Global Air Freight Forwarding Market Size, Share, Trends, Growth Forecast Report By Services (Freight Transportation, Warehousing & Distribution, Customs Brokerage, Freight Consolidation and Value-Added Services), Destination, Customer, End User, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Air Freight Forwarding Market Size

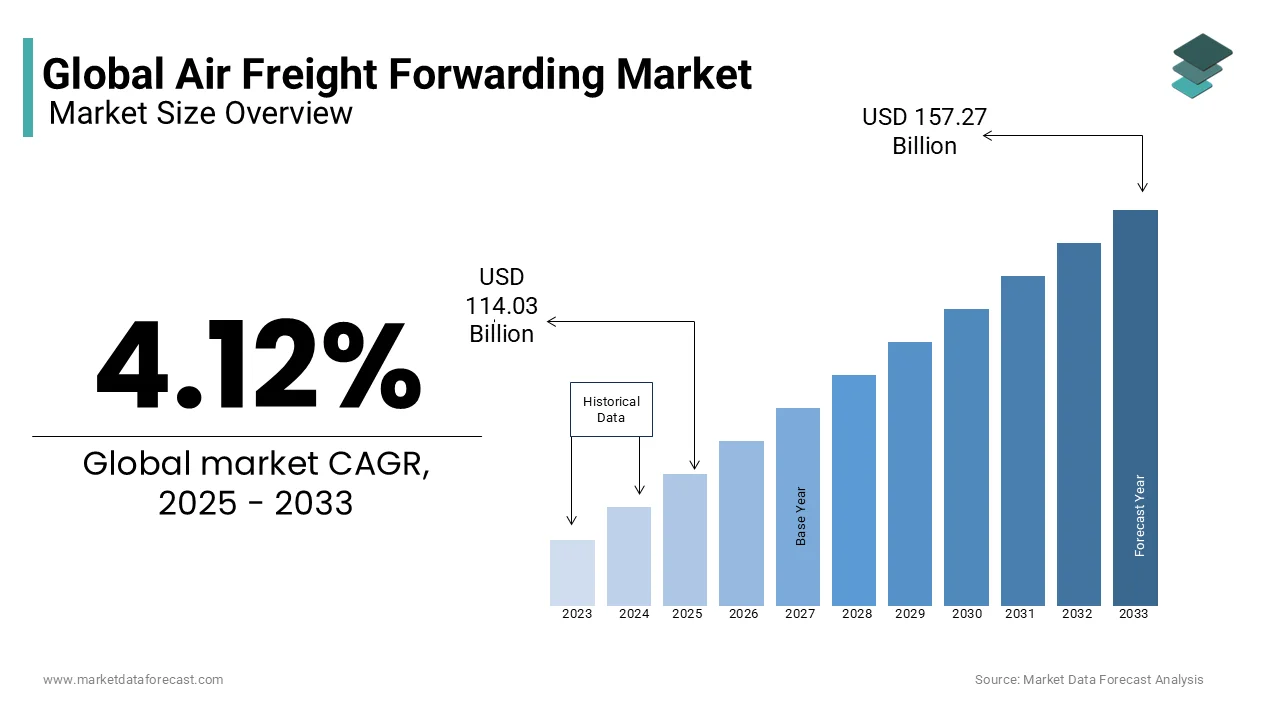

The size of the global air freight forwarding market was worth USD 109.52 billion in 2024. The global market is expected to reach USD 157.27 billion in 2033 from USD 114.03 billion by 2025, growing at a CAGR of 4.12% over the forecast period 2025 to 2033.

The Air Freight Forwarding is facilitating the transportation of goods via air carriers across international borders. Air freight forwarding involves the coordination and management of shipments is leveraging airlines' capabilities to ensure timely delivery of high-value, time-sensitive, or perishable goods. This market serves as a vital conduit for global trade by supporting industries such as pharmaceuticals, electronics, e-commerce, and perishable goods like fresh produce and seafood. The International Air Transport Association (IATA) emphasizes that air cargo accounts for less than 1% of global trade by volume but over 35% by value with its importance in delivering high-value commodities.

In recent years, the rise of cross-border e-commerce has significantly bolstered demand for air freight services, with Statista reporting that global e-commerce sales exceeded $5.7 trillion in 2022. According to the World Health Organization, nearly half of all temperature-sensitive pharmaceutical products are transported via air by ensuring the integrity of vaccines and life-saving medications. Another interesting fact is that air freight plays a pivotal role in the food supply chain is the International Trade Administration notes that approximately 35% of global perishable goods by including fruits, vegetables, and seafood, are shipped by air to maintain freshness and meet consumer demands.

MARKET DRIVERS

Surge in E-Commerce Demand

The exponential growth of global e-commerce has emerged as a significant driver for the air freight forwarding market. The demand for faster and more reliable delivery options has skyrocketed with consumers increasingly shifting to online shopping. According to the United States Census Bureau, e-commerce sales in the U.S. alone accounted for over $1 trillion in 2022 thereby reflecting a year-over-year increase of 10.4%. This trend is mirrored globally, with the International Trade Administration reporting that cross-border e-commerce transactions are expected to grow by 25% annually through 2025. Air freight plays a pivotal role in meeting these demands, particularly for high-value goods like electronics and fashion items, which require swift delivery. Its ability to ensure rapid transit times makes it indispensable for retailers aiming to meet customer expectations for expedited shipping.

Growth in Pharmaceutical and Healthcare Logistics

The pharmaceutical and healthcare sectors have become critical drivers of the air freight forwarding market during the post-pandemic era. According to the World Health Organization, over 50% of all temperature-sensitive medical products with the vaccines and biologics, are transported via air to ensure their efficacy and safety. This growth is fueled by increasing demand for life-saving medications and the expansion of healthcare infrastructure in emerging markets. Air freight’s ability to maintain strict temperature controls and provide rapid delivery is crucial for transporting sensitive medical supplies by making it an essential component of the healthcare supply chain.

MARKET RESTRAINTS

Rising Fuel Costs and Economic Uncertainty

Fluctuating fuel prices pose a significant restraint to the global air freight forwarding market, as aviation fuel constitutes a substantial portion of operational expenses. The U.S. Energy Information Administration reports that jet fuel prices surged by over 50% in 2022 compared to the previous year owing to the geopolitical tensions and supply chain disruptions. These escalating costs are often passed on to customers through higher freight rates, which can suppress demand for air cargo services. Additionally, economic uncertainty, such as inflationary pressures and fluctuating currency values that further complicates the market landscape. According to the International Monetary Fund, global inflation rates reached a 40-year high in 2022 that is impacting consumer spending and business investments. This economic volatility reduces the appetite for premium logistics services by forcing companies to explore cost-effective alternatives like sea freight.

Stringent Environmental Regulations

The growing emphasis on environmental sustainability presents another major restraint for the air freight forwarding market. Aviation is a significant contributor to greenhouse gas emissions, accounting for approximately 2-3% of global CO2 emissions, according to the European Environment Agency. Governments worldwide are implementing stricter regulations to curb these emissions, including carbon pricing mechanisms and mandates for sustainable aviation fuels (SAFs). For instance, the European Union’s Emissions Trading System requires airlines to purchase carbon credits, increasing operational costs. Moreover, the International Civil Aviation Organization emphasizes that achieving net-zero emissions by 2050 will require substantial investments in green technologies, which many air freight forwarders may find financially burdensome.

MARKET OPPORTUNITIES

Expansion of Emerging Markets and Trade Agreements

The rise of emerging markets presents a significant opportunity for the global air freight forwarding market is driven by increasing industrialization and trade liberalization. Free trade agreements, such as the African Continental Free Trade Area (AfCFTA), are expected to boost intra-regional trade by 52% by 2030, according to the United Nations Economic Commission for Africa. This surge in trade creates demand for efficient logistics solutions, particularly air freight, to transport high-value goods quickly. Additionally, rising middle-class populations in these regions are driving demand for imported electronics, apparel, and luxury items, further fueling opportunities for air cargo services to expand their networks and cater to new customer bases.

Adoption of Advanced Technologies and Digitalization

The integration of advanced technologies offers transformative opportunities for the air freight forwarding market, enhancing efficiency and transparency. The International Telecommunication Union reports that global internet penetration reached 67% in 2022 by enabling widespread adoption of digital tools like blockchain, artificial intelligence, and IoT in logistics. These innovations streamline operations by improving shipment tracking, optimizing routes, and reducing manual errors. For instance, the U.S. Department of Transportation emphasizes that real-time data analytics can reduce operational costs by up to 20% while improving delivery accuracy. Furthermore, the growing trend of automation in warehouses and customs clearance processes is expected to cut processing times significantly.

MARKET CHALLENGES

Infrastructure Limitations at Key Airports

Infrastructure bottlenecks at major airports present a significant challenge to the global air freight forwarding market, particularly as demand for air cargo services continues to grow. The International Air Transport Association reports that over 60% of global air cargo is transported through just 50 airports, many of which are operating at or near capacity. According to the U.S. Federal Aviation Administration, congestion at key hubs like Los Angeles International Airport led to a 15% increase in delays during peak seasons in 2022. Limited runway availability, outdated facilities, and insufficient ground handling equipment further exacerbate these issues that is causing inefficiencies and increased costs. Such constraints hinder the seamless flow of goods, especially during high-demand periods like holiday seasons or emergency supply chain disruptions by ultimately affecting the reliability and scalability of air freight operations.

Geopolitical Tensions and Trade Disruptions

Geopolitical tensions and trade disputes pose another critical challenge to the air freight forwarding market by disrupting established supply chains and increasing operational risks. The World Bank notes that geopolitical instability has contributed to a 5% decline in global trade growth in 2022, with sanctions, tariffs, and export restrictions impacting key markets. For example, the U.S. Department of Commerce reports that trade barriers imposed during recent U.S.-China tensions have forced companies to reroute shipments, increasing transit times and costs. Additionally, conflicts in regions like Eastern Europe have disrupted flight routes by leading to higher fuel consumption and operational complexities. These uncertainties not only strain logistics networks but also force businesses to adopt costly contingency plans with the efficiency and profitability of air freight forwarding services globally.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.12% |

|

Segments Covered |

By Service and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kuehne + Nagel International AG, Deutsche Post DHL Group, DB Schenker, Nippon Express Co., Ltd., DSV A/S, UPS Supply Chain Solutions Inc., Expeditors International, Sinotrans Limited, The Panalpina Group and Hellmann Worldwide Logistics and Others. |

SEGMENTAL ANALYSIS

By Services Insights

The freight transportation segment was the largest by accounting for 60.1% of the Global Air Freight Forwarding Market share in 2024. The growth of the segment is attributed by enabling the rapid movement of high-value and time-sensitive goods, such as electronics and pharmaceuticals. According to the U.S. Department of Commerce, over 35% of global trade by value is transported via air freight due to its indispensability.

The value-Added Services segment is growing with a CAGR of 8.5% from 2025 to 2033. This growth is driven by increasing customer expectations for tailored logistics solutions, including packaging, labeling, and inventory management. The World Trade Organization emphasizes that businesses are prioritizing supply chain resilience, boosting demand for these services. Additionally, the rise of e-commerce has amplified the need for customization, with the U.S. Census Bureau reporting a 10.4% annual increase in online retail sales.

By Destination Insights

The international air freight segment held the dominant share of the global air freight forwarding market in 2024. This segment's prominence is attributed to the globalization of trade, with cross-border shipments accounting for over 35% of global trade by value, as per the World Trade Organization. The International Air Transport Association notes that international routes are essential for transporting high-value goods like electronics and pharmaceuticals, which require rapid delivery across continents.

The domestic air freight segment is expected to witness a CAGR of 7.2% from 2025 to 2033. This growth is fueled by the rise of e-commerce and the demand for same-day or next-day deliveries within countries. The Census Bureau reports that domestic e-commerce sales in the U.S. grew by 14.3% in 2022 by reflecting increasing reliance on fast logistics. According to the Federal Aviation Administration, advancements in regional airport infrastructure and last-mile delivery solutions have bolstered domestic freight efficiency.

By Customer Insights

The Business-to-Business (B2B) segment was the largest by occupying significant share of the Global Air Freight Forwarding Market in 2024. This segment thrives due to its focus on transporting high-value industrial goods, machinery, and electronics, which require rapid delivery and reliability. According to the U.S. Department of Commerce, B2B air freight supports industries like automotive and aerospace, where just-in-time manufacturing relies heavily on timely shipments. With global industrial output growing at 3.5% annually, the demand for B2B air freight remains robust.

The Business-to-Consumer (B2C) segment is likely to experience a CAGR of 12.8% during the forecast period. Consumers increasingly expect fast deliveries, driving demand for air freight to transport items like electronics, fashion, and luxury goods. The International Trade Administration notes that cross-border e-commerce is expanding by 25% annually. Its rapid growth amplifies the shift toward consumer-centric logistics models by emphasizing speed and convenience in meeting evolving customer expectations.

By End User Insights

The Healthcare & Pharmaceuticals segment was the largest by accounting for 35.4% of the Global Air Freight Forwarding Market share in 2024. The growth of the segment is driven with growing need for temperature-controlled logistics to transport vaccines, biologics, and other sensitive medical supplies. According to the World Health Organization, over 50% of all pharmaceutical products require cold chain solutions, with air freight being the preferred mode due to its speed and reliability. This segment's importance surged during the COVID-19 pandemic, with the U.S. Department of Commerce noting a 65% increase in vaccine shipments via air freight in 2021 alone.

The Retail sector is esteemed to exhibit a CAGR of 13.1% from 2025 to 2033. This rapid growth is fueled by rising consumer demand for fast delivery for high-value goods like electronics and fashion items. Cross-border e-commerce transactions are projected to grow by 25% annually by boosting air freight demand. The ability of air cargo to ensure swift transit times and meet customer expectations makes it indispensable for retailers aiming to capitalize on the booming online shopping trend.

REGIONAL ANALYSIS

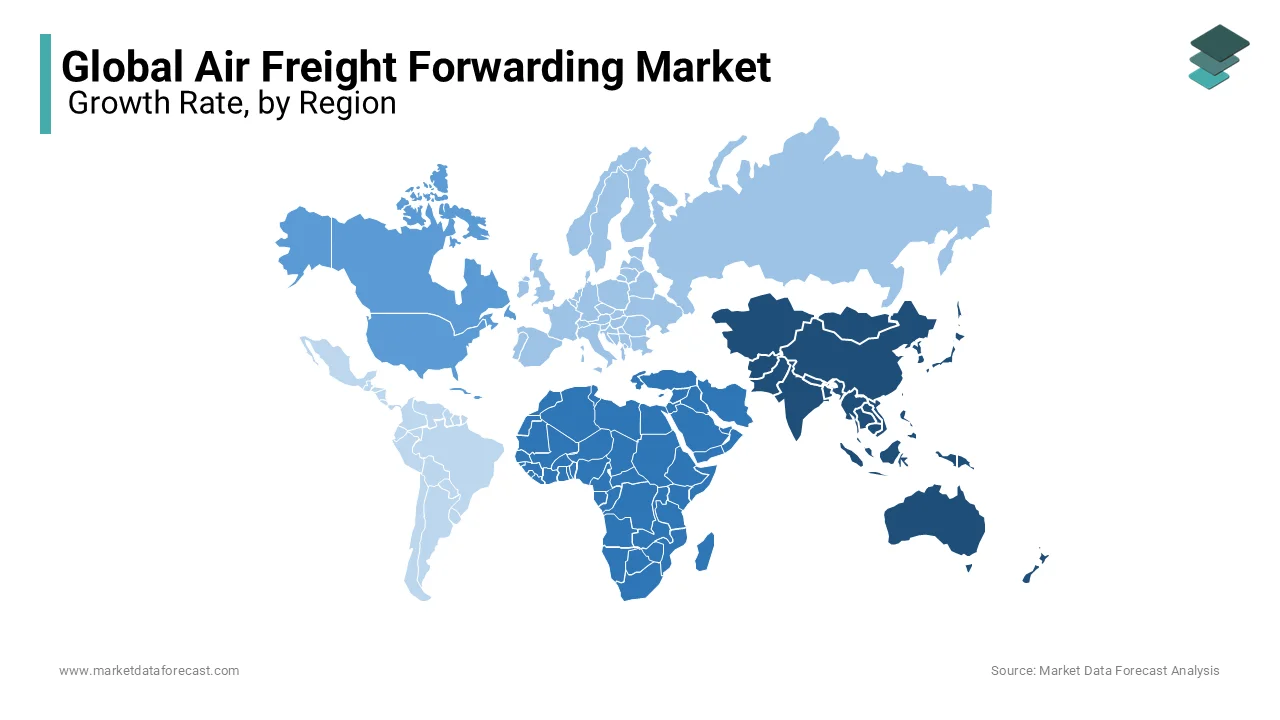

Asia-Pacific dominated the Global Air Freight Forwarding Market with an estimated share of 40.5% in 2024 owing to the region's role as a global manufacturing hub and its booming e-commerce sector. The United Nations Conference on Trade and Development reports that Asia accounted for over 42% of global exports in 2022, with China and India being key contributors. The region's strategic location, advanced infrastructure, and growing trade agreements are to boost the growth of the market in this region. Additionally, the rise of middle-class consumers has increased demand for imported goods is making air freight indispensable for timely delivery.

The Middle East and Africa region is likely to have a CAGR of 9.5% during the forecast period. This growth is fueled by expanding trade corridors, such as the African Continental Free Trade Area (AfCFTA), which is projected to boost intra-African trade by 52% by 2030. According to the International Monetary Fund, economic diversification efforts in Gulf countries are also driving demand for air cargo services. Investments in airport infrastructure, like Dubai’s Al Maktoum International Airport, further enhance regional capabilities.

North America, Europe, and Latin America are expected to witness steady growth due to increasing trade activities and industrialization. The U.S. Department of Commerce projects North America’s air freight market to grow at 5% annually, supported by robust pharmaceutical and retail sectors. Europe benefits from strong intra-regional trade, with the European Environment Agency noting that air cargo accounts for 35% of the region’s high-value trade. Latin America’s market is driven by agricultural exports, with the Food and Agriculture Organization reporting a 10% annual increase in perishable goods shipments.

KEY MARKET PARTICIPANTS

Some of the major players in the global air freight forwarding market are Kuehne + Nagel International AG, Deutsche Post DHL Group, DB Schenker, Nippon Express Co., Ltd., DSV A/S, UPS Supply Chain Solutions Inc., Expeditors International, Sinotrans Limited, The Panalpina Group, and Hellmann Worldwide Logistics.

TOP 3 PLAYERS IN THE MARKET

Kuehne + Nagel International AG

Kuehne + Nagel International AG is a leading player in the global air freight forwarding market. The company has established itself as a pioneer in digitalization by leveraging advanced technologies to enhance shipment tracking, optimize routes, and improve customer experience. Its strong focus on sustainability is evident through initiatives aimed at reducing carbon emissions, such as investments in sustainable aviation fuels. Kuehne + Nagel’s expertise spans diverse industries, including pharmaceuticals, e-commerce, and perishables, where it provides tailored solutions to meet specific client needs. Its ability to adapt to evolving market demands and deliver reliable, high-quality services has solidified its position as a market leader.

Deutsche Post DHL Group

Deutsche Post DHL Group is a dominant force in the global air freight forwarding market by offering comprehensive logistics services through its DHL brand. The company’s global presence and robust infrastructure enable it to serve customers across key markets, ensuring seamless connectivity and timely deliveries. DHL is particularly recognized for its dominance in the healthcare and life sciences sector, where it provides specialized solutions for transporting temperature-sensitive goods like vaccines and biologics. Its commitment to innovation is reflected in its adoption of cutting-edge technologies, such as AI and IoT, to streamline operations and enhance efficiency.

DB Schenker

DB Schenker stands out as a major contributor to the global air freight forwarding market, leveraging its extensive expertise and worldwide network to deliver exceptional value to clients. The company is known for its ability to handle complex logistics challenges, particularly in industries such as automotive, aerospace, and retail. DB Schenker’s focus on digital transformation has enabled it to offer real-time visibility and data-driven insights, empowering businesses to make informed decisions. Additionally, its emphasis on sustainability is demonstrated through initiatives aimed at reducing the environmental impact of logistics operations.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Digital Transformation and Technological Innovation

Key players in the Global Air Freight Forwarding Market are increasingly investing in digital transformation to enhance operational efficiency and customer satisfaction. For instance, many firms have developed proprietary digital platforms that provide real-time visibility into cargo movements by enabling clients to monitor their shipments and make data-driven decisions. This focus on innovation not only improves service reliability but also reduces manual errors and operational costs. Additionally, the integration of automation in warehouses and logistics hubs has allowed these companies to handle higher volumes of freight with greater precision that is strengthening their competitive edge.

Sustainability Initiatives and Green Logistics

Sustainability has become a cornerstone strategy for leading air freight forwarders aiming to align with global environmental goals and meet customer expectations. Companies are investing in sustainable aviation fuels (SAFs), carbon offset programs, and energy-efficient logistics solutions to reduce their carbon footprint. Many players are also collaborating with airlines and regulatory bodies to promote eco-friendly practices across the supply chain. Furthermore, adopting green logistics practices enhances brand reputation and positions these firms as responsible leaders in the industry is fostering long-term loyalty among stakeholders.

Strategic Partnerships and Expansion of Global Networks

To strengthen their market position, key players are actively engaging in strategic partnerships, mergers, and acquisitions to expand their global reach and service capabilities. Collaborations with airlines, technology providers, and local logistics firms enable these companies to enhance their service offerings and tap into emerging markets. Additionally, establishing new hubs and expanding existing facilities in strategic locations allows them to improve connectivity and cater to regional demands more effectively. By broadening their networks, these players can offer end-to-end logistics solutions, ensuring seamless operations across borders.

COMPETITIVE LANDSCAPE

The Global Air Freight Forwarding Market is characterized by intense competition, driven by the presence of several established players and emerging companies striving to gain a foothold in this dynamic industry. Leading firms such as Kuehne + Nagel, Deutsche Post DHL Group, and DB Schenker dominate the market through their extensive global networks, advanced technological capabilities, and diversified service portfolios. These companies leverage their expertise in specialized sectors like healthcare, e-commerce, and perishables to differentiate themselves and cater to high-value, time-sensitive shipments. Meanwhile, regional players focus on niche markets or localized services, fostering a fragmented yet competitive landscape.

Competition is further intensified by the rapid adoption of digitalization and sustainability initiatives. Key players are investing heavily in AI-driven platforms, IoT-enabled tracking systems, and blockchain technologies to enhance operational efficiency and customer experience. Simultaneously, the growing emphasis on green logistics has prompted firms to adopt sustainable practices, such as using eco-friendly fuels and optimizing energy consumption, to align with regulatory standards and consumer expectations. Strategic partnerships, mergers, and acquisitions are also prevalent by enabling companies to expand their reach and strengthen their service offerings.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, DHL Global Forwarding began construction of a new state-of-the-art air freight center at Frankfurt Airport’s CargoCity South. This facility is expected to enhance DHL’s air freight capacity in Europe and strengthen its position in the global market.

- In January 2024, Nippon Express Holdings completed the acquisition of Cargo-Partner, an Austrian logistics firm. This acquisition is anticipated to position Nippon Express among the top five global airfreight forwarders and expand its presence in Central and Eastern Europe.

- In October 2024, DSV A/S agreed to acquire DB Schenker, Deutsche Bahn’s logistics division, in a €14.3 billion deal. The acquisition is expected to double DSV’s revenue and make it the largest freight forwarder globally.

- In April 2025, DHL Express signed an agreement with Cosmo Energy Holdings to procure 7,200 kiloliters of sustainable aviation fuel (SAF) annually in Japan. This initiative supports DHL’s environmental goals and enhances its sustainable air freight offerings.

- In January 2024, Nippon Express Holdings invested in Wiz Freight, a digital forwarding services provider based in India. This move aims to advance Nippon Express’s digital capabilities and strengthen its global forwarding business.

- In June 2024, Nippon Express launched the "NX-FORWARDING - AIR - Ohio Midnight Express," a high-speed consolidated air freight service from Chubu Airport, Japan to Ohio, USA. This service is designed to reduce delivery times and improve responsiveness for urgent shipments.

- In 2024, UPS secured a major air cargo contract from the United States Postal Service (USPS), becoming its primary domestic air cargo provider. This agreement is expected to significantly expand UPS’s presence in the U.S. air freight market.

- In December 2024, Nippon Express partnered with Otsuka Pharmaceutical to introduce environmentally-friendly isothermal containers in international air freight. This initiative reduced CO2 emissions and contributed to sustainable pharmaceutical logistics.

- In January 2025, DHL Supply Chain, in partnership with Volvo Autonomous Solutions, initiated autonomous truck operations between Dallas and Houston. This move is expected to enhance operational efficiency and position DHL as a leader in next-gen freight transport.

- In October 2024, DHL announced a strategic growth plan aiming to increase its revenue by 50% by 2030, focusing on key sectors like pharmaceuticals and energy, and targeting expansion in regions such as India, Southeast Asia, and the Middle East.

MARKET SEGMENTATION

This research report on the global air freight forwarding market has been segmented and sub-segmented based on the service and region.

By Services

- Freight Transportation

- Warehousing & Distribution

- Customs Brokerage

- Freight Consolidation

- Value-Added Services

By Destination

- Domestic

- International

By Customer

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

By End User

- Healthcare & Pharmaceuticals

- Food & Beverage

- Agriculture

- Retail

- Manufacturing

- Automotive

- Aerospace

By Region

- North America

- USA

- Canada

- Rest of North America

- Europe

- UK

- France

- Italy

- Spain

- Germany

- Belgium

- Netherlands

- Luxembourg

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Indonesia

- Malaysia

- Vietnam

- Thailand

- Singapore

- Taiwan

- Hong Kong

- Latin America

- Mexico

- Brazil

- Argentina

- Colombia

- Peru

- Chile

- MEA

- Middle East

- Africa

Frequently Asked Questions

What are the main factors driving the growth of the air freight forwarding market?

The main factors driving the growth of the air freight forwarding market include the rise in global e-commerce, increasing demand for perishable and time-sensitive goods, advancements in cargo handling technologies, and the need for efficient supply chain management solutions.

What are the key challenges faced by the air freight forwarding industry?

Key challenges include fluctuating fuel prices, stringent regulatory requirements, capacity constraints, and the need for investment in digitalization and automation to enhance efficiency and competitiveness. Additionally, geopolitical tensions and trade wars can impact market dynamics.

What are the different types of services offered by air freight forwarders?

Air freight forwarders offer a variety of services, including door-to-door delivery, customs brokerage, cargo insurance, warehousing, and value-added services like packaging and labeling. They also provide specialized solutions for handling hazardous materials, temperature-sensitive goods, and oversized cargo.

What future trends are expected in the air freight forwarding market?

Future trends in the air freight forwarding market include increased digitalization and use of artificial intelligence, greater emphasis on sustainability, and the growth of e-commerce driving higher demand for express and same-day delivery services. Additionally, the integration of multimodal transport solutions and partnerships with technology firms are expected to enhance efficiency and service quality.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]