Global Animal Genetics Market Size, Share, Trends & Growth Forecast Report By Animal Genetic Product (Live Animals and Genetic Materials), Testing Service (DNA Typing, Genetic Trait Tests and Genetic Disease Tests) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Animal Genetics Market Size

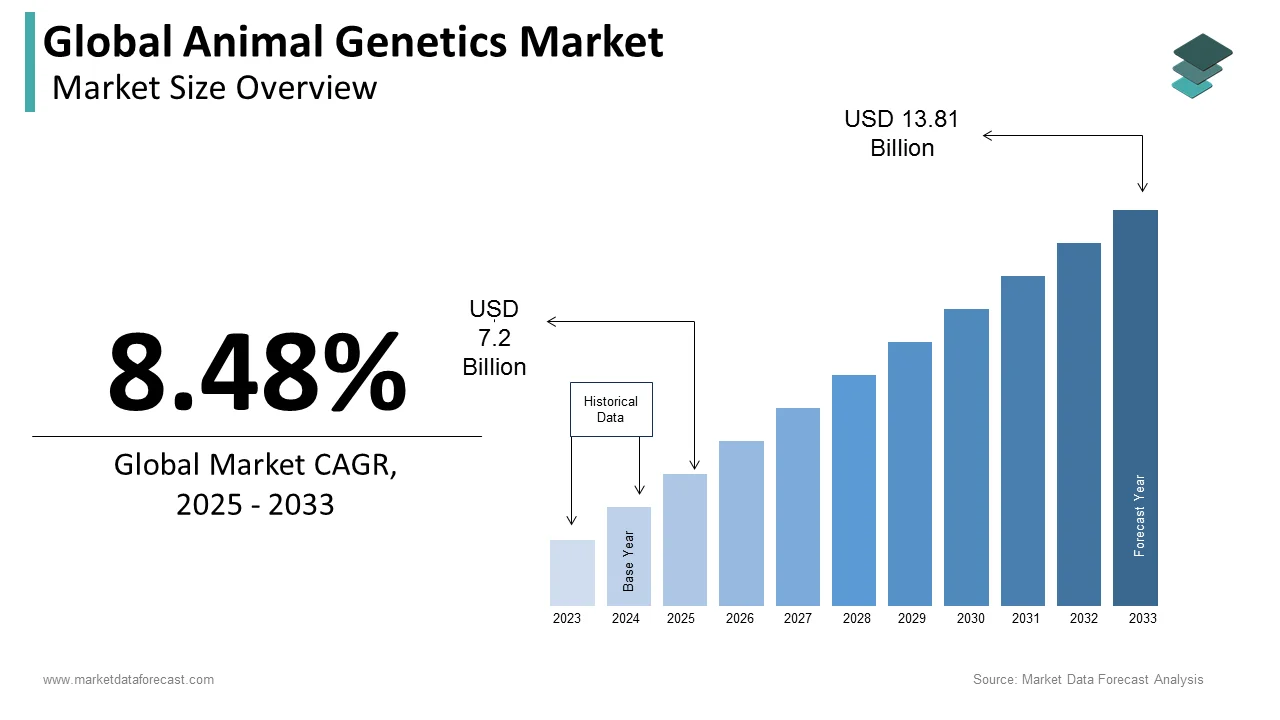

The global animal genetics market size was valued at USD 6.64 billion in 2024. The global market is projected to reach USD 13.81 billion by 2033 and USD 7.2 billion in 2025, exhibiting a CAGR of 8.48% from 2025 to 2033.

Animal genetics is a branch that deals with the study of inheritance and genetic variation, primarily in domestic and wild animals. Animal genetics is based on heredity's general principles, which encompass areas such as gene expression, animal breeding, and physical trait genetics such as coat color. In addition, animal genetics uses hybrid, population, cytological, mathematical-statistical, ontogenetic, and twin general genetics methods. Animal genetics is used for services such as genetic trait testing, DNA typing, and genetic disease testing at the commercial level.

MARKET DRIVERS

Growing Demand for Animal Protein

The steep rise in the demand for and consumption of animal proteins and a rapidly increasing urban population worldwide propel the growth of the global animal genetics market. Producers are inclined toward animal genetics to breed high-quality livestock and secure large-scale production to meet rising global demands for animal products. In addition, the growing animal population suffering from various leading to the growth of the animal genetics market. The rapid increase in animal diseases is promoting the need for genetic testing to identify and diagnose animal diseases, which includes tests for inherited disorders and to find disease-causing agents or pathogens.

Rising Adoption of Pets Worldwide

In addition, the increasing trend of possessing companion animals is anticipated to result in the growth of the animal genetics market. The pet adoption culture is growing worldwide. Due to the growing adoption of pets, the need for genetic testing and other genetic services is expected to grow to confirm the health and well-being of the animals. The high prevalence of zoonotic diseases has fuelled the demand for high-end diagnostic methods such as genetic testing and propelling the growth of the animal genetics market. Moreover, increasing investments to conduct R&D of novel drugs and vaccines by private and government bodies is expected to fuel the growth rate of the animal genetics market during the forecast period.

Furthermore, the growing number of animals suffering from chronic diseases and rising expenditure on veterinary healthcare are estimated to result in the growth rate of the market. The growing incidence of chronic diseases is expected to demand more genetic testing services and determine and diagnose these conditions. In addition, the rising adoption of the latest technologies and growing launching activities of various innovative products are promoting the animal genetics market growth. Additionally, the growing advancements in veterinary services and drugs support the expansion of the market. In addition, new diagnostic procedures and establishing better healthcare and infrastructure in veterinary studies support the market's growth. The growing number of animal groomers and breeders, along with analytics in drugs and health, support the expansion of the market. Furthermore, as there is a rising concern about the growing number of endangered species, studies on genetics are gaining the utmost prominence. Preserving genetic material (conservation genetics) has become a priority for many researchers to prolong and prevent the extinction of animal species on the verge of vanishing. Scientists are also conducting genetic studies to create clones of extinct organisms based on our understanding of their genetic composition. Therefore, animal genetics is an essential part of the past and present in zoology.

MARKET RESTRAINTS

Stringent Regulations & High Costs

Stringent regulations and policies surrounding animal genetics are one of the major factors hampering market growth. High costs associated with the R&D of animal genetics are another notable factor hindering market growth. Poor awareness regarding the benefits of animal genetics and the potential advantages it can offer, such as improved health and productivity in animals and limited genetic diversity of some animal populations further inhibit the growth rate of the global market. Ethical concerns about genetic engineering in animals among some people, resistance to change from farmers and breeders to adopt to the new breeding technologies and lack of required infrastructure in some countries are further predicted to have a negative impact on the global market. High costs associated with installing and maintaining the devices used for the services of animal genetics is one of the key factors inhibiting the market’s growth rate. In addition, the lack of awareness regarding equipment utilization, low returns on research and development (R&D), high cost of animal testing, stringent regulatory framework, and rising concerns about the adverse effects of animal genetic engineering on animals are hampering the growth of the global animal genetics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Animal Genetic Products, Testing Services, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Genus Plc, Hendrix Genetics BV, Alta Genetics, CRV Holding B.V. |

SEGMENTAL ANALYSIS

By Animal Genetic Product Insights

The live animal segment had the largest share of the global animal genetics market in 2024. The segment's domination is expected to continue throughout the forecast period. The rising adoption of advanced genetic technologies for larger-scale production and quality breeds and growing awareness about veterinary genetic diseases and disorders drive the segment's growth. Under the various sub-segments of live animals, the poultry segment led the market in 2024, whereas porcine has been growing faster in the past few years. The rise in meat consumption rate is one of the significant factors contributing to the segment's growth.

On the other hand, the genetic material segment is projected to witness a healthy CAGR during the forecast period. Furthermore, among various sub-segments of genetic material, semen genetic material is predicted to lead during the forecast period owing to the increasing priority for animal protein and advanced genetic practices.

However, the embryo segment is also expected to support the market's growth due to the several applications of embryos. The embryo transfer from one animal to another is more effortless when compared to semen, and the embryo helps to completely modify an animal's genetic composition allowing farmers to create healthy and robust crossbreeds for better food production. Therefore, embryo stability and efficiency support the segment's growth during the forecast period.

By Testing Service Insights

The DNA testing-based segment holds the largest share of the animal genetics market during the forecast period. The growing number of genetic diseases and demand for early diagnosis drive the segment's growth. However, the genetic disease testing segment is also expected to have significant growth during the forecast period due to the growing adoption of pet animals and the need for gene testing in them to avoid diseases contracted by birth. Additionally, gene-disease testing enables farmers to reduce the number of losses caused by growing genetically sick animals for livestock, leading to more profits. Therefore, the applications for disease testing are expected to support the segment's growth during the forecast period.

REGIONAL ANALYSIS

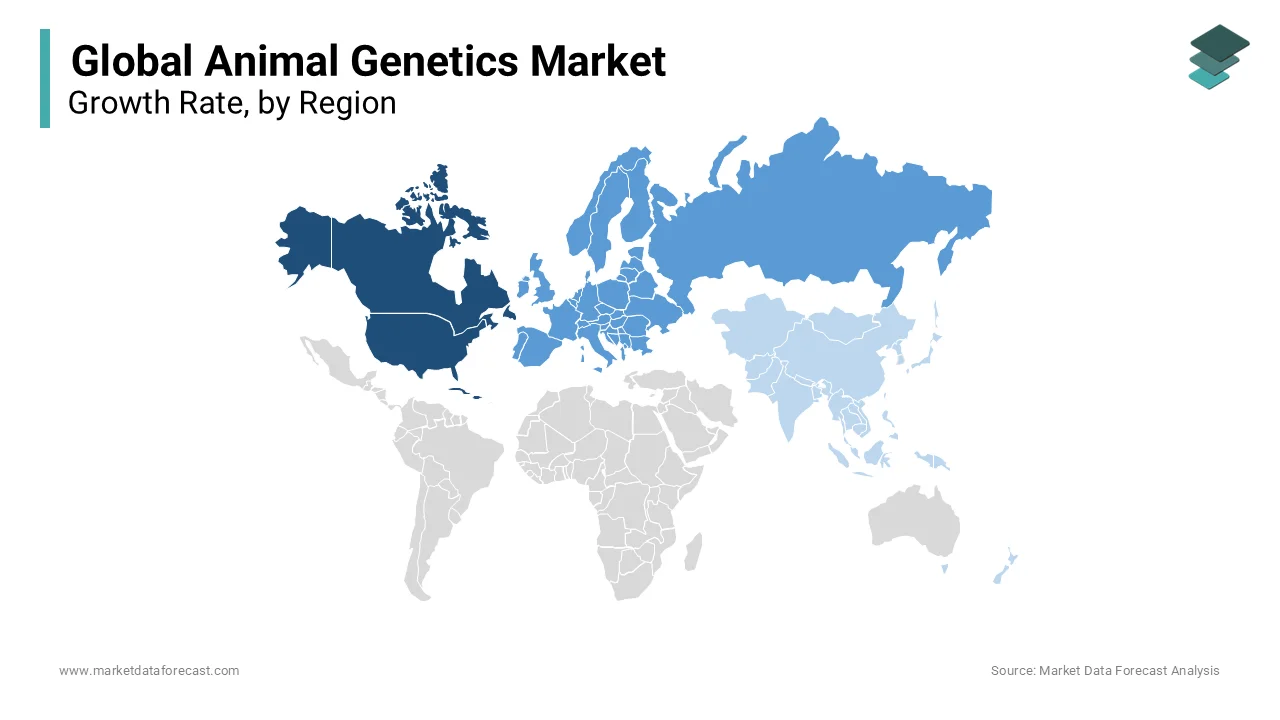

The North American animal genetics market accounted for the most significant share of the global market in 2024. Furthermore, the North American region is also expected to showcase domination in the global market during the forecast period due to the presence of key market participants and established healthcare infrastructure. The rising pet ownership among the countries of North America is expected to promote the market’s growth rate. In addition, the growing number of animals diagnosed with chronic diseases and increasing demand for genetically modified animal products are anticipated to showcase a favorable impact on regional market growth. Companies such as Zoetis, Neogen Corporation, and GeneSeek are playing a vital role in the global animal genetics market, and such companies have a significant presence across the North American region, which is further allowing the market to grow. The growing number of R&D activities around animal genetics from numerous universities and research institutions in the North American region is a big plus to the market’s growth rate. In 2024, the U.S. held the major share of the North American animal genetics market, followed by Canada.

The animal genetics market in Europe had the second-largest market share in 2024 and is predicted to hold a substantial global market share during the forecast period. Increasing demand to produce quality breeds is one of the key factors propelling the European animal genetics market. Doing genetic testing on animals gives a wide range of advantages such as the improvement of livestock, the conservation of endangered species, and the development of new therapies and treatments for animal diseases. Genetic testing activities on animals are increasing in the European region, which is expected to result in regional market growth. The Europe-based animal genetic companies such as Hendrix Genetics, Genus plc, and CRV are putting significant efforts and offering a wide range of products and services for animal genetics.

The Asia Pacific animal genetics market is projected to register the fastest CAGR during the forecast period. The growing geriatric population and support from private and public organizations are leveraging the market growth in the Asia-Pacific region. The branch of animal genetics is playing a promising role in the agriculture industry of the APAC region. The market growth in this region is further driven by the increasing adoption of technological developments in the agricultural industry, rising demand for animal-based protein and increasing number of favorable initiatives by the governments of the APAC countries.

KEY MARKET PLAYERS

Companies that play a major role in the global animal genetics market include Genus Plc, Hendrix Genetics BV, Alta Genetics, CRV Holding B.V., Neogen Corporation, VetGen, Animal Genetics Inc., and Zoetis.

RECENT HAPPENINGS IN THIS MARKET

- In February 2020, Neogen Corporation announced it entered a partnership with food industry blockchain pioneer Ripe Technology to adapt innovative blockchain technology for use with Neogen’s food safety diagnostics and animal genomics.

- In January 2020, Neogen Corporation announced that it had acquired Products Quimicos Magiar, a distributor of Neogen’s food and safety diagnostics, with businesses in Argentina and Uruguay.

- In January 2020, Neogen Corporation confirmed that it has partnered with genetic testing company Gencove to develop Neogen’s next generation of animal genomic tests.

- In March 2014, Pawprint Genetics and VetGen reached a settlement related to a patent lawsuit filed by paw genetics. As a result, this paw print genetics will offer a test for Von Willebrand Disease, an abnormal blood clotting in dogs.

- In November 2022, Shareholders of Genus plc should be pleased with the share price's 16% increase over the past month. The share price has yet to work well over the past year. Considering that the share price has decreased by 47% over the past year and has severely lagged the market, On a more positive note, the company has increased its market capitalization by UK£216m in the past week alone.

MARKET SEGMENTATION

This research report on the global animal genetics market has been segmented and sub-segmented based on the animal genetic product, testing service, and region.

By Animal Genetic Product

- Live Animals

- Poultry

- Porcine

- Canine

- Bovines

- Other Animals

- Genetic Material

- Semen

- Bovine Semen

- Porcine Semen

- Canine Semen

- Equine Semen

- Other Animals

- Embryos

- Bovine Embryo

- Equine Embryo

- Other Animals

- Semen

By testing service

- DNA Typing

- Genetic Trait Tests

- Genetic Disease Tests

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region is growing the fastest in the global animal genetics market?

The Asia-Pacific region is predicted to grow at the fastest CAGR in the global market during the forecast period.

How much was the global animal genetics market worth in 2024?

The global animal genetics market was valued at USD 6.64 billion in 2024.

Which are the companies playing a key role in the animal genetics market?

Genus Plc, Hendrix Genetics BV, Alta Genetics, CRV Holding B.V., Neogen Corporation, VetGen, Animal Genetics Inc., and Zoetis are a few of the companies playing a key role in the global animal genetics market.

Which segment by animal genetic product held the major share in the animal genetics market?

Based on the animal genetic product, the live animal segment led the animal genetics market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]