Global Antibody Drug Conjugates Market Size, Share, Trends & Growth Forecast Report By Pipeline, Technology, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Antibody Drug Conjugates Market Size

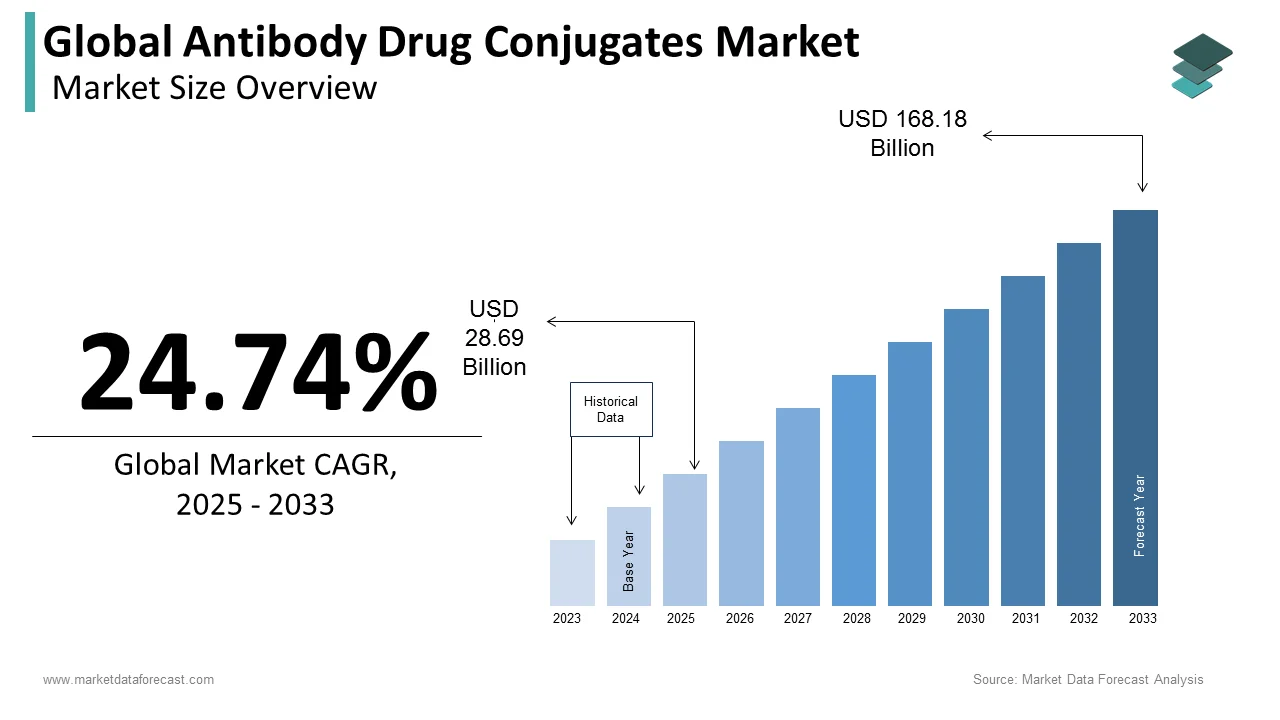

The size of the global antibody drug conjugates market was worth USD 23 billion in 2024. The global market is anticipated to grow at a CAGR of 24.74% from 2025 to 2033 and be worth USD 168.18 billion by 2033 from USD 28.69 billion in 2025.

MARKET DRIVERS

Rising Cancer Cases and Aging Population Driving ADC Market Growth

The rising prevalence of cancer and the growing geriatric population across the globe primarily drive the growth of the antibody-drug conjugates market. The number of people suffering from cancer is growing rapidly worldwide and causing a significant number of mortalities worldwide every year. As per the statistics published by WHO, an estimated 19.3 new million cancer cases were found in 2020. By 2040, an estimated 28.4 million new cases per year are expected to register. Factors such as changing lifestyles, environmental pollution, and an aging population are majorly resulting in the incidence of cancer among people. With the growing cancer patient population, the demand for more effective and targeted cancer treatments such as ADCs is anticipated to grow. On the other hand, the growing aging population worldwide is also contributing to the increasing demand for antibody-drug conjugates. With growing age, people are more likely to diagnose with various age-related diseases including cancer. Likewise, the growing aging population is expected to fuel the need for effective cancer therapies. As per the data published by the United Nations, the population aged 65 years is expected to reach 1.5 billion by 2050 from USD 703 million in 2019. Antibody-drug conjugates are a more effective and safer option for cancer treatment, especially among patients who are aged and may be more sensitive to the side effects of traditional chemotherapy.

Technological Advancements and Strong Pipeline Supporting Market Expansion

The development of advanced technologies in the field of ADCs such as site-specific conjugation, linker technology and improved antibody engineering and the strong pipeline of ADCs in various stages of development contribute to the market growth. Several pharmaceutical companies have been investing significant resources in R&D to develop new and advanced antibody-drug conjugates to address unmet medical needs. In addition, the growing number of regulatory approvals of new ADCs by government agencies such as the FDA, EMA, and PMDA, the rising trend towards personalized medicine, the increasing number of collaborations and partnerships between pharmaceutical companies and research organizations and increasing healthcare expenditure in developed and developing countries boost the growth rate of the antibody-drug conjugates market.

Biotechnology Innovations and Increased Investments Boosting ADC Adoption

Furthermore, rapid advancements in biotechnology, such as gene editing and synthetic biology, increasing investments by pharmaceutical companies in the development of ADCs, rising adoption of targeted therapies, including ADCs, growing prevalence of chronic diseases such as cancer, autoimmune diseases, and inflammatory disorders and increasing use of combination therapies, which involve the use of multiple drugs to treat a single disease fuel the growth of the antibody-drug conjugates market.

MARKET RESTRAINTS

High Development Costs and Manufacturing Complexities Restrain ADC Market Growth

High costs associated with the development of ADCs, complex manufacturing process of ADCs that requires specialized expertise and equipment and limited number of targets primarily hamper the market growth. In addition, rigorous regulatory requirements, competition from other therapies such as chemotherapy and immunotherapy and side effects of ADCs such as liver toxicity hinder the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Pipeline, Technology, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Seattle Genetics, Genentech, Takeda Pharmaceuticals, Hoffmann-La Roche, Bayer Healthcare, Agensys, Inc., Immunogen, Novartis, Oxford Biotherapeutics, Synthon Biopharmaceuticals, and Othes. |

SEGMENTAL ANALYSIS

By Pipeline Insights

Based on the pipeline, the linker segment had the leading share of the worldwide antibody drug conjugates market in 2024 and is anticipated to account for a substantial global market share during the forecast period. The growing demand for ADCs that have improved efficacy and safety profiles is one of the key factors boosting segmental growth. Cleavable linkers have gained popularity in recent years. Cleavable linkers provide a way to deliver cytotoxic agents directly to cancer cells, reducing the risk of off-target toxicity.

On the other hand, segments such as phase, mode of action and Igg1 antibodies are predicted to account for a substantial share of the worldwide market during the forecast period.

By Technology Insights

Based on technology, the seattle genetics segment held the major share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period. The segmental growth is driven by factors such as the success of Seattle Genetics' first FDA-approved ADC, Adcetris, and the development of other promising ADCs in its pipeline.

The ImmunoGen segment is anticipated to hold for a substantial share of the worldwide market during the forecast period.

By End User Insights

Based on end-user, the hospital segment led the global ADCs market in 2024 and is expected to grow at a healthy CAGR during the forecast period. Factors such as the growing incidence of cancer, the growing demand for targeted therapies and the growing number of hospital-acquired infections primarily contribute to the growth of the segment.

The research institutes segment is another major segment among all and is expected to capture a considerable share of the worldwide market during the forecast period. The growing investments in research and development activities by academic and research institutes, increasing demand for novel therapies for cancer treatment, and the collaboration between research institutes and pharmaceutical companies for the development of ADCs drive segmental growth.

The clinics segment is expected to grow steadily during the forecast period owing to factors such as the rising demand for personalized medicine, the growing need for targeted therapies that can be administered on an outpatient basis and the growing popularity of immunotherapy and the development of ADCs that can be administered orally or subcutaneously.

REGIONAL ANALYSIS

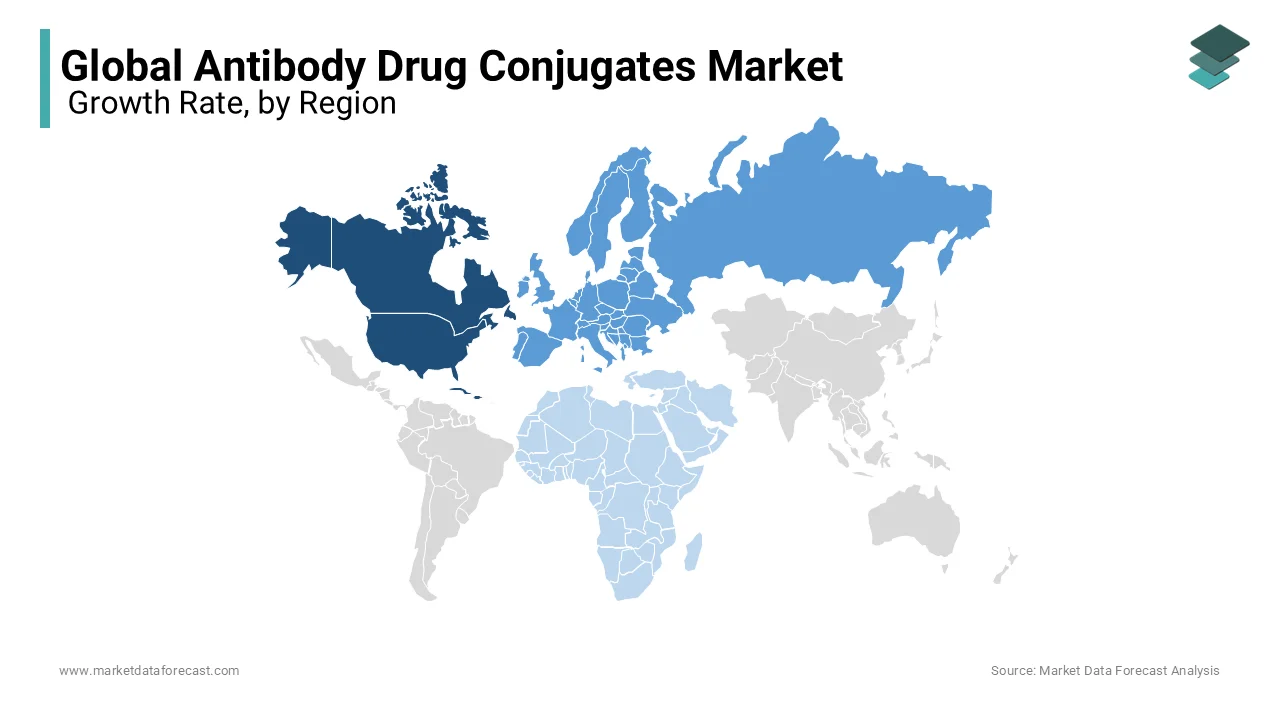

North America dominated the antibody drug conjugates market in 2024 and is anticipated to continue playing the dominating role throughout the forecast period. The presence of several pharmaceutical and biotechnology companies such as Seattle Genetics, Immunogen, and Genentech involved in the development and commercialization of ADCs in North America, the growing prevalence of cancer, the increasing demand for targeted therapies, and the availability of favorable reimbursement policies majorly drive the North American market growth. Furthermore, the growing demand for personalized medicine and targeted therapies, the presence of advanced healthcare infrastructure and skilled healthcare professionals in North America contribute to the regional market growth. The U.S. occupied the leading share of the North American market in 2022, followed by Canada. During the forecast period, the U.S. ADCs market is anticipated to grow at a promising CAGR due to factors such as the increasing cancer patient population and growing support from the U.S. government for ADCs. Approximately 1.8 million new cancer cases were found in the U.S. in 2020. The Canadian market is expected to showcase a healthy CAGR in the coming years owing to the increased spending by the Canadian government in favor of cancer treatment.

Europe is another promising regional market for antibody drug conjugates and is anticipated to account for a substantial share of the worldwide market during the forecast period. The growth of the European market is primarily driven by factors such as the presence of a sophisticated healthcare infrastructure, increasing patient population of cancer, growing R&D activities in Europe and the rising demand for personalized medicine. In addition, the presence of major biopharmaceutical companies such as Roche, Novartis, and Bayer and increasing investments by these companies for the R&D of ADCs, rising emphasis on precision medicine and personalized cancer treatment, growing government funding for research and development of new drugs by the European governments fuel the growth rate of the European market. Germany had a considerable share of the European market in 2024 and is anticipated to grow at a healthy CAGR during the forecast period. Favorable regulatory policies for drug approvals and clinical trials and increasing demand for innovative cancer treatments favour the German market.

APAC is forecasted to register the fastest CAGR during the forecast period and is considered as the most lucrative regional market. The growing number of R&D activities by pharmaceutical and biotechnology companies, the increasing demand for targeted therapies and the rising incidence of cancer in the Asia-Pacific region propel the APAC market growth. The growing patient population of cancer in countries like China and India, rising number of government initiatives for drug development and approvals, increasing investments by pharmaceutical and biotech companies in research and development of ADCs further fuel the growth rate of the APAC market. Japan, China, India are expected to hold the major share of the APAC market during the forecast period.

Latin America accounted for a considerable share of the worldwide market in 2024 and is anticipated to grow at a healthy CAGR during the forecast period. Factors such as the growing prevalence of cancer and other chronic diseases in Latin America, increasing government funding for healthcare infrastructure and research and development of new drugs, rising demand for targeted therapies and precision medicine and growing adoption of advanced healthcare technologies boost the antibody drug conjugates market in Latin America.

MEA held a moderate share of the worldwide market in 2024 and is estimated to grow at a steady CAGR in the coming years.

KEY MARKET PARTICIPANTS

Some promising companies in the global antibody drug conjugate market profiled in the report are Seattle Genetics, Genentech, Takeda Pharmaceuticals, Hoffmann-La Roche, Bayer Healthcare, Agensys, Inc., Immunogen, Novartis, Oxford Biotherapeutics, Synthon Biopharmaceuticals, and Others.

KEY MARKET DEVELOPMENTS

- In November 2022, Ambrx Biopharma Inc., or Ambrx, a clinical-stage biopharmaceutical company, dosed its first patient with advanced solid tumors through ARX305, an overexpressed protein in a wide range of solid and hematological tumors.

- In November 2022, Exelixis, Inc. announced a new licensing agreement in which Catalent's Redwood Bioscience will grant an exclusive license subsidiary for three targeted programs with lead antibodies and ADC candidates.

- In March 2020, Oxford Biotherapeutics, a leading clinical-stage oncology industry that produces immune-oncology and antibody-drug conjugate-based therapies, made a public statement that they have chosen formal IND-enabling studies.

- In March 2019, Takeda Pharmaceutical company and LegoChem Biosciences announced that both companies have agreed to become one for developing antibody-drug conjugate for cancer therapies.

MARKET SEGMENTATION

This market research report on the global antibody drug conjugates market has been segmented and sub-segmented into the following categories.

By Pipeline

- Phase

- Mode of action

- Igg1 antibodies

- HER2 antibodies

- Technology

- Linker

By Technology

- Seattle Genetics

- Immunogen

- Immunomedics

By End User

- Research institutes

- Hospitals

- Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

which region accounted for the largest share in the global antibody-drug conjugates market ?

The antibody-drug conjugates market in North America is expected to grow significantly and hold the largest share of the revenue during the forecast period.

who are the key players of the global antibody-drug conjugates market?

Seattle Genetics, Genentech, Takeda Pharmaceuticals, Hoffmann-La Roche, Bayer Healthcare, and Agensys, Inc., are some of the key market players in the antibody-drug conjugates market.

What is the compound annual growth rate (CAGR%) of the antibody-drug conjugates market during the forecast period?

The global antibody-drug conjugates market is expected to grow at a CAGR of 24.74% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]