Global Aircraft Insulation Market Size, Share, Trends, & Growth Forecast Report – Segmented by Type (Thermal, Acoustic & Vibration, Electric), Material (Foamed Plastics, Fiberglass, Mineral Wool, Ceramic-based Materials) & Region - Industry Forecast From 2024 to 2032

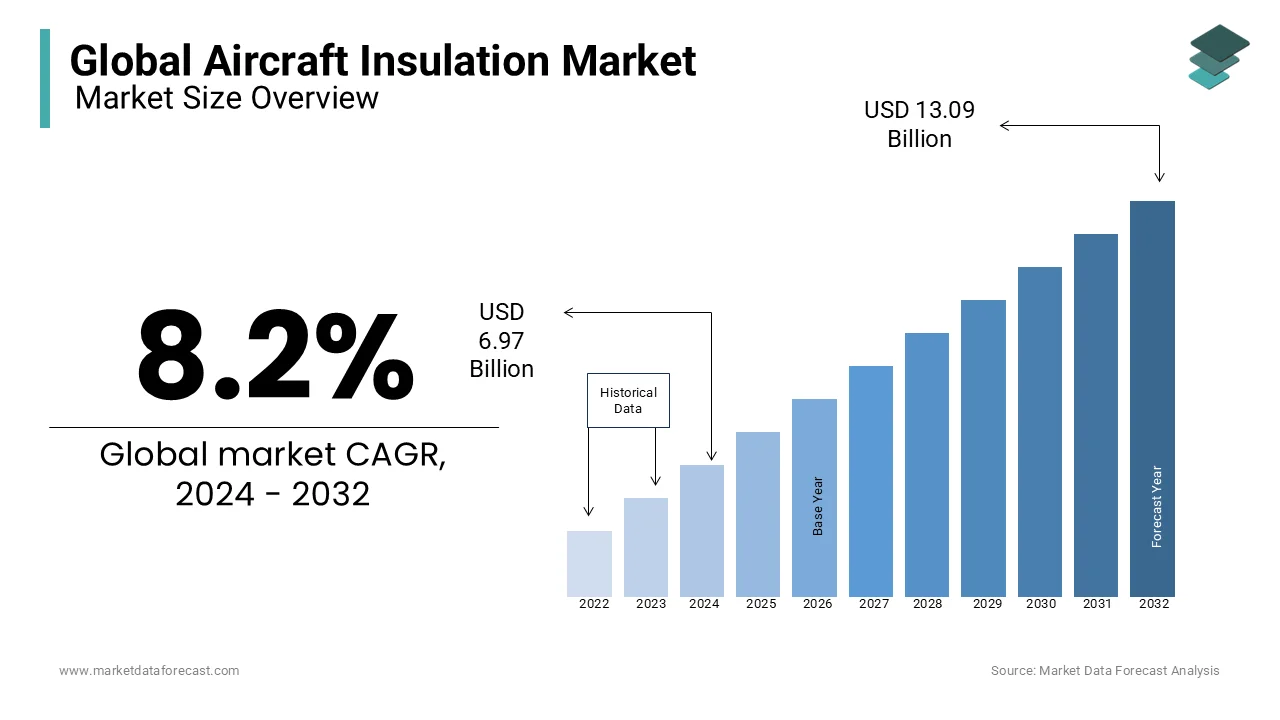

Global Aircraft Insulation Market Size (2024 to 2032)

The global aircraft insulation market was worth USD 6.44 billion in 2023. The global market is expected to reach USD 6.97 billion in 2024 and USD 13.09 billion by 2032, rising at a CAGR of 8.2% during the forecast period.

The aerodynamic movement and noise of aircraft engines have been a cause for concern. The need for a safer trip and transparent communication within the aircraft covers has been expanded and prioritized in recent years. Giving sufficient importance to the safety of aircraft, the use of insulation has become famous for its ability to ensure the safety and comfort of passengers.

MARKET DRIVERS

The growing demand for commercial aircraft shipments, the increased demand for light insulation and the increased demand for advanced acoustics and refractory materials are some of the factors that will drive the growth of the global aircraft insulation market.

The market for aircraft insulation depends mostly on the fact that chemical companies and paint manufacturers are witnessing a massive demand for light insulators in modern aircraft. Excellent and lightweight insulators help outside and inside the plane against leaks of rain, dust and dirt, reducing noise and vibration. The demand for light insulators among aircraft manufacturers is driving the market for aircraft insulation technology. In addition, the sharp drop in the price of composite materials allows aircraft manufacturers to use them as aircraft insulation. The composite material is lightweight and can withstand various parameters, such as heat, vibration, noise. These benefits generate interest in composite insulation in aircraft. This factor is also strengthening the growth of the aircraft insulation market.

The aircraft insulation business is expected to grow due to several conductors, but demand for the use of composite materials acquired in the general aviation industry is likely to overtake in the coming years as they help to reduce noise significantly. The commercial aviation industry is increasing the demand for insulation compounds to minimize noise and vibration. Therefore, the need for compounds in commercial aviation is presumed to strengthen the aircraft insulation industry.

MARKET RESTRAINTS

The main challenges in the aircraft insulation market are those related to reduced life and compound recycling. Chemical companies and paint manufacturers adhere to the strict rules established by various aviation authorities, such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA). Compounds, paints or chemicals manufactured by insulation companies have a short shelf life and must be replaced regularly and cannot be recycled for reuse. This factor is causing problems for companies, which in turn hinders market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.2% |

|

Segments Covered |

By Type, Material, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Duracote Corporation, DuPont, Triumph Group Inc., Zodiac Aerospace, Esterline Technologies Corporation, Polymer Technologies, Inc, Zotefoams Inc., InsulTech LLC, Morgan Advanced Materials, etc. |

SEGMENTAL ANALYSIS

Global Aircraft Insulation Market Analysis By Type

The global aircraft insulation market is divided into thermal insulation, vibration, and acoustic insulation and electrical insulation. Increasing the use of materials with low thermal conductivity can reduce heat transfer between other components and components of the aircraft, and ensure a high level of safety during the operation of the plane. The insulation system maintains a comfortable indoor environment while the aircraft is in flight and significantly reduces noise levels and vibrations.

Global Aircraft Insulation Market Analysis By Material

Global aircraft insulation market is divided into foamed plastics, fiberglass, mineral wool, ceramic materials and other materials. Material-based foam segments are assumed to lead the aircraft insulation business. Plastic foam is widely used to absorb heat, noise insulation, vibrations, etc. in the rooms of the cushions and mattresses of the seats. The aerospace industry uses a variety of materials. Polyimide and polyurethane foam are used as acoustic and thermal insulation in aircraft cabins for wall coverings and panels, and as resting areas or insulating blankets of aircraft doors.

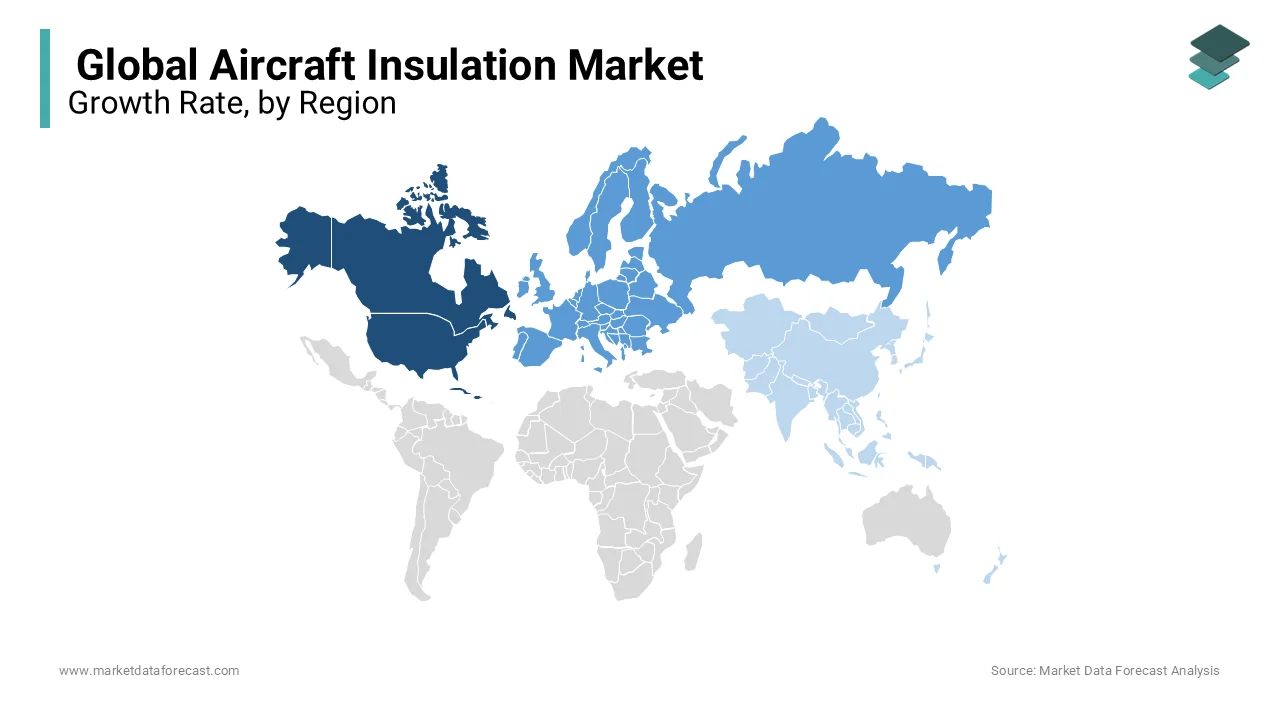

REGIONAL ANALYSIS

On the provincial side, the North America aircraft insulation market will continue to be the most dominant for the global industry during the forecast period. The area is the center of the aviation industry with several aircraft insulation manufacturers, aircraft OEMs, level players, airlines, aircraft leasing companies, MRO companies, and raw material suppliers.

Europe aircraft insulation market is expected to experience healthy growth over the next five years, due to the increasing production speed of the main Airbus commercial aircraft program and Irkut's entry into the retail aircraft sector.

It is estimated that the Asia-Pacific aircraft insulation market will have the highest growth rate during the same period. Boeing predicts that, around 20,930 commercial and regional aircraft will be delivered to the Asia-Pacific region, mainly in China, Japan, and India.

KEY MARKET PARTICIPANTS

BASF SE, Duracote Corporation, DuPont, Triumph Group Inc., Zodiac Aerospace, Esterline Technologies Corporation, Polymer Technologies, Inc, Zotefoams Inc., InsulTech LLC, Morgan Advanced Materials, etc., are some of the main players in the market.

RECENT HAPPENINGS IN THE MARKET

- The Turkish-Belgian joint venture to establish a thermal insulation manufacturing plant in Alsózsolca, Hungary, serves as an essential perspective for the future.

- DuPont, the industry-leading aircraft insulation, opened an innovation center in Silicon Valley to support innovation in the Bay Area to deliver efficient products.

- The acquisition of Dunmore by Steel Partners gives the latter a growth platform. The agreement will help improve aerospace services while increasing penetration into the isolation market and opening new adjacent markets for existing capabilities and technologies.

- July 2019: the Indian airline IndiGo has booked a total of 237 flights to the region, extending its destination to the Middle East. The airline is also considering to add new aircraft, including the long-distance A321neo LR on Airbus and the next model, the A321 XLR.

DETAILED SEGMENTATION OF THE GLOBAL AIRCRAFT INSULATION MARKET INCLUDED IN THIS REPORT

This research report on the global aircraft insulation market has been segmented and sub-segmented based on the type, material, and region.

By Type

- Thermal

- Acoustic and Vibration

- Electric

By Material

- Foamed Plastics

- Fiberglass

- Mineral Wool

- Ceramic-based

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key drivers of growth in the aircraft insulation market?

Key drivers include the rising demand for fuel-efficient aircraft, advancements in insulation materials, increased air passenger traffic, and stringent safety regulations. The focus on reducing noise, vibration, and harshness (NVH) in aircraft also propels market growth.

What types of insulation materials are most commonly used in aircraft?

Common insulation materials in aircraft include foams, fiberglass, mineral wool, ceramic-based materials, and aerogels. Each type offers specific benefits in terms of weight reduction, thermal and acoustic insulation, and fire resistance.

How are technological advancements impacting the aircraft insulation market?

Technological advancements, such as the development of nanotechnology-based insulation materials and innovative manufacturing techniques, are enhancing the performance and efficiency of insulation products. These advancements contribute to better thermal and acoustic insulation properties while reducing weight.

What role do regulatory standards play in the aircraft insulation market?

Regulatory standards play a crucial role in ensuring the safety, performance, and environmental compliance of aircraft insulation materials. Organizations such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) set stringent guidelines that manufacturers must adhere to.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]