Global Ant Control Market Size, Share, Trends & Growth Forecast Report By Type (Spray, Bait, Powder & Others), Application (Farms, Residential, Commercial And Industrial, Gardening, Livestock Farms & Others) & Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis From 2025 to 2033

Global Ant Control Market Size

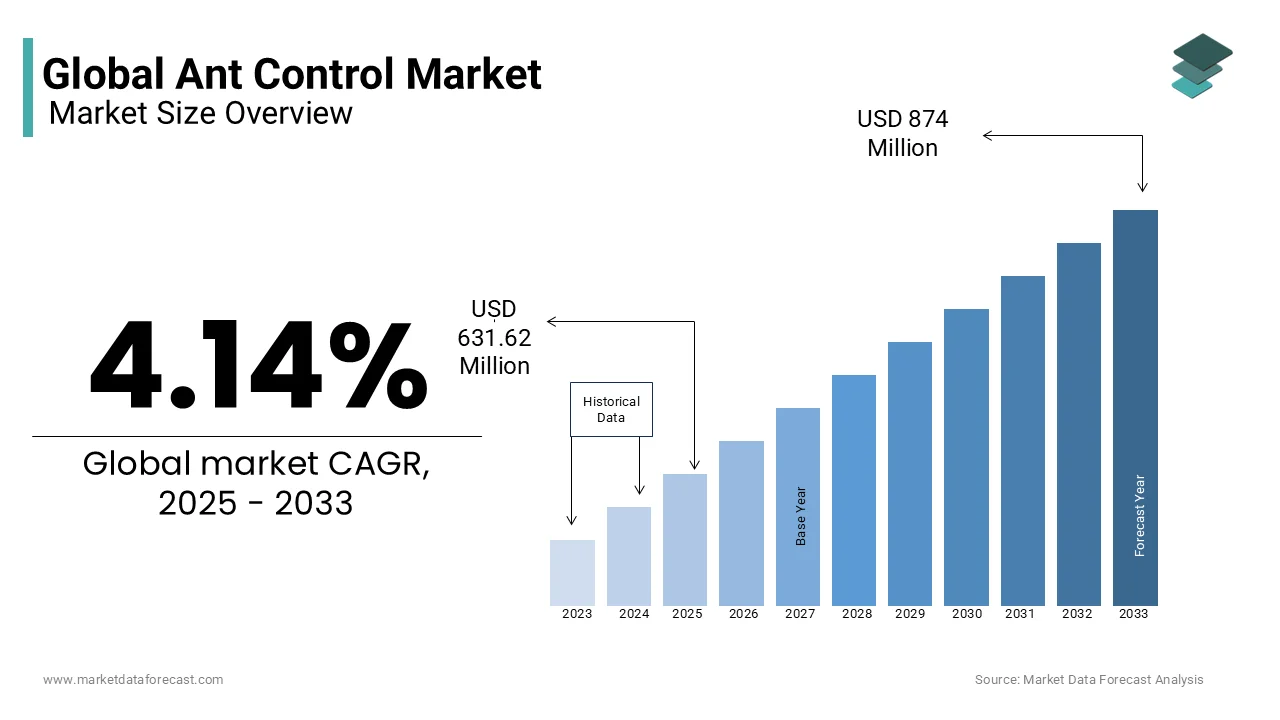

The size of the global ant control market was valued at USD 606.51 Million in 2024 and is anticipated to reach USD 631.62 Million in 2025 from USD 874 Million by 2033, growing at a CAGR of 4.14% from 2025 to 2033.

Ants, while seemingly innocuous, can cause significant damage to infrastructure, contaminate food supplies, and disrupt ecosystems. According to the National Pest Management Association, ants are the most commonly reported pest issue globally, accounting for over 40% of pest control service requests annually. The economic impact of ant infestations is substantial, with the U.S. Department of Agriculture estimating that invasive ant species alone cost $6 billion annually in damages and control efforts. Urbanization, climate change, and globalization have exacerbated the spread of ant populations, intensifying the need for effective control solutions. Europe and North America lead in adopting advanced ant control measures, driven by stringent hygiene regulations and consumer demand for pest-free environments. With innovative formulations and eco-friendly alternatives gaining traction, the ant control market is poised for sustained growth as stakeholders strive to balance efficacy with environmental responsibility.

MARKET DRIVERS

Rising Urbanization and Hygiene Standards

The rapid pace of urbanization and the growing emphasis on hygiene standards are propelling the ant control market to new heights. The United Nations projects that 68% of the global population will reside in urban areas by 2050, creating densely populated environments where ant infestations thrive. In cities like Tokyo and New York, the proliferation of high-rise buildings and shared spaces has increased the demand for effective ant control solutions. According to the World Health Organization, poor sanitation in urban areas contributes to the spread of diseases carried by ants, such as salmonella and E. coli, underscoring the importance of proactive pest management. Additionally, the European Hygiene Council reports that businesses in the hospitality and food service sectors spend over $1 billion annually on pest control to maintain compliance with health regulations. This trend highlights how urbanization not only amplifies the prevalence of ant infestations but also drives investment in advanced control technologies to safeguard public health and safety.

Increasing Incidence of Invasive Ant Species

The increasing incidence of invasive ant species is another significant driver fueling the growth of the ant control market. The International Union for Conservation of Nature identifies invasive ants as one of the top threats to biodiversity, with species like the Argentine ant and red imported fire ant causing widespread ecological and economic damage. For instance, the U.S. Department of Agriculture estimates that the red imported fire ant alone costs the United States $6 billion annually in medical treatments, crop losses, and control efforts. Similarly, Australia’s Department of Agriculture reports that invasive ants have disrupted native ecosystems, leading to declines in indigenous flora and fauna. These species are highly adaptive, thriving in diverse climates and outcompeting local ant populations. As globalization facilitates their spread through trade and travel, the demand for targeted ant control solutions is surging. Stakeholders are investing in innovative products and strategies to combat these invasive pests, ensuring both environmental preservation and economic stability.

MARKET RESTRAINTS

High Costs of Advanced Formulations

The high costs associated with advanced ant control formulations is one of the major factors hampering the ant control market growth. These high costs particularly making it difficult for small-scale users and developing regions. The International Finance Corporation estimates that premium ant control products, such as gel baits and eco-friendly sprays, are priced 30-50% higher than conventional alternatives. For instance, bio-based formulations, which are gaining popularity due to their reduced environmental impact, often require sophisticated manufacturing processes that drive up production expenses. In regions like Sub-Saharan Africa, where access to affordable pest control solutions is limited, this financial burden discourages widespread adoption. According to the African Development Bank, less than 20% of rural households utilize advanced ant control measures due to cost constraints. While government subsidies and financing programs aim to alleviate these challenges, their reach remains insufficient to meet the growing demand for sustainable and effective pest management solutions, hindering broader market penetration.

Limited Awareness Among End-Users

Limited awareness among end-users about the benefits and proper application of ant control solutions is further hindering the growth of the ant control market. A survey conducted by the Consultative Group on International Agricultural Research found that only 25% of households in Latin America are familiar with integrated pest management practices, including ant control. This knowledge gap often results in improper usage, undermining the effectiveness of control measures. For example, incorrect placement of bait stations or overuse of chemical sprays can lead to resistance development among ant populations, negating the intended benefits. The African Soil Health Consortium highlights that extension services, which aim to educate users on sustainable practices, remain underfunded in many rural areas. Additionally, misinformation spread through unverified sources exacerbates the problem, deterring potential adopters. Without targeted educational campaigns and accessible training programs, the full potential of ant control solutions cannot be realized, limiting their adoption in underserved communities.

MARKET OPPORTUNITIES

Growing Demand for Eco-Friendly Solutions

The growing demand for eco-friendly ant control solutions is a significant opportunity for market players seeking to align with global sustainability trends. The Organisation for Economic Co-operation and Development forecasts that bio-based pest control products will capture 25% of the global market by 2030, driven by consumer preference for environmentally safe alternatives. For instance, plant-derived formulations, such as neem oil-based sprays, are gaining traction due to their biodegradability and low toxicity. The European Bioplastics Association highlights that bio-based ant control products reduce carbon footprints by 30% compared to synthetic options. Additionally, advancements in biotechnology have improved the efficacy of eco-friendly solutions, making them competitive alternatives. As governments worldwide enforce stricter environmental regulations, manufacturers are incentivized to innovate and expand their portfolios of sustainable products. This shift not only addresses ecological concerns but also caters to the rising demand for green consumer goods, positioning eco-friendly ant control solutions as a cornerstone of future market growth.

Expansion into Emerging Markets

Emerging markets offer untapped potential for the ant control industry, driven by increasing urbanization and investments in infrastructure. The Asian Development Bank reports that agricultural output in South Asia and Southeast Asia is projected to grow by 4% annually over the next decade, creating robust demand for pest management solutions. For example, India’s Ministry of Agriculture has launched initiatives to promote ant control adoption, aiming to combat crop losses caused by invasive species. Similarly, Brazil’s agrochemical sector, valued at $12 billion in 2022, offers significant opportunities for market expansion. According to the International Trade Centre, trade agreements and reduced tariffs are facilitating the entry of foreign suppliers into these regions. By capitalizing on these developments, stakeholders can establish a strong foothold in burgeoning economies, unlocking substantial revenue streams and fostering sustainable agricultural and urban growth.

MARKET CHALLENGES

Resistance Development Among Ant Populations

Resistance development among ant populations is a major challenge to the effectiveness of ant control solutions, threatening their long-term viability. The International Plant Protection Convention reports that over 200 pest species, including several ant varieties, have developed resistance to commonly used pesticides, rendering traditional control methods ineffective. For instance, the Argentine ant, a pervasive pest in Mediterranean climates, has shown resistance to multiple chemical treatments, causing annual damages exceeding $1 billion in California alone. The European AgriTech Association highlights that even biological control agents face diminishing efficacy as ants adapt to new threats. Addressing this issue requires continuous innovation and diversification of control strategies, which can be costly and time-consuming. Without proactive measures, the rise of resistant ant populations could undermine the progress achieved through advanced formulations, necessitating urgent action to preserve their impact.

Regulatory Hurdles and Approval Delays

Regulatory hurdles and approval delays pose significant challenges to the ant control market, particularly in regions with stringent compliance requirements. The European Chemicals Agency mandates rigorous testing of all pest control products, including bio-based formulations, to ensure minimal ecological impact. This process can take up to five years and cost millions of dollars, deterring smaller companies from entering the market. According to the Pesticide Action Network, approximately 40% of new pest control products face delays during the regulatory approval phase, impacting their commercial viability. Furthermore, inconsistencies in regulatory standards across countries create additional barriers. For example, while the European Union enforces strict guidelines, some developing nations lack clear frameworks, leading to fragmented market dynamics. Streamlining processes and harmonizing regulations are essential to facilitate faster adoption and market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.14% |

|

Segments Covered |

By Product Type, Application and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer Crop Science, BASFres, Sumitomo Chemical, United Phosphorus Limited, ADAMA Agricultural Solutions, Ensystex, Rentokil Initial plc, Syngenta AG, Nufarm Limited, FMC Corporation and Others. |

SEGMENT ANALYSIS

By Type

The bait segment accounted for the major share of 46.2% of the global ant control market in 2024. The dominance of bait segment in the global market is attributed to its ability to target entire ant colonies by exploiting their foraging behavior, ensuring long-lasting control. The U.S. Environmental Protection Agency reports that bait formulations, such as gel and granular options, have reduced ant infestations by 30% in residential settings. Additionally, their ease of use and compatibility with eco-friendly ingredients make them a preferred choice for consumers and pest control professionals alike. The segment's leadership reflects its critical role in addressing ant infestations effectively while minimizing environmental impact, making it indispensable for modern pest management practices.

The spray segment is predicted to register the fastest CAGR of 7.7% over the forecast period owing to their versatility and immediate effectiveness, particularly in high-traffic areas like kitchens and offices. Germany’s Federal Ministry of Agriculture highlights that spray formulations have gained traction in urban environments, where quick solutions are prioritized. Their ability to provide instant relief aligns with the growing emphasis on hygiene and safety, making them indispensable for pest-free environments.

By Application

The residential segment dominated the ant control market by commanding a 50.7% of the global market share in 2024. The promising position of residential segment in the global market can be credited to the increasing demand for pest-free living spaces, particularly in urban areas. The Canadian Housing Association reports that over 60% of homeowners invest in ant control solutions annually, driven by hygiene concerns and property protection. The segment's leadership reflects its pivotal role in ensuring comfort and safety for households while addressing the challenges posed by dense urbanization.

The commercial and industrial segment is projected to grow at a CAGR of 9.88% over the forecast period owing to the ising demand for pest-free environments in offices, retail spaces, and manufacturing facilities. The United States Environmental Protection Agency highlights that ant control adoption in commercial settings has reduced pest-related complaints by 40%, improving tenant satisfaction and operational efficiency. Their ability to provide long-term solutions aligns with the growing emphasis on hygiene and safety, making them indispensable for urban infrastructure.

REGIONAL ANALYSIS

North America accounted for 39.7% of the global ant control market share in 2024. North America is the largest market for ant control products and the growth of North America in the global market is primarily driven by the high prevalence of ant infestations, particularly in urban areas, and the increasing awareness of pest control solutions among consumers. The leading position of North America in the global market is likely to continue during the forecast period as ant control being a significant segment in this region due to the commonality of species like the carpenter ant and the odorous house ant. The growth of the real estate sector and the rising trend of home gardening have also contributed to the demand for effective ant control solutions. Additionally, stringent regulations on pest control products and a focus on environmentally friendly solutions have led to the development of innovative, less toxic ant control methods, further enhancing market growth.

Europe is another major regional market for ant control worldwide. The growth of the European market in the global market is driven by a combination of stringent regulations on pest management and a growing emphasis on sustainable practices. The European Union's directives on pesticide use have led to increased demand for integrated pest management (IPM) solutions, which include biological control methods and eco-friendly products. Countries like Germany, France, and the UK are leading the way in adopting advanced pest control technologies, including smart traps and monitoring systems. The rising awareness of health and safety concerns related to chemical pesticides has also prompted consumers to seek safer alternatives, driving innovation in the ant control segment. The increasing urbanization and the need for effective pest management in residential and commercial properties further bolster the market in this region.

The Asia-Pacific region is experiencing rapid growth in the ant control market. In the Asia-Pacific region, the rising population, urbanization, and increasing disposable incomes are resulting in the higher demand for pest control services. Countries like China, India, and Australia are witnessing significant investments in pest management technologies, including the use of smart traps and eco-friendly products. The increasing awareness of health risks associated with pest infestations, such as allergies and disease transmission, has also driven demand for effective ant control solutions. Additionally, the growing agricultural sector in the region is pushing for integrated pest management practices, further enhancing the market's growth potential.

Latin America is likely to account for a considerable share of the global ant control market over the forecast period, with countries like Brazil and Mexico leading the way. The growth in this region is primarily driven by the increasing urbanization and the rising awareness of pest control solutions among consumers. The agricultural sector's expansion, particularly in Brazil, has also contributed to the demand for effective pest management solutions, including ant control. However, challenges such as limited access to advanced pest control technologies and regulatory hurdles may hinder the market's full potential. The increasing prevalence of ant species, such as the leafcutter ant, which poses significant threats to crops, further emphasizes the need for effective ant control measures in the region.

The Middle East and Africa represent a smaller share of the global ant control market. However, the region is witnessing growth due to increasing urbanization and the rising need for effective pest management solutions. Countries like South Africa and the UAE are leading initiatives to enhance pest control practices, driven by the growing awareness of health risks associated with pest infestations. The agricultural sector's expansion, particularly in countries like Kenya and Egypt, is also contributing to the demand for ant control solutions. Additionally, the increasing focus on sustainable pest management practices and the adoption of integrated pest management (IPM) strategies are expected to drive further growth in the ant control market in this region.

KEY MARKET PARTICIPANTS

Bayer Crop Science, BASFres, Sumitomo Chemical, United Phosphorus Limited, ADAMA Agricultural Solutions, Ensystex, Rentokil Initial plc, Syngenta AG, Nufarm Limited and FMC Corporation are a few of the leading companies in the global ant control market.

MARKET SEGMENTATION

This research report on the global control market is segmented and sub-segmented based on Product Type, Application, and Region.

By Product Type

- spray

- baits

- powder

- others

By Application

- farms

- residential

- commercial

- and industrial

- gardening

- livestock farms

- others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East & Africa

Frequently Asked Questions

What is the current market size of the global ant control market?

The current market size of the global ant control market was valued at USD 632 million in 2025

What segments are added in the global ant control market?

The product type, application and by region are the segments tht are added in the global ant control market.

Who are the market players that are dominating the global ant control market?

Bayer Crop Science, BASFres, Sumitomo Chemical, United Phosphorus Limited, ADAMA Agricultural Solutions, Ensystex, Rentokil Initial plc, Syngenta AG, Nufarm Limited and FMC Corporation are a few of the leading companies in the global ant control market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]