Asia Pacific Cybersecurity Market Size, Share, Trends, & Growth Forecast Report By Component, Deployment Type, User Type, Industry Verticals, and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and Rest of APAC), Industry Analysis From 2024 to 2033

APAC Cybersecurity Market Size

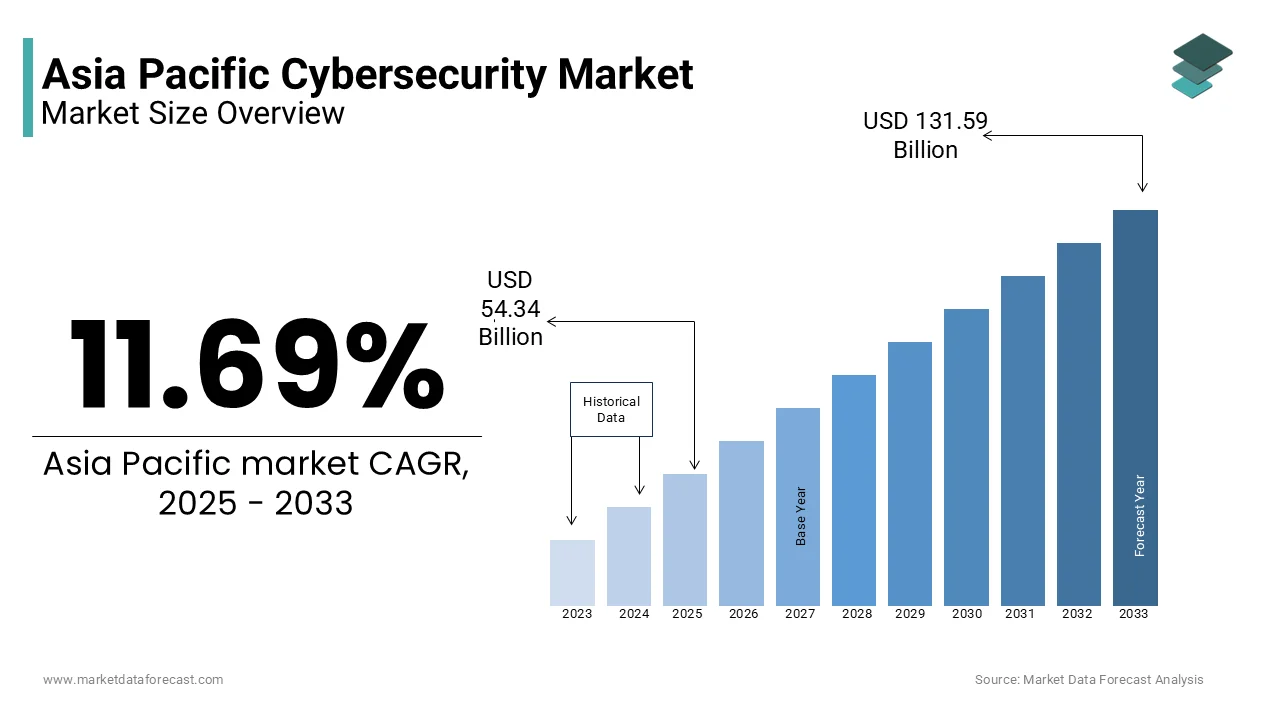

The size of the cybersecurity market in the Asia-Pacific region was worth USD 48.65 billion in 2024, and is estimated to grow at a CAGR of 11.69% from 2025 to 2033 and the APAC market size is expected to be valued at USD 131.59 billion by 2033 from USD 54.34 billion in 2025.

MARKET DRIVERS

The rise in IoT and the expanding rate of digital transformation in the Asia-Pacific is propelling the cybersecurity market growth in the Asia-Pacific region.

APAC is seeing a sharp surge in cybersecurity due to a substantial increase in internet, social media and mobile users in recent years. The scope of cyberattacks is projected to rise in the coming years. The stringent regulations from the governments of the APAC countries will serve to fuel the growth of the regional market.

The growing number of connected devices such as consumer electronics, connected cars, connected factories and others are driving the adoption of IoT and bolstering cybersecurity in enterprises. The growth of the APAC cybersecurity market is also fuelled by novel business approaches and applications along with decreasing device costs. Thus, the cybersecurity market in the Asia-Pacific region is propelled using M2M or IoT connectivity.

The rising awareness among people of cyber security and fast digitization are creating various opportunities for the APAC cybersecurity market. The region's investment in cybersecurity exceeded US $3.2 billion in 2021, and it is predicted to rise by 14% to US 6.1 billion dollars by 2026. The cybersecurity teams of Southeast Asian businesses are also highly confident in their ability to mitigate cyber risks over the past year, enabling remote and hybrid work, accelerating cloud adoption by more than 80 percent, and increasing data volumes. In addition, XDR platforms offer multiple benefits against Endpoint Detection and Response (EDR) and Endpoint Protection Platform (EPP) solutions because of their AI and ML capabilities. These advantages are mostly in the areas of threat prediction and cybersecurity automation.

MARKET RESTRAINTS

Large dependence on traditional authentication methods and poor preparedness are limiting the APAC cybersecurity market growth. Security experts advise the use of identity management technologies like facial recognition and biometric identification but over 80% of organizations still use usernames and passwords for login. Other difficulties include the difficulty of complying with regulations, the financial limitations of smaller enterprises and the lack of qualified cybersecurity experts. Therefore, constant investment is also necessary due to the dangerous dynamic character.

Gaps in cybersecurity skills, lack of awareness and investments and data privacy concerns are some of the major challenges for the APAC cybersecurity market. With 2.6 million experts required to properly protect digital assets Asia’s cybersecurity talent gap has hit a record high, which is a 23% increase from 2023 the largest increase globally second only to North America. Since conditions of consent are still new and being developed in the region, users frequently lack clear easy-to-read language that would secure their data and make it difficult to understand modifications.

Impact of COVID-19

COVID-19 had a positive impact on the APAC cybersecurity market due to the increasing prevalence of ransomware and malware cyberattacks. These cyberattacks are forcing organizations to adopt cybersecurity solutions, as many have shifted to online workplaces during restrictions in various countries. Throughout the epidemic, more people are using cloud-based services and operating in unfamiliar, unsecured surroundings, which has turned into a hotspot for cyberattacks. COVID-19-related email threats have increased by 67%. Therefore, cloud-based cybersecurity solutions are expected to grow and become crucial during this epidemic.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.69% |

|

Segments Covered |

By Component, Deployment Type, Enterprise, End-User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

NEC Corporation, Cisco Systems Inc., Kaspersky Labs, Dell Technologies Inc., Check Point Software Technologies Ltd., IBM Corporation, Imperva and Proofpoint Inc. |

SEGMENTAL ANALYSIS

By Component Insights

Based on components, the services segment is projected to grow at the fastest CAGR in the Asia-Pacific cybersecurity market during the forecast period. The deployment of cybersecurity services across various industries and sectors is driven by the increased adoption of cybersecurity solutions by enterprises in APAC depending on organizational structure. Companies are a prime target for cybercriminals because of the large number of resources, data and network connectivity.

By Deployment Type Insights

Based on deployment type, the cloud segment is expected to propel in the coming years in the Asia-Pacific cybersecurity market. As cloud services such as Dropbox, Google Drive, and Microsoft Azure are becoming more prevalent and constitute a vital part of corporate operations, businesses are faced with security challenges including losing control over confidential data. As a result, on-demand cyber-security solutions are being included more often.

By Enterprise Insights

Based on the enterprise, the large enterprises segment is estimated to hold the largest share of the APAC cybersecurity market during the forecast period. Large enterprises are incorporating cyber insurance into their business insurance plans to mitigate risks like data breaches and hacking associated with the implementation of multiple technologies.

By End-User Insights

The IT and Telecom and Manufacturing segments together accounted for almost 50% of the APAC cybersecurity market share in 2023. The aerospace & defense segment is predicted to account for a considerable share of the APAC market during the forecast period. Considering their information is sensitive government and defense organizations are frequently vulnerable to security breaches caused by state-sponsored hacktivists. As a result, many Asian Pacific governments are heavily investing in bolstering their country’s cyber security.

REGIONAL ANALYSIS

China is the biggest cybersecurity market in the Asia Pacific. The Chinese government is enhancing cybersecurity through the Cyberspace Administration, implementing policies and coordinating with other agencies, thereby increasing the demand for such measures.

India is anticipated to propel with a significant growth rate in the forecast period. The limited internet hardware control is challenging the national security architecture which is providing opportunities for the companies in the market. Authorities are also tackling localized cybercrimes with CERT-In handling increased incidents, therefore driving demand for cyber security.

Japan's APAC cyber security market is expected to move forward at a considerable pace in the future. The Japanese government and enterprises are gaining interest in cybersecurity due to the rise in cyberattacks, prompting the establishment of new legislation, strategies, and facilities.

South Korea is estimated to elevate further in the coming years. The ICT ministry of South Korea will make investments of USD 607 million by 2023 to work with significant cloud and data center firms to strengthen cybersecurity capabilities and counteract digital threats. It also intends to broaden the scope of collaborative training and send more employees to the center to improve its cyber response skills.

Singapore's APAC cyber security market will grow at a steady rate. The demand for cloud-based solutions and on-demand security services is rising as more Singaporean firms realize how cost-effective they can be.

KEY MARKET PLAYERS

NEC Corporation, Cisco Systems Inc., Kaspersky Labs, Dell Technologies Inc., Check Point Software Technologies Ltd., IBM Corporation, Imperva and Proofpoint Inc. are a few of the leading companies in the APAC cyber security market.

MARKET SEGMENTATION

This research report on the APAC cybersecurity market has been segmented and sub-segmented into the following categories.

By Component

-

Solutions

-

Services

By Deployment Type

-

Cloud

-

On-Premises

By Enterprise

-

Large

-

SMEs

By End-User

-

Aerospace & Defense

-

Healthcare

-

IT & Telecom

-

Energy

-

Manufacturing

By Region

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Thailand

-

Malaysia

-

Vietnam

-

Philippines

-

Indonesia

-

Singapore

-

Rest of APAC

Frequently Asked Questions

What are the main factors driving the growth of the cybersecurity market in APAC?

The main factors driving growth include increasing cyber threats, rapid digital transformation, strict regulatory requirements, and growing adoption of IoT and cloud-based services.

How is the regulatory environment in APAC affecting the cybersecurity market?

The regulatory environment, with stringent data protection laws and cybersecurity regulations, is pushing organizations to invest heavily in cybersecurity solutions to ensure compliance and protect sensitive data.

What are the key cybersecurity technologies being adopted in the APAC region?

Key technologies include endpoint security, cloud security, network security, threat intelligence, and AI-based cybersecurity solutions.

What are the emerging trends in the APAC cybersecurity market?

Emerging trends include the rise of zero-trust security models, increased investment in AI and machine learning for threat detection, the growing importance of data privacy solutions, and the expansion of cybersecurity services tailored to the needs of remote workforces.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]