Asia-Pacific Biomarkers Market Size, Share, Trends & Growth Forecast Report By Product, Type, Disease Indications & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific), Industry Analysis From 2025 to 2033

Asia-Pacific Biomarkers Market Size

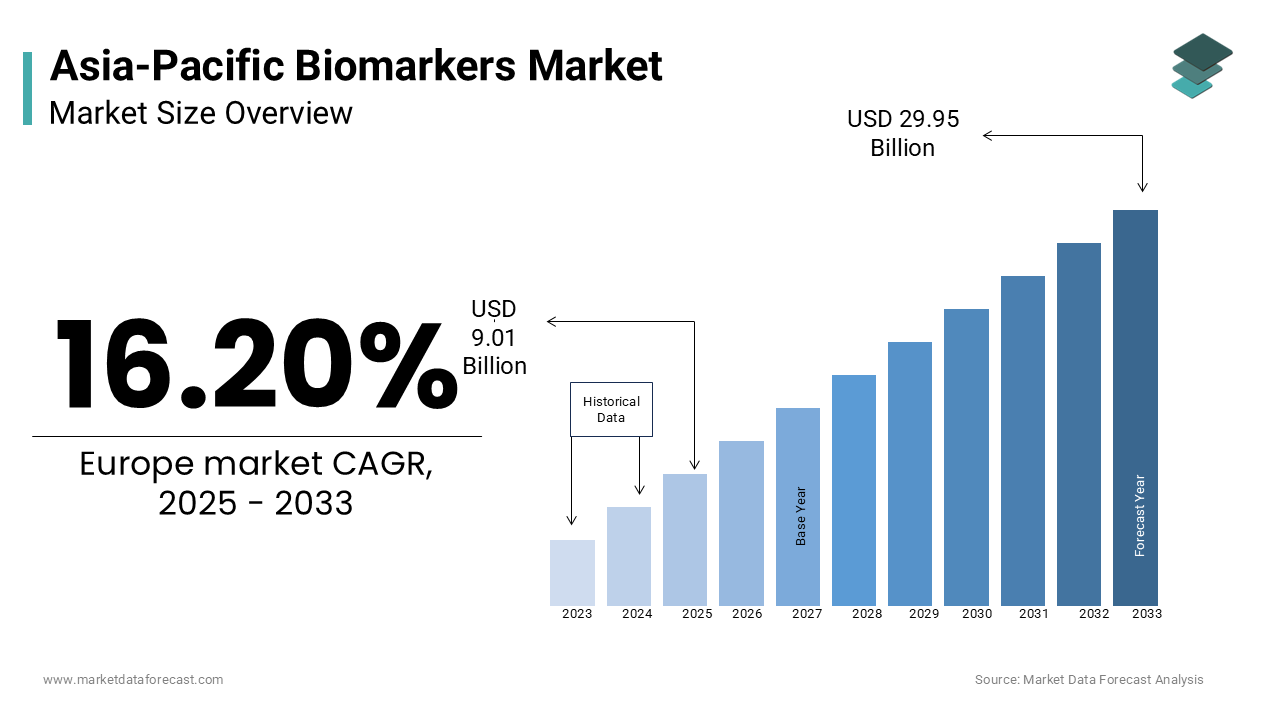

The biomarkers market size in the Asia-Pacific was valued at USD 7.75 billion in 2024. The regional market is predicted to be worth USD 29.95 billion by 2033 from USD 9.01 billion in 2025, growing at a CAGR of 16.20% during the forecast period.

Biomarkers are biological indicators, such as genes, proteins, or molecules that provide critical information about the health status of an individual. These indicators are widely used in diagnostics, prognostics, and therapeutic monitoring, playing a pivotal role in improving patient outcomes and advancing precision medicine. According to the World Health Organization, non-communicable diseases, including cancer, cardiovascular conditions, and diabetes, account for over 80% of deaths in the Asia-Pacific region. The high prevalence of these diseases has accelerated the adoption of biomarkers for early detection and targeted therapies. Governments across countries like China, Japan, and India are investing in biomarker research, recognizing its potential to enhance healthcare outcomes and reduce long-term costs. The integration of biomarkers with advanced technologies such as artificial intelligence and next-generation sequencing has further strengthened the market. For example, Japan’s Ministry of Health, Labour and Welfare actively supports biomarker-based cancer diagnostics as part of its national health strategy.

MARKET DRIVERS

Rising Prevalence of Chronic and Non-Communicable Diseases

The increasing burden of chronic and non-communicable diseases (NCDs) is a major driver of the Asia-Pacific biomarkers market. According to the World Health Organization, NCDs such as cancer, diabetes, and cardiovascular diseases account for over 80% of deaths in the region. For instance, China reports over 4.5 million new cancer cases annually, making early detection crucial. Biomarkers enable precise diagnostics and targeted therapies, improving patient outcomes and reducing healthcare costs. Additionally, governments in countries like India and Japan are prioritizing biomarker research to combat the rising NCD burden, further fueling demand for innovative biomarker-based solutions.

Advancements in Genomics and Precision Medicine

Technological advancements in genomics and the growing emphasis on precision medicine are significantly driving the biomarkers market in Asia-Pacific. Next-generation sequencing (NGS) technologies have revolutionized biomarker discovery, enabling the identification of molecular signatures for various diseases. According to Japan’s Ministry of Health, Labour and Welfare, genomic medicine programs focusing on cancer diagnostics have accelerated biomarker adoption. Similarly, India’s Genome India Project aims to map the genetic makeup of its population, enhancing the understanding of disease pathways and facilitating personalized therapies.

MARKET RESTRAINTS

High Costs of Biomarker Development and Implementation

The high costs associated with biomarker development and implementation are a significant restraint for the Asia-Pacific biomarkers market. According to the World Health Organization, developing a single biomarker-based diagnostic or therapeutic tool can cost upwards of $100 million, encompassing research, clinical trials, and regulatory approvals. These expenses make biomarkers inaccessible for small-scale healthcare providers and patients in low- and middle-income countries. Additionally, the lack of widespread reimbursement policies in countries like India and Indonesia further limits the affordability of biomarker-based diagnostics. This financial barrier restricts the adoption of advanced biomarker technologies, particularly in economically constrained regions.

Limited Standardization and Regulatory Challenges

The lack of standardization and regulatory frameworks across Asia-Pacific countries presents another major challenge for the biomarkers market. The World Health Organization highlights that inconsistent guidelines for biomarker validation and approval hinder market growth. Countries like Vietnam and the Philippines face regulatory delays, limiting the timely introduction of innovative biomarker solutions. Furthermore, the absence of harmonized protocols for data collection, storage, and analysis affects the reproducibility and reliability of biomarker studies. These challenges not only delay market entry for new technologies but also affect patient trust in biomarker-based diagnostics, necessitating regional efforts to streamline regulatory processes.

MARKET OPPORTUNITIES

Increasing Investment in Biomarker Research and Development

The Asia-Pacific biomarkers market has significant growth potential due to rising investments in research and development. Governments and private organizations are prioritizing biomarker discovery to address the region’s healthcare challenges. According to the Ministry of Science and Technology in China, over $3 billion was allocated to precision medicine initiatives in 2022, focusing heavily on biomarker development for cancer and cardiovascular diseases. Similarly, Japan’s Moonshot R&D Program emphasizes advancing biomarker-based diagnostics and treatments for age-related conditions. These investments accelerate innovation, improve diagnostic accuracy, and expand the availability of biomarker-based solutions, creating new opportunities for market players across the region.

Adoption of Digital Health and AI in Biomarker Applications

The integration of digital health technologies and artificial intelligence (AI) in biomarker research offers transformative opportunities for the Asia-Pacific market. The World Health Organization highlights that digital platforms and AI algorithms enhance biomarker analysis by processing complex datasets quickly and accurately. Countries like South Korea and Singapore are leading this trend with AI-driven tools for cancer diagnostics and personalized therapies. For instance, South Korea’s National Cancer Center has adopted AI platforms to identify predictive biomarkers, improving treatment outcomes. These advancements not only enhance the scalability of biomarker solutions but also enable the development of cost-effective diagnostics tailored to the region’s unique healthcare needs.

MARKET CHALLENGES

Data Privacy and Security Concerns in Biomarker Research

The increasing reliance on large-scale biomarker data poses significant challenges related to data privacy and security in the Asia-Pacific region. The World Health Organization emphasizes that the collection and storage of sensitive patient data, particularly for genomic and proteomic studies, require stringent safeguards. Countries like India and Indonesia face gaps in data protection regulations, leading to vulnerabilities in biomarker research frameworks. Unauthorized access or data breaches can compromise patient trust and hinder the adoption of biomarker-based solutions. Addressing these concerns necessitates robust cybersecurity measures and harmonized data governance policies to ensure the ethical use of sensitive health information.

Limited Access to Advanced Diagnostic Infrastructure

Inadequate access to advanced diagnostic infrastructure hampers the growth of the Asia-Pacific biomarkers market, particularly in low- and middle-income countries. According to the World Bank, rural regions in countries like Bangladesh, Nepal, and Cambodia face significant disparities in healthcare access, with limited availability of biomarker testing facilities. The lack of advanced diagnostic tools, such as next-generation sequencing platforms, restricts the widespread application of biomarkers for disease detection and treatment. Furthermore, the high costs associated with establishing such infrastructure make it challenging for healthcare providers to expand their services, particularly in economically constrained areas. Bridging this gap is crucial for equitable market growth.

REGIONAL ANALYSIS

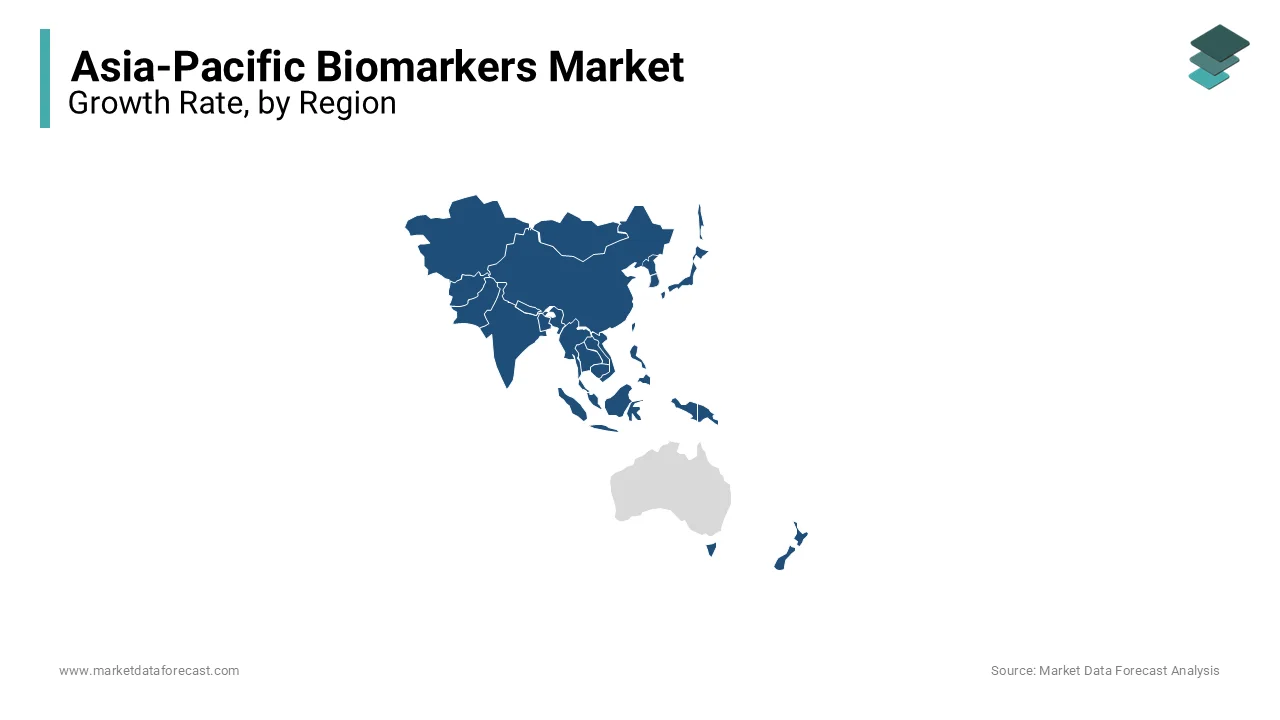

China leads the Asia-Pacific biomarkers market due to its substantial investments in precision medicine and growing healthcare infrastructure. According to the Ministry of Science and Technology, China allocated over $3 billion to biomarker research and related technologies in 2022. The country’s emphasis on genomics, driven by projects like the China Precision Medicine Initiative, supports advanced biomarker discovery for cancer and rare diseases. Additionally, China’s high burden of non-communicable diseases, with over 4.5 million annual cancer cases reported by the World Health Organization, underscores the demand for biomarker-based diagnostics and treatments. This focus solidifies China’s leadership in the regional market.

Japan is a key player in the Asia-Pacific biomarkers market, supported by its advanced research ecosystem and aging population. The Ministry of Health, Labour and Welfare highlights that Japan’s initiatives in genomic medicine, such as the Cancer Genome Screening Project, have accelerated biomarker adoption in oncology. With over 28% of its population aged 65 or older, the demand for personalized treatments for age-related diseases has grown significantly. Japan’s biopharmaceutical industry actively collaborates with academia, driving innovation in biomarkers for diagnostics and therapeutic monitoring. These factors, coupled with government funding for precision medicine, strengthen Japan’s position in the regional market.

India’s large population and high prevalence of chronic diseases drive its leadership in the biomarkers market. According to the World Health Organization, India has over 77 million diabetes patients, creating a strong demand for biomarkers for early detection and management. Initiatives like the Genome India Project, which maps the genetic makeup of the population, contribute to advancements in personalized medicine. India’s growing pharmaceutical and biotechnology sectors also invest heavily in biomarker research, particularly for oncology and cardiovascular diseases. These factors, combined with government support for R&D, position India as a major player in the Asia-Pacific biomarkers market.

South Korea’s technological advancements and focus on digital health significantly contribute to its leading position in the biomarkers market. The Ministry of Health and Welfare notes that South Korea has adopted AI-driven biomarker tools to enhance cancer diagnostics and precision medicine. The country’s National Cancer Center actively researches predictive biomarkers to improve treatment outcomes. Additionally, South Korea’s strong healthcare infrastructure and high adoption of cutting-edge technologies, such as next-generation sequencing, facilitate biomarker applications in various therapeutic areas. Government funding for biomedical R&D further drives innovation, making South Korea a prominent market for biomarkers in the Asia-Pacific region.

Australia’s robust healthcare system and focus on translational research position it as a leader in the Asia-Pacific biomarkers market. The Australian Institute of Health and Welfare highlights that the country invests significantly in cancer biomarker research, with projects like the Australian Genomic Cancer Medicine Program driving advancements. Australia’s high incidence of cancer, with over 150,000 new cases annually, increases demand for biomarker-based diagnostics. Additionally, its focus on integrating biomarkers into clinical trials and personalized medicine initiatives has enhanced healthcare outcomes. These factors, coupled with government-backed programs to expand research capabilities, solidify Australia’s role in the regional biomarkers market.

KEY MARKET PLAYERS

A few of the noteworthy companies operating in the Asia-Pacific biomarkers market profiled in this report are Bio-Rad Laboratories (U.S.), Qiagen N.V. (Netherlands), Enzo Biochem (U.S.), PerkinElmer, Inc. (U.S.), Merck & Co, Inc. (U.S.), EKF Diagnostics Holdings plc. (U.S.), Meso Scale Diagnostics, LLC (U.S.), Singulex, Inc. (U.S.), BioSims Technologies (France), Cisbio Bioassays (France), and Signosis, Inc. (U.S.).

MARKET SEGMENTATION

This research report on the Asia-Pacific biomarkers market has been segmented and sub-segmented into the following categories.

By Product

- Consumables

- Software

- Services

By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Validation Biomarkers

By Application

- Diagnostics Developments

- Drug Discovery & Development

- Personalized Medicine

- Disease Risk Assessment

By Disease Indications

- Cancer

- Cardiovascular

- Neurological

- Immunological Disorders

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the growth rate of the APAC Biomarkers Market?

The APAC biomarkers market is estimated to grow at a CAGR of 16.2% from 2025 to 2033.

Who are the key players in the APAC Biomarkers Market?

Thermo Fisher Scientific, Bio-Rad Laboratories, Roche Diagnostics, and Qiagen are some of the notable companies in the APAC biomarkers market.

What are the key factors driving the APAC Biomarkers Market?

The growth of the biomarkers market in APAC is primarily driven by factors such as increasing prevalence of chronic diseases, growing demand for personalized medicine, and advancements in biomarker discovery and development.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]