Global Antithrombotic/Anticoagulant Drugs Market Size, Share, Trends & Growth Forecast Report By Type (Low Molecular Weight Heparin, Oral Anticoagulants (Vitamin K Antagonists), Antiplatelet Drugs and Thrombin Inhibitors) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis (2025 to 2033)

Global Antithrombotic/Anticoagulant Drugs Market Size

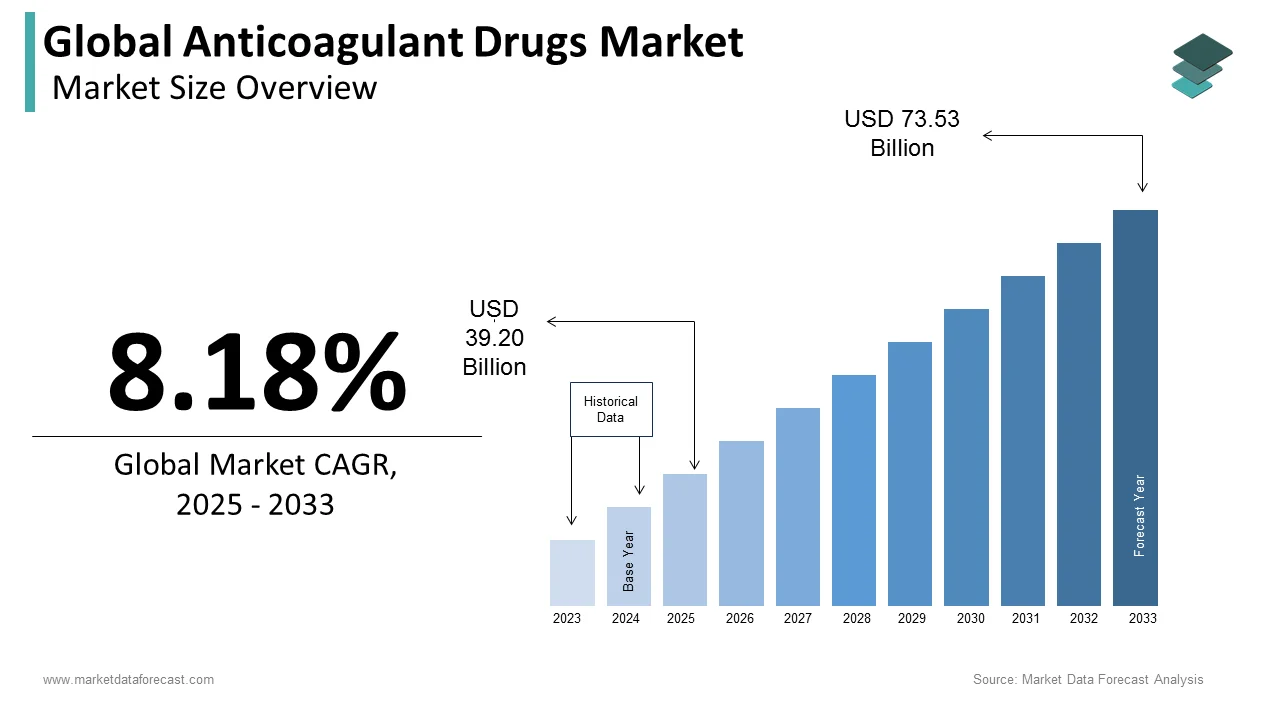

The size of the global anticoagulant drugs market was valued at USD 36.24 billion in 2024. The global market is expected to grow at a CAGR of 8.18% from 2025 to 2033 and grow from USD 39.20 billion in 2025 to USD 73.53 billion by 2033.

The antithrombotic and anticoagulant drugs market is growing due to an increase in cardiovascular diseases, which are a major health concern globally. Many people, especially older adults, face risks of blood clots that can lead to strokes or heart attacks. Conditions like atrial fibrillation (an irregular heartbeat) also raise the chance of clots, making anticoagulant drugs important in treatment plans. Newer drugs, like direct oral anticoagulants (DOACs), are designed to be more convenient and safer, often reducing the need for regular blood tests. As the population ages and healthcare access improves, the need for these drugs is expected to keep rising.

MARKET TRENDS

Shift Toward Direct Oral Anticoagulants (DOACs)

Direct Oral Anticoagulants (DOACs) are rapidly replacing traditional therapies like warfarin due to their safety and convenience. Unlike warfarin, DOACs do not require frequent blood monitoring, making them more user-friendly for patients. In recent years, DOACs have shown strong effectiveness in reducing stroke risk in patients with conditions such as atrial fibrillation, a disorder affecting around 37 million people globally. With fewer dietary restrictions and predictable dosing, DOACs are set to dominate the market. By 2023, DOACs already represented over 70% of new anticoagulant prescriptions in the U.S. alone, underlining the strong shift toward these newer drugs.

Focus on Reducing Bleeding Risks

A major trend in the antithrombotic market is the push to develop drugs that balance efficacy with minimal bleeding risks, a key side effect of anticoagulants. Studies show that bleeding complications affect nearly 15-20% of patients on long-term anticoagulant therapy, making safety enhancements a high priority. New formulations and next-generation anticoagulants aim to reduce this risk, targeting safer profiles, especially for high-risk groups, such as elderly patients. This trend is evident in the extensive R&D investment; several new drugs have recently gained regulatory approval, addressing these bleeding concerns to improve patient outcomes and treatment adherence.

MARKET DRIVERS

Rising Cardiovascular Disease Prevalence

Cardiovascular diseases (CVDs) are the leading cause of death globally, responsible for approximately 32% of all deaths, according to the World Health Organization. Conditions like atrial fibrillation, deep vein thrombosis, and pulmonary embolism drive demand for anticoagulant drugs to prevent life-threatening blood clots. As populations age, the prevalence of CVDs is projected to rise, particularly in regions with higher life expectancies. Consequently, this growing patient base directly boosts demand for effective antithrombotic therapies, pushing pharmaceutical companies to innovate safer and more efficient options in the anticoagulant market.

The Growing Aging Population

The increasing number of older adults worldwide is a critical driver for the anticoagulant drugs market. Older individuals are at greater risk for blood clot-related conditions due to slower circulation and comorbidities like diabetes and hypertension. According to the United Nations, the population aged 65 and older is expected to double by 2050, which will substantially increase the need for anticoagulant therapies. Given that older adults often require long-term anticoagulant use, pharmaceutical companies are focused on developing drugs that balance effectiveness with safety, particularly reducing the risk of bleeding in this vulnerable age group.

Shift Toward Minimally Invasive and Convenient Treatment Options

Patient demand for safer, more convenient treatments has fueled a move away from traditional therapies like warfarin, which requires frequent blood monitoring. Newer Direct Oral Anticoagulants (DOACs) simplify anticoagulation management, offering predictable dosing without the need for regular blood tests. As a result, DOACs are increasingly preferred; for instance, they accounted for a majority of new anticoagulant prescriptions in the U.S. by 2024. This trend reflects a market shift, as DOACs reduce patient burden and improve compliance, creating a more user-friendly approach that appeals to both patients and healthcare providers.

MARKET RESTRAINTS

High Cost of Anticoagulant Drugs

The high price of anticoagulant therapies, especially newer options like Direct Oral Anticoagulants (DOACs), presents a significant barrier. For example, while a traditional therapy like warfarin costs a few dollars per dose, newer drugs can reach several hundred dollars monthly without insurance. This cost factor limits accessibility for patients without sufficient healthcare coverage, particularly in lower-income regions. High costs also strain healthcare systems, as anticoagulant drugs often require long-term use. As a result, affordability issues hinder market growth and reduce treatment adherence, especially in countries without robust health insurance structures.

Bleeding Risk and Safety Concerns

A major restraint in the anticoagulant market is the risk of severe bleeding, a common side effect of these drugs. Anticoagulants are essential for preventing clots but can increase the likelihood of dangerous bleeding events, especially in elderly patients or those with multiple health conditions. Studies indicate that approximately 15-20% of patients on long-term anticoagulants experience bleeding complications, which can be life-threatening. Due to these risks, some patients avoid or discontinue anticoagulant therapy altogether, limiting the market. Pharmaceutical companies face pressure to develop safer options that balance efficacy with lower bleeding risks.

Regulatory Challenges and Stringent Approval Processes

Anticoagulant drugs face complex and rigorous regulatory approval due to their high-risk profile. Regulatory agencies like the FDA and EMA require extensive clinical testing to assess both efficacy and safety, particularly the bleeding risks associated with these drugs. This lengthy approval process can delay the introduction of new anticoagulants, adding to development costs and time-to-market. Additionally, post-market surveillance requirements to monitor adverse effects can be costly and challenging for manufacturers. Regulatory challenges thus slow innovation and increase financial risks, restraining market growth despite the high demand for safer anticoagulant solutions.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present substantial growth opportunities for the anticoagulant drugs market. Rising healthcare spending and increased access to medical treatments in countries like India and Brazil enable wider adoption of anticoagulant therapies. Cardiovascular diseases, which contribute to over 75% of CVD-related deaths in low- and middle-income regions, are a growing concern, driving demand for antithrombotic treatments. As these regions expand healthcare infrastructure, pharmaceutical companies can leverage unmet needs by offering cost-effective anticoagulants or partnerships with local firms to increase market presence and accessibility in these high-growth areas.

Development of Safer and Targeted Therapies

Innovation focused on reducing bleeding risks presents a promising opportunity. Approximately 15-20% of patients on traditional anticoagulants experience bleeding complications, highlighting a significant need for safer alternatives. New drugs under development, including Factor Xa inhibitors and direct thrombin inhibitors, aim to minimize these risks while providing effective clot prevention. Additionally, precision medicine approaches are advancing targeted anticoagulant therapies based on genetic profiles, potentially improving treatment safety and efficacy. Addressing safety concerns not only increases patient adherence but could also widen the eligible patient pool, further driving market growth.

Rising Demand for Convenient Oral Anticoagulants (DOACs)

As patient preference shifts toward convenient, non-invasive treatments, oral anticoagulants like DOACs are gaining momentum over traditional injectables. DOACs simplify treatment by eliminating the need for regular blood monitoring and offering predictable dosing, which significantly improves patient adherence. By 2023, DOACs made up over 70% of new anticoagulant prescriptions in certain regions, reflecting their rapid adoption. This preference for ease-of-use therapies creates opportunities for pharmaceutical companies to expand DOAC offerings and improve patient satisfaction. Additionally, new formulations aimed at longer-lasting effects are in development, further supporting market growth and product diversification.

MARKET CHALLENGES

High Risk of Adverse Drug Interactions

One of the significant challenges in the anticoagulant drugs market is the risk of adverse interactions with other medications, especially for patients with multiple comorbidities. Many anticoagulants, including warfarin, interact with commonly prescribed drugs for conditions like diabetes, hypertension, and mental health, affecting efficacy or increasing bleeding risks. For example, about 20% of adults over 65 are on five or more medications, according to the CDC, which elevates the chance of adverse interactions. These risks require cautious prescribing and frequent monitoring, complicating treatment and potentially limiting the use of newer anticoagulants that may interact with specific drug classes.

Complexity of Long-Term Patient Adherence

Ensuring adherence to anticoagulant therapy is challenging due to the long-term nature of treatment and potential side effects, which can deter consistent use. For instance, non-adherence rates for long-term anticoagulants can exceed 30%, leading to higher risks of thrombotic events. Factors like dietary restrictions, lifestyle adjustments, and bleeding concerns with drugs like warfarin can reduce adherence. Additionally, the need for regular blood monitoring in certain therapies increases patient burden, making it difficult to maintain long-term compliance. Poor adherence leads to suboptimal outcomes, heightening the need for patient-centered approaches and educational initiatives to improve adherence.

Limited Accessibility in Low-Income Regions

Access to anticoagulant medications remains a major challenge in low- and middle-income regions due to high drug costs and limited healthcare infrastructure. Although cardiovascular diseases contribute to over 75% of CVD-related deaths in low-income countries, access to advanced therapies like DOACs is often restricted due to affordability issues. Many health systems in these regions lack the resources for consistent patient monitoring and drug supply chains, which are necessary for effective anticoagulant treatment. Limited accessibility hampers optimal patient outcomes, creating disparities in healthcare and underlining the need for cost-effective solutions and expanding healthcare infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.18% |

|

Segments Covered |

By Drug Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer AG, Boehringer Ingelheim International GmbH, Bristol Myers Squibb, Daiichi Sankyo Co. Ltd., F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Merck & Co. Inc., Pfizer Inc. and Sanofi |

SEGMENTAL ANALYSIS

By Drug Type Insights

The oral anticoagulants (Vitamin K Antagonists) segment held 36.6% of the global market share in 2023. The domination of the segment is primarily attributed to the widespread use of warfarin, one of the most established anticoagulants. Vitamin K antagonists have been prescribed for decades to prevent blood clot formation, particularly in patients with conditions like atrial fibrillation. Despite newer anticoagulants emerging, Vitamin K antagonists remain crucial because of their effectiveness in long-term clot prevention and affordability. In regions with limited access to advanced drugs, these anticoagulants are often the standard due to their cost-effectiveness and familiarity among healthcare providers.

The Direct Factor Xa Inhibitors segment is the fastest-growing segment in the anticoagulant drugs market. These drugs include options such as rivaroxaban and apixaban, which are gaining popularity due to their convenience and reduced need for regular monitoring compared to traditional Vitamin K antagonists. Unlike older anticoagulants, Direct Factor Xa Inhibitors provide a more predictable anticoagulant effect, reducing bleeding risks and offering fewer dietary restrictions, which significantly improves patient compliance. Their importance is underscored by growing demand in both high-income and emerging markets, where patient adherence and safety are prioritized.

REGIONAL ANALYSIS

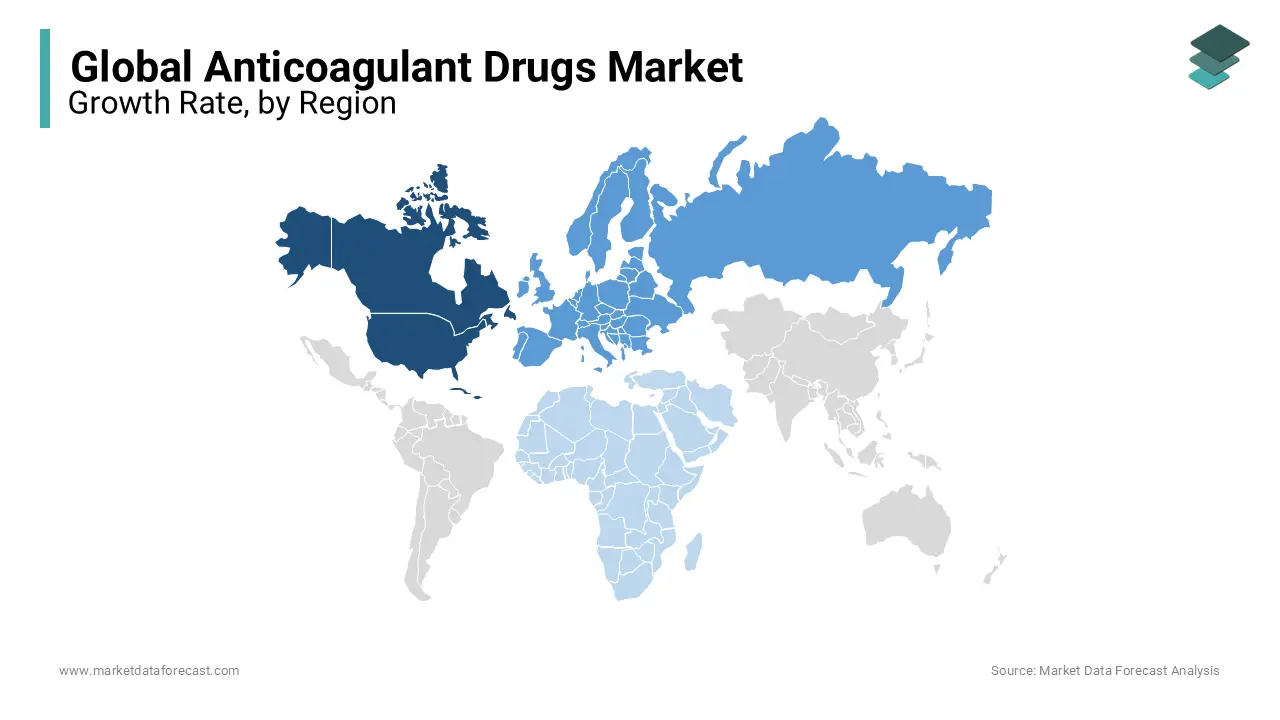

North America is currently dominating the market and 38.8% of the share in the global market in 2023 owing to the high rates of cardiovascular diseases (CVD) and an advanced healthcare infrastructure. Over the forecast period, the North American region is also estimated to register a healthy CAGR and the growth of the regional market is likely to be driven by factors such as an aging population and strong R&D investments. The United States is the largest contributor to the North American market. The U.S. has frequent regulatory approvals and significant adoption of new therapies like Direct Oral Anticoagulants (DOACs), which are making the U.S. a key player in the region.

Europe was the second-largest regional market for anticoagulant drugs and held a substantial share of the global market in 2024. The demand for anticoagulant drugs in Europe is largely driven by the increasing aging population and high CVD prevalence, particularly in Germany, France, and the UK. The growth of the European market is further driven by favorable reimbursement policies and increased adoption of advanced therapies. Government healthcare initiatives in major European countries to tackle CVD risks contribute significantly to market growth.

Asia-Pacific captured a notable share of the global market share in 2024 and is projected to be the fastest-growing regional segment in the worldwide market during the forecast period. Rapid healthcare infrastructure expansion, rising healthcare expenditure, and increasing awareness of CVD risk factors are propelling the regional market expansion. China, India and Japan are the key markets in the Asia-Pacific region for anticoagulant drugs. The large patient base of China and the advanced healthcare capabilities of Japan are driving substantial demand for anticoagulant drugs in the respective countries. Government initiatives focused on cardiovascular health further support growth in this region.

Latin America is likely to account for a considerable share of the worldwide market over the forecast period. The growth potential of the Latin American market is driven by an improving healthcare landscape and rising awareness of cardiovascular health. Brazil and Mexico are the primary contributors to this regional market. Increased healthcare spending and a growing elderly population are contributing to the expansion of the anticoagulant drugs market in Latin America.

The market in the Middle East and Africa is experiencing a gradual increase in demand for anticoagulant therapies. Growth is driven by an increasing burden of lifestyle-related diseases, particularly in affluent countries like Saudi Arabia, the UAE, and South Africa. The improved healthcare investments and a rising focus on CVD awareness are driving the regional market expansion.

KEY MARKET PARTICIPANTS

Companies playing a major role in the global anticoagulant drugs market include

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb

- Daiichi Sankyo Co. Ltd.

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services Inc.

- Merck & Co. Inc.

- Pfizer Inc.

- Sanofi

RECENT MARKET HAPPENINGS

- In August 2023, Boehringer Ingelheim announced a collaboration with Google Health to utilize artificial intelligence in clinical trials for its anticoagulant therapies. This partnership is expected to accelerate trial efficiency and improve patient outcomes, enhancing Boehringer's competitive edge in digital health.

- In August 2024, the U.S. government selected Eliquis, co-developed by Bristol Myers Squibb and Pfizer, for Medicare price negotiations under the Inflation Reduction Act. This initiative aims to reduce healthcare expenses and could impact the market dynamics for anticoagulant drugs.

- In February 2023, Roche partnered with a prominent biotech company to develop anticoagulant therapies leveraging mRNA technology. This partnership aims to enhance Roche’s research capabilities and expand its innovation pipeline in the anticoagulant market.

- In October 2023, Johnson & Johnson launched a real-world evidence study to evaluate the long-term safety of its Direct Oral Anticoagulant (DOAC) therapy. The study is expected to provide valuable insights and reinforce Johnson & Johnson’s position as a trusted provider of safe anticoagulant solutions.

- In September 2023, Merck acquired a minority stake in a biotech firm specializing in novel anticoagulant formulations. This investment is anticipated to strengthen Merck’s R&D capabilities and broaden its product offerings in the anticoagulant space.

- In August 2023, Pfizer launched a global awareness campaign for stroke prevention, emphasizing the importance of anticoagulant therapy. This initiative is expected to boost Pfizer’s brand visibility and increase public awareness of its anticoagulant solutions.

- In May 2023, Bayer received FDA approval for an expanded indication of its popular anticoagulant drug in venous thromboembolism management. This approval is anticipated to strengthen Bayer’s market share in the U.S. by broadening its drug’s application in high-demand treatment areas.

MARKET SEGMENTATION

This research report on the global anticoagulant drugs market is segmented and sub-segmented into the drug type and region.

By Drug Type

- Low Molecular Weight Heparin

- Oral Anticoagulants (Vitamin K Antagonists)

- Antiplatelet Drugs

- Oral Antiplatelets

- Thrombin Inhibitors

- Direct Thrombin Inhibitors

- Thrombolytic Agents

- Direct Factor Xa Inhibitors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global anticoagulant drugs market?

The global anticoagulant drugs market was worth USD 36.24 bn in 2024.

What is the expected CAGR of the anticoagulant drugs market?

The anticoagulant drugs market is predicted to grow at a CAGR of 8.18% over the forecast period.

Which region is likely to dominate the anticoagulant drugs market in the coming future?

North America registered the domination in the worldwide market in 2024 and is expected to continue to hold the leading position in the worldwide market throughout the forecast period.

Who are the key players in the anticoagulant drugs market?

Bayer AG, Boehringer Ingelheim International GmbH, Bristol Myers Squibb, Daiichi Sankyo Co. Ltd., F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Merck & Co. Inc., Pfizer Inc. and Sanofi are some of the notable players in the worldwide market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]