Global Alternative Marine Power Market Size, Share, Trends, & Growth Forecast Report by Vessel (Container Vessels, Cruises, and Roll on/Roll-off Ships), Power (Up to 2 MW, 2 MW – 5 MW, Above 5 MW) & Region, Industry Forecast From 2024 to 2033

Global Alternative Marine Power Market Size

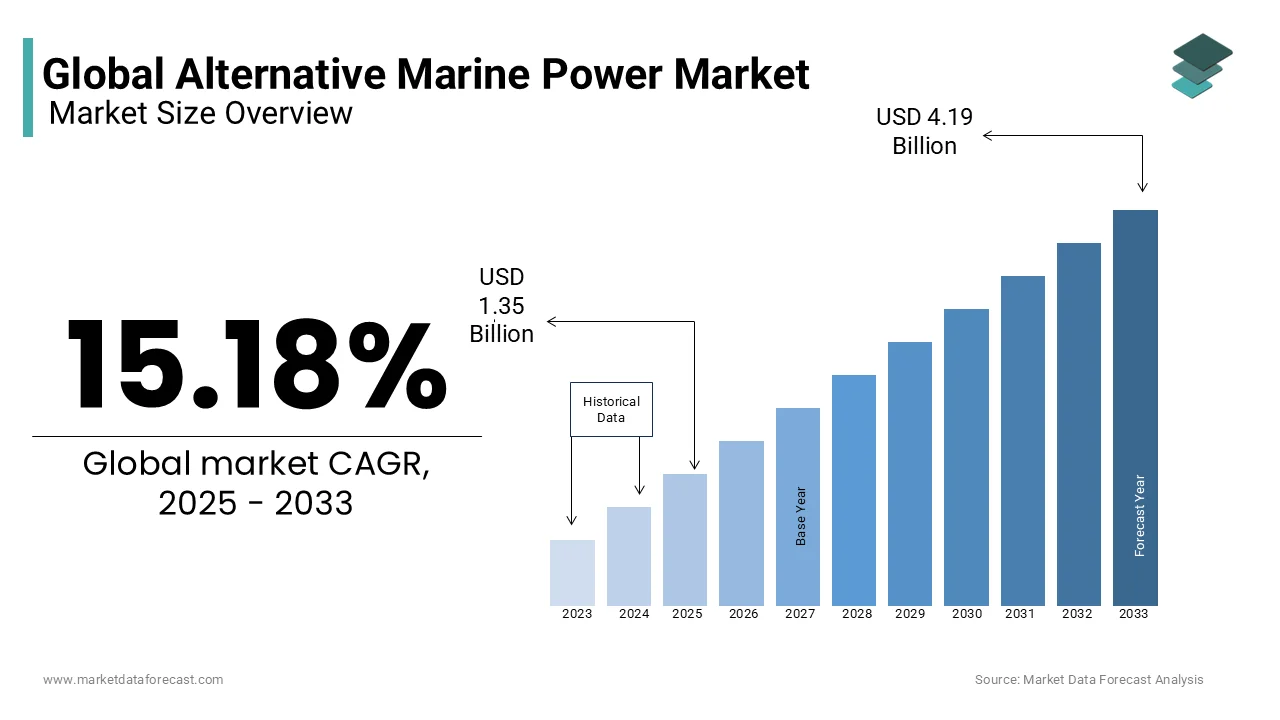

The Global Alternative Marine Power Market was worth USD 1.17 billion in 2024 and is predicted to reach USD 4.19 billion by 2033 from USD 1.35 billion in 2025, with a CAGR of 15.18% between 2025 and 2033.

Alternative Marine Power is an anti-pollution measure that assists in the decrease in air pollution generated by diesel generators. It uses electrical power at the dock as a substitute. It is used in the harbor when a ship stops. This considerably reduces emissions from ships. It is also known as cold pressing. It powers lights, air conditioners, refrigerators, and other equipment onboard ships. Alternative marine energy is the provision of electrical power on land to a ship that goes out to sea at the dock while its auxiliary and main engines are turned off during the loading and unloading of cargo. The use of alternative marine energy minimizes greenhouse gas (GHG) emissions by providing clean electricity for emergency equipment while the ship is docked.

MARKET GROWTH

In recent years, there has been a hike in investment to modernize ports. This includes infrastructure improvements related to energy, ICT/digital infrastructure, intermodal/multimodal terminals, transport connectivity, environmental footprint reduction infrastructure, and other basic infrastructure. Europe is supposed to account for more than 3,000 ports, including seaports and inland ports, by the end of 2025. The governments of European countries plan to install alternative marine energy systems in all ports in the region. Furthermore, the Chinese government projects that 90% of ships will visit the country's main ports using land-based power by 2020. Thus, renovating ports offers a lucrative opportunity for the global alternative marine energy market.

MARKET DRIVERS

Greenhouse gas (GHG) emissions in and around port areas are becoming a major concern around the world. The boats run on bunker fuel, which is one of the most polluting fuels. Large numbers of ships and trucks visit the ports every day. This becomes the cause of a significant increase in the prevalence of respiratory diseases and cancer and also leads to a degradation of water quality. Alternative marine energy systems provide electricity instead of diesel, reducing greenhouse gas (GHG) emissions. Furthermore, a significant increase in globalization and industrialization has created a strong demand for maritime trade due to the low cost of transport. This is expected to boost the global alternative marine energy market during the outlook period.

MARKET RESTRAINTS

The initial investment costs required to build alternative land-side marine power systems, the operating costs of these systems, and the costs required to modify vessels for the alternative marine power systems are high. This is likely to make an impact on the global alternative marine power market during the forecast period. The cost of converting a vessel is between US $ 2 million and US$ 6 million. The cost of transporting electricity from a local grid to a port terminal varies between US$ 300,000 and US$ $ 4 million per vessel, depending on the type of vessel, voltage, frequency, electricity demand, and location of the port. The initial cost includes the installation of high-voltage power transformers, distribution and control panels, electrical distribution systems, etc. The ROI associated with alternate marine power systems is low, and the payback period is over a few years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.18% |

|

Segments Covered |

By Vessel, Power Requirement, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB Ltd., Cavotec SA, Schneider Electric, Nidec ASI, MacGregor, PowerCon, Siemens, ESL Power Systems, Inc., VINCI Energies, Danfoss, Ratio Electric B.V., Piller Group GmbH, Wartsila, and Wabtec Corporation, and Others. |

REGIONAL ANALYSIS

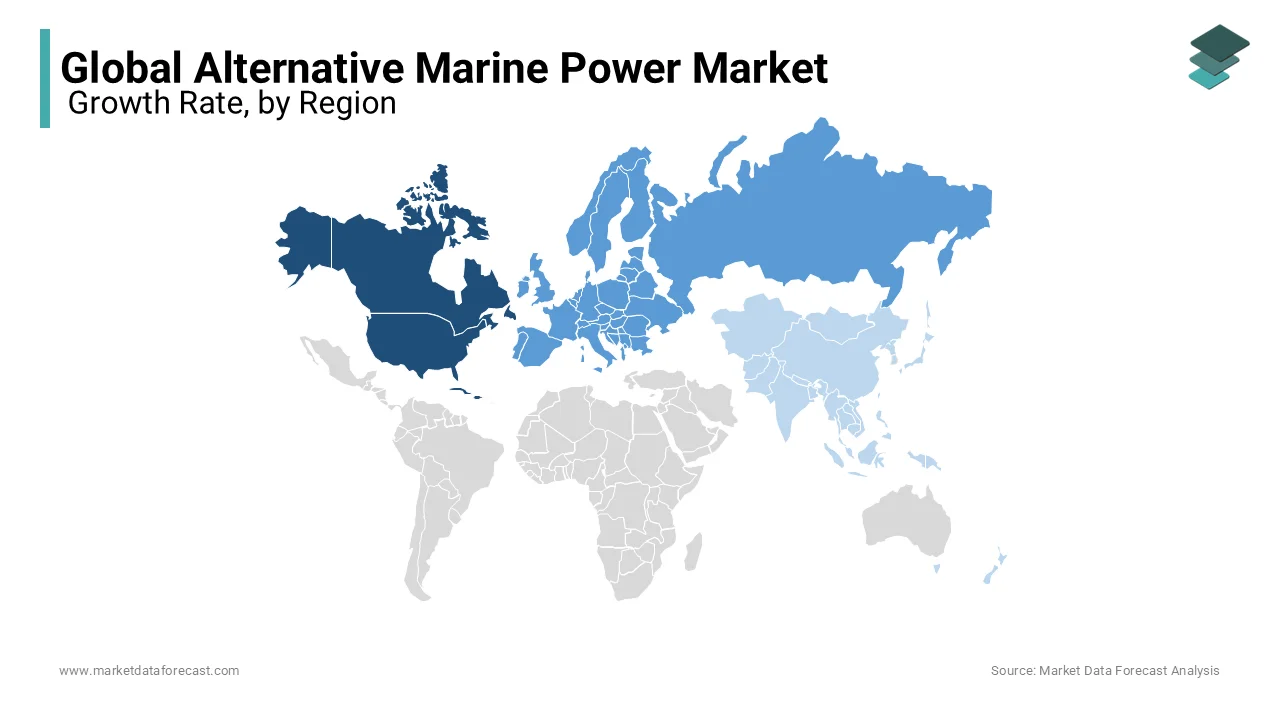

North America is expected to have a dominant share of the global market. The increasing flow of goods and passengers through US ports has resulted in an increase in the number of ships. And growing air pollution at ports is driving demand for the alternative marine power market in North America. Europe is forecasted to grow in the global market with a healthy CAGR during the forecast period. The growing emphasis on the development of alternative fuels as a substitute for fossil oil sources used in the energy supply of transport on European territory contributes to the growth of the alternative marine energy market in Europe. The Asia-Pacific region offers fruitful opportunities in the global alternative marine power market. Growing business activities in India and China and growing economies in Asia-Pacific countries are contributing to the growth of an alternative marine power market in the Asia-Pacific region. During the predicted period, the Middle Eastern countries promise high market potential.

KEY PLAYERS IN THE MARKET

Companies playing a prominent role in the global alternative marine power market include ABB Ltd., Cavotec SA, Schneider Electric, Nidec ASI, MacGregor, PowerCon, Siemens, ESL Power Systems, Inc., VINCI Energies, Danfoss, Ratio Electric B.V., Piller Group GmbH, Wartsila, and Wabtec Corporation, and Others.

RECENT HAPPENINGS IN THE MARKET

- Star International, a global supplier to the marine and offshore industries, has launched a line of onboard fuel testing and treatment products that provide a turnkey fuel management solution for the marine industry. The range has been developed to meet the requirements of maritime operators who want to ensure compliance with the 0.5% sulfur limit of the International Maritime Organization (IMO) and minimize the risks of contamination related to an increase in base fuels, fatty acid methyl ester (FAME) in navy blue. Supply chain.

- ExxonMobil recently announced the launch of a new line of ultra-low sulfur marine fuels with 0.50% sulfur, EMF.5 ™. The new range of fuels will be all residual and will comply with the ISO 8217: 2017 specification.

MARKET SEGMENTATION

This research report on the global alternative marine power market has been segmented and sub-segmented based on vessel, power requirement, and region.

By Vessel

- Container Vessels

- Cruises

- Roll-on/Roll-off Ships

By Power Requirement

- Up to 2 MW

- 2 MW-5 MW

- Above 5 MW

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of the Alternative Marine Power market?

The primary drivers for the AMP market are stricter environmental regulations, such as the International Maritime Organization's (IMO) sulfur cap, and the industry's push for decarbonization. The transition to renewable energy sources is essential for meeting global emissions targets, and technological advancements in energy storage and alternative propulsion systems are enabling this shift. Additionally, growing demand for sustainable practices from consumers and stakeholders is influencing the market.

What are the major technologies used in Alternative Marine Power?

Some of the major technologies in the AMP market include wind-assisted propulsion systems, solar panels, battery energy storage systems, and hydrogen fuel cells. Wind-assisted technologies such as Flettner rotors and sails help reduce fuel consumption by harnessing wind energy. Solar energy is utilized through solar panels installed on ships, while batteries and hydrogen fuel cells provide efficient and clean power storage and generation for vessels.

What challenges are associated with the Alternative Marine Power market?

Despite the growth of the AMP market, challenges remain in terms of high initial investment costs, technological maturity, and infrastructure requirements. Many of the alternative power systems, such as hydrogen fuel cells, still require significant development to become commercially viable at a large scale. Additionally, the adoption of these technologies requires significant changes to existing maritime infrastructure, such as ports and supply chains.

What role does government policy play in the Alternative Marine Power market?

Government policy plays a pivotal role in the AMP market's growth. Many countries have introduced subsidies, tax incentives, and regulatory frameworks to encourage the adoption of green technologies in the maritime sector. For instance, the European Union’s Green Deal and various national initiatives in countries like Norway have significantly accelerated AMP adoption. These policies help reduce the financial barriers for shipowners and operators looking to switch to cleaner alternatives.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]