Global Animation Market Size, Share, Trends, Growth Forecast Report Segmentation By Revenue Stream (OTT, Advertising, Sale of Tickets, and Others), Type (Stop Motion, Flipbook Animation, 2D Animation, and 3D Animation), Application (Media and Entertainment, Automotive, Online Education, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Animation Market Size

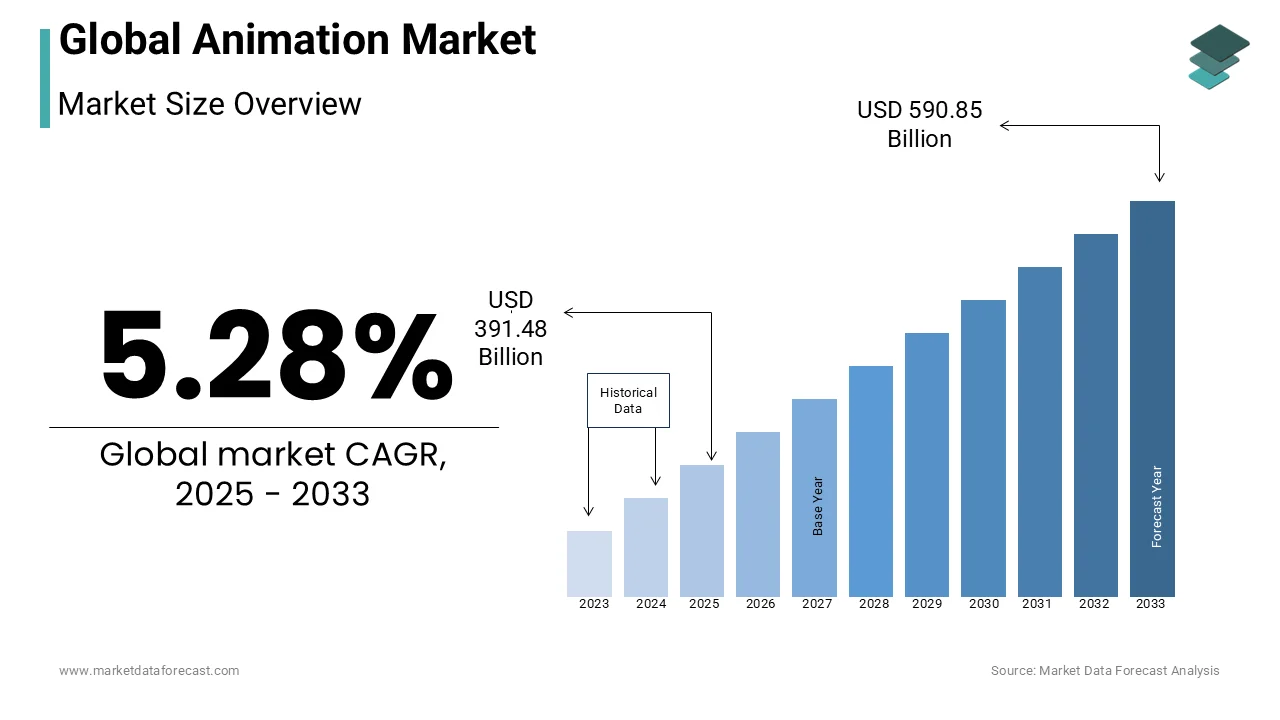

The global animation market was worth 371.85 billion in 2024. The global market is projected to reach USD 590.85 billion in 2033 from USD 391.48 billion in 2025, growing at a CAGR of 5.28% from 2025 to 2033.

Animation technology has significantly reshaped how stories are told across film, television, and online platforms due to the advancements in 3D and CGI. The use of animation in educational tools has proven highly effective, with studies showing that learners retain 60% more information when visualized through animated content, as opposed to traditional teaching methods. In the entertainment sector, animated films are now among the top-grossing movies globally, with films like Frozen II and The Lion King demonstrating the widespread appeal and commercial viability of animated content. The growing integration of augmented reality (AR) and virtual reality (VR) technologies is expanding the potential for animation in interactive media. Furthermore, the increasing demand for mobile gaming, with more than 2.8 billion mobile gamers globally is further highlighting the vital role of animation in game development.

MARKET DRIVERS

Rise of Streaming Platforms

The rapid growth of streaming services has been a significant driver of the global animation market growth. Platforms like Netflix, Disney+, and Amazon Prime Video have heavily invested in animated series and films, contributing to a surge in demand for animated content. According to the U.S. Federal Communications Commission (FCC), the number of U.S. households with broadband internet reached 118 million in 2021 by providing a broader audience for streaming services. This connectivity has led to increased viewership of animation, especially in children’s content and family films. As of 2022, Netflix alone reported that animated content accounted for over 30% of its children's programming, highlighting the sector’s central role in its content strategy. This growing digital consumption is expected to continue fueling animation production and distribution.

Technological Advancements in Animation

Technological advancements, particularly in 3D rendering, CGI, and AI-driven animation tools, have transformed the animation industry. The development of advanced software like Autodesk Maya and Blender has enabled studios to produce high-quality animations more efficiently and cost-effectively. According to the National Science Foundation (NSF), innovations in computing and digital graphics have decreased production costs for animated films by 40-50% over the past decade. Moreover, the rise of VR and AR technologies is creating more immersive and interactive animated experiences, driving growth in entertainment and gaming sectors. As per the U.S. Bureau of Labor Statistics (BLS), the demand for multimedia artists and animators is expected to grow by 16% from 2021 to 2031 by reflecting the increasing need for skilled professionals in these high-tech animation fields.

MARKET RESTRAINTS

High Production Costs

One significant restraint in the animation market is the high production cost associated with creating high-quality animated content. Producing a feature-length animated film can cost upwards of $100 million by depending on the complexity and technology involved. The U.S. Bureau of Economic Analysis (BEA) has reported that the entertainment and media sectors in the U.S. saw a decline in profitability in recent years due to rising production costs. Additionally, the labor-intensive nature of animation, which requires skilled professionals such as animators, voice actors, and technicians, further increases expenses. Despite technological advancements that have helped reduce some costs, the overall financial burden remains significant for many animation studios, limiting the scope for smaller companies to enter the market or expand their operations.

Intellectual Property Challenges

The animation market faces challenges related to intellectual property (IP) protection, which can restrict growth and innovation. Animation studios invest considerable resources into developing original content, but the risk of copyright infringement, piracy, and unauthorized use of IP is significant. According to the U.S. Intellectual Property and Patent Office (USPTO), the creative industries, including animation, suffer billions in losses annually due to piracy and IP theft. In 2020, U.S. losses in the film and TV industries were estimated to be over $10 billion due to online piracy. Such infringements diminish the profitability of original works, dissuading investment in new animated content and leading to increased legal costs for studios aiming to protect their intellectual property.

MARKET OPPORTUNITIES

Expansion of Virtual Reality (VR) and Augmented Reality (AR) Applications

The growing adoption of Virtual Reality (VR) and Augmented Reality (AR) technologies presents a significant opportunity for the animation market. VR and AR offer immersive experiences that leverage animation to create interactive and engaging environments. The U.S. Bureau of Labor Statistics (BLS) predicts that the demand for VR and AR developers will grow by 21% from 2021 to 2031 with an increasing market for animated content in these sectors. Animation studios can expand their offerings by developing VR/AR-based animated experiences in industries such as gaming, education, and healthcare. This trend is amplified by the expanding consumer base for VR headsets, with the U.S. Consumer Technology Association (CTA) estimating that 8 million VR headsets were sold in the U.S. alone in 2021.

Growing Demand for Educational Animation

There is an increasing opportunity for animation in the educational sector, driven by the effectiveness of animated content in engaging students. Studies show that students retain 60% more information when lessons are presented through animation compared to traditional methods, as reported by the U.S. Department of Education. The shift toward online learning platforms, especially post-pandemic has increased the demand for educational videos and animated tutorials. According to the National Center for Education Statistics (NCES), U.S. K-12 schools saw an exponential rise in digital content usage, with over 90% of public schools integrating technology into daily learning by 2020. This growing trend opens avenues for animation companies to create engaging, educational content for a global audience, spanning subjects from science to languages.

MARKET CHALLENGES

Talent Shortages and Skill Gaps

A major challenge facing the animation market is the shortage of skilled talent. The demand for qualified animators, 3D artists, and technical directors has been growing rapidly, outpacing the supply of trained professionals. According to the U.S. Bureau of Labor Statistics (BLS), employment in the arts, design, entertainment, sports, and media occupations is projected to grow by 4% from 2021 to 2031, which is slower than the average for other sectors. However, the competition for highly skilled animation professionals remains fierce, especially with the increasing need for cutting-edge animation techniques like CGI and VR. This shortage can lead to high turnover rates and increased hiring costs for animation studios, further complicating production timelines and quality control.

Rising Competition and Market Saturation

The animation market is facing increasing competition, particularly from emerging markets where production costs are lower. Countries like India, China, and South Korea have become hubs for outsourcing animation services, offering cost-effective solutions for global studios. The U.S. International Trade Administration (ITA) notes that the global animation industry is highly fragmented, with numerous players competing for market share. This market saturation creates pressure on smaller studios to differentiate their offerings or reduce prices, which can impact profitability. Additionally, the increased availability of animation software and tools has allowed new entrants to create content, intensifying competition. These dynamic challenges established studios to innovate continually while maintaining high-quality standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.28% |

|

Segments Covered |

By Revenue Stream, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The major players in the global animation market include Warner Bros. Discovery, Inc. (U.S.), Sony Pictures Digital Productions Inc. (U.S.), Dreamworks Animation (U.S.), TOEI ANIMATION CO., LTD. (Japan), Paramount (U.S.), AARDMAN ANIMATIONS LTD (U.K.), OLM, Inc. (Japan), Madman Entertainment Pty. Ltd. (Australia), Kyoto Animation Co., Ltd. (Japan), and BluBlu Studios (Poland). |

SEGMENTAL ANALYSIS

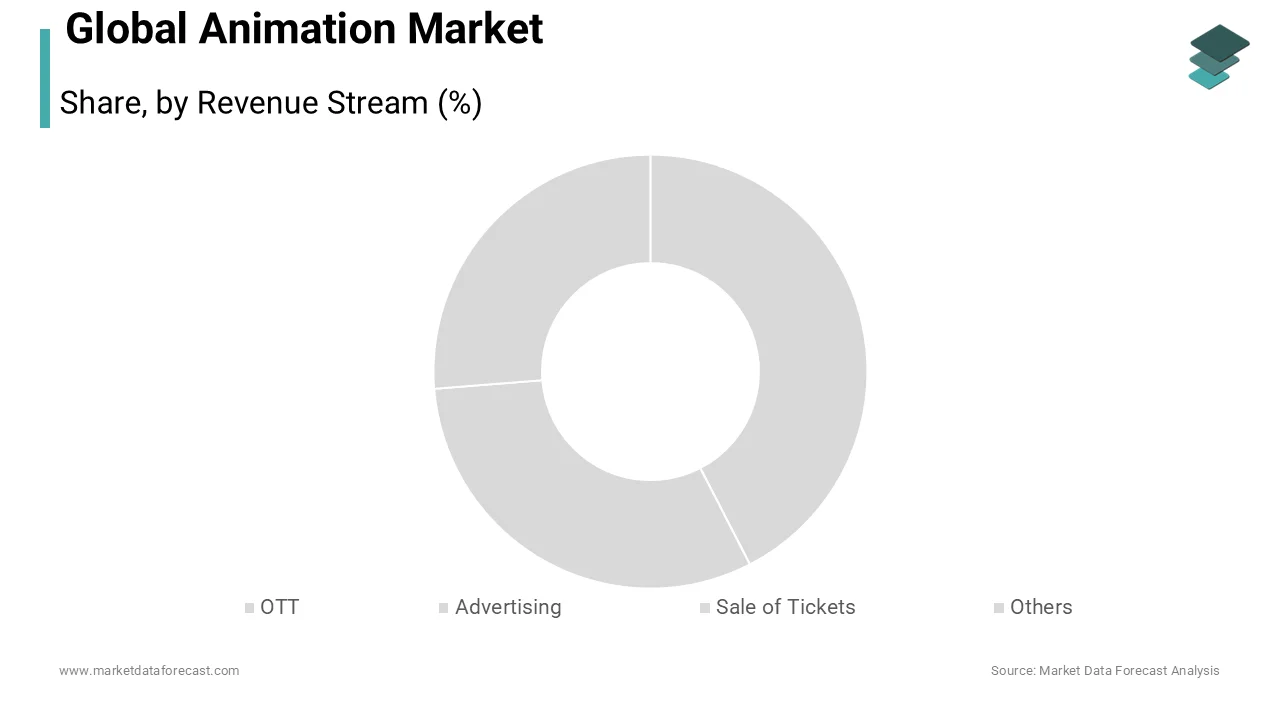

By Revenue Stream Insights

The OTT market accounted for 50.8% of the global animation market share in 2024. Platforms like Netflix, Disney+, and Amazon Prime Video are leading the charge. According to the U.S. Federal Communications Commission (FCC), U.S. households with broadband connections increased to over 118 million in 2021 is contributing to the rise in OTT content consumption. The ease of access and growing subscriber base for these services is driving this segment’s dominance by providing a sustainable revenue model for animation studios through licensing and original content.

On the other hand, the advertising segment is growing rapidly and is projected to register a CAGR of 7.5% over the forecast period. The rise of digital advertising platforms such as YouTube and social media, which increasingly rely on animated content for engaging advertisements, is propelling this growth. According to the U.S. Digital Advertising Revenue Report, digital ad revenue in the U.S. surpassed $200 billion in 2022, with a significant portion attributed to animated content. This growth is driven by advertisers’ preference for eye-catching and engaging animated visuals that boost consumer interaction, making it an essential tool for modern advertising strategies.

By Type Insights

The 3D animation led the market by holding 61.2% of the global animation market share in 2024. 3D animation has emerged as the largest segment in the global animation market. This dominance of the 3D animation segment in the global animation market is primarily driven by its use in high-budget movies, video games, and cutting-edge virtual reality (VR) and augmented reality (AR) experiences. The U.S. Bureau of Economic Analysis (BEA) highlights that the film industry, particularly animated films is significantly to the U.S. economy, with animation accounting for over $270 billion in annual revenue. The demand for 3D animation has been further bolstered by the success of major blockbuster films like Avatar and Toy Story, both of which rely heavily on 3D animation technology. 3D animation's market share is expected to grow in the coming years with advancements in CGI and real-time rendering technology.

The 2D animation segment is predicted to register a CAGR if 5.8% over the forecast period owing to the increasing demand for animated content on streaming platforms, social media, and advertising, where 2D animation is widely used due to its cost-effectiveness and efficiency in production. According to the U.S. Federal Communications Commission (FCC), the number of U.S. broadband subscribers reached over 118 million in 2021 by expanding access to digital platforms and driving consumption of animated content. Additionally, 2D animation’s widespread use in mobile gaming and web series has made it a popular choice among content creators with significant uptake seen on platforms like YouTube and TikTok, where animated content garners millions of views. This expanding audience, combined with its affordability which ensures that 2D animation continues to grow at a rapid pace.

By Application Insights

The media and entertainment segment dominated the market and held 51.8% of the global market share in 2024. The domination of the media and entertainment segment is majorly attributed to the increasing demand for animated films, television series, and online content. According to the U.S. Bureau of Economic Analysis (BEA), the film and television industries contributed over $200 billion to the U.S. economy in 2020, with animated content playing a key role in global box office earnings. Animated movies, such as Frozen II and Toy Story 4 has significant immense commercial success of animation in the entertainment space by maintaining its position as the market leader.

The online education segment is rapidly expanding and is estimated to grow at a CAGR of 8.4% from 2025 to 2033 due to the increasing integration of animation in e-learning platforms, where animated videos are used to enhance engagement and improve learning outcomes. According to the U.S. Department of Education, more than 60% of U.S. public schools have adopted online learning platforms by driving demand for interactive educational content. Studies show that animated lessons help improve student retention rates by up to 60% by making this application crucial in the rapidly expanding e-learning industry.

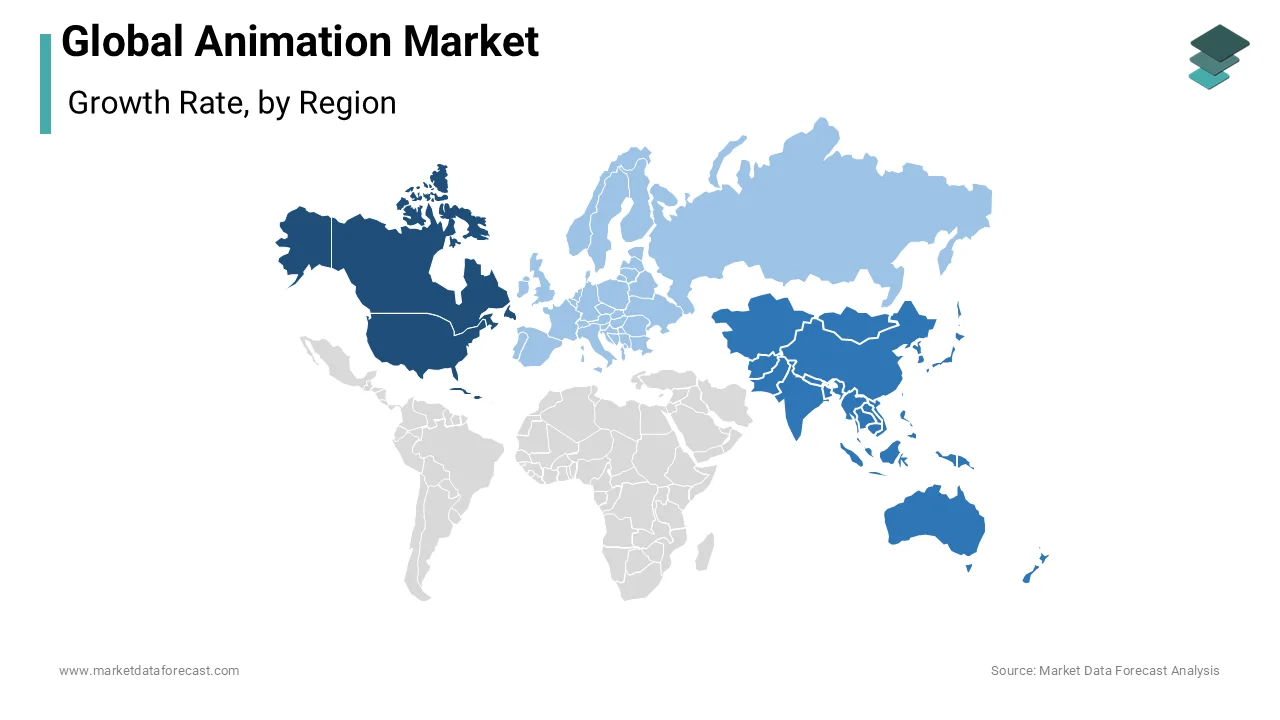

REGIONAL ANALYSIS

North America dominated the animation market by accounting for 40% of the global market share in 2024. This is primarily driven by the presence of major animation studios such as Disney, Pixar, and DreamWorks, along with a high demand for animated content in the media and entertainment sector. According to the U.S. Bureau of Economic Analysis (BEA), the U.S. film and television industries generated over $200 billion in 2020, with animated films playing a substantial role in box office earnings. The rapid expansion of OTT platforms like Netflix and Disney+ further supports the region's leadership in animation production and consumption.

The Asia-Pacific region is the fastest-growing regional market for animation worldwide and is predicted to showcase a of 8.3% during the forecast period. This growth is attributed to the increasing adoption of animation in television, gaming, and online content, especially in countries like Japan, South Korea, and China. According to the U.S. International Trade Administration (ITA), Asia is home to some of the world's largest animation outsourcing markets, significantly boosting the sector’s growth. Additionally, the rise of mobile gaming and streaming platforms has fueled demand for localized animated content in this region, contributing to its rapid expansion.

Europe holds a strong position in the global animation market. Key markets such as the UK, France, and Germany are contributing significantly to the European market. The European Union's creative industries, including animation, contributed over €700 billion to the economy in 2020, as reported by Eurostat. The region is expected to continue performing well due to increased investments in animated films and TV shows, especially with the growth of local OTT platforms. European animation is also gaining international recognition through festivals and global distribution deals by enhancing its export potential.

Latin America is poised for significant growth in the global animation market with the rising demand for animated content in the entertainment and education sectors. According to the World Bank, the digital economy in Latin America grew at a rate of 20% annually in the past decade, which includes a surge in online content consumption. The region is also becoming a hub for animation outsourcing, particularly in Mexico and Brazil, where costs are competitive and skilled labor is available. More consumers are accessing animated content via digital platforms with mobile internet penetration rises.

The Middle East and Africa region is gradually expanding in the animation market, fueled by the increasing investment in entertainment infrastructure and digital content creation. According to the Middle East Media & Advertising Outlook report, the regional media industry is expected to grow at a CAGR of 6.5% over the next few years, with animation playing a pivotal role in the region's media content. Additionally, the region’s growing youth population with increased internet access, is driving demand for animated films and TV shows in the digital and educational sectors.

KEY MARKET PLAYERS

The major players in the global animation market include Warner Bros. Discovery, Inc. (U.S.), Sony Pictures Digital Productions Inc. (U.S.), Dreamworks Animation (U.S.), TOEI ANIMATION CO., LTD. (Japan), Paramount (U.S.), AARDMAN ANIMATIONS LTD (U.K.), OLM, Inc. (Japan), Madman Entertainment Pty. Ltd. (Australia), Kyoto Animation Co., Ltd. (Japan), and BluBlu Studios (Poland).

COMPETITIVE LANDSCAPE

The competition in the global animation market is intense, with a diverse array of players competing for dominance across various segments, including films, television series, streaming content, gaming, and educational media. Major studios like Disney, Warner Bros. Discovery, Sony Pictures, and DreamWorks Animation are at the forefront, using their extensive portfolios, technological advancements, and established fanbases to capture market share. These companies rely on large-scale production capabilities, including advanced CGI and animation technologies, to create high-budget, globally recognized franchises such as Frozen, Shrek, and Spider-Man.

Alongside these traditional powerhouses, emerging players and smaller studios are carving out niches, particularly in digital platforms and short-form content. Studios in Asia, such as TOEI Animation and Kyoto Animation, dominate the anime market, contributing to the rise of global animation trends and influencing content across genres. Companies in the Middle East and Latin America are also gradually increasing their share through localized content and international collaborations. In addition to content creation, competition extends to distribution and streaming platforms. The rise of OTT platforms like Netflix, Disney+, and Amazon Prime Video has heightened competition, as these services invest heavily in exclusive animated content to attract and retain subscribers. Ultimately, the competition in the animation market is shaped by a combination of innovation, content diversification, technological advancements, and the ability to expand into new global markets, keeping companies on their toes to meet evolving consumer demands.

Top 3 Players in the Market

Warner Bros. Discovery, Inc. (U.S.)

Warner Bros. Discovery is a major player in the global animation market, known for its rich legacy in both animated films and television shows. The company’s vast portfolio includes iconic animated series like Looney Tunes, Tom and Jerry, and Scooby-Doo, as well as blockbuster films such as The Lego Movie series. Through its Warner Bros. Animation division, the company has a strong presence in both traditional animation and CGI. In recent years, Warner Bros. Discovery has capitalized on the growing streaming market with its HBO Max platform, which features a wide range of animated content, including exclusive original series and movies. The company’s commitment to high-quality animation, combined with its global distribution network, makes it a key contributor to the global animation landscape.

Sony Pictures Digital Productions Inc. (U.S.)

Sony Pictures Digital Productions, a subsidiary of Sony Pictures Entertainment, is a leading force in the global animation market. Sony is known for creating successful animated franchises like Cloudy with a Chance of Meatballs and Hotel Transylvania. Additionally, Sony's involvement in the Spider-Man: Into the Spider-Verse series has brought critical and commercial success, redefining animation with groundbreaking visual styles and techniques. Sony’s animation division is also a prominent player in the burgeoning 3D and computer-generated animation market. With its production capacity, partnerships, and distribution channels, including the popular streaming service Crunchyroll, Sony continues to be a significant force in global animation.

DreamWorks Animation (U.S.)

DreamWorks Animation, a major subsidiary of Universal Filmed Entertainment Group, is one of the most influential players in the animation market. Known for creating global franchises such as Shrek, Kung Fu Panda, and How to Train Your Dragon, DreamWorks has a proven track record of producing highly successful animated films that resonate with both children and adults. DreamWorks Animation has expanded its presence on streaming platforms, especially through its collaborations with Netflix, producing original animated series such as Trollhunters and The Dragon Prince. The company has also led innovation in CGI animation, with its films consistently being among the top-grossing animated films worldwide, further solidifying its dominance in the market.

Top Strategies Used by the Key Market Participants

Diversification of Content and Platforms

A core strategy employed by leading animation studios, such as Warner Bros. Discovery, Sony Pictures, and DreamWorks, is the diversification of content across multiple platforms. With the rise of OTT (Over-the-Top) streaming platforms like HBO Max, Disney+, and Netflix, these companies have adapted by creating exclusive animated content tailored for digital consumption. For example, Sony has expanded its animated content through platforms like Crunchyroll, while DreamWorks produces series for Netflix, such as Trollhunters. By focusing on both traditional film and digital media, these companies ensure wider reach and engagement with various audiences, increasing their market share.

Strategic Acquisitions and Partnerships

To further strengthen their position, key market players engage in strategic acquisitions and partnerships. Warner Bros. Discovery has bolstered its animation portfolio through the acquisition of companies like DC Comics and Cartoon Network Studios, providing access to a vast library of intellectual properties and expanding its production capabilities. Sony’s acquisition of Crunchyroll, a major anime streaming platform, has allowed it to dominate the anime market globally. Similarly, DreamWorks has collaborated with streaming platforms like Netflix, ensuring a steady pipeline of original animated content. These partnerships not only increase content offerings but also help companies tap into diverse global audiences.

Technological Innovation and Investment in Animation Tools

A focus on technological advancements is another strategy key players use to maintain their market edge. Companies like Pixar and DreamWorks continuously invest in research and development to improve animation tools, technologies, and visual effects. This allows them to create high-quality, immersive animations that appeal to modern audiences. For example, DreamWorks has invested heavily in CGI and motion capture technologies to enhance the realism of its animated characters. Similarly, Warner Bros. Discovery integrates cutting-edge animation techniques into its productions, such as in the Lego Movie franchise. Staying at the forefront of technology helps animation companies produce content that pushes creative boundaries, attracting larger audiences and retaining loyal fans.

RECENT HAPPENINGS IN THE MARKET

- In October 2023, Warner Bros. Discovery launched a new animated film division focused on producing original animated content for both theatrical releases and streaming platforms. This move is expected to diversify their content library and strengthen their position in the global animation market.

- In June 2023, Sony Pictures Digital Productions Inc. (U.S.) formed a strategic partnership with a leading gaming company to develop a new line of animated content based on popular video game franchises. This collaboration is aimed at expanding Sony's reach in both the gaming and animation markets.

- In April 2023, DreamWorks Animation (U.S.) signed a multi-year partnership with Netflix to exclusively produce original animated series and films. This collaboration is anticipated to enhance DreamWorks’ presence in the global streaming market and cater to increasing demand for animated content.

- In January 2023, TOEI ANIMATION CO., LTD. (Japan) Animation partnered with a leading North American streaming service to globally distribute a new slate of anime series. This strategic move is expected to strengthen TOEI’s market presence, particularly in North America and Europe, in response to growing global demand for anime content.

- In March 2023, Paramount (U.S.) launched a new animated feature film studio dedicated to producing high-quality animated films for theatrical and streaming releases. This initiative aims to strengthen Paramount’s position in the animation market, offering a wider variety of content across different genres.

- In February 2023, AARDMAN ANIMATIONS LTD (U.K.) announced a partnership with a global toy company to create merchandise based on its animated characters, starting with Wallace & Gromit. This collaboration is expected to expand Aardman’s brand presence and revenue streams in the global market.

- In November 2022, OLM, Inc. (Japan) entered a collaboration with a major U.S. tech company to integrate augmented reality (AR) into its animated content. This partnership is aimed at creating interactive, immersive experiences, tapping into the growing demand for AR in animation.

- In July 2022, Madman Entertainment Pty. Ltd. (Australia) secured distribution rights for several high-profile Japanese animated films and series. This strategic move is expected to increase its share in the global animation market, particularly in North America and Europe.

- In September 2022, Kyoto Animation Co., Ltd. (Japan) announced plans to open a new studio in the United States, aimed at expanding its production capabilities for international animation projects. This expansion is expected to strengthen Kyoto’s global presence and meet the growing demand for high-quality anime content.

- In May 2022, BluBlu Studios (Poland) launched a new VR-focused animation studio to create immersive animated experiences for gaming and entertainment. This move positions BluBlu to tap into the rapidly growing virtual reality market and diversify its content offerings in the animation sector.

MARKET SEGMENTATION

This research report on the global animation market is segmented and sub-segmented into the following categories.

By Revenue Stream

- OTT

- Advertising

- Sale of Tickets

- Others

By Type

- Stop Motion

- Flipbook Animation

- 2D Animation

- 3D Animation

By Application

- Media and Entertainment

- Automotive

- Online Education

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key drivers of growth in the animation market?

The growth of the animation market is driven by advancements in technology, the rise of streaming platforms, increasing demand for visual effects (VFX) in films and gaming, and the expansion of animated content into sectors like education and healthcare.

What are the most popular animation styles used today?

Popular animation styles include 2D animation, 3D animation, stop-motion, motion graphics, and hybrid techniques that combine live-action with computer-generated imagery (CGI).

What role does artificial intelligence play in animation?

AI is used to automate animation processes, enhance character movement, generate backgrounds, and streamline production workflows, reducing time and costs while improving quality.

What is the future outlook for the animation market?

The future of animation looks strong, with increasing integration of AI, virtual reality (VR), and augmented reality (AR), along with growing global collaborations and diverse content catering to different cultures and audiences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]