Global Android Set-Top Box Market Size, Share, Trends, & Growth Forecast Report By Resolution (HD & Full HD, 4K & above), Distribution Channel (Online, Brick & Mortar), Application (Residential and Commercial/Enterprises) & Region - Industry Forecast From 2024 to 2033

Global Android Set-Top Box Market Size

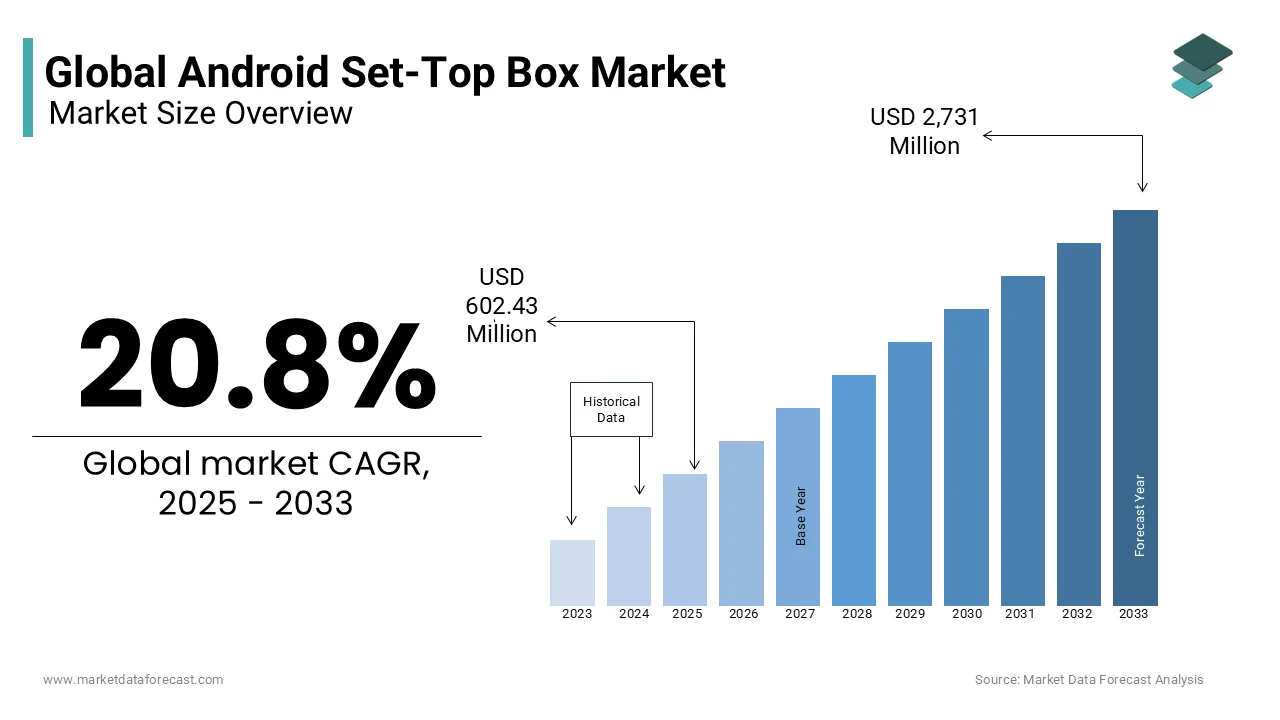

The global android set-top box market was valued at USD 498.7 million in 2024. The global market is expected to reach USD 2,731 million by 2033 from USD 602.43 million in 2025, growing at a CAGR of 20.8% during the foreseen period 2025 to 2033.

An Android setup box is a gadget that connects to your television through an HDMI cable. Network TV shows, video websites, and games may all be seen via the Android setup box. Because of their ability to run the Android TV operating platform, they come in various shapes and sizes. Due to their seamless experience, their recognition has increased. It is best suited for those who travel regularly. They offer local storage so that videos can be stored in the library and viewed on-demand. In addition, they provide consumers with a wide range of services on their televisions, from web surfing to video streaming. Due to a considerable shift in media habits, the global android set-top box industry is expected to rise significantly in the following years.

MARKET DRIVERS

One of the major factors driving the global market for an Android set-top box is increased viewers' demand for hybrid content.

Furthermore, the expansion of digitization in emerging countries assists the need for an android set-top box (STB) to overgrow. Other factors, such as increased internet penetration and the adoption of OTT and IPTV platforms, are likely to provide considerable development potential throughout the projection period.

Because of its features, such as broad content, a rich and powerful user experience, and access to a more excellent range of apps, Android-powered set-top boxes are quickly becoming a popular choice among consumers. These devices are far more individualized than traditional STBs and so appeal to a broader audience. Several built-in features, like speech recognition, a robust app ecosystem, TV Input Framework (TIF), and videoconferencing, are projected to boost device adoption in the coming years. In addition, these Android boxes provide users with various connectivity options, including HDMI outputs, USB ports, Bluetooth, Wi-Fi, and Ethernet.

Android set-top boxes are increasingly gaining popularity among manufacturers as well. Because of the lower development costs and faster time-to-market, significant participants in the market are designing and deploying Android set-top boxes. As a result, these boxes are gaining traction and are beginning to eat into the already crowded set-top box market. This expansion is primarily due to an increase in the number of relationships with OEMs and operators worldwide. Customers have been growing their demand for OTT streaming services and platforms over the last few years. The global availability of high-speed internet encourages OTT and video-on-demand (VoD) services. Consumers now have a variety of content consumption options thanks to the entry of OTT services. OTT streaming's rise is fueled by several factors, including low-cost, flexible business models, as well as accessibility across several devices without the need to sign a long-term commitment.

Because of advanced technologies like 4G/LTE and quick development in next-generation 5G connectivity, the world is seeing significant growth in broadband connection throughout growing regions. Furthermore, advances in next-generation satellite technology are also projected to lead to faster and more reliable delivery of digital services. In addition, because video consumption is increasingly taking place in digital formats, viewers are spending more time on digital platforms than on conventional mediums.

MARKET RESTRAINTS

Customers' uncertainty, fear, and skepticism about the product, on the other hand, will be a significant impediment to the expansion of the Android set-top box (STB) and television (TV) markets. In addition, the Android set-top box (STB) and television (TV) markets will be constrained by high labor costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.8% |

|

Segments Covered |

By Resolution, Distribution Channel, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Panasonic Corporation, Hitachi, Ltd, Sony Corporation, NVIDIA Corporation, Airtel India, SAMSUNG, Huawei Technologies Co., Ltd, International Limited, Toshiba Corporation, Evolution Digital, LLC, Xiaomi, Kaonmedia Co., Ltd., HUMAX Electronics Co., Ltd., Skyworth Group Limited, SAGEMCOM, Technicolor, Shenzhen SDMC Technology Co., Ltd., Hisense, SHARP CORPORATION, TCL, and others. |

SEGMENTAL ANALYSIS

By Resolution Insights

Based on the resolution, the 'HD and full HD' segment led the market in 2024 and is yet to continue during the forecast period. Because of the high-video quality delivery at a cheap price, HD and full HD Android boxes are majorly recognized by consumers. Furthermore, the low pricing and convenience with which these boxes are available entice the middle-class population, resulting in increased demand for this market. Thus, traditional SD boxes are gradually being replaced with HD and Full HD Android set-top boxes, resulting in more significant revenue.

Between the projection period and the end of the forecast period, the '4K and above' category is predicted to increase at the highest rate. A rising desire for unique, ultra-high-resolution content is expected to fuel demand for "4K and above" boxes worldwide. Furthermore, the growing preference for at-home entertainment via large-screen TV displays is expected to provide considerable growth prospects for 4K Android set-top boxes shortly.

By Distribution Channel Insights

Depending on the distribution channel, the brick-and-mortar segment accounted for the majority of total income. Physical verification of the product by the consumer before making any purchase decision is one of the elements driving the growth of this market. Furthermore, most buyers first study and gather product-related information on online platforms before purchasing it in physical stores, boosting the brick-and-mortar segment's growth.

Because of shifting customer preferences to purchase on e-commerce platforms, the online segment is expected to develop significantly in the future years.

REGIONAL ANALYSIS

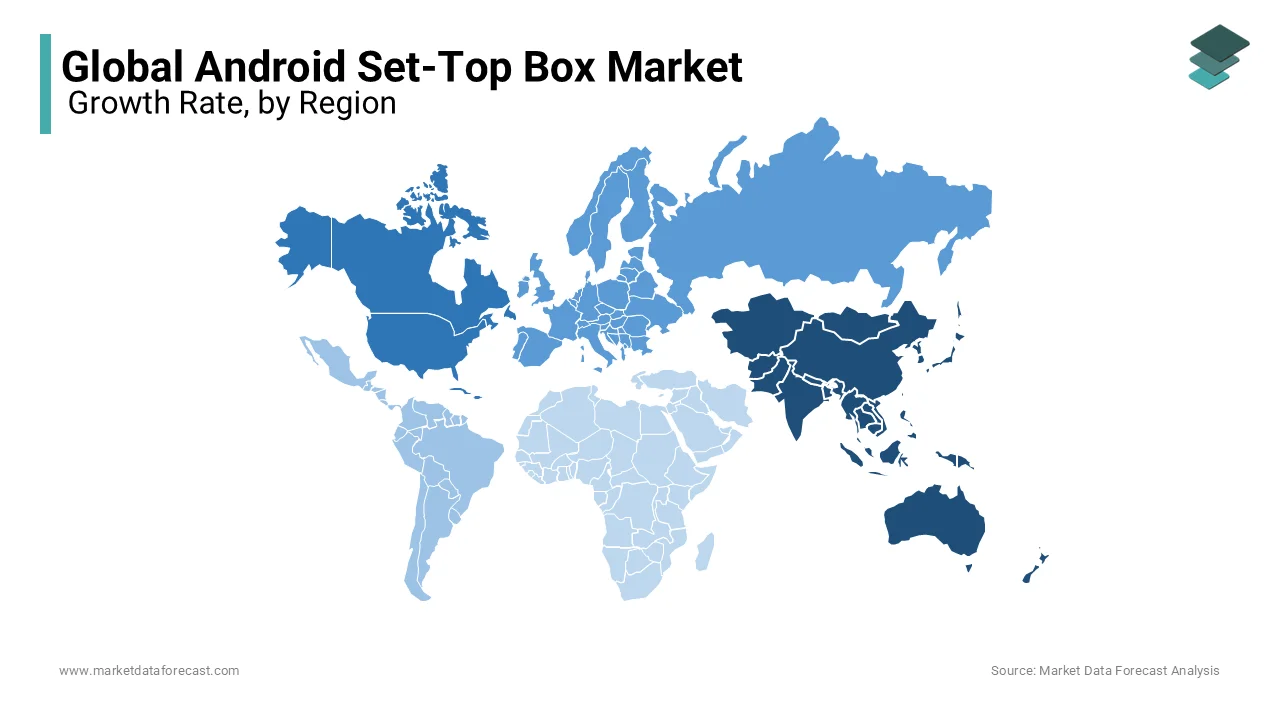

In terms of volume, the Asia Pacific region dominated the entire market for Android set-top boxes. An increase in internet usage and intelligent TV penetration, which leads to online data consumption, is a crucial element influencing growth in the region. Furthermore, increased consumer awareness of content digitalization in emerging markets like India will boost regional growth. China is one of the leading countries, with many companies producing both low-cost and feature-rich Android set-top boxes.

The android STB market in North America is predicted to grow significantly throughout the foreseen period with a CAGR of 2%. The adoption of Ultra-High-Definition (UHD) devices, the proliferation of UHD content, and the growing consumer desire for viewing content via subscription-based OTT platforms like Netflix & HBO are the primary reasons driving the regional market's growth. Because of the increasing interest in OTT and IPTV platforms, particularly among younger demographics, the United States is estimated to be dominant. In addition, media consumption in the United States has increased significantly, with a shift away from traditional forms and toward new-age digital media.

KEY PLAYERS IN THE MARKET

Companies playing a significant role in the global Android set-top box market include Panasonic Corporation, Hitachi, Ltd, Sony Corporation, NVIDIA Corporation, Airtel India, SAMSUNG, Huawei Technologies Co., Ltd, International Limited, Toshiba Corporation, Evolution Digital, LLC, Xiaomi, Kaonmedia Co., Ltd., HUMAX Electronics Co., Ltd., Skyworth Group Limited, SAGEMCOM, Technicolor, Shenzhen SDMC Technology Co., Ltd., Hisense, SHARP CORPORATION and TCL.

RECENT HAPPENINGS IN THE MARKET

-

Tata Sky announced in August 2020 that a significant amount of its set-top box procurement would be moved to India. Technicolor has partnered with the company to produce set-top boxes for the Indian market, manufactured and distributed in the country.

MARKET SEGMENTATION

This research report on the global android set-top box market has been segmented and sub-segmented based on resolution, distribution channel, application, and region.

By Resolution

-

HD & Full HD

-

4K & above

By Distribution Channel

-

Online

-

Brick & Mortar

By Application

-

Residential

-

Commercial / Enterprises

By Region

-

North America

-

Latin America

-

Europe

-

Asia Pacific

-

Middle East & Africa

Frequently Asked Questions

What are the key factors driving the growth of the Android set-top box market?

The key factors driving the growth include the rising popularity of OTT (Over-The-Top) streaming services, advancements in Android technology, increasing internet penetration, and the demand for high-definition video content.

What are the technological advancements in Android set-top boxes?

Technological advancements in Android set-top boxes include support for 4K and 8K resolution, HDR (High Dynamic Range), Dolby Atmos sound, faster processors, improved graphics performance, voice control integration, and enhanced AI capabilities.

What challenges are faced by the Android set-top box market?

Challenges faced by the market include intense competition from other smart TV platforms, potential issues with software fragmentation, cybersecurity concerns, and the need to continuously innovate to meet evolving consumer expectations.

How do Android set-top boxes compare to other streaming devices in terms of market share?

Android set-top boxes hold a significant share of the streaming device market, competing closely with other major platforms like Roku, Apple TV, and Amazon Fire TV. Their market share is bolstered by the versatility and customization options offered by the Android operating system, as well as a wide range of price points catering to different consumer needs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]