frequently Asked Questions

1. What is the current size of the Asia Pacific Frozen Processed Food market?

The Asia Pacific Frozen Processed Food market was valued at USD 14.02 billion in 2024.

2. What factors are driving growth in the Asia Pacific Frozen Processed Food market?

Key drivers include increasing urbanization, rising disposable incomes, consumer preference for convenient and hygienic food options, and the expansion of fast-food outlets in countries like India, China, and Indonesia.

3. What challenges does the Asia Pacific Frozen Processed Food market face?

Challenges include inadequate distribution networks, a lack of refrigeration facilities in some areas, and cultural preferences for fresh food over frozen alternatives.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]