Asia Pacific Cloud-Based Contact Center Market Size, Share, Trends, & Growth Forecast Report By Solution (ACD, APO, Diallers, IVR, CTI, Reporting and Analytics, and Security), Service (Professional and Managed), Application, Deployment Model, Organization Size, Vertical and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2024 to 2033

APAC Cloud-Based Contact Center Market Size

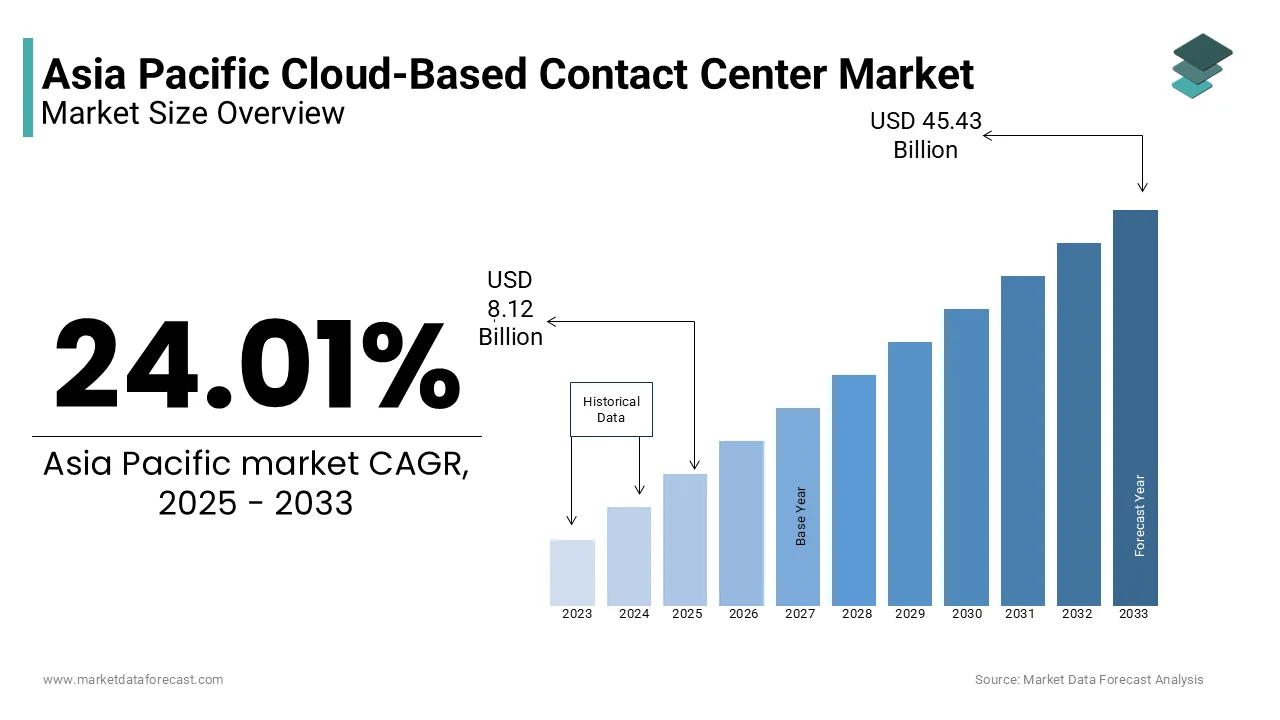

The Asia Pacific cloud-based contact center market was worth USD 6.55 billion in 2024. The Asia Pacific market is expected to register a CAGR of 24.01% from 2025 to 2033 and the APAC market is predicted to be worth USD 45.43 billion by 2033 from USD 8.12 billion in 2025.

A cloud-based contact center is the center of an organization hosted on an Internet network, where all outbound and inbound communications are managed. Cloud contact centers communicate with the aid of social media platforms, emails, voice and the Internet, which can be reached from any place virtually. Cloud contact centers are used to reduce costs, increase ROI, maximize agent performance, improve mobility and scalability, and enhance customer experience and empowerment. The implementation model for cloud-based contact centers allows companies to set up contact centers for third-party organizations.

MARKET DRIVERS

The growing demand from end-users for cloud-based services is one of the major factors propelling the growth of the APAC cloud-based contact center market.

These centers are scalable which allows companies to modify their capacity according to the client's needs. Likewise, agents and resources can be added or removed instantly by organizations, therefore offering cost-effective and peak performance. The adoption of generative AI and other technological advancements are contributing to the growth of the Asia Pacific cloud-based contact center market. The productivity of contact centers increased by more than 13 percent by utilizing generative AI tools which was measured by the number of customer issues addressed per hour. The utilization of omnichannel solutions and technologies is a significant contributor to regional market growth. Companies that use omnichannel solutions for client interaction are reporting improved employee retention rates, based on a recent survey.

Customer support with predictive customer experience (CX) accelerates the Asia Pacific cloud-based contact center market growth. Proactively solving problems before customers contact service providers or organizations can decrease interactions and enhance customer satisfaction. Experience communications as a service (XCaaS) is another related concept that is becoming steadily more prevalent in the area. Businesses can handle internal as well as external communications by using a single solution that integrates CCaaS and unified communications as a service into XCaaS.

The growing competition in the retail industry and evolving trends in customer services, preferences, attitudes and e-commerce are driving the growth of the cloud-based contact center market in the Asia-Pacific region. Many retailers, both offline and online, find cloud contact centers to be revenue streams with customer experience as a strategic priority. The e-commerce industry is making a considerable contribution to the development of cloud contact centers. Most large corporations understand that Cloud-based contact centers are a very cost-effective method of setting up their centers in an environment that offers inexpensive skilled labor. With the increasing acceptance of the cloud, the number of service providers offering full suites of contact center applications is proliferating.

MARKET RESTRAINTS

The rising cost is limiting the expansion of the Asia Pacific cloud-based contact center market. The growth will be impeded by expensive maintenance and deployment costs for omnichannel solutions. Small and medium-sized businesses could find it challenging to access technologically advanced services due to their financial constraints. Consequently, these sectors depend on conventional customer service technologies, which have a detrimental effect on the adoption rate. One of the major issues for the cloud-based contact center market is the capacity to scale its services to cope with the increasing consumer base. CCaas companies must invest in scalable infrastructure like cloud-based servers and storage solutions to meet the growing demand from businesses. Ensuring the security of consumer conversations and data is another significant concern for service providers.

Impact of COVID-19

The cloud-based contact center market was greatly influenced by COVID-19. This shift can be attributed to the adaptability of cloud platforms and subscription-based service models but automation is also becoming increasingly important for scaling customer support without sacrificing the quality of service. Multiple businesses and regions observed an upsurge in contact traffic in customer service centers due to COVID-19. Most contact centers' average handle time (AHT) went from three to six minutes to more like ten or more minutes. Longer wait times were linked with higher abandonment rates. Longer average wait times have an increasing impact on transfer rates, hence it is expected that average queue/hold times will grow.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

24.01% |

|

Segments Covered |

By Solution, Service, Application, Deployment Mode, Organization Size, Vertical, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

8x8 Inc. (US), Five9 (US), Cisco Systems (US), Genesys (US), Oracle (US), NewVoiceMedia (UK), Connect First (US), Aspect Software (US), and 3CLogic (US) |

SEGMENTAL ANALYSIS

By Solution Insights

Based on the solution, the ACD segment is the biggest in the Asia-Pacific cloud-based contact center market. ACD is still widely used in APAC as the foundation for effective call routing. To maximize customer happiness and operational efficiency, call flow and agent utilization must be optimized.

By Service Insights

Based on service, the managed segment is expected to hold the major share of the APAC market during the forecast period. Despite a decline in cloud service investment managed services demand in Asia Pacific remained robust during the second quarter of 2023.

By Application Insights

The real-time decision-making segment is estimated to capture the major share of the Asia-Pacific market during the forecast period. The personalized client experiences and agent coaching are available in this subsegment are driving this segment. Adoption rates are affected by the fact that AI and machine learning technologies are still developing.

By Deployment Mode Insights

Based on the deployment mode, the public cloud segment is expected to grow at the largest CAGR in the APAC market during the forecast period. These platforms enable IT and telecom companies to swiftly deploy and configure cloud-based contact centers, offering scalability and resource-based demand adjustments for business expansion.

By Organization Size Insights

Based on the organization size, the large enterprises segment holds the maximum share of the Asia-Pacific cloud-based contact center market. Large enterprises with diverse customer bases are investing in advanced technologies and utilizing contact center software solutions to enhance efficiency and profitability.

By Vertical Insights

Based on the vertical, the telecommunication and infrastructure technology-enabled services segment is anticipated to have the largest share of the APAC market during the forecast period. Cloud-based contact centers are becoming increasingly appealing to IT and telecom companies because they provide several advantages over conventional on-premise systems.

REGIONAL ANALYSIS

The APAC regional market is expected to provide many market opportunities and is projected to grow at the highest CAGR rate during the forecast period.

The Japanese cloud-based contact center market is expected to grow further in the future. It is a mature market that has strong adoption rates and is currently being slowed down by worries about data security and compliance with rules such as the APEC Cross border Privacy Rules.

The Chinese cloud-based contact center market is the biggest market in the Asia Pacific region. The most lucrative and fastest-growing cloud contact center market in Asia is propelled by indigenous players like UCloudlink, a sizable customer base and government initiatives.

The Indian cloud-based contact center market will move forward at a faster rate due to its sizable and youthful labor force, growing internet penetration and government programs like Digital India, therefore the nation has tremendous growth potential.

The South Korean cloud-based contact center market is estimated to propel in the coming years. The demand for sophisticated AI-powered solutions and integrated CRM systems is rising in the tech-savvy industry in the country.

The Singapore cloud-based contact center market will grow at a steady pace in the forecast period due to its prominence as a hub for innovation and technology, the area attracts players from across the world and even locally to support big businesses.

KEY MARKET PARTICIPANTS

The key players in the Asia-Pacific cloud-based contact center market include 8x8 Inc. (US), Five9 (US), Cisco Systems (US), Genesys (US), Oracle (US), NewVoiceMedia (UK), Connect First (US), Aspect Software (US), and 3CLogic (US)

MARKET SEGMENTATION

This research report on the Asia-Pacific cloud-based contact center market has been segmented and sub-segmented into the following categories.

By Solution

-

ACD

-

APO

-

Dialers

-

IVR

-

CTI

-

Reporting and Analytics

-

Security

By Service

-

Professional

-

Managed

By Application

-

Call Routing and Queuing

-

Data Integration and Recording

-

Chat Quality and Monitoring

-

Real-Time Decision-Making

-

Workforce Optimization (WFO)

By Deployment Mode

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

By Organization Size

-

Small and Medium-sized Enterprises

-

Large Enterprises

By Vertical

-

Banking, Financial Services, and Insurance

-

Consumer goods and retail

-

Government and public sector

-

Healthcare and life sciences

-

Manufacturing

-

Media and entertainment

-

Telecommunication and Information Technology Enabled Services

-

Others

By Region

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Thailand

-

Malaysia

-

Vietnam

-

Philippines

-

Indonesia

-

Singapore

-

Rest of APAC

Frequently Asked Questions

Which countries in the Asia-Pacific region are at the forefront of adopting cloud-based contact center solutions?

Countries like India, Australia, and Japan are at the forefront of adopting cloud-based contact center solutions in the Asia-Pacific region, driven by the need for scalable and flexible customer service solutions.

What factors are contributing to the growth of cloud-based contact centers in China?

In China, the growth of cloud-based contact centers is fueled by the increasing demand for omnichannel customer experiences, the rapid expansion of e-commerce, and a focus on enhancing customer engagement.

What is the market share of cloud-based contact centers in the rapidly growing tech hubs of Southeast Asia?

Cloud-based contact centers hold a substantial market share in the tech hubs of Southeast Asia, such as Kuala Lumpur and Bangkok, as companies prioritize digital transformation initiatives to stay competitive.

Who are the key players in the Asia-Pacific cloud-based contact center market?

8x8 Inc. (US), Five9 (US), Cisco Systems (US), Genesys (US), Oracle (US), NewVoiceMedia (UK), Connect First (US), Aspect Software (US), and 3CLogic (US) are playing the leading role in the regional market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]