Global Algae and Seaweed Protein Market Size, Share, Growth, Trends & Growth, Forecast Report - Segmented By Type (Microalgae, Seaweed/microalgae), Application (Food and Baverages, Animal Feed, Dietary Supplements, others), And By Region ((North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) – Industry Analysis From 2024 to 2032

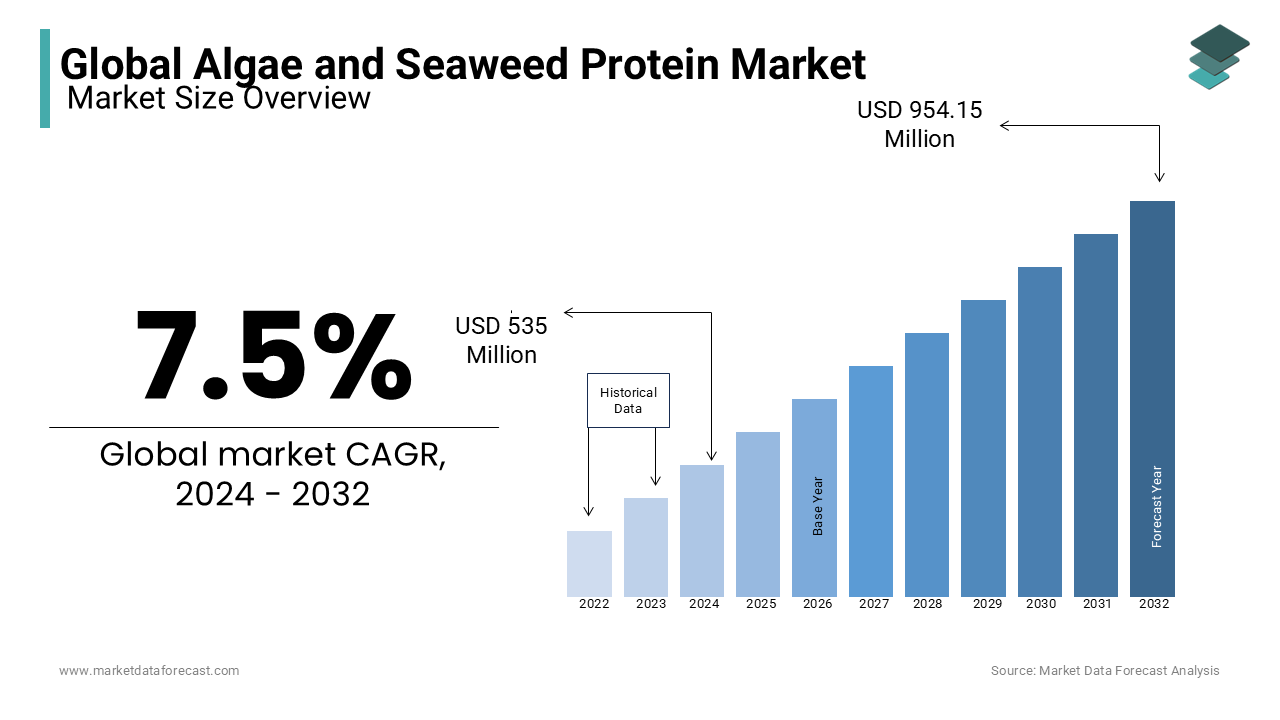

Global Algae and Seaweed Protein Market Size (2024 to 2032)

The global algae and seaweed protein market was valued at USD 497.67 million in 2023 and is anticipated to reach USD 535 million in 2024 from USD 954.15 million by 2032, growing at a CAGR of 7.5% from 2024 to 2032.

The algae and seaweed protein market is a rapidly growing element in the sustainable food industry. The growing demand for eco-friendly and nutrient-dense protein sources are propelling the growth of the algae and seaweed protein market primarily. Algae, including spirulina and chlorella, and seaweeds such as nori and kelp, are prized for their high protein content and rich profiles of essential amino acids, vitamins (like B12), and minerals such as iodine. For example, spirulina contains up to 70% protein by weight and is also a rich source of antioxidants like phycocyanin. Algae and seaweed grow without requiring arable land or freshwater, making them highly sustainable. Additionally, their application extends beyond food, being used in cosmetics, animal feed, and bio-based products. According to studies, algae protein may also contribute to heart and gut health due to its omega-3 fatty acids and dietary fiber. Algae protein is likely to become a versatile and essential component of global food security due to the ongoing technological advancements.

MARKET TRENDS

Expansion of Functional Food Applications

Algae and seaweed proteins are increasingly being incorporated into functional foods and beverages due to their exceptional nutrient density. Spirulina, for instance, provides 60–70% protein by dry weight, alongside vitamins like B12 and antioxidants such as phycocyanin. Seaweeds such as nori are rich in iodine, essential for thyroid health. These proteins are used in fortified snacks, plant-based protein bars, and beverages targeting health-conscious consumers. As per a 2022 study, omega-3 fatty acids from algae could reduce cardiovascular disease risk by 20% and drive their appeal as a functional ingredient.

Advancements in Cultivation Technology

Innovative cultivation techniques are enhancing the scalability and sustainability of algae and seaweed protein production. Bioreactors and precision fermentation methods improve yield efficiency and nutrient consistency. For example, algae farming can achieve biomass production rates up to 10 times faster than land crops while using 20 times less water. These advancements support the growing adoption of algae protein in mainstream food systems and support its integration into affordable and high-quality products for global consumption.

MARKET DRIVERS

Growing Demand for Sustainable Nutrition

Algae and seaweed proteins are recognized for their minimal environmental footprint compared to traditional protein sources. Algae farming requires no arable land and consumes significantly less water, which is nearly 20 times less than conventional crops. Additionally, algae absorb carbon dioxide during growth and aid in carbon sequestration. These sustainable attributes are particularly appealing as consumers increasingly prioritize eco-friendly food choices. For instance, 67% of global consumers are willing to pay more for sustainably produced food, boosting demand for algae and seaweed proteins.

Rising Prevalence of Food Allergies

The increasing incidence of allergies to common proteins like dairy, soy, and gluten is driving interest in alternative protein sources. Algae and seaweed proteins are hypoallergenic and provide a complete amino acid profile and make them suitable for allergen-free diets. According to the reports of CDC, a 50% increase in food allergies among children over the past two decades, which is highlighting the need for alternative protein options. This trend supports algae and seaweed proteins' adoption in allergen-friendly food products.

Health Benefits and Nutritional Density

Algae and seaweed proteins are rich in essential nutrients such as omega-3 fatty acids, B vitamins, and antioxidants, which provide specific health benefits. Spirulina, for example, has been shown to reduce LDL cholesterol by 10%–15% and improve gut health due to its dietary fiber content. These proteins are increasingly used in functional foods that target health-conscious consumers. The rising awareness of chronic disease prevention through diet and supported by a 20% projected increase in functional food consumption globally by 2030.

MARKET RESTRAINTS

High Production Costs

The cultivation and processing of algae and seaweed proteins remain expensive compared to traditional protein sources. Technologies such as bioreactors and precision fermentation are efficient but require significant initial investment and operational costs. For instance, microalgae production costs can reach $5–$10 per kilogram far exceeding soy protein costs of $1–$2 per kilogram. These high costs limit the scalability and affordability of algae-based products, particularly in price-sensitive markets.

Limited Consumer Awareness

Despite their nutritional and environmental benefits, algae and seaweed proteins face low consumer recognition outside niche markets. Many consumers are unfamiliar with their taste profiles and potential applications, which is slowing down the adoption of mainstream. A 2022 survey revealed that only 25% of consumers in the U.S. could identify algae as a protein source, which is highlighting the need for better education and marketing efforts to expand awareness and acceptance.

Regulatory and Quality Challenges

The algae and seaweed protein market encounters varying regulatory standards across regions and complicating international trade and product approvals. Issues such as heavy metal contamination in seaweed and maintaining consistent quality in algae-derived proteins also pose challenges. Research has shown that some wild-harvested seaweed contains unsafe levels of cadmium and lead and require stringent monitoring and processing protocols. These regulatory and quality concerns can deter investments and hinder the global market expansion.

MARKET OPPORTUNITIES

Growing Focus on Functional Food

Algae and seaweed proteins are rich in essential amino acids, vitamins, and antioxidants and are ideal for functional foods. They can improve gut health, reduce inflammation, and support weight management. For example, spirulina contains about 60–70% protein by weight and a better option than many traditional protein sources. With rising consumer demand for superfoods, integrating these proteins into snack bars, beverages, and supplements offers a robust opportunity. According to WHO, protein-energy malnutrition affects over 45 million children globally.

Sustainable Aquafeed Ingredients

Algae and seaweed proteins serve as sustainable alternatives to fishmeal in aquaculture. Fishmeal production depletes marine stocks whereas algae-based feed offers high protein content without ecological harm. Certain algae strains such as Nannochloropsis contain more than 50% protein and omega-3 fatty acids and promotes fish growth and health. According to the Food and Agriculture Organization, global aquaculture production will need to increase by over 30% by 2030 to meet seafood demand and boost the demand for eco-friendly feed.

Plant-Based Meat Alternatives

Algae and seaweed proteins are emerging as key ingredients in plant-based meats due to their unique texture, binding properties, and high nutrient density. Seaweed-derived hydrocolloids such as alginate enhance the texture of products while delivering essential minerals like iodine. Beyond Meat and similar brands increasingly explore algae as a source to meet the rising demand for clean-label alternatives. According to a 2022 report by the Good Food Institute, plant-based meat sales grew by 74% over the last three years.

MARKET CHALLENGES

Taste and Sensory Barriers

Algae and seaweed proteins often have distinct flavors and odors that can deter consumers, particularly in mainstream food applications. The earthy or marine taste of spirulina and seaweed requires masking or formulation adjustments, which is increasing the complexity of product development. According to a 2022 study, 45% of surveyed consumers mentioned taste as a primary barrier to adopting algae-based foods.

Seasonal and Environmental Dependency

Seaweed farming heavily depends on environmental factors such as water temperature, salinity, and seasonal availability. For instance, seaweed harvests in some regions can fluctuate by up to 30% due to climate change impacts like rising ocean temperatures. These variabilities create supply chain inconsistencies, impacting manufacturers’ ability to meet steady demand.

Limited Global Supply Chain Infrastructure

The algae and seaweed protein market lacks established infrastructure for large-scale production, processing, and distribution. Many regions face logistical hurdles, such as limited access to advanced bioreactors or processing facilities. As of 2023, more than 60% of algae cultivation occurs in Asia and is creating geographic concentration and increasing transport costs for global markets. Building localized infrastructure is critical to expanding global reach and reducing reliance on a few production hubs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.5% |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Corbion N.V, Cyanotech Corporation, E.I.D. Parry (India) Limited, DSM Nutritional Products, Heliae Development LLC, Algama Food, AlgaeTech Internationa, Roquette Frères, DuPont Nutrition & Biosciences, Triton Algae Innovations. |

SEGMENT ANALYSIS

Global Algae and Seaweed Protein Market By Type

The spirulina segment dominated the market by accounting for the largest share of the global market in 2023. The prominence of spirulina is attributed to its high protein content and its rich profile of essential amino acids, vitamins, and antioxidants. Its versatility allows incorporation into various products, including dietary supplements, functional foods, and beverages that cater to health-conscious consumers. Spirulina was also recognised by the World Health Organization (WHO) as a valuable food source.

On the other hand, the seaweed/macroalgae segment is predicted to record the fastest CAGR of 13.7% during the forecast period in the global market. The rapid expansion of seaweed segment is majorly due to its high nutritional value, including proteins, vitamins, minerals, and its sustainable cultivation methods. Seaweed farming requires no arable land and minimal freshwater, which makes it an environmentally friendly protein source. Additionally, the applications of seaweed extend beyond food and encompass cosmetics, pharmaceuticals and biofuels and contributing to the segmental expansion.

Global Algae and Seaweed Protein Market By Application

The Food and Beverages segment led the market in 2023 and is likely to continue to hold its leading position in the market throughout the forecast period due to increasing consumer demand for plant-based and sustainable protein sources. Algae proteins such as spirulina and chlorella are widely used in functional foods, protein-enriched beverages, and meat substitutes. For instance, the high protein content (60–70% by dry weight) of spirulina and its ability to provide essential nutrients like B12 make it a popular ingredient in health-oriented products. The global trend toward clean-label and eco-friendly food products is also boosting the adoption of spirulina worldwide.

The dietary supplements segment is estimated to be fastest growing segment and register a CAGR of 12.5% over the forecast period. Algae-based supplements are gaining popularity due to their high bioavailability and concentration of beneficial nutrients such as omega-3 fatty acids, antioxidants, and essential amino acids. For example, spirulina has been shown to reduce LDL cholesterol and boost immunity, driving its use in supplements. Additionally, a 2023 survey revealed that 70% of consumers prioritize supplements with natural and sustainable ingredients.

REGIONAL ANALYSIS

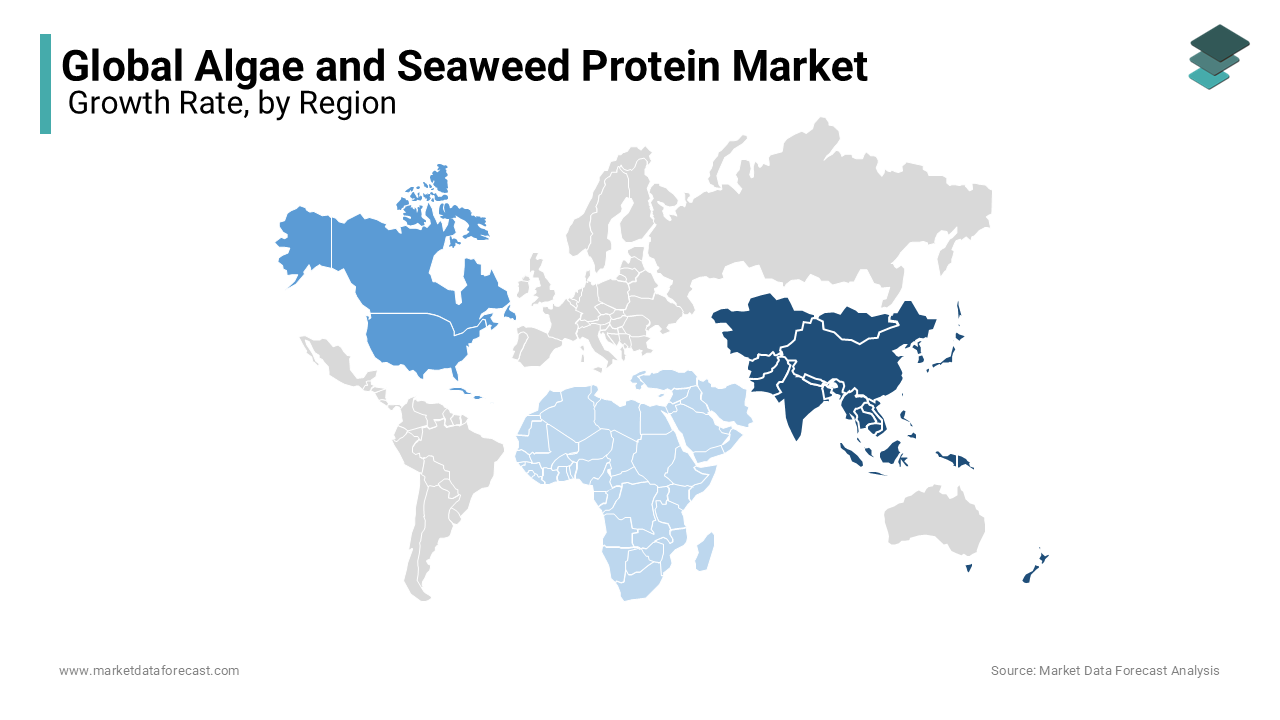

The Asia-Pacific dominates the market and captured a substantial share of global production and consumption. Countries such as China, Japan, and Indonesia lead in seaweed cultivation and algae-based product development. China's extensive coastline and favorable climatic conditions make it a hub for seaweed farming, particularly for species like nori and kelp. Japan's long-standing tradition of seaweed consumption, coupled with technological advancements, positions it as a significant player in the market. Indonesia's rich marine biodiversity supports its growing seaweed industry, focusing on carrageenan and agar production. The growth of the market in the Asia-Pacific region is also driven by the increasing health consciousness, a shift towards plant-based diets, and supportive government policies promoting sustainable aquaculture.

North America holds a significant position in the algae and seaweed protein market. The market growth in North America driven by the United States and Canada. The U.S. leads in research and development, focusing on algae-based dietary supplements, functional foods, and biofuels. The growing trend towards veganism and plant-based diets and increasing awareness of algae's nutritional benefits are fuelling the market growth in the U.S. On the other hand, the investments in sustainable aquaculture and algae cultivation in Canada are further bolstering the growth of the North American region in the worldwide market.

Europe represented a substantial share of the algae and seaweed protein market in 2023. The European market is anticipated to grow steadily over the forecast period owing to the rising focus on sustainability, innovation, and regulatory support. The commitment of Europe to reduce carbon footprints and promote healthy lifestyles promotes the adoption of algae and seaweed proteins in this region. France, Norway, and Ireland at the forefront in the European market. The emphasis of France on sustainable agriculture and functional foods drives its algae protein industry. The expertise of Norway in aquaculture and marine biotechnology contributes to its significant market role. Ireland's rich marine resources and government support for blue economy initiatives enhance its position in seaweed cultivation and processing.

Latin America holds a smaller share of the global algae and seaweed protein market but exhibits promising growth potential. Countries like Chile and Brazil are investing in seaweed farming and algae-based product development. Chile's extensive coastline and favorable oceanographic conditions make it suitable for seaweed cultivation, particularly for species like Gracilaria. Brazil's research initiatives in algae biotechnology and sustainable aquaculture practices contribute to its emerging market presence.

The region's growth is driven by increasing awareness of sustainable protein sources, government support for aquaculture, and the potential for export opportunities.

The Middle East and Africa currently hold a smaller share of the algae and seaweed protein market but are poised for growth. South Africa's research into algae cultivation and Nigeria's interest in seaweed farming indicate a growing recognition of the market's potential. The region's favorable climatic conditions and vast coastlines offer opportunities for algae and seaweed production.

Challenges such as limited infrastructure and investment are being addressed through government initiatives and international collaborations aimed at promoting sustainable aquaculture and food security.

KEY MARKET PLAYERS

Corbion N.V, Cyanotech Corporation, E.I.D. Parry (India) Limited, DSM Nutritional Products, Heliae Development LLC, Algama Food, AlgaeTech Internationa, Roquette Frères, DuPont Nutrition & Biosciences, Triton Algae Innovations. These are the market players that are dominating the global algae seaweed protein market.

Detailed segmentation of the Global Algae and Seaweed Protein Market included in this report

This research report on the global algae and seaweed protein market is segmented and sub-segmented into the following categories.

By Type

- Microalgae

- Spirulina

- Chlorella

- Others

- Seaweed/Macroalgae

By Application

- Food and Beverages

- Animal Feed

- Dietary Supplements

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]