Asia Pacific Ambulance Services Market Size, Share, Trends & Growth Forecast By Transport, Emergency Services, Equipment & Country (India, China, Japan, South Korea, Australia & New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Ambulance Services Market Size

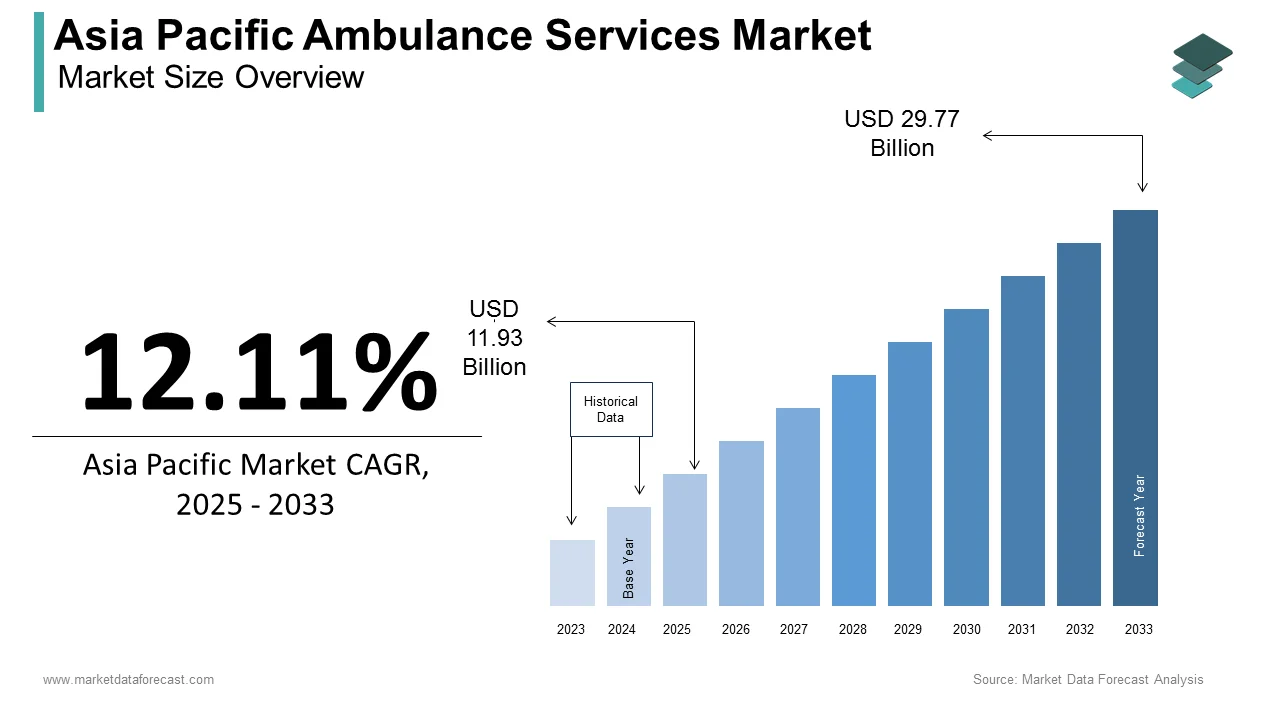

The ambulance services market size in Asia-Pacific was valued at USD 10.64 billion in 2024. The regional market is estimated to be growing at a CAGR of 12.11% from 2025 to 2033 and be worth USD 29.77 billion by 2033 from USD 11.93 billion in 2025.

Ambulance services include ground, air, and water ambulance operations, equipped with basic life support (BLS) and advanced life support (ALS) systems. According to the World Health Organization (WHO), the demand for ambulance services in the Asia Pacific region has surged due to the increasing prevalence of chronic diseases, road traffic accidents, and aging populations. For instance, cardiovascular diseases alone account for over 25% of all deaths in the region, necessitating rapid medical interventions facilitated by ambulance services.

The growing urbanization and the expansion of healthcare facilities across key countries such as India, China, and Japan are significantly fuelling the demand for ambulance services in the Asia-Pacific region. According to the Asian Development Bank, urban populations in the region are projected to grow by 1.2 billion people by 2050, intensifying the need for efficient emergency response systems. Additionally, advancements in medical technology have enhanced the capabilities of ambulance services, enabling them to deliver pre-hospital care that significantly improves patient outcomes. As per the Ministry of Health in Australia, ALS-equipped ambulances have reduced mortality rates in cardiac arrest cases by up to 30%. These factors collectively underscore the importance of ambulance services as a cornerstone of modern healthcare delivery in the Asia Pacific region.

MARKET DRIVERS

Rising Incidence of Road Traffic Accidents

According to the Global Burden of Disease Study, road traffic accidents are among the leading causes of death and disability in the Asia Pacific region, accounting for approximately 750,000 fatalities annually. The WHO estimates that over 60% of these incidents occur in low- and middle-income countries like India and Indonesia, where inadequate emergency response systems exacerbate the severity of injuries. In response, governments are investing heavily in upgrading ambulance fleets and training paramedics to reduce response times. For instance, the Indian government’s National Health Mission has allocated $250 million to enhance emergency medical services, including the procurement of 5,000 new ambulances by 2025. Furthermore, the Japan Automobile Federation reports that ambulance response times in urban areas have improved by 15% over the past five years due to technological advancements such as GPS tracking and real-time traffic monitoring. This growing focus on mitigating the impact of road accidents underscores the pivotal role of ambulance services in saving lives and reducing long-term healthcare costs.

Aging Population and Chronic Disease Burden

According to the United Nations Department of Economic and Social Affairs, the Asia Pacific region is home to over 60% of the world’s elderly population, with projections indicating that individuals aged 65 and above will constitute 25% of the population by 2050. This demographic shift has led to a significant rise in chronic diseases such as diabetes, hypertension, and respiratory disorders, which require frequent medical attention. According to the Ministry of Health in Japan, more than 80% of ambulance calls in the country are linked to age-related health issues. Similarly, China’s National Health Commission reports a 20% increase in ambulance usage among the elderly population over the past decade. To address this growing demand, governments are expanding their ambulance networks and integrating telemedicine solutions into emergency services. For example, South Korea has introduced smart ambulances equipped with remote diagnostic tools, enabling paramedics to consult specialists during transit. This convergence of demographic trends and healthcare innovation positions ambulance services as a vital component of geriatric care in the region.

MARKET RESTRAINTS

Inadequate Infrastructure in Rural Areas

According to the Asian Development Bank, rural regions in the Asia Pacific account for over 45% of the population but often lack the necessary infrastructure to support efficient ambulance services. For instance, the Indian Ministry of Health reports that nearly 70% of rural areas do not have access to timely ambulance services, primarily due to poor road connectivity and insufficient funding. The WHO highlights that in countries like Indonesia and the Philippines, mountainous terrains and scattered islands further complicate ambulance operations, resulting in delayed response times and increased mortality rates. Additionally, the absence of trained paramedics and outdated ambulance fleets exacerbates the challenges faced by rural communities. For example, a study conducted by the University of Melbourne reveals that response times in rural Australia are 30% longer than in urban areas, underscoring the disparity in service quality. These infrastructural gaps not only hinder the effectiveness of ambulance services but also widen the urban-rural divide in healthcare accessibility.

High Operational Costs and Budget Constraints

According to the Ministry of Finance in Thailand, the operational costs of maintaining an ambulance fleet, including fuel, maintenance, and staffing, can exceed $50,000 annually per vehicle. This financial burden is particularly acute for developing nations, where healthcare budgets are already stretched thin. For instance, the Bangladesh Health Economics Association reports that the country allocates less than 1% of its healthcare budget to emergency medical services, severely limiting the expansion of ambulance networks. Furthermore, the rising cost of advanced medical equipment, such as defibrillators and ventilators, poses additional challenges for ALS-equipped ambulances. The Australian Institute of Health and Welfare notes that despite government subsidies, private ambulance operators face a 10% annual increase in operational expenses, forcing them to pass these costs onto consumers. These financial constraints not only impede service scalability but also threaten the sustainability of existing ambulance operations across the region.

MARKET OPPORTUNITIES

Integration of Telemedicine and IoT Technologies

According to the International Telecommunication Union, the integration of telemedicine and Internet of Things (IoT) technologies into ambulance services presents a transformative opportunity for the Asia Pacific region. Smart ambulances equipped with IoT devices can transmit real-time patient data to hospitals, enabling doctors to initiate treatment protocols before the patient arrives. For instance, the Japanese Ministry of Health reports that IoT-enabled ambulances have reduced hospital admission times by 20%, improving survival rates for critical conditions. Similarly, as per the Health Sciences Authority of Singapore, telemedicine consultations conducted during ambulance transit have increased diagnostic accuracy by 15%. The adoption of these technologies is further supported by the region’s rapid digital transformation, with the Asia Cloud Computing Association projecting a 25% annual growth in IoT applications through 2030. By leveraging telemedicine and IoT, ambulance services can enhance operational efficiency and deliver superior patient outcomes, positioning themselves at the forefront of healthcare innovation.

Public-Private Partnerships (PPPs) for Service Expansion

According to the World Bank, public-private partnerships (PPPs) offer a viable solution to expand ambulance services across underserved areas in the Asia Pacific region. For example, the Indian government’s collaboration with private entities under the National Health Mission has resulted in the deployment of over 10,000 ambulances in rural districts, benefiting 500 million people. Similarly, the Philippine Department of Health reports that PPP initiatives have reduced ambulance response times by 25% in urban areas. The Australian Healthcare and Hospitals Association highlights that PPPs enable governments to leverage private sector expertise and funding, ensuring sustainable service delivery. Furthermore, the Asian Development Bank estimates that PPP-driven projects could generate $50 billion in healthcare investments by 2030, with a significant portion allocated to emergency medical services. By fostering collaboration between public and private stakeholders, the ambulance services market can overcome resource limitations and achieve equitable healthcare access.

MARKET CHALLENGES

Shortage of Trained Paramedics

According to the International Paramedic Association, the Asia Pacific region faces a critical shortage of trained paramedics, with an estimated deficit of 500,000 professionals as of 2022. According to the World Health Organization, countries like Vietnam and Malaysia have fewer than 10 paramedics per 100,000 people, far below the global average of 35. This shortage is exacerbated by limited training facilities and low awareness about paramedic careers. For instance, the Indonesian Ministry of Health reports that only 30% of ambulance staff receive formal paramedic training, compromising the quality of pre-hospital care. Additionally, the Australian Paramedics Association notes that rural areas experience a 40% higher turnover rate among paramedics due to challenging working conditions and inadequate remuneration. These workforce challenges not only hinder service delivery but also undermine public confidence in ambulance services, necessitating urgent policy interventions to address the paramedic deficit.

Regulatory Fragmentation Across Countries

According to the Asian Health Policy Forum, regulatory fragmentation poses a significant challenge to the standardization of ambulance services across the Asia Pacific region. Each country operates under distinct legal frameworks, creating inconsistencies in service quality and operational protocols. For example, the Chinese Ministry of Health mandates ALS-equipped ambulances for all urban areas, while neighboring countries like Cambodia lack such regulations, resulting in uneven service standards. The WHO reports that cross-border ambulance operations are further complicated by differing licensing requirements and insurance policies, limiting regional cooperation during emergencies. Additionally, the New Zealand Ministry of Health highlights that fragmented regulations delay the adoption of innovative technologies, as manufacturers must comply with multiple standards. These regulatory barriers not only impede market growth but also hinder the development of a cohesive regional emergency response system.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Services, Transport, Equipment, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, and the Rest of North America. |

|

Market Leader Profiled |

Falck A/S, Babcock International Group PLC (Scandinavian AirAmbulance), Acadian Ambulance Service, Inc. (Acadian Companies), Medivic Pharmaceutical Pvt. Ltd. (Medivic Aviation), BVG India Ltd., America Ambulance Services, Inc., Air Methods Corporation (ASP AMC Intermediate Holdings, Inc.), Global Medical Response, Inc., Ziqitza Health Care Limited and Dutch Health B.V., and Others. |

SEGMENTAL ANALYSIS

By Services Insights

The emergency services segment held the largest share of 65.4% of the Asia Pacific ambulance services market in 2024. The growth of the emergency services segment is majorly driven by the high incidence of acute medical conditions and trauma cases. The Indian Ministry of Health reports that over 70% of ambulance calls in urban areas are for emergencies, reflecting the critical role of these services in saving lives. This segment’s dominance is further reinforced by government initiatives, such as Japan’s Emergency Medical Service Act, which mandates rapid response times for life-threatening conditions. Additionally, the integration of advanced technologies, such as GPS navigation and automated dispatch systems, has enhanced the efficiency of emergency services, making them indispensable in the healthcare ecosystem.

The non-emergency services segment is projected to grow at a CAGR of 9.4% over the forecast period owing to the increasing demand for scheduled medical transportation. According to the South Korean Ministry of Health, non-emergency services now account for 40% of ambulance usage among elderly patients requiring routine hospital visits. Furthermore, the adoption of subscription-based models has expanded access to these services, particularly in urban areas. This segment’s rapid growth underscores its potential to complement traditional emergency services while addressing the evolving needs of the population.

By Transport Insights

The ground ambulance services segment ruled the regional market by accounting for the most significant share of the Asia-Pacific in 2024 owing to their widespread availability and cost-effectiveness. The Chinese Ministry of Health reports that ground ambulances are responsible for 90% of all medical transports in urban areas, highlighting their central role in emergency response systems. This segment’s leadership is attributed to its ability to navigate diverse terrains and integrate seamlessly with existing healthcare infrastructure.

The air ambulance services segment is predicted to register a CAGR of 12.2% over the forecast period. Factors such as the ability of air ambulance services to provide rapid medical evacuation in remote and inaccessible areas is propelling the expansion of the air ambulance services segment in the Asia-Pacific market. As per the Japanese Ministry of Health, air ambulances have reduced response times by 40% in mountainous regions, which is underscoring their importance in enhancing healthcare accessibility. The potential of air ambulances to revolutionize emergency medical services in geographically challenging environments is further promoting the growth of the air ambulance services segment in the regional market.

By Equipment Insights

The BLS ambulance services segment led the market by occupying 70.4% of the Asia-Pacific market share in 2024. The Indian Ministry of Health reports that BLS ambulances are widely used in rural areas, where advanced medical equipment is often unavailable. This segment’s prominence is further supported by its affordability and ease of operation, making it a practical choice for large-scale deployments.

The ALS ambulance services segment is estimated to expand at a notable CAGR of 10.11% over the forecast period owing to the rising prevalence of critical conditions requiring intensive pre-hospital care. According to the South Korean Ministry of Health, ALS-equipped ambulances have improved survival rates by 25% in cardiac arrest cases, emphasizing their importance in modern healthcare. The potential of ALC ambulances to enhance patient outcomes through advanced medical interventions is contributing to the expansion of the ALS ambulances segment in the Asia-Pacific market.

REGIONAL ANALYSIS

India captured the leading share of 26.6% of the Asia Pacific ambulance services market share in 2024 and is anticipated to continue to hold the leading position in this regional market throughout the forecast period. The growth of the Indian market is attributed to its large population and increasing healthcare investments. Government initiatives, such as the National Health Mission, have significantly expanded ambulance networks, particularly in rural areas.

China is another leading market for ambulance services in the Asia-Pacific market. The robust healthcare infrastructure of China and rapid adoption of technological advancements are propelling the Chinese market growth. The integration of AI and IoT in ambulance services has positioned China as a leader in innovation.

Japan is estimated to account for a substantial share of the Asia-Pacific over the forecast period owing to the strong emphasis on emergency preparedness and geriatric care. The country’s aging population has driven demand for ALS-equipped ambulances.

Australia and New Zealand are together expected to hold a notable share of the regional market over the forecast period. The Australian Institute of Health and Welfare reports that this region accounts for 10% of the market, characterized by high-quality services and extensive use of telemedicine.

South Korea is anticipated to showcase a prominent CAGR during the forecast period. Factors such as the rapid urbanization and technological adoption driving the market growth in South Korea.

KEY MARKET PLAYERS

Companies such as Falck A/S, Babcock International Group PLC (Scandinavian AirAmbulance), Acadian Ambulance Service, Inc. (Acadian Companies), Medivic Pharmaceutical Pvt. Ltd. (Medivic Aviation), BVG India Ltd., America Ambulance Services, Inc., Air Methods Corporation (ASP AMC Intermediate Holdings, Inc.), Global Medical Response, Inc., Ziqitza Health Care Limited and Dutch Health B.V. are currently playing a leading role in the APAC ambulance services market.

MARKET SEGMENTATION

This research report on the Asia-Pacific ambulance services market is segmented and sub-segmented into the following categories.

By Services

- Emergency Services

- Non-emergency Services

By Transport

- Ground Ambulance Services

- Air Ambulance Services

- Water Ambulance Services

By Equipment

- Basic Life Support (BLS) Ambulance Services

- Advanced Life Support (ALS) Ambulance Services

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]