Global Anchor Market Size, Share, Trends, & Growth Forecast Report By Product (Hangers, Chemical, Nail-in, Wall, and Others), Materials, End-use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Anchor Market Size

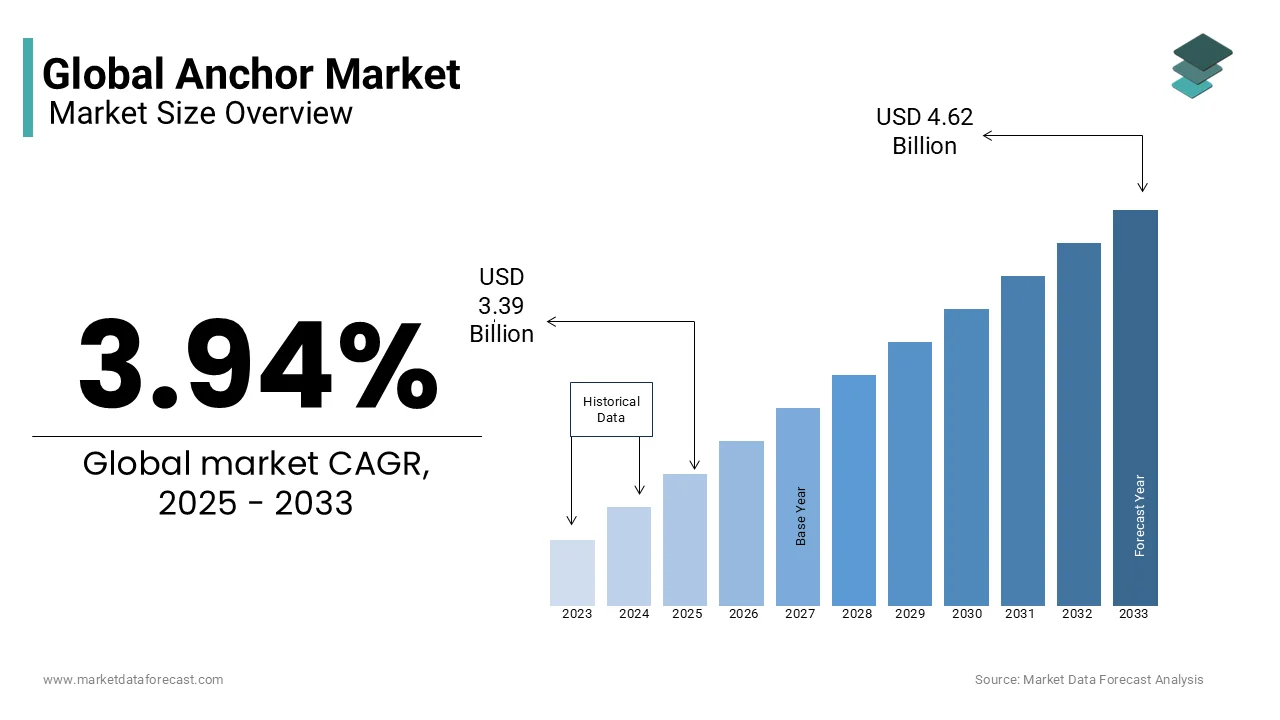

The global anchor market was valued at USD 3.26 billion in 2024. The global market is projected to reach USD 4.62 billion by 2033 from USD 3.39 billion in 2025, rising at a CAGR of 3.94% from 2025 to 2033.

The anchors serve as gravitational centers by creating ecosystems that benefit from their scale, reputation, and resource allocation. In 2023, the concept has transcended traditional retail paradigms, encompassing universities, hospitals, tech giants, and even virtual platforms that act as hubs for smaller enterprises. For instance, Amazon’s marketplace acts as a digital anchor by enabling third-party sellers to thrive within its infrastructure, while urban universities like MIT have catalyzed innovation districts in their host cities. Anchor institutions significantly influence property values and urban planning, with a Brookings Institution analysis in 2023 revealing that neighborhoods within a one-mile radius of university campuses experienced a 22% increase in median home prices over the past decade. Hospitals, too, play a pivotal role, as nonprofit hospitals invested $95 billion in community health initiatives in 2022, according to the American Hospital Association. Similarly, digital anchors like Shopify have redefined economic ecosystems, with merchants generating over $444 billion in global activity in 2023.

MARKET DRIVERS

Urbanization and Infrastructure Development

The rapid pace of urbanization has emerged as a key driver of the anchor market, with cities becoming hubs for economic activity and innovation. According to the United Nations Department of Economic and Social Affairs, 56% of the global population resides in urban areas as of 2023 with a figure projected to rise to 68% by 2050. This demographic shift amplifies the role of anchor institutions like universities, hospitals, and transit hubs, which serve as magnets for development. For instance, the U.S. Census Bureau reported that metropolitan areas with robust anchor institutions experienced a 19% higher rate of infrastructure investment between 2018 and 2022. These anchors attract public-private partnerships, fostering mixed-use developments. Furthermore, according to the Federal Transit Administration, regions integrating transit-oriented anchors saw a 25% increase in local business registrations.

Technological Advancements and Digital Transformation

The technological innovation has revolutionized the anchor market by enabling digital platforms to function as virtual anchors, reshaping traditional economic dynamics. According to the U.S. Bureau of Economic Analysis, the digital economy accounted for 10.2% of the nation’s GDP in 2022 with the growing influence of tech-driven anchors. Platforms like Amazon and Shopify have redefined commerce, with Shopify’s 2023 report indicating that its ecosystem supported over 4 million jobs globally. According to the National Science Foundation, tech hubs anchored by research institutions contributed $800 billion to the U.S. economy in 2021, emphasizing their role in fostering innovation clusters. Furthermore, the World Bank reports that countries investing in digital infrastructure witnessed a 20% rise in small business creation, showcasing how technological anchors drive inclusive growth while bridging geographical divides through connectivity and accessibility.

MARKET RESTRAINTS

Economic Inequality and Regional Disparities

Economic inequality poses a significant restraint to the anchor market, as the benefits of anchor institutions are often concentrated in affluent regions by leaving underserved areas marginalized. The U.S. Department of Agriculture reports that rural communities, which account for 14% of the national population that receive only 6% of total infrastructure investments, limiting the establishment of anchors like hospitals or universities. This disparity stifles local economic growth, with the Federal Reserve noting that counties lacking anchor institutions experienced a 30% slower recovery rate post-pandemic compared to those with robust anchors. As per the Organisation for Economic Co-operation and Development, regions with high inequality see 40% less private sector engagement, further exacerbating the divide. These imbalances hinder the ability of anchors to fulfill their role as catalysts for equitable development by perpetuating cycles of underinvestment and reduced social mobility.

Environmental and Climate Vulnerabilities

Climate change presents a growing challenge to the anchor market by threatening the physical and operational resilience of anchor institutions. The National Oceanic and Atmospheric Administration (NOAA) recorded 18 weather-related disasters in the U.S. during 2022, each causing over $1 billion in damages by impacting critical anchors such as hospitals and universities. According to the Federal Emergency Management Agency (FEMA), coastal cities housing major anchors face a 10% annual risk of flooding by 2050 due to rising infrastructure and disrupting economic activity. Furthermore, the Intergovernmental Panel on Climate Change warns that rising temperatures could reduce agricultural productivity by 25% in vulnerable regions, undermining rural anchors like cooperatives. These environmental vulnerabilities demand substantial adaptation investments, yet the World Bank notes that only 1% of global climate finance targets resilience projects by leaving anchors ill-prepared for escalating climate risks.

MARKET OPPORTUNITIES

Integration of Smart City Initiatives

The integration of anchor institutions into smart city frameworks presents a transformative opportunity for the anchor market. According to the U.S. Department of Transportation, cities adopting smart technologies have seen a 20% improvement in traffic efficiency and a 15% reduction in energy consumption by creating an ideal environment for anchors like universities and hospitals to thrive. For instance, the Smart Cities Initiative reports that urban areas leveraging IoT-enabled infrastructure attracted 35% more private investments in 2022, benefiting anchor-driven ecosystems. Additionally, the European Commission notes that regions integrating digital anchors with smart governance systems experienced a 25% increase in local business startups. These advancements enable anchors to enhance operational efficiency while fostering innovation clusters. Furthermore, the International Telecommunication Union emphasizes that smart city projects incorporating anchors as central nodes could generate $20 trillion in global economic value by 2030.

Expansion of Green and Circular Economy Models

The shift toward green and circular economy practices offers significant opportunities for anchor markets to lead sustainability efforts. As per Environmental Protection Agency (EPA), businesses adopting circular economy principles reduced waste management costs by 30% in 2022 with the financial and environmental benefits for anchors like manufacturing hubs and tech platforms. According to the United Nations Environment Programme, regions prioritizing green anchors witnessed a 40% increase in renewable energy adoption rates, creating synergies with local enterprises. Moreover, the World Economic Forum states that circular economy initiatives could unlock $4.5 trillion in economic value globally by 2030, with anchors playing a pivotal role in driving these transitions. The U.S. Energy Information Administration further notes that cities with green-certified anchor institutions reduced carbon emissions by 18% annually.

MARKET CHALLENGES

Aging Infrastructure and Underinvestment

Aging infrastructure poses a significant challenge to the anchor market, as many anchor institutions rely on outdated facilities that hinder their operational efficiency. According to the American Society of Civil Engineers (ASCE), the U.S. faces a $2.59 trillion infrastructure funding gap by 2029, with schools, hospitals, and transit hubs particularly affected. As per the National Center for Education Statistics, nearly 40% of public school buildings are over 50 years old, limiting their ability to serve as modern educational anchors. According to the Federal Highway Administration, 42% of urban roads near anchor institutions are in poor condition, deterring economic activity and accessibility. This underinvestment not only stifles growth but also increases maintenance costs, with the Government Accountability Office estimating that deferred repairs could escalate expenses by 25%.

Workforce Skill Gaps and Labor Shortages

The labor shortages and skill gaps present another critical challenge for the anchor market, particularly in sectors reliant on specialized talent. The U.S. Bureau of Labor Statistics projects that industries such as healthcare and technology will face a shortfall of 1.2 million skilled workers by 2030, directly impacting anchors like hospitals and tech hubs. According to the National Science Foundation, only 13% of STEM graduates enter local workforce pipelines, limiting innovation capacity in anchor-driven regions. According to the Organisation for Economic Co-operation and Development, countries with high skill mismatches experience a 15% reduction in productivity growth by affecting anchor institutions’ ability to scale operations. As per the Federal Reserve Bank of New York, small businesses linked to anchors report a 30% decline in performance when labor shortages persist by emphasizing the interconnected nature of this challenge across the broader economic ecosystem.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.94% |

|

Segments Covered |

By Product, Materials, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hilti Corporation, Stanley Black & Decker, Inc., DEWALT, Illinois Tool Works Inc., Adolf Wurth GmbH & Co. KG, Fischer fixings UK Ltd., Mechanical Plastics Corp., Cobra Anchors, MKT Fastening, LLC., SFS Group Fastening Technology Ltd., Friulsider S.p.A., CEAS (Construction Engineered Attachment Solutions), Sika AG, Koelner Rawlplug IP, and Guangdong Kin Long Hardware Products Co., Ltd. |

SEGMENT ANALYSIS

By Product Outlook Insights

The chemical anchors segment was the largest and held 45.4% of the anchor market share in 2024 with the versatility and superior bonding strength by making them indispensable in construction and infrastructure projects. According to the U.S. Department of Transportation, chemical anchors are used in 60% of bridge retrofitting projects due to their durability in extreme conditions. According to the Federal Highway Administration, regions utilizing chemical anchors report a 20% reduction in structural failures.

The nail-in anchors segment is anticipated to witness a fastest CAGR of 8.5% from 2025 to 2033. This growth is driven by their cost-effectiveness and ease of installation by appealing to residential and small-scale commercial projects. The U.S. Census Bureau reports a 12% annual increase in housing starts since 2021 that directly boosting demand for nail-in anchors. According to the National Association of Home Builders, 70% of contractors prefer nail-in anchors for lightweight applications due to their speed and efficiency. The World Bank predicts a 30% rise in affordable housing projects globally by 2030.

By Materials Outlook Insights

The stainless steel dominated the anchor market by holding a 45.3% share in 2024. Its corrosion resistance and durability make it indispensable for marine anchors and industrial applications. According to the U.S. Department of Commerce, stainless steel usage in maritime industries grew by 18% from 2020 to 2023. According to the National Institute of Standards and Technology, stainless steel’s lifecycle cost is 30% lower than alternatives due to reduced maintenance needs. This growth is due to its adaptability across sectors by ensuring long-term reliability and safety.

The carbon steel segment is esteemed to achieve a CAGR of 6.8% during the forecast period. Its rapid growth is driven by affordability and widespread use in construction and shipping industries. According to the World Steel Association, global carbon steel production reached 1.9 billion metric tons in 2022 by accounting for 90% of total steel output. Governments like India’s Ministry of Steel emphasize infrastructure projects is boosting demand by 22% annually. According to the U.S. Energy Information Administration, renewable energy installations, requiring durable yet cost-effective anchors and increased carbon steel consumption by 15% in 2023. This segment’s importance lies in balancing cost-efficiency with performance by making it vital for scalable anchor solutions amidst rising industrialization.

By End-use Outlook Insights

The residential segment dominated the anchor market by capturing a share of 45.6% in 2024 owing to the growing demand for housing driven by urbanization, with the United Nations projecting a 68% global urban population by 2050. Residential anchors, such as gated communities and smart homes, are pivotal in shaping urban ecosystems. According to the National Association of Home Builders, residential projects contribute $1.1 trillion annually to the U.S. economy. Additionally, the Federal Housing Finance Agency reports a 17% rise in home prices since 2020 by reflecting robust investment in this segment. Its importance lies in fostering stable communities and supporting ancillary industries like retail and education.

The infrastructural segment is likely to witness a significant CAGR of 2025 to 2033. This rapid expansion is fueled by global infrastructure investments, with the Global Infrastructure Hub estimating a $94 trillion spending requirement by 2040. Governments are prioritizing sustainable infrastructure, as per the U.S. Department of Energy, which notes that green infrastructure projects grew by 30% in 2022. The World Bank emphasizes that every dollar invested in infrastructure boosts GDP by 20% by making it a critical driver of economic recovery. Infrastructural anchors, such as transit hubs and smart grids, are vital for urban resilience and connectivity, addressing climate challenges while enhancing productivity.

REGIONAL ANALYSIS

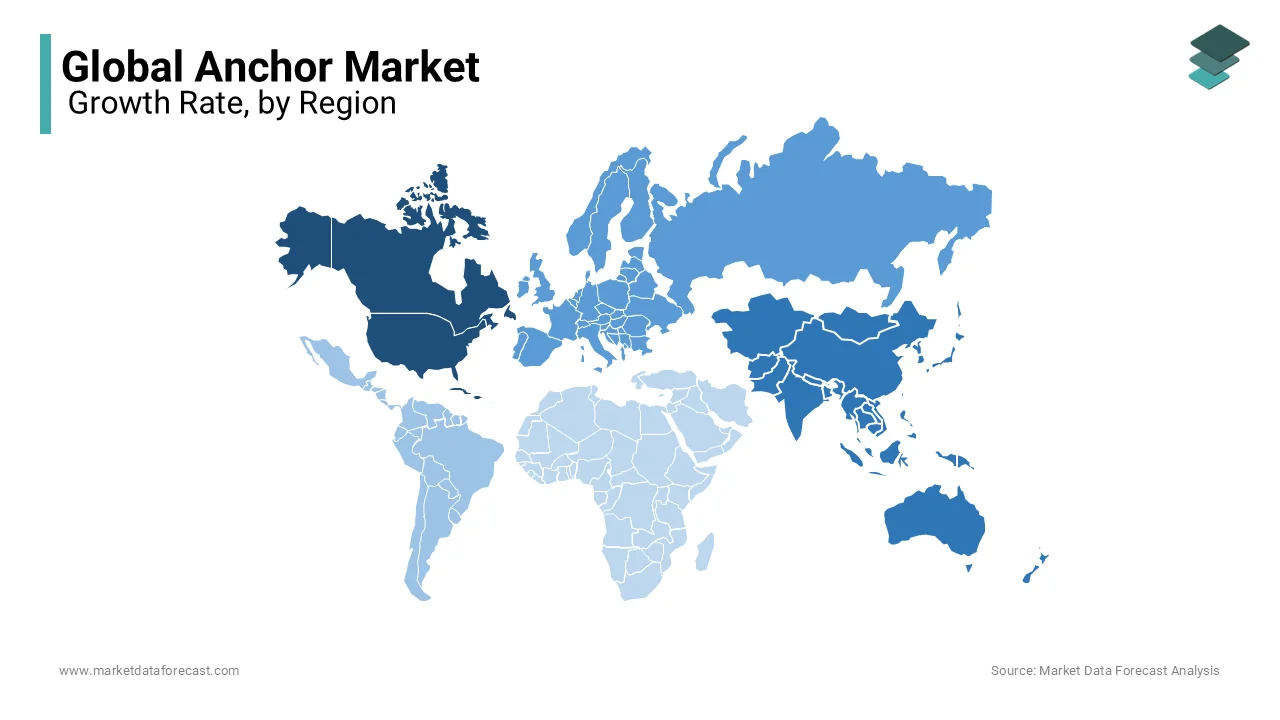

North America led the anchor market with 38.5% of share in 2024. This dominance is driven by advanced infrastructure, robust urbanization, and the presence of major anchors like universities and tech hubs. According to the Federal Reserve, the region’s anchor-driven ecosystems contribute $6 trillion annually to the economy. According to the Organisation for Economic Co-operation and Development, North America accounts for 40% of global R&D spending by fostering innovation clusters. Its importance lies in shaping sustainable urban models, with cities like New York and San Francisco serving as benchmarks for mixed-use developments.

Asia-Pacific is likely to exhibit a CAGR of 9.5% from 2025 to 2033. This growth is fueled by rapid urbanization, with the United Nations projecting that 54% of Asia’s population will reside in cities by 2030. China and India are at the forefront, investing $1.5 trillion annually in infrastructure, as reported by the World Bank. According to the International Energy Agency, the region leads in green building projects, with a 25% increase in sustainable developments since 2020. Asia-Pacific’s importance lies in its ability to integrate digital anchors like e-commerce platforms. This rapid expansion positions it as a key driver of global economic transformation.

Europe is expected to maintain steady growth, supported by the European Commission’s Green Deal, which allocates €1 trillion for sustainable anchors by 2030. Latin America, despite challenges, could see a 5% annual growth due to urbanization, as per the Inter-American Development Bank. The Middle East benefits from mega-projects like NEOM, with PricewaterhouseCoopers estimating $1 trillion in investments by 2035. Africa, though nascent, shows promise with the African Development Bank reporting a 7% rise in infrastructure funding, driven by urban hubs.

KEY MARKET PLAYERS

The major players in the global anchor market include Hilti Corporation, Stanley Black & Decker, Inc., DEWALT, Illinois Tool Works Inc., Adolf Wurth GmbH & Co. KG, Fischer fixings UK Ltd., Mechanical Plastics Corp., Cobra Anchors, MKT Fastening, LLC., SFS Group Fastening Technology Ltd., Friulsider S.p.A., CEAS (Construction Engineered Attachment Solutions), Sika AG, Koelner Rawlplug IP, and Guangdong Kin Long Hardware Products Co., Ltd.

TOP 3 PLAYERS IN THE MARKET

Hilti Corporation

Hilti Corporation is a global leader in the anchor market, recognized for its cutting-edge fastening and anchoring solutions. The company is renowned for its ability to cater to diverse sectors, including infrastructure, commercial, and industrial applications. Hilti’s focus on innovation has enabled it to develop advanced products like adhesive anchors and mechanical fasteners, which are widely adopted in large-scale projects. The company has also embraced digital transformation, introducing tools such as asset management systems that enhance construction efficiency. By prioritizing sustainability, Hilti integrates eco-friendly practices into its product designs, reinforcing its reputation as a forward-thinking industry leader.

Stanley Black & Decker, Inc.

Stanley Black & Decker is a dominant player in the anchor market, leveraging its extensive portfolio of tools and storage solutions. The company’s DEWALT brand is particularly influential, offering durable and high-performance anchors for both residential and commercial applications. Stanley Black & Decker emphasizes sustainability, committing to reducing its environmental footprint through innovative manufacturing processes. Its robust global distribution network ensures widespread accessibility to its products, making it a preferred choice for contractors and builders worldwide. The company’s dedication to quality and reliability has cemented its position as a key contributor to the anchor market.

Fischer Fixings UK Ltd.

Fischer Fixings UK Ltd., part of the Fischer Group, is celebrated for its high-quality mechanical and chemical anchors, which are integral to critical infrastructure projects. The company places a strong emphasis on research and development, consistently introducing groundbreaking products that set industry standards. Fischer’s commitment to excellence is reflected in its adherence to rigorous quality certifications, ensuring consistent performance across its offerings. With localized manufacturing facilities spanning Europe, Asia, and North America, Fischer effectively addresses regional demands, enhancing its competitive edge. Its focus on precision and reliability has established Fischer as a trusted name in the global anchor market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Innovation and R&D Investments

Leading companies prioritize research and development to introduce advanced products that cater to niche applications. For instance, Hilti Corporation focuses on developing cutting-edge adhesive and mechanical anchors, leveraging innovations like IoT-enabled tools to improve construction efficiency. Similarly, Fischer Fixings invests heavily in R&D to launch high-performance chemical anchors, ensuring compliance with stringent safety standards. These innovations not only differentiate their offerings but also reinforce their reputation as industry pioneers.

Sustainability and Eco-Friendly Solutions

Sustainability has become a cornerstone strategy for key players. Stanley Black & Decker emphasizes reducing its carbon footprint by adopting eco-friendly manufacturing processes and materials. Sika AG integrates sustainable practices into its product lifecycle, offering green-certified anchoring solutions. By aligning with global environmental goals, these companies appeal to environmentally conscious customers and regulatory frameworks, enhancing their brand equity.

Strategic Partnerships and Collaborations

Players like Illinois Tool Works Inc. and Adolf Wurth GmbH engage in collaborations with construction firms, governments, and academic institutions to co-develop tailored solutions. These partnerships enable them to access new markets, share expertise, and scale their operations effectively. Additionally, alliances with digital platforms help integrate smart technologies into traditional anchoring systems.

Global Expansion and Localization

To strengthen their foothold, companies like Guangdong Kin Long Hardware Products Co., Ltd., and Friulsider S.p.A. focus on expanding their geographic presence. They establish localized manufacturing units and distribution networks to cater to regional demands while complying with local regulations. This approach ensures faster delivery, cost efficiency, and stronger customer relationships.

Digital Transformation and Smart Solutions

Adopting digital tools is another critical strategy. Hilti and DEWALT have introduced IoT-based systems for asset tracking and predictive maintenance, enhancing operational efficiency for end-users. By embedding smart technologies into their products, these companies create value-added services that set them apart from competitors.

COMPETITIVE LANDSCAPE

The anchor market is characterized by intense competition, driven by the presence of established global players, regional manufacturers, and emerging innovators. This competitive landscape is shaped by the demand for high-performance anchoring solutions across residential, commercial, industrial, and infrastructural sectors. Key players such as Hilti Corporation, Stanley Black & Decker, and Fischer Fixings UK Ltd. dominate the market through their extensive product portfolios, technological advancements, and strong brand recognition.

However, the market also features mid-sized and regional players like Friulsider S.p.A., Cobra Anchors, and Guangdong Kin Long Hardware Products Co., Ltd., which compete on cost-effectiveness, localized offerings, and niche applications. This creates a fragmented yet dynamic ecosystem where smaller firms challenge larger corporations by addressing underserved markets or offering specialized solutions. The rise of e-commerce platforms has further intensified competition, enabling direct-to-consumer sales and reducing dependency on traditional distribution channels.

Additionally, regulatory standards and sustainability requirements have become key competitive factors. Companies that align with green building certifications and eco-friendly practices gain a strategic edge. Collaborations, mergers, and acquisitions are common strategies to consolidate market share and expand geographic reach. For instance, partnerships with construction firms or governments allow players to co-develop tailored solutions. Overall, the anchor market’s competitive intensity is fueled by innovation, globalization, and evolving customer demands, ensuring a constant push for excellence and differentiation among participants.

RECENT MARKET DEVELOPMENTS

- In July 2017, Hilti Corporation acquired Oglaend System Group, a fastening and support systems provider. This acquisition strengthened Hilti’s position in fastening and support systems for industrial applications.

- In April 2018, Stanley Black & Decker acquired Nelson Fastener Systems, a fastening solutions company. This acquisition expanded Stanley Black & Decker’s anchoring and fastening solutions for infrastructure and construction.

- In September 2020, DEWALT launched the Power-Stud+ SD2 Anchor, a high-performance mechanical anchor. This product launch enhanced DEWALT’s chemical and mechanical anchoring systems to meet higher safety standards.

- In June 2019, Illinois Tool Works Inc. expanded its Red Head Trubolt+ Wedge Anchors, a line of mechanical fasteners. This expansion improved the performance of ITW’s anchors in cracked and uncracked concrete applications.

- In May 2021, Adolf Würth GmbH & Co. KG introduced the W-BS Seismic Anchor, a high-performance anchor designed for seismic applications. This introduction reinforced Würth’s presence in seismic-resistant mechanical anchors.

- In March 2022, Fischer Fixings UK Ltd. launched the FIS V Zero Chemical Anchor, an environmentally friendly anchoring solution. This product introduction strengthened Fischer Fixings’ portfolio with a styrene-free chemical anchor.

- In January 2023, Sika AG acquired MBCC Group, a leading construction chemicals company. This acquisition strengthened Sika’s anchoring and construction chemicals business, expanding its market reach.

- In November 2021, Rawlplug (Koelner Rawlplug IP) developed the R-XPTII Zinc Plated Anchors, a corrosion-resistant fastening solution. This development improved Rawlplug’s product durability for industrial anchoring applications.

- In August 2020, Guangdong Kin Long Hardware Products Co., Ltd. expanded its global manufacturing capacity by opening new production facilities. This expansion enhanced Kin Long’s anchor manufacturing capabilities to meet growing demand.

- In July 2019, MKT Fastening, LLC. launched high-performance adhesive anchors, an advanced chemical bonding solution. This launch introduced innovative structural anchoring solutions, strengthening MKT Fastening’s market position.

MARKET SEGMENTATION

This research report on the global anchor market is segmented and sub-segmented into the following categories.

By Product

- Hangers

- Mechanical

- Cast-in Anchors

- Post-installed Anchors

- Screw

- Expansion

- Undercut

- Chemical

- Nail-in

- Wall

- Others

By Materials

- Stainless Steel

- Carbon Steel

- Others

By End-use

- Residential

- Commercial

- Industrial

- Infrastructural

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which industries rely on anchor markets the most?

Sectors like finance, technology, real estate, and retail heavily depend on anchor markets. These industries use them as a reference for pricing, consumer behavior, and economic health.

How do businesses benefit from anchor markets?

Companies use them for trend analysis, investment strategies, and competitive positioning. Access to an anchor market often provides better financial stability and global expansion opportunities.

How do investors use anchor markets?

Investors monitor them to gauge economic trends, predict asset performance, and manage risks. These markets help in portfolio diversification and strategic decision-making.

What factors define an anchor market?

A strong economy, high trade volume, and industry leadership make a market an anchor. Stability, innovation, and policy influence also contribute to its global significance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]