Global Analytical Laboratory Instruments Manufacturing Market Size, Share, Trends & Growth Forecast Report By Type (Elemental Analysis Instruments, Molecular Analysis Instruments, Separation Analysis Instruments and Others), End-User (Life Science, Chemical/ Petrochemical and Oil & Gas, Food Testing and Others) & Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis (2025 to 2033)

Global Analytical Laboratory Instruments Manufacturing Market Size

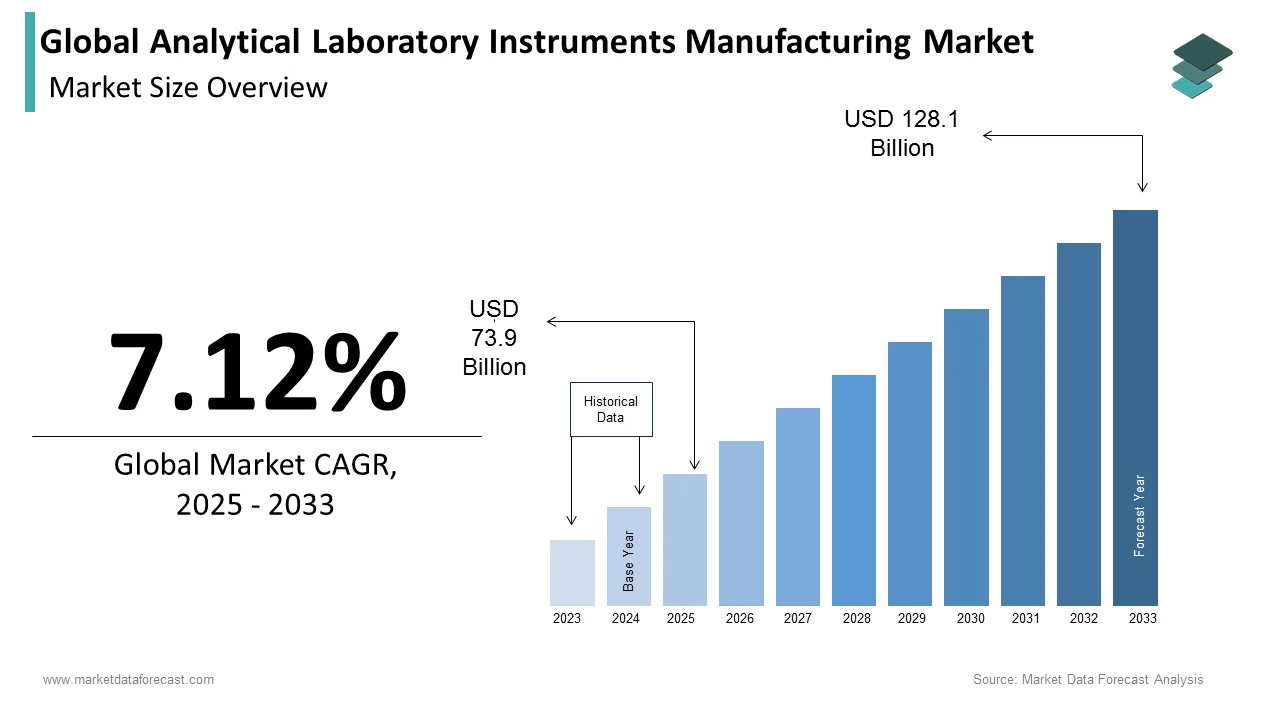

The size of the global analytical laboratory instruments manufacturing market was valued at USD 69 billion in 2024. The global market is anticipated to grow from USD 73.9 billion by 2025 to USD 128.1 billion by 2033, registering a CAGR of 7.12% from 2025 to 2033.

The analytical laboratory instruments manufacturing market is integral to various sectors, including pharmaceuticals, biotechnology, environmental testing, and food safety. These instruments such as spectrometers, chromatographs, microscopes, and PCR systems play a critical role in research, development, and quality assurance to enable precise measurements and analyses necessary for advancing scientific knowledge and meeting regulatory standards.

The growth of the market is driven by increasing demand for high-precision testing, particularly in the pharmaceutical and biotechnology sectors. Rising health and safety standards and heightened regulatory scrutiny worldwide propel growth as companies strive to ensure compliance with stringent quality measures. Technological advancements, such as AI-enhanced analytical instruments, automation, and portable devices, are also contributing factors, expanding the accessibility and functionality of these instruments. Regionally, North America and Europe dominate due to substantial investments in healthcare and research infrastructure. At the same time, Asia-Pacific shows strong growth potential, driven by expanding R&D activities and industrialization in countries like China and India. Key players focus on product innovation, strategic mergers, and acquisitions to expand their global footprint and enhance their product offerings.

MARKET TRENDS

Increased Automation and AI Integration

Automation and AI are rapidly advancing the analytical laboratory instruments market, with automated systems reducing human errors by approximately 70% and improving data throughput by up to 50%. AI-enhanced instruments, such as mass spectrometers equipped with machine learning, accelerate sample analysis by nearly 40%, enabling faster identification of complex compounds and molecules. In a recent survey, 60% of laboratories reported increased productivity and accuracy due to automation and AI, meeting stringent regulatory standards with higher precision and reproducibility. These technologies have also enabled labs to process data faster, with an average reduction in analysis time of about 30%.

Rising Demand for Portable and Compact Instruments

Demand for portable analytical instruments has grown, with the market for handheld and field-deployable devices projected to grow by 7.5% annually. Portable instruments, like handheld spectrometers and miniaturized gas chromatographs, are now used in over 45% of fieldwork applications in environmental monitoring, food safety, and point-of-care healthcare. This shift allows for rapid, on-site analysis, cutting down sample transport time by as much as 80% and reducing operational costs. In rural and remote regions, portable devices have improved testing accessibility, with a 25% increase in diagnostic coverage where traditional lab infrastructure is limited.

MARKET DRIVERS

Growth in Pharmaceutical and Biotechnology R&D

The analytical laboratory instruments market is significantly driven by the expanding pharmaceutical and biotechnology sectors, where precise, reliable testing is essential. The growing R&D spending is estimated to exceed $220 billion globally, which is resulting in the rising demand for high-performance instruments in drug development, quality control, and diagnostics. For instance, chromatography and mass spectrometry are crucial for identifying and quantifying complex molecules. In the United States alone, the biotechnology R&D sector saw a growth rate of 15% in recent years, fueling the need for advanced analytical tools to support breakthroughs in precision medicine, gene therapy, and vaccine development.

Stringent Regulatory Standards

Rising regulatory requirements in sectors like pharmaceuticals, food safety, and environmental testing are major drivers for analytical laboratory instruments. Agencies such as the FDA and EPA impose strict testing standards to ensure public health and safety. As a result, industries rely on advanced instruments capable of producing highly accurate, reproducible data. For example, ISO standards in environmental testing mandate sensitive detection of contaminants, prompting demand for instruments like spectrometers and gas chromatographs. Nearly 75% of laboratories in highly regulated fields report increased investment in instrumentation to meet compliance, demonstrating how regulatory compliance fuels market growth.

Technological Advancements in Instrumentation

Innovations in laboratory instruments such as automation, AI integration, and miniaturization—are expanding capabilities and increasing demand. New technologies, including cloud-connected instruments and portable analyzers, provide faster and more accurate analysis, enhancing productivity. For example, AI-driven systems improve data analysis speeds by up to 40%, reducing time-to-result in clinical and research labs. Furthermore, the push for compact, portable devices addresses the need for versatile field testing in areas like environmental monitoring. As of recent surveys, approximately 65% of laboratories are adopting newer, tech-enabled instruments, highlighting the role of advanced technology in propelling market growth.

MARKET RESTRAINTS

High Cost of Advanced Instruments

The substantial costs of advanced analytical instruments, which range from $50,000 to over $500,000, act as a significant barrier, particularly for smaller laboratories and institutions with limited budgets. High-performance equipment, such as mass spectrometers and high-resolution chromatographs, require substantial upfront investment, alongside ongoing maintenance costs, which can reach up to 15% of the instrument’s value annually. In many emerging markets, the affordability of such instruments restricts adoption, with roughly 40% of smaller labs reporting financial constraints as a primary obstacle. This limits market growth, especially in cost-sensitive regions with growing demand for analytical capabilities.

Shortage of Skilled Workforce

The analytical laboratory instruments market faces a critical shortage of skilled technicians, particularly in operating and maintaining complex instruments like spectrometers and chromatographs. Reports indicate that over 30% of labs experience delays due to a lack of trained personnel, as these instruments require specialized knowledge for calibration, troubleshooting, and accurate data interpretation. Additionally, with the advancement of technologies like AI and automation, technicians need cross-disciplinary expertise in data science, further intensifying the skill gap. This workforce shortage can hinder the effective utilization of high-tech instruments and reduce overall productivity in labs.

Compliance and Regulatory Hurdles

While regulatory standards drive demand, they also present challenges for manufacturers. Developing instruments that meet the diverse regulatory requirements across regions such as FDA, ISO, and EU guidelines can be complex and time-consuming. Manufacturers often invest significant resources to ensure compliance, which can slow down innovation and increase costs. For example, modifications to comply with updated standards may delay product launches by 6–12 months. Smaller companies are particularly affected, as nearly 50% report difficulties in keeping up with changing regulations, making it challenging to compete with larger, well-resourced players in this highly regulated market.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

Emerging markets in Asia, Latin America, and Africa present significant opportunities for analytical laboratory instrument manufacturers due to increasing industrialization, R&D investments, and government initiatives supporting healthcare and environmental monitoring. For instance, China and India have increased their spending on scientific research by over 10% annually, fueling demand for analytical instruments in pharmaceutical, food safety, and environmental sectors. These regions exhibit a rising need for affordable, versatile equipment tailored to local requirements. Market analysis suggests that companies targeting these regions can benefit from a 20–30% growth rate due to unmet demands and expanding laboratory infrastructure.

Growing Demand for Point-of-Care Testing and Portable Devices

With the rising importance of rapid diagnostics and on-site testing, the market for portable analytical instruments is expanding. These devices, such as handheld spectrometers and compact PCR machines, cater to needs in healthcare, food safety, and environmental applications. Point-of-care testing is particularly crucial in remote areas where traditional lab access is limited. As healthcare demand grows worldwide, the portable instruments sector is expected to see a compound annual growth rate (CAGR) of around 7.5%. Companies that innovate in this space stand to gain by providing versatile, easy-to-use tools that meet increasing global needs for accessible testing.

Advancements in Digitalization and IoT Integration

The integration of digitalization and IoT capabilities into laboratory instruments opens up new avenues for remote monitoring, data management, and predictive maintenance. IoT-enabled instruments allow continuous data flow, enhancing real-time analysis and simplifying compliance reporting. This innovation reduces downtime by enabling proactive maintenance, which can boost equipment uptime by up to 25%. The global trend towards "smart labs" is gaining traction, with nearly 40% of labs in developed regions adopting digital tools for improved efficiency. Manufacturers can leverage this trend to develop IoT-compatible products that meet the modern laboratory’s need for automation, connectivity, and enhanced data handling.

MARKET CHALLENGES

Rapid Technological Obsolescence

The fast-paced evolution of technology in the analytical instruments market presents a significant challenge, as manufacturers must constantly innovate to stay competitive. Advanced tools like AI-integrated spectrometers or cloud-connected systems quickly become industry standards, rendering older models obsolete within 3-5 years. This rapid obsolescence drives up R&D costs for companies, which allocate an estimated 10-15% of their revenue to innovation. Additionally, labs face frequent upgrade cycles, straining budgets and complicating long-term planning. This cycle pressures manufacturers to balance cutting-edge development with sustainable product support, a complex challenge in a constantly advancing market.

Complex Regulatory Compliance

Navigating diverse and stringent regulatory standards worldwide poses a major challenge for manufacturers. Instruments must meet varied requirements, from FDA guidelines in the U.S. to EU standards, which necessitates extensive testing, documentation, and quality control measures. Achieving and maintaining compliance can extend product development timelines by up to 12 months, hindering speed-to-market. Compliance costs also weigh heavily on companies, especially smaller manufacturers, consuming 10-20% of development budgets. Frequent updates to regulations add to this complexity, making it challenging to remain compliant across regions without incurring delays and additional costs.

High Maintenance and Operational Costs

Analytical laboratory instruments require regular maintenance and calibration to ensure accuracy, which can be costly and resource-intensive. For example, mass spectrometers and chromatographs typically need periodic servicing, costing laboratories around 15% of the instrument’s initial purchase price annually. Downtime during maintenance affects productivity, particularly in high-demand sectors like pharmaceuticals and environmental testing. Smaller labs and institutions with limited budgets face difficulties absorbing these ongoing expenses, leading to reduced operational efficiency. These high maintenance demands present a barrier to market growth, particularly in cost-sensitive sectors or regions with limited access to service infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.12% |

|

Segments Covered |

By Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Agilent Technologies Inc., Ametek, Avantor, Bruker, Danaher, Hitachi, Jeol, Leco, Malvern Panalytical, Mettler-Toledo, PerkinElmer, Shimadzu, Thermo Fisher Scientific, Waters Corp. and Zeiss Group |

SEGMENTAL ANALYSIS

By Type Insights

The molecular analysis segment was the largest segment in the global analytical laboratory instruments manufacturing market and occupied 38.4% of the global market share in 2023. This segment is led by the high demand for molecular analysis in fields such as genomics, pharmaceuticals, and biotechnology. Molecular analysis instruments are vital for the precise detection and quantification of biomolecules, which is crucial in drug development and disease diagnostics. For instance, the use of PCR and spectrometry in COVID-19 diagnostics underscored their importance, driving an unprecedented surge in demand. As a result, investments in this segment remain high, given its foundational role in advancing personalized medicine, disease control, and genetic research.

The separation analysis segment is the fastest-growing segment and is projected to experience a CAGR of 8.2% over the forecast period. The growth is fueled by increased applications in pharmaceuticals, food safety, and environmental testing, where high-purity compound separation is critical for analysis. The pharmaceutical industry’s demand for high-precision drug development and quality control is a significant driver, as chromatography is essential for analyzing compound purity and efficacy. Additionally, regulatory mandates on food and environmental safety are accelerating the adoption of separation instruments, emphasizing their role in ensuring product quality and compliance with global safety standards.

By Application Insights

The life sciences sector segment dominated the market and had 46.6% of the global market share in 2023. This dominance is driven by the high demand for laboratory instruments in pharmaceuticals, biotechnology, and clinical research, where precision in molecular and cellular analysis is critical. In pharmaceutical R&D, instruments like spectrometers, PCR machines, and chromatographs play a vital role in drug discovery, quality control, and regulatory compliance. The increased focus on personalized medicine and the ongoing need for innovative drug therapies underscore the importance of life sciences, with R&D spending in this sector projected to grow annually by 10% globally. This sustained investment solidifies life science applications as a leading force in the market.

The food testing segment is the fastest-growing segment in the analytical laboratory instruments market and is predicted to register a CAGR of 8.12% over the forecast period. Rising consumer awareness and regulatory requirements for food safety drive this growth, as governments worldwide impose stringent quality controls to detect contaminants, pesticides, and pathogens. High-profile food safety concerns have intensified demand for robust testing capabilities, with advanced instruments like gas and liquid chromatographs and mass spectrometers increasingly used to ensure compliance. The importance of food testing extends beyond safety; it also supports product quality and transparency, making it a high-priority area for investment and technological advancement.

REGIONAL ANALYSIS

North America holds the largest share of the analytical laboratory instruments market, accounting for 34.8% of the global market share in 2023. The growth of the North American market is driven by advanced healthcare infrastructure, high R&D spending, and stringent regulatory standards. The U.S. leads the market in this region owing to the availability of substantial public and private investments in biotechnology and pharmaceuticals. For instance, the total of public and private investments in biotechnology and pharmaceuticals in the U.S. is more than USD 40 billion annually. The market in North American region is expected to continue steadily due to the strong demand for analytical laboratory instruments manufacturing across healthcare, environmental testing, and food safety sectors in this region.

Europe is another leading region in the global market and the growth of the regional market is majorly attributed to the robust regulatory frameworks, a well-established pharmaceutical industry, and public funding for scientific research. Germany, the UK, and France hold most of the share of the European market as these countries prioritize innovation in pharmaceuticals and environmental testing. Over the forecast period, the European region is expected to witness a healthy CAGR owing to the increasing environmental monitoring requirements and advancements in life sciences.

Asia-Pacific is the fastest-growing region and is predicted to grow at a CAGR of 9.44% over the forecast period. Rapid industrialization, expanding pharmaceutical and biotechnology industries, and government support for healthcare and R&D drive its growth. China, Japan, and India lead the region, particularly with China’s increasing investments in food safety, environmental testing, and pharmaceuticals, indicating strong future growth potential.

Latin America is expected to grow at a notable CAGR during the forecast period and the market growth in Latin America is driven by rising focus on food safety and expanding healthcare services. Brazil and Mexico lead the region, with Brazil advancing in biotechnology and agriculture. Although R&D investment is limited, demand for analytical instruments continues to grow, particularly for food and agricultural testing.

The market in the Middle East and Africa is gradually growing. Investments in healthcare and food safety, particularly in the Gulf region, support this growth. Saudi Arabia, the UAE, and South Africa lead the region, as these countries enhance healthcare infrastructure and testing capabilities in line with broader economic diversification efforts.

KEY MARKET PLAYERS

Agilent Technologies Inc., Ametek, Avantor, Bruker, Danaher, Hitachi, Jeol, Leco, Malvern Panalytical, Mettler-Toledo, Perkinelmer, Shimadzu, Thermo Fisher Scientific, Waters Corp. and Zeiss Group are some of the companies that play a promising role in the global analytical laboratory instruments manufacturing market.

RECENT MARKET DEVELOPMENTS

- In March 2024, Thermo Fisher Scientific launched its latest automated chromatography system, enhancing laboratory efficiency by 30%. This product aims to meet the growing demand for high-throughput testing in pharmaceuticals and environmental labs.

- In April 2024, Agilent Technologies introduced a new AI-powered mass spectrometer with improved sensitivity for biomolecular analysis. This advancement targets precision medicine research, supporting faster, more accurate diagnostics.

- In February 2024, Shimadzu Corporation expanded its operations in India by opening a new research and training center, strengthening its footprint in the Asia-Pacific region and supporting local laboratories with advanced analytical training.

- In January 2024, Danaher Corporation acquired a biotechnology firm specializing in genomic tools, aiming to bolster its offerings in molecular diagnostics and broaden its portfolio in life sciences.

- In May 2024, Mettler-Toledo launched an IoT-integrated balance system designed to improve data accessibility and accuracy across lab networks, aligning with the trend of digital transformation in lab instruments.

- In March 2024, Waters Corporation unveiled a new liquid chromatography-mass spectrometry (LC-MS) system targeting pharmaceutical research. This system enhances drug analysis efficiency, supporting quality control in R&D labs.

- In April 2024, Avantor partnered with a leading pharmaceutical company to supply laboratory materials and instruments, expanding its reach in the life sciences market and accelerating growth in clinical labs.

- In February 2024, ZEISS Group launched a high-resolution microscope specifically designed for nanotechnology research, focusing on precision imaging crucial for materials science applications.

- In January 2024, Bruker Corporation acquired a software firm specializing in analytical lab data integration, aiming to provide comprehensive data solutions and streamline lab workflows.

- In June 2024, PerkinElmer introduced a portable mass spectrometry device designed for field analysis, catering to environmental monitoring needs and enhancing the accessibility of analytical testing.

MARKET SEGMENTATION

This research report on the global analytical laboratory instruments manufacturing market is segmented and sub-segmented based on type, end-user industry and region.

By Type

- Elemental Analysis Instruments

- Elemental Analysis in Environmental Testing

- Elemental Analysis in Pharmaceutical & Forensic

- Molecular Analysis Instruments

- Infrared Spectroscopy

- Raman Spectroscopy

- Fluorescence Spectroscopy

- Separation Analysis Instruments

- Other Instruments

By Application

- Life Science

- Chemical/Petrochemical and Oil & Gas

- Food Testing

- Others

- Environmental Testing

- Materials

- Forensic Science

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the analytical laboratory instruments manufacturing market?

The global analytical laboratory instruments manufacturing market was valued at USD 64.4 billion in 2023 and is expected to be as big as USD 128.1 billion by 2033.

What is the CAGR of the analytical laboratory instruments manufacturing market?

The global analytical laboratory instruments manufacturing market is anticipated to grow at a CAGR of 7.12% from 2025 to 2033.

Which segment by type is dominating the analytical laboratory instruments manufacturing market?

The molecular analysis instruments segment is currently the analytical laboratory instruments manufacturing market.

Who are the key players in the analytical laboratory instruments manufacturing market?

Companies playing a major role in the global analytical laboratory instruments manufacturing market include Agilent Technologies Inc., Ametek, Avantor, Bruker, Danaher, Hitachi, Jeol, Leco, Malvern Panalytical, Mettler-Toledo, PerkinElmer, Shimadzu, Thermo Fisher Scientific, Waters Corp. and Zeiss Group

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]