Global Anomaly Detection Market Size, Share, Trends, Growth Forecast Report – Segmented By Service (Professional, Managed), Solution (Network Behavior, User Behavior), Deployment (Cloud, On-Premise), Vertical (BFSI, Retail, Manufacturing, IT & Telecom, Healthcare, Government, Aerospace and Defense), and Application (Intrusion Detection, Fraud Detection, System Status Monitoring, Fault Detection and Others) & Region - Industry Forecast From 2024 to 2032

Global Anomaly Detection Market Size (2024 to 2032)

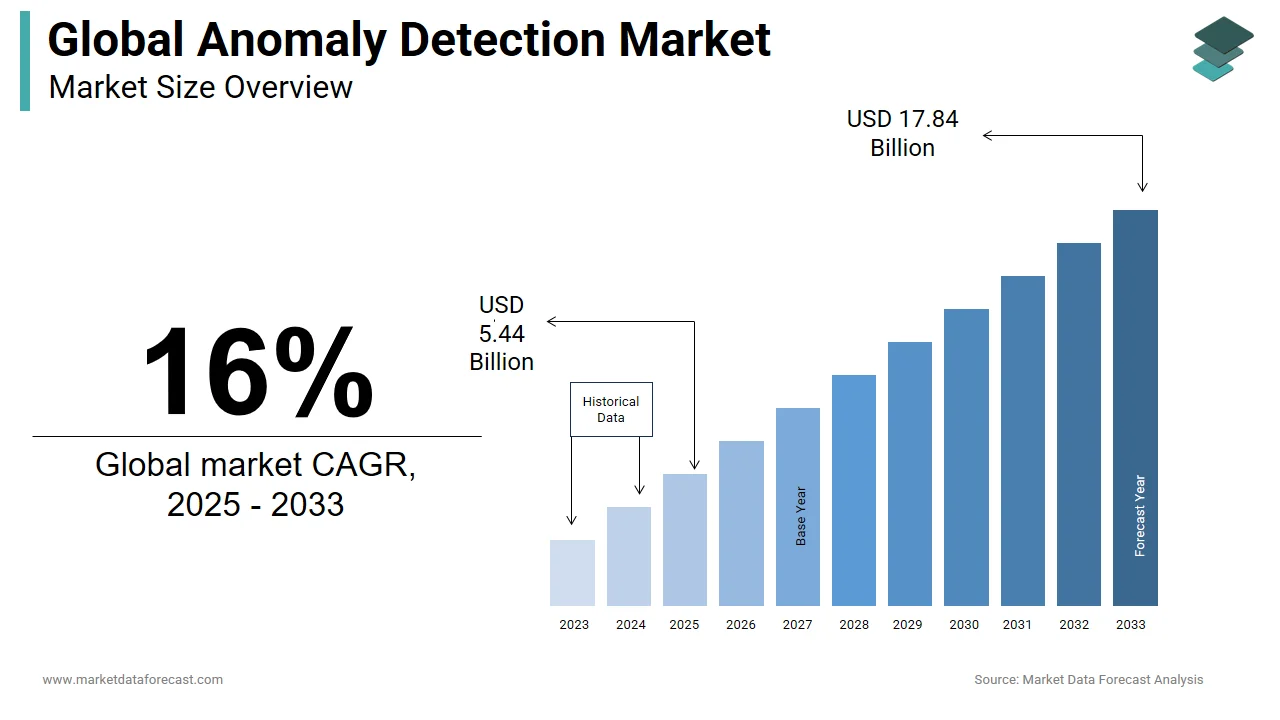

The global anomaly detection market was worth USD 4.04 billion in 2023. The global market is predicted to reach USD 4.69 billion in 2024 and USD 15.38 billion by 2032, growing at a CAGR of 16% during the forecast period.

Anomaly detection can be called a process for identifying anomalies, such as an unusual change in the process or event in a procedure that does not follow the expected pattern or dataset. This change in the usual pattern of the activity is the leading cause of a failure, defect, or error in the process. Anomaly detection is extensively used for applications such as intruder detection, fraud detection, system, health monitoring, and many more in a similar ecosystem.

MARKET DRIVERS

The main factor contributing to the growth of the global anomaly detection market is the growing number of networked devices.

The more extensive the network, the more likely traffic congestion will lead to unusual patterns in the system. Anomaly detection detects these strange patterns in network traffic, which could be an essential reason for detecting intruders, cyber-attacks, and fraud.

The increasing number of connected devices in banking and finance, healthcare, manufacturing, information technology, telecommunications, defense, and the government should stimulate the market to detect anomalies during the forecast period. These industries regularly process essential data, which exposes them to fraud, theft, and hacking, allowing criminals to take control of the business infrastructure.

Banking operations include numerous periodic and aperiodic activities and transactions carried out by employees, customers, and external agencies. The nature of these activities is complicated and requires constant monitoring to ensure that neither the bank nor its end customers are adversely affected by malicious and random events. This represents a tremendous opportunity for companies offering solutions and services to prevent such anomalies. For example, CSI anomaly detection software for banks updates the institution on suspicious activity by generating automatic alerts, allowing them to maintain diligence and compliance. The various directives or regulations issued by regulatory agencies and agencies should stimulate the market during the projection period. For example, as a financier, the Federal Financial Institutions Review Council (FFIEC) requires establishing a process to help monitor possible abnormal behavior in online banking.

MARKET RESTRAINTS

Competition from open-source alternatives that hamper the demand for business solutions and the lack of skills and experience are some of the factors restricting the global anomaly detection market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

16% |

|

Segments Covered |

By Type of Service, Solution, Deployment, Application, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

International Business Machines Corporation (United States), SAS Institute, Inc. (United States), Cisco Systems, Inc. (United States), Dell Technologies, Inc. (United States), Hewlett Packard Enterprise Company (United States), Symantec Corporation (United States), Trend Micro, Inc. (Japan), Splunk, Inc. (United States) and Others. |

SEGMENTAL ANALYSIS

Global Anomaly Detection Market Analysis By Type of Service

Global Anomaly Detection Market Analysis By Solution

Of these, the network behavior anomaly segment is likely to extend with the highest growth rate during the estimated period due to increasing technological developments and attacker threats.

Global Anomaly Detection Market Analysis By Deployment

The cloud segment is expected to account for the principal portion of the global anomaly detection market because of its numerous benefits, such as cost-efficiency, remote access, etc.

Global Anomaly Detection Market Analysis By Application

Intrusion and fraud detection are anticipated to register the highest demand in this business in the coming years.

Global Anomaly Detection Market Analysis By Vertical

Of these, the BFSI is the leading worldwide segment, which is projected to continue its reign in the forecast period.

REGIONAL ANALYSIS

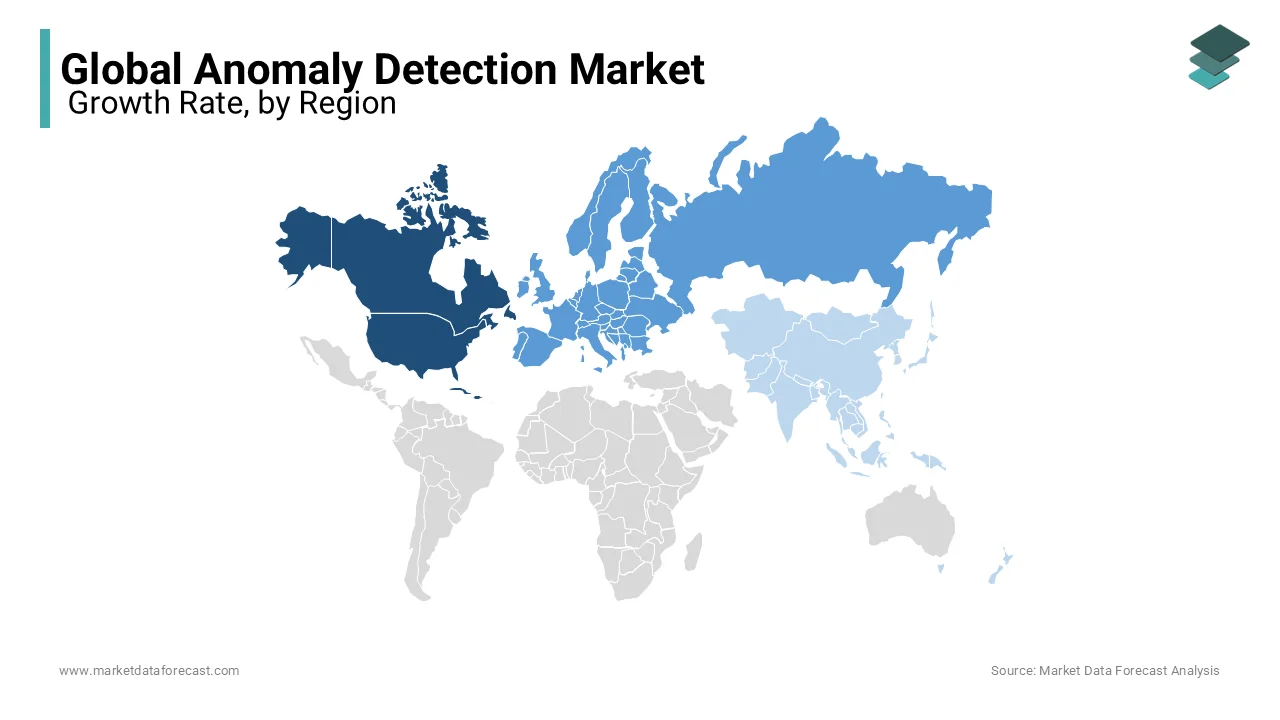

North America's anomaly detection market dominated the global business due to growing trends such as BYOD, which encourages employees to bring their devices to the office. Large companies actively adopt this trend, improving performance and productivity. On the other hand, Europe's anomaly detection market closely follows North America in terms of value and volume. Europe and North America are technically advanced regions, and an essential factor that affects the progress of this market in Europe is the investments of the various critical actors in this region. This has led numerous small businesses to grow and partner with large suppliers to provide services. Asia-Pacific anomaly detection market is foreseen to be the fastest-growing region due to the increasing development of the information and technology sector in nations like India, China, Japan, etc.

KEY PARTICIPANTS IN THE ANOMALY DETECTION MARKET

The major companies operating in the global anomaly detection market include International Business Machines Corporation (United States), SAS Institute, Inc. (United States), Cisco Systems, Inc. (United States), Dell Technologies, Inc. (United States), Hewlett Packard Enterprise Company (United States), Symantec Corporation (United States), Trend Micro, Inc. (Japan), Splunk, Inc. (United States), Wipro Limited (India), Securonix, Inc. (United States), Gurucul (United States), Happiest Minds (India) and Guardian Analytics (United States).

RECENT HAPPENINGS IN THE ANOMALY DETECTION MARKET

-

In March 2019, Microsoft expanded its availability of anomaly detectors with the launch of the Microsoft Azure anomaly detector, which easily integrates anomaly detection capabilities into user applications so that they can quickly identify data models that are unusual, rare, or irregular.

-

In April 2019, Guardian Analytics Inc., a market leader in real-time behavior analysis and machine learning solutions for detecting bank payment and corporate B2B portal fraud, announced a webinar series on detecting electronic fraud in real time.

DETAILED SEGMENTATION OF THE GLOBAL ANOMALY DETECTION MARKET INCLUDED IN THIS REPORT

This research report on the global anomaly detection market is segmented and sub-segmented based on the type of service, solution, deployment, application, vertical, and region.

By Type of Service

- Professional Service

- Managed Service

By Solution

- Network Behavior

- User Behavior

By Deployment

- Cloud

- On-Premise

By Application

- Intrusion Detection

- Fraud Detection

- System Status Monitoring

- Fault Detection

- Others

By Vertical

- Banking

- Financial Services and Insurance (BFSI)

- Retail

- Manufacturing

- IT and Telecommunications

- Government

- Aerospace and Defense

- Medical Care

- Others

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

How is the global Anomaly Detection market addressing the rise of sophisticated cyber threats?

The market is responding to advanced cyber threats by incorporating machine learning and artificial intelligence techniques into Anomaly Detection solutions, enabling real-time detection and response to evolving cybersecurity challenges.

How are cloud-based Anomaly Detection solutions gaining prominence in the global market?

Cloud-based Anomaly Detection solutions are gaining popularity due to their scalability, flexibility, and the ability to analyze large datasets. These solutions offer real-time anomaly detection and are accessible from anywhere, contributing to their global adoption.

In what ways is the global Anomaly Detection market contributing to fraud prevention in the financial sector?

Anomaly Detection solutions in the financial sector contribute significantly to fraud prevention by identifying unusual transaction patterns, unauthorized access, or irregular user behavior, thereby minimizing financial losses and enhancing security.

How is the global Anomaly Detection market adapting to the increasing volume and complexity of data?

The market is adapting by incorporating big data analytics, distributed computing, and edge computing technologies to efficiently process and analyze vast amounts of data in real-time, ensuring timely detection of anomalies on a global scale.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]