Global Air Fryer Market Size, Share, Trends, & Growth Forecast Report - Segmented By Function (Manual, Digital Air Fryers), Fryer Type (Basket, Oven, and Hybrid Air Fryers), Capacity (Less Than 1 Quart to 5 Quarts, 5 Quarts to 10 Quarts, and Over 10 Quarts), Distribution Channel (Online and Offline), By End User (Residential and Commercial Users)and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

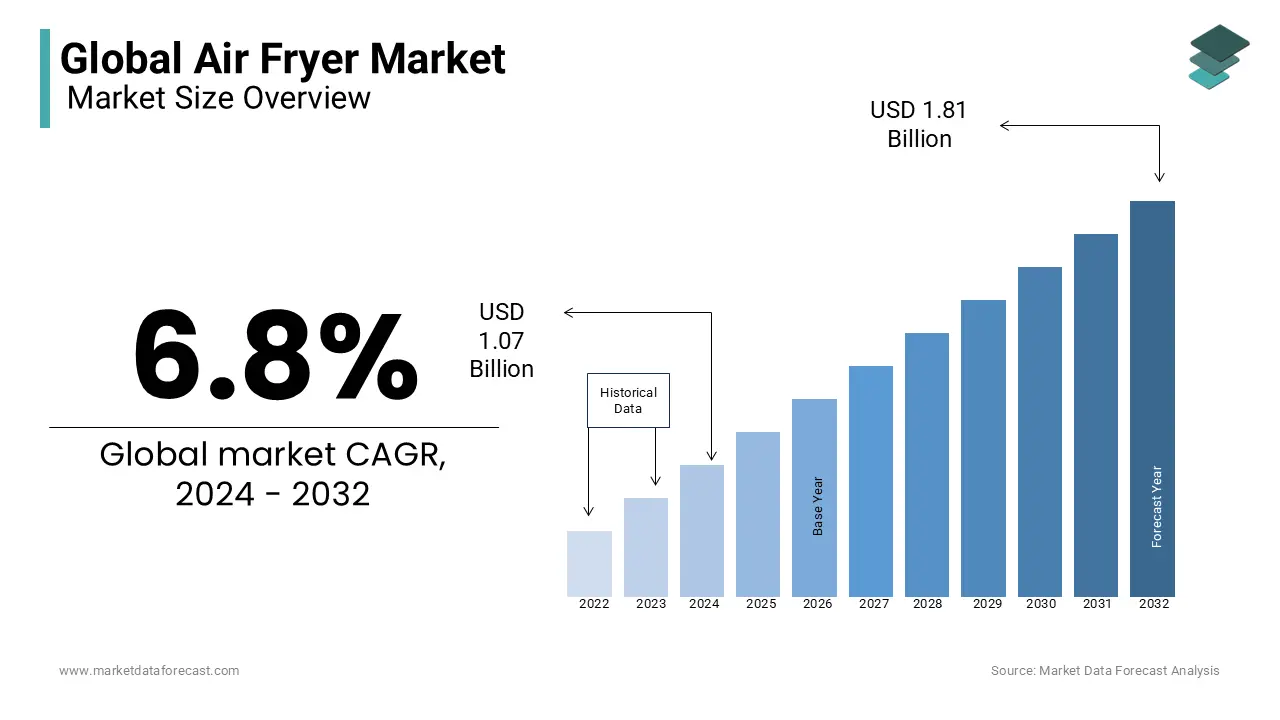

Global Air Fryer Market Size (2024 to 2032)

The Air Fryer market is estimated to be valued at USD 1.07 billion in 2024 and is anticipated to reach USD 1.81 billion by 2032, with a CAGR of 6.8% during the forecast period.

Current Scenario of the Global Air Fryer Market

Air fryers are kitchen appliances that use convection technology to circulate hot air, providing a healthier alternative to traditional frying by significantly reducing oil usage. By cooking food with up to 80% less fat, air fryers cater to the increasing demand for health-conscious cooking options. As consumers seek ways to enjoy fried foods with fewer calories, the global shift toward healthier eating has fueled the rise of air fryers. Initially introduced in the early 2000s, with Philips launching one of the first models in 2010, air fryers have rapidly evolved. Today’s models feature innovations like temperature control, digital interfaces, and multi-functionality, including roasting, grilling, and baking, making them indispensable in modern kitchens.

MARKET DRIVERS

Increasing Focus on Healthy Eating

The global trend toward healthier lifestyles has heightened consumer demand for low-oil cooking methods. Air fryers meet this need, using hot air to cook food with minimal oil, offering up to 80% less fat than traditional deep frying. This has made air fryers a go-to appliance for consumers seeking healthier meal options without compromising flavor.

Innovation in Kitchen Appliances and Smart Trends

Technological advancements have led to the integration of smart features, such as Wi-Fi connectivity and app control, in air fryers. These advancements cater to the growing preference for smart homes, driving the demand for digital air fryers equipped with multi-functional cooking modes.

Rising Disposable Income and Convenience

With disposable incomes rising, particularly in emerging economies, more consumers are investing in time-saving appliances like air fryers. According to the World Bank, global per capita income rose by 4.5% in 2022, contributing to increased spending on modern appliances that offer faster meal preparation and less cleanup.

E-commerce and Digital Retail Expansion

E-commerce has significantly boosted the accessibility of air fryers, offering consumers a wide array of options, price comparisons, and customer reviews. Brands are increasingly using digital marketing and direct-to-consumer channels to reach broader audiences, further driving market growth.

MARKET RESTRAINTS

High Initial Costs

Air fryers typically come with higher upfront costs compared to conventional cooking appliances like stovetops or convection ovens. Entry-level models start at around $100, while premium models exceed $300, which may deter cost-sensitive consumers, particularly in regions with lower disposable incomes.

Limited Awareness in Developing Regions

In many developing countries, air fryers face lower awareness and slower adoption. In regions such as parts of Southeast Asia and Africa, traditional cooking methods dominate, and new technology adoption is limited. With internet penetration at only 40%, digital marketing efforts have limited reach in these regions.

Challenges in Replacing Traditional Fryers

In markets where deep-fried foods are integral to traditional cuisines, such as South Asia and Latin America, air fryers face resistance. Despite their health benefits, air fryers may not replicate the exact texture and taste achieved with deep frying, making widespread adoption more challenging.

MARKET OPPORTUNITIES

Demand for Multi-Functional Kitchen Appliances

Consumers increasingly prefer appliances that offer versatility. Air fryers with multi-functional capabilities such as roasting, grilling, and baking are highly appealing. A 2022 Consumer Reports survey found that 68% of buyers favor appliances with multiple uses, offering manufacturers a significant opportunity to capture this growing market segment.

Growth in the Commercial Sector (QSRs)

The commercial use of air fryers is rising, particularly in quick-service restaurants (QSRs), as they provide healthier alternatives to traditional frying. With the QSR industry valued at $316 billion in 2022, air fryers present an opportunity to meet health-conscious consumer demand while improving operational efficiency by reducing oil consumption.

Smart Kitchen Devices and IoT Integration

The integration of IoT technology into kitchen appliances is gaining momentum. Smart air fryers, which can be controlled via smartphone apps or voice-activated assistants, are becoming popular. As smart home adoption grows, air fryers with these features are expected to see increased demand.

MARKET CHALLENGES

Competition from Other Cooking Technologies

Air fryers face competition from other appliances, such as convection ovens, which also offer oil-free cooking but typically have larger capacities. While air fryers have faster cooking times, consumers may opt for convection ovens for their versatility in preparing larger meals, posing a challenge for market penetration.

Maintaining Product Differentiation

As the market becomes more saturated, brands are finding it harder to stand out. With many competitors offering similar features like smart connectivity and multi-functionality, innovation, and strong brand positioning are essential for maintaining a competitive edge. Price competition is also intensifying, further challenging manufacturers to balance differentiation and profitability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.8% |

|

Segments Covered |

By Product Type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Market Leaders Profiled |

Breville Group Limited, Koninklijke Philips, SharkNinja Operating LLC, Arovast Corporation, Stanley Black & Decker, Inc., The Steelstone Group LLC, Instant Brands Inc., Conair Corporation, Avalon Bay, Meyer Manufacturing Company Limited |

SEGMENT ANALYSIS

By Function: Manual and Digital Air Fryers

Manual Air Fryers: These models use analog controls and are favored by budget-conscious consumers, accounting for 40% of the market. Their affordability makes them popular in emerging markets, where straightforward operation outweighs the lack of advanced features.

Digital Air Fryers: Digital models, which hold 60% of the global market share, are equipped with features like touchscreens, preset cooking modes, and smart connectivity. The trend of smart homes and IoT-enabled devices is driving this segment’s growth, with an expected CAGR of 8%. Consumers value the convenience and precision that digital air fryers offer, making them a top choice in modern kitchens.

By Fryer Type: Basket, Oven, and Hybrid Air Fryers

Basket air fryers hold the largest share of the market, accounting for around 50% of total sales. Their compact size, ease of use, and affordability make them popular among small households. With a pull-out basket for food, these models are ideal for quick meals and smaller portions. Oven air fryers, with larger capacities and multifunctional features like roasting, grilling, and baking, are gaining traction, particularly among families looking for versatile cooking solutions. This segment is expected to grow at a CAGR of 9%, driven by its ability to accommodate larger portions. Hybrid air fryers, which combine the functions of both basket and oven air fryers, are gaining popularity in the premium market segment. Although they hold a smaller market share, their multifunctionality and convenience are attracting consumers looking for high-performance kitchen appliances.

By Capacity: Less Than 1 Quart to 5 Quarts, 5 Quarts to 10 Quarts, and Over 10 Quarts

Air fryers with a capacity of less than 1 to 5 quarts account for about 45% of the market, catering to singles, couples, and small households. These compact units are favored for their affordability and convenience. The 5 to 10 quarts segment, comprising roughly 35% of the market, is growing rapidly due to its appeal to larger families. With a projected CAGR of 9%, these mid-sized fryers offer a balance between size and capacity, ideal for versatile meal preparation. Units over 10 quarts are primarily used in commercial kitchens and larger households. This segment is gaining popularity, particularly in quick-service restaurants (QSRs), where the ability to prepare larger meals efficiently is essential.

By Distribution Channel: Online and Offline

Online sales account for around 55% of the market, fueled by the convenience of e-commerce, wider product selection, and easy access to customer reviews. This channel is expected to grow at a CAGR of 10%, driven by increasing internet penetration and the expansion of digital retail platforms globally. Offline sales, which account for 45% of the market, remain significant, particularly in regions where consumers prefer in-person shopping experiences. Appliance showrooms and supermarkets still play a crucial role, especially for consumers who value hands-on product demonstrations before purchasing.

By End User: Residential and Commercial Users

Residential users represent approximately 70% of the market, as more households adopt air fryers for healthier cooking. The residential segment is projected to grow at a CAGR of 8%, driven by rising disposable incomes, growing health awareness, and the trend toward home cooking. The commercial segment, which includes QSRs, cafés, and food service providers, is expected to grow at a faster pace, with a CAGR of 9%. Commercial users are increasingly adopting air fryers to meet consumer demand for healthier options while reducing oil consumption and improving operational efficiency.

REGIONAL ANALYSIS

North America

North America continues to lead the global air fryer market, capturing approximately 35% of the share. This dominance is fueled by a well-established kitchen appliance industry, high technology adoption rates, and increasing health consciousness among consumers. The U.S. remains at the forefront, driven by strong consumer spending and a rising preference for healthier cooking alternatives. The region’s growing interest in smart kitchen appliances and home automation further contributes to the popularity of digital air fryers. The North American market is projected to grow at a CAGR of 7%, supported by innovations in smart technology and rising disposable incomes.

Europe

Europe accounts for roughly 30% of the global air fryer market, driven by growing demand for healthier lifestyles across countries such as Germany, France, and the UK. Consumers in the region are increasingly seeking convenient, low-fat cooking solutions. The European market is anticipated to expand at a CAGR of 8%, spurred by advancements in kitchen appliances, the popularity of multifunctional air fryers, and government efforts promoting healthy eating. Additionally, strong e-commerce infrastructure and targeted digital marketing campaigns are enhancing product accessibility across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the air fryer market, supported by rising disposable incomes, increasing urbanization, and a burgeoning middle class in countries like China, Japan, and South Korea. The region is also witnessing a shift toward healthier cooking methods, driven by growing awareness of health and wellness. Rapid expansion in the smart appliance sector is expected to further propel the air fryer market in Asia-Pacific, with a higher projected CAGR than other regions. Increasing online retail penetration is also enhancing product accessibility and fueling market growth.

Latin America

The air fryer market in Latin America is experiencing growth due to improved access to modern kitchen appliances and heightened health awareness. Countries like Brazil and Mexico are leading the adoption of air fryers, particularly for residential use. The growth of e-commerce and the expansion of digital retail platforms are also contributing to the rising popularity of air fryers across the region.

Middle East and Africa (MEA)

The MEA region accounts for around 7% of the global air fryer market. Growth is primarily driven by increasing disposable incomes and growing investments in modern kitchen appliances, particularly in countries like the UAE and Saudi Arabia. Health-conscious consumers and the demand for innovative cooking solutions are driving air fryer adoption. However, challenges such as limited awareness and lower e-commerce penetration in certain areas are slowing wider adoption. Despite this, rising investments in retail infrastructure are expected to support future growth in the region.

COMPETITIVE LANDSCAPE AND KEY PLAYERS IN THE MARKET

The air fryer market is highly competitive, with major players such as Philips N.V., Tefal (Groupe SEB), and SharkNinja Inc. leading the industry. Philips maintains a strong position through its pioneering technology and global reach, while Tefal’s unique ActiFry design emphasizes health-focused cooking. SharkNinja has quickly gained market share by offering versatile, multifunctional air fryers that appeal to a broad consumer base. To stay competitive, companies are focusing on innovation, integrating smart features, expanding product ranges, and leveraging robust distribution networks to meet increasing global demand.

List of key participants in the Global Air Fryer market include

- COSORI (Arovast Corp.)

- Philips (Koninklijke Philips N.V.)

- Instant Brands Inc.

- Breville Group Ltd.

- SharkNinja Inc.

- Tefal SAS

- Gourmia Inc.

- Chefman

- Nuwave LLC

- Empower Brands LLC

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Empower Brands LLC launched a 10-quart air fryer oven, designed for larger households. This product is expected to solidify Empower Brands' presence in the high-capacity appliance segment.

- In July 2023, COSORI (Arovast Corp.) launched a new smart air fryer compatible with Alexa and Google Assistant. This move is expected to enhance COSORI's presence in the smart kitchen appliance market.

- In August 2023, Philips introduced its Rapid Air Technology for air fryers, aimed at improving cooking efficiency. This innovation is anticipated to help Philips capture a larger market share by offering superior product differentiation.

- In September 2023, Instant Brands Inc. launched the Instant Vortex series, a multifunctional air fryer that includes roasting, broiling, and baking capabilities. This launch is expected to boost consumer interest in versatile kitchen appliances and drive market penetration.

- In October 2023, Breville Group Ltd. partnered with Williams-Sonoma to launch exclusive air fryer models featuring advanced digital interfaces and premium designs, strengthening its position in the high-end appliance market.

- In November 2023, SharkNinja Inc. introduced the Ninja Foodi DualZone Air Fryer, enabling users to cook two different meals simultaneously. This innovation is expected to attract convenience-seeking consumers and increase SharkNinja’s market share.

- In December 2023, Tefal SAS released the ActiFry Genius XL, a smart air fryer featuring automatic stirring. This product is expected to appeal to health-conscious consumers and strengthen Tefal's market competitiveness.

- In October 2023, Gourmia Inc. launched a digital marketing campaign utilizing influencers and social media to engage younger, tech-savvy consumers. This campaign is expected to drive brand awareness and sales growth.

- In September 2023, Chefman launched the TurboFry Touch air fryer, featuring a sleek design and enhanced touch interface. This release is anticipated to attract modern kitchen consumers and boost Chefman’s market position.

- In June 2023, Nuwave LLC introduced the Brio Digital Air Fryer Pro, featuring customizable presets and temperature controls. This product is expected to enhance Nuwave's market share by appealing to consumers seeking precise cooking functionality.

DETAILED SEGMENTATION OF THE GLOBAL AIR FRYER MARKET INCLUDED IN THIS REPORT

This research report on the global air fryer market has been segmented and sub-segmented based on product type, end-user, distribution channel, and region.

By Function

- Manual

- Digital Air Fryers)

By Fryer Type

- Basket

- Oven

- Hybrid Air Fryers

By Capacity

- Less Than 1 Quart to 5 Quarts

- 5 Quarts to 10 Quarts

- Over 10 Quarts

By Distribution Channel

- Online

- Offline

By End User

- Residential

- Commercial Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

2. What are the challenges facing the air fryer market?

Challenges include high competition among brands, price sensitivity among consumers in emerging markets, and the need for continuous innovation to meet evolving consumer preferences. Additionally, some consumers may have concerns about the taste and texture differences compared to traditional frying.

1. What are the latest trends in the air fryer market?

Latest trends include the integration of smart technology in air fryers, such as Wi-Fi connectivity and app control, multi-functional air fryers that combine several cooking functions in one appliance, and the rise in demand for compact, space-saving models suitable for small kitchens.

3. What is the future outlook for the air fryer market?

The future outlook for the air fryer market is positive, with continued growth expected. Innovations in product design, the expansion of e-commerce channels, and increasing consumer awareness about healthy cooking are likely to drive further market expansion.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]