Global Air Filters Market Size, Share, Trends & Growth Forecast Report By Type (Cartridge Filters, Dust Collectors, HEPA Filters, Baghouse Filters, and Others), End-User (Residential, Commercial, and Industrial), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Air Filters Market Size

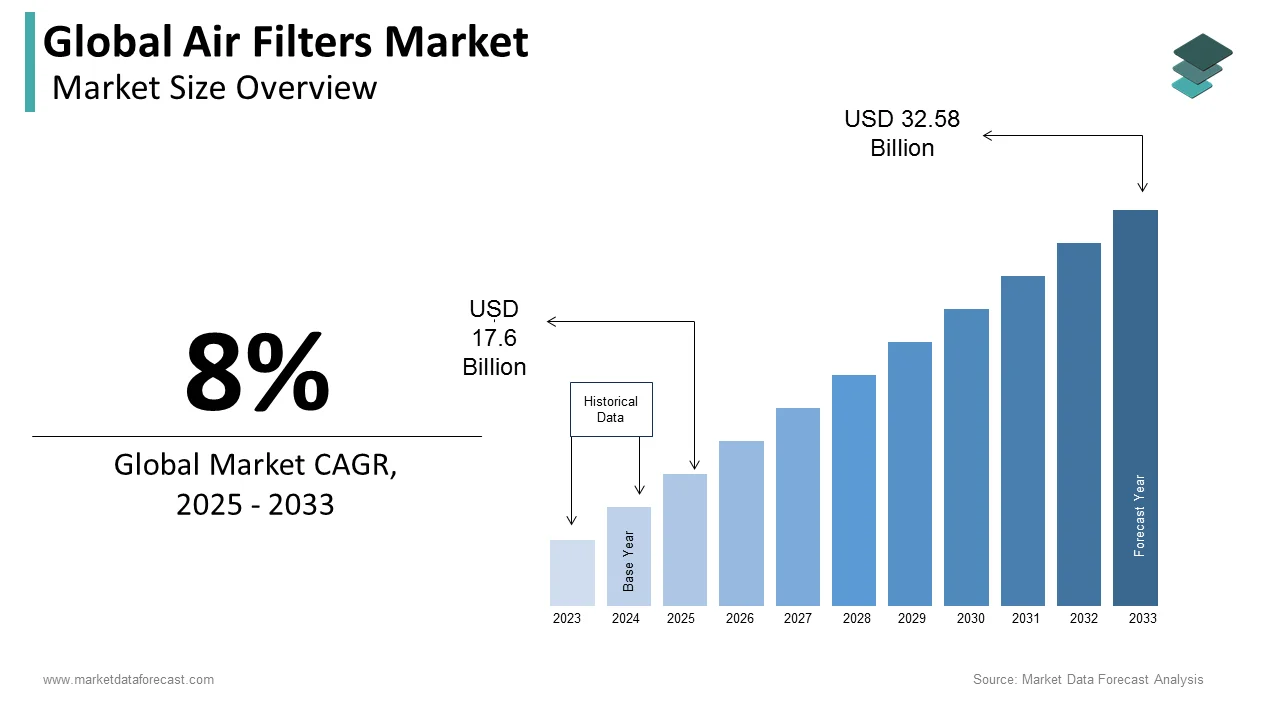

The size of the global air filters market was worth USD 16.3 billion in 2024. The global market is anticipated to grow at a CAGR of 8% from 2025 to 2033 and be worth USD 32.58 billion by 2033 from USD 17.6 billion in 2025.

Air filters are highly necessary within the environmental and industrial health sectors to focus on products designed to purify air by capturing contaminants such as dust, pollen, mold spores, and harmful gases. These filtration systems are integral to maintaining indoor air quality (IAQ) which has gained significant attention due to its direct correlation with human health and productivity. According to the World Health Organization, approximately 99% of the global population breathes air that exceeds safe pollution levels which is the growing necessity for effective air filtration solutions. Furthermore, as per the Environmental Protection Agency, the indoor air can be two to five times more polluted than outdoor air is emphasizing the importance of advanced filtration technologies in residential, commercial, and industrial settings.

In recent years, the increased awareness about respiratory diseases and allergens has driven demand for high-efficiency particulate air (HEPA) filters and other specialized filtration systems. The rise in smart homes and connected devices has also contributed to innovations in air filter designs, enabling real-time monitoring of IAQ metrics. A study published in The Lancet Planetary Health that poor air quality contributes to over 6.7 million premature deaths annually worldwide reinforcing the urgency for improved air purification measures. Additionally, the International Energy Agency notes that buildings consume nearly 30% of global energy with HVAC systems accounting for a substantial portion with the dual role of air filters in enhancing both energy efficiency and air cleanliness. Collectively, these factors illustrate the pivotal role of air filters in safeguarding public health while addressing broader environmental challenges.

MARKET DRIVERS

Stringent Air Quality Regulations and Policies

Governments worldwide are implementing stringent air quality standards, which is propelling the demand for advanced air filtration systems. The U.S. Environmental Protection Agency (EPA) enforces the National Ambient Air Quality Standards (NAAQS) to mandate limits on pollutants like particulate matter (PM2.5) and ozone. These regulations compel industries and commercial establishments to adopt high-efficiency air filters to comply with emission norms. For instance, the EPA estimates that compliance with the Clean Air Act has prevented over 230,000 premature deaths annually in the United States alone. According to the European Environment Agency, air pollution remains the largest environmental health risk in Europe is causing approximately 307,000 premature deaths annually. Such alarming figures have led to stricter enforcement of air quality directives is driving investments in filtration technologies to mitigate health risks and ensure regulatory adherence.

Rising Prevalence of Respiratory Diseases

The increasing incidence of respiratory conditions is a significant driver for the air filters market. The World Health Organization states that chronic obstructive pulmonary disease (COPD) affects over 200 million people globally while asthma impacts an estimated 262 million individuals. Poor indoor air quality exacerbates these conditions is prompting consumers to invest in air purification solutions. According to the Centers for Disease Control and Prevention (CDC), exposure to indoor allergens and pollutants can increase asthma-related hospitalizations by up to 30%. Furthermore, as per a study by the American Lung Association, nearly 40% of Americans live in areas with unhealthy air quality is intensifying the need for effective air filtration systems. This growing awareness of the link between air quality and respiratory health is fueling demand for advanced air filters in homes, schools, and healthcare facilities.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

The high upfront costs associated with advanced air filtration systems pose a significant restraint to air filters market growth. High-efficiency particulate air (HEPA) filters and other premium filtration technologies often require substantial investment is making them less accessible for small businesses and low-income households. The U.S. Department of Energy estimates that HVAC systems which heavily rely on air filters which account for about 48% of household energy consumption that adds on operational expenses. Additionally, the National Institute of Standards and Technology that regular maintenance and replacement of filters can increase lifecycle costs by up to 20% which is discouraging some consumers from adopting advanced systems. These financial barriers are particularly pronounced in developing regions where budget constraints limit the adoption of cutting-edge filtration solutions despite their long-term health benefits.

Limited Awareness in Rural and Underserved Areas

Limited awareness about the importance of air quality and filtration systems in rural and underserved areas acts as another major restraint for the market growth. As per the Centers for Disease Control and Prevention, rural populations are disproportionately affected by indoor air pollutants due to older housing infrastructure and reliance on solid fuels for cooking and heating. Similarly, the World Health Organization states that nearly 2.1 billion people globally still cook using open fires or simple stoves is exposing them to harmful indoor pollutants. This lack of awareness, coupled with limited access to modern filtration technologies is ascribed to hinder the market growth in these regions which is leaving a significant portion of the population vulnerable to poor air quality.

MARKET OPPORTUNITIES

Growing Demand for Smart and IoT-Enabled Air Filters

The integration of smart technologies and the Internet of Things (IoT) into air filtration systems presents a significant growth opportunity. According to the U.S. Department of Energy, smart HVAC systems include IoT-enabled air filters can reduce energy consumption by up to 30% through real-time monitoring and optimization. These advanced systems allow users to track air quality metrics, such as particulate matter levels and humidity, via mobile applications by fostering greater control over indoor environments. According to the International Energy Agency, buildings equipped with smart technologies are expected to grow at a compound annual growth rate (CAGR) of 20% over the next decade. Furthermore, the Environmental Protection Agency emphasizes that real-time air quality data can enhance public awareness which is driving demand for innovative filtration solutions in both residential and commercial sectors.

Expansion of Air Filters in Emerging Markets

Emerging markets offer immense potential for the air filters industry due to rapid urbanization and industrialization. According to the World Health Organization, urban populations in developing countries are projected to increase by 2.5 billion by 2050 which is leading to higher demand for clean indoor air solutions. According to the United Nations Environment Programme, industries in these regions are increasingly adopting sustainable practices by including the use of energy-efficient air filtration systems is to comply with global environmental standards. For instance, in India, the Ministry of Environment, Forest and Climate Change has mandated stricter emission norms for industries by boosting the adoption of advanced air filters. This shift towards cleaner technologies is coupled with rising disposable incomes in emerging economies that is expected to drive significant market expansion in regions like Asia-Pacific, Latin America, and Africa.

MARKET CHALLENGES

Disposal and Environmental Impact of Used Air Filters

The environmental impact of disposing used air filters poses a significant challenge to the air filters market. Many conventional air filters are made from non-biodegradable materials, such as synthetic fibers and plastics which contribute to landfill waste. The U.S. Environmental Protection Agency estimates that over 100 million air filters are discarded annually in the United States alone with less than 10% being recycled. This issue is exacerbated by the growing demand for disposable filters which are often replaced every few months. Additionally, as per the European Environment Agency, improper disposal of industrial-grade filters can release trapped pollutants back into the environment that further degrades air quality. The manufacturers are facing huge challenges in developing eco-friendly alternatives such as biodegradable or reusable filters as per the circular economy models that is additionally to hamper the growth rate of the market.

Inconsistent Performance in High-Pollution Environments

Air filters often struggle to maintain consistent performance in regions with extremely high pollution levels which is limiting the air filters market’s growth rate. According to the World Health Organization, cities in low- and middle-income countries frequently exceed safe PM2.5 levels by more than five times that is overwhelming filtration systems designed for moderate pollution. For instance, in Delhi, India, the Central Pollution Control Board recorded average PM2.5 levels of 200 µg/m³ during peak pollution months, far exceeding the WHO guideline of 5 µg/m³. Under such conditions, filters clog quickly which require frequent replacements and increasing operational costs. Furthermore, the U.S. National Institute of Environmental Health Sciences notes that extreme pollution can degrade filter efficiency that is allowing harmful particles to bypass filtration systems. This challenge underscores the need for advanced technologies capable of withstanding severe pollution while maintaining optimal performance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Daikin Industries, Ltd. (Japan), Camfil (Sweden), MANN+HUMMEL (Germany), Parker Hannifin Corp (U.S.), Cummins, Inc. (U.S.), Donaldson Company, Inc. (U.S.), Freudenberg Filtration Technologies SE & Co. KG. (Germany), Absolent Group AB (publ) (Sweden), Lydall Gutsche GmbH & Co. Kg (Germany), Purafil, Inc. (U.S.), and Others. |

SEGMENT ANALYSIS

By Type Insights

The HEPA filters segment dominated the air filters market with 35.5% of the global market share in 2024. These filters superior ability to capture 99.97% of particles as small as 0.3 microns is making them indispensable in healthcare, pharmaceuticals, and cleanroom applications. The World Health Organization studies have shown that HEPA filters are critical in reducing airborne transmission of pathogens in hospitals. Increasing concerns over indoor air quality and allergens levelled up the demand for these air filters. Additionally, the American Lung Association emphasizes that HEPA filters reduce asthma triggers further amplifies their importance in residential and commercial settings.

The cartridge filters segment is expected to exhibit a CAGR of 8.5% during the forecast period owing to their versatility and efficiency in industrial applications, such as metalworking and chemical processing where they effectively capture fine dust and contaminants. The U.S. Department of Labor notes that industries are increasingly adopting cartridge filters due to their compact design and lower maintenance costs compared to traditional baghouse systems. According to the Environmental Protection Agency that advancements in nanofiber technology have enhanced their filtration efficiency is making them ideal for high-pollution environments. Cartridge filters are expected to witness accelerated adoption globally as industries prioritize sustainability and regulatory compliance.

By End-User Insights

The residential segment dominated the air filters market and held 45% of the global market share in 2024. Increasing awareness of indoor air quality (IAQ) and its impact on health is majorly driving the segmental expansion in the global market. The World Health Organization studies have shown that household air pollution causes 3.8 million premature deaths annually which is driving demand for home air purification systems. Additionally, the rise in smart homes has bolstered adoption, with HVAC systems consuming 48% of household energy as per the U.S. Department of Energy. Residential filters are crucial in combating allergens and pollutants by ensuring healthier living environments.

The industrial segment is anticipated to witness a CAGR of 8.5% during the forecast period. This rapid growth is fuelled by stringent environmental regulations, such as those enforced by the U.S. Environmental Protection Agency by mandating industries to reduce emissions. The World Health Organization notes that industrial activities contribute to 24% of global PM2.5 emissions with advanced filtration systems. Furthermore, the United Nations Environment Programme emphasizes the shift toward sustainable industrial practices is boosting demand for energy-efficient filters. The need for high-performance air filters to meet regulatory standards and improve workplace safety escalates the segment's growth rate.

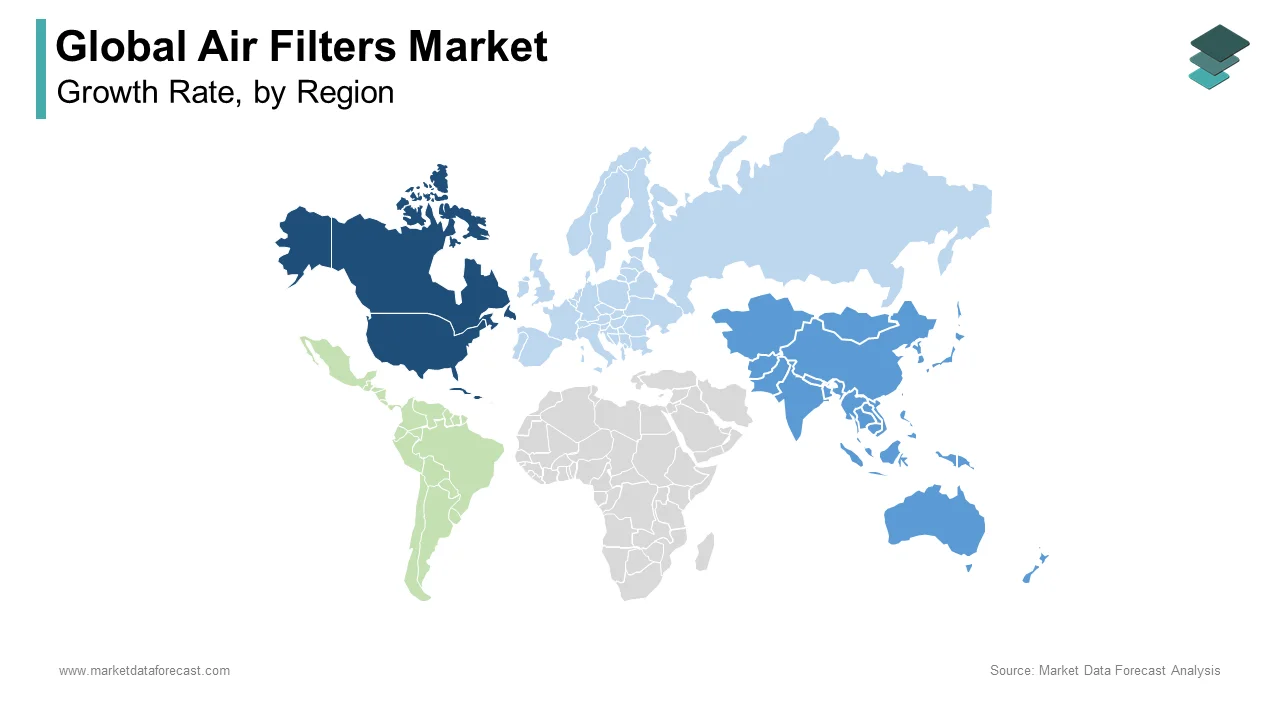

REGIONAL ANALYSIS

North America outperformed other regions in the global air filters market by accounting for 35% of global market share in 2024. The domination of North America in the global market is attributed to stringent air quality regulations, such as the Clean Air Act, and a high prevalence of respiratory conditions. The Centers for Disease Control and Prevention reports that over 25 million Americans suffer from asthma by driving demand for advanced filtration systems in homes, schools, and healthcare facilities. Additionally, the rise of smart homes has bolstered adoption, with HVAC systems consuming nearly 48% of household energy, as per the U.S. Department of Energy. North America’s emphasis on innovation and sustainability ensures its dominance in setting global benchmarks for air filtration technologies.

Asia-Pacific is the fastest-growing region and is expected to register a CAGR of 9.2% during the forecast period. Rapid urbanization and industrialization are key drivers, with the United Nations projecting a 2.5 billion increase in urban populations by 2050. The World Health Organization identifies this region as home to 9 out of the 10 most polluted cities globally with the growing demand for air purification solutions. Governments, such as India’s Central Pollution Control Board, are enforcing stricter emission norm. The region's economic expansion, coupled with rising awareness of health risks from air pollution.

Europe is expected to maintain steady growth, driven by stringent environmental policies like the EU Air Quality Directive. The European Environment Agency aims to reduce air pollution by 55% by 2030 that is fostering the demand for advanced air filtration systems. Industrial hubs in Germany and France are increasingly adopting energy-efficient HVAC systems, which rely heavily on high-performance filters. The World Health Organization notes that air pollution causes 600,000 premature deaths annually in Europe, reinforcing the need for effective filtration solutions. Europe’s focus on sustainability and green technologies positions it as a key contributor to market stability and innovation.

Latin America is poised for moderate growth, supported by urbanization and industrial projects. According to the World Bank, air pollution contributes to over 150,000 premature deaths annually in the region by creating demand for air filters in urban areas. Countries like Brazil and Mexico are investing in renewable energy and sustainable infrastructure which is boosting industrial air filter adoption. Additionally, increasing awareness of indoor air quality in commercial buildings and healthcare facilities is expected to drive market expansion. While growth may be slower compared to Asia-Pacific, Latin America’s focus on environmental sustainability offers huge opportunities for the air filters market in the coming years.

The Middle East and Africa is likely to emerging with significant untapped potential in the air filters market. The World Health Organization reports that air pollution causes 700,000 premature deaths annually in Sub-Saharan Africa alone with the urgent need for air filtration solutions. In the Middle East, rapid urbanization and industrial activities in oil-rich nations, are driving demand for industrial-grade filters. However, limited awareness and economic constraints in some African regions hinder widespread adoption. Despite these challenges, initiatives by governments and international organizations to improve air quality and public health are expected to gradually boost market penetration in the coming years.

KEY MARKET PLAYERS

Some of the notable companies dominating the global air filters market profiled in this report are Daikin Industries, Ltd. (Japan), Camfil (Sweden), MANN+HUMMEL (Germany), Parker Hannifin Corp (U.S.), Cummins, Inc. (U.S.), Donaldson Company, Inc. (U.S.), Freudenberg Filtration Technologies SE & Co. KG. (Germany), Absolent Group AB (publ) (Sweden), Lydall Gutsche GmbH & Co. Kg (Germany), Purafil, Inc. (U.S.), and Others.

TOP 3 PLAYERS IN THE MARKET

Daikin Industries, Ltd. (Japan)

Daikin Industries is a global leader in air filtration and HVAC systems, renowned for its innovative technologies and comprehensive product range. The company specializes in advanced air purifiers, HEPA filters, and integrated air conditioning systems that emphasize superior air quality and energy efficiency. Daikin’s commitment to sustainability is evident in its development of eco-friendly refrigerants and smart filtration systems, aligning with global environmental standards. With a strong presence in Asia-Pacific, Europe, and North America, Daikin has established itself as a preferred choice for both residential and commercial applications. Its focus on research and development ensures the delivery of cutting-edge solutions that cater to diverse market needs, reinforcing its leadership in the global air filters market.

Camfil (Sweden)

Camfil is a pioneer in clean air solutions, recognized for its expertise in high-efficiency particulate air (HEPA) and molecular filtration systems. The company addresses critical indoor air quality challenges across industries such as healthcare, pharmaceuticals, and food processing. Camfil’s products are designed to meet stringent regulatory standards and are widely adopted for their reliability and performance. The company’s innovations in sustainable filtration materials have set new benchmarks in the industry, reducing waste and improving filter longevity. With a robust footprint in Europe and North America, Camfil has become a trusted name in the global air filters market. Its dedication to advancing clean air technologies continues to drive its growth and influence worldwide.

MANN+HUMMEL (Germany)

MANN+HUMMEL is a global leader in filtration technologies, offering a wide range of air filters for automotive, industrial, and residential applications. The company’s expertise lies in developing advanced filtration systems that effectively address fine particulate matter and other harmful pollutants. MANN+HUMMEL collaborates with governments and industries to meet environmental regulations and promote cleaner air solutions. Known for its innovative approach, the company has embraced digitalization and IoT-enabled filtration systems, positioning itself at the forefront of smart air quality management. With a strong presence in Europe and Asia-Pacific, MANN+HUMMEL continues to expand its reach and influence, delivering reliable and efficient filtration solutions that cater to the evolving demands of the global market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Technological Advancements

Key players in the air filters market, such as Daikin Industries, Camfil, and MANN+HUMMEL, prioritize product innovation to maintain their competitive edge. These companies invest heavily in research and development to introduce advanced filtration technologies, such as IoT-enabled smart filters and high-efficiency particulate air (HEPA) systems. For instance, Daikin has developed energy-efficient HVAC systems with integrated air purification capabilities, catering to the growing demand for sustainable solutions. Similarly, Camfil focuses on molecular filtration systems that target ultrafine pollutants, addressing the needs of industries like healthcare and pharmaceuticals. By continuously enhancing product performance and adopting cutting-edge technologies, these companies strengthen their market position and meet evolving customer expectations.

Strategic Acquisitions and Partnerships

Acquisitions and partnerships are critical strategies employed by leading players to expand their market presence and diversify their product portfolios. For example, MANN+HUMMEL has acquired several smaller filtration companies to enhance its expertise in industrial and automotive filtration. Such acquisitions allow companies to access new markets, leverage complementary technologies, and consolidate their leadership. Additionally, partnerships with governments and environmental organizations enable companies like Camfil to align with global air quality initiatives, reinforcing their reputation as industry leaders. These strategic moves not only broaden their reach but also enhance their ability to deliver comprehensive solutions across diverse sectors.

Focus on Sustainability and Eco-Friendly Solutions

Sustainability is a key focus area for major players in the air filters market. Companies like Daikin and Camfil emphasize the development of eco-friendly products, such as biodegradable filters and energy-efficient systems, to address environmental concerns. Daikin’s introduction of refrigerants with low global warming potential (GWP) reflects its commitment to reducing carbon footprints. Similarly, Camfil’s sustainable filtration materials minimize waste and improve filter longevity, appealing to environmentally conscious consumers. By aligning their strategies with global sustainability goals, these companies not only comply with regulatory standards but also attract a growing base of eco-aware customers.

Expansion into Emerging Markets

To capitalize on growth opportunities, key players are expanding their operations into emerging markets, particularly in Asia-Pacific, Latin America, and Africa. For instance, Daikin has established manufacturing facilities and distribution networks in countries like India and China to cater to the rising demand for air filtration systems in urbanized regions. MANN+HUMMEL has similarly focused on industrial hubs in developing nations, offering tailored solutions for local industries. This geographic expansion allows companies to tap into untapped markets, address regional air quality challenges, and strengthen their global footprint.

Brand Building and Customer-Centric Approaches

Building strong brand recognition and fostering customer loyalty are essential strategies for market leaders. Companies like Donaldson Company and Freudenberg Filtration Technologies invest in marketing campaigns and educational initiatives to raise awareness about the importance of clean air and the benefits of their products. They also adopt customer-centric approaches by offering customized solutions, extended warranties, and after-sales services. By prioritizing customer satisfaction and building trust, these companies enhance their brand equity and secure long-term relationships with clients across residential, commercial, and industrial segments.

COMPETITIVE LANDSCAPE

The air filters market is characterized by intense competition, driven by the presence of established global players and regional manufacturers striving to capture market share. Key companies such as Daikin Industries, Camfil, and MANN+HUMMEL dominate the industry through their extensive product portfolios, technological expertise, and strong geographic presence. These leaders leverage innovations in filtration technologies, including IoT-enabled systems and eco-friendly materials, to differentiate themselves and cater to diverse customer needs across residential, commercial, and industrial sectors. The competitive landscape is further intensified by strategic initiatives such as mergers, acquisitions, and partnerships, enabling companies to expand their capabilities and enter emerging markets.

Regional players also contribute to the competitive dynamics by offering cost-effective solutions tailored to local demands, particularly in Asia-Pacific, Latin America, and Africa. This has led to a fragmented market structure where global giants compete with smaller firms on pricing, product quality, and customization. Additionally, stringent environmental regulations and increasing awareness of indoor air quality have heightened competition, as companies race to develop advanced filtration systems that comply with international standards.

Despite the dominance of major players, the market remains highly dynamic due to rapid technological advancements and evolving consumer preferences. Companies are increasingly focusing on sustainability, energy efficiency, and smart features to gain a competitive edge. This combination of innovation, strategic expansion, and regulatory compliance ensures that the air filters market remains a fiercely contested arena, with opportunities for both established and emerging players to thrive.

RECENT MARKET DEVELOPMENTS

- In November 2024, Micronics Engineered Filtration Group acquired Action Filtration, a recognized aftermarket leader in high-quality replacement pleated filters and cartridge dust collector filters. This strategic acquisition aims to expand Micronics' portfolio of engineered filtration solutions, enhancing their ability to meet diverse customer needs in air pollution control and environmental protection sectors.

- In 2024, PureAir Filtration relocated to a new 40,000-square-foot headquarters equipped with advanced laboratories and doubled its manufacturing capacity. These initiatives were undertaken to meet increasing demand and underscore the company's commitment to innovation and growth under the leadership of President Ashley Jameson.

- In March 2022, Air Liquide unveiled its ADVANCE strategic plan, aiming to link growth with a sustainable future. The plan focuses on delivering strong financial performance, leading in decarbonization efforts, and promoting technological innovation in air filtration and other sectors.

- In September 2021, Eagle Filters Group, formerly known as Loudspring Oyj, acquired the remaining 15% of Eagle Filters Oy, transitioning from an investment company to an industrial entity centered around advanced air filtration solutions.

- In February 2016, MFRI, Inc. announced the sale of its domestic and international filtration businesses, including TDC Filter Manufacturing and Nordic Air Filtration. This strategic decision was made to refocus the company's portfolio on its core piping businesses.

- In December 2016, Parker Hannifin entered into a definitive agreement to acquire CLARCOR, a filtration systems manufacturer, for approximately $4.3 billion in cash. This acquisition aimed to enhance Parker Hannifin's filtration product offerings and market reach.

- In 1997, Donaldson Company launched Donaldson Korea Company, expanding its presence in the Asian market. This move aimed to tap into the growing demand for industrial air filtration solutions in the region.

- In 2020, Molekule raised $58 million in Series C funding, facilitating the development of advanced air purification technologies and expanding its product line to address diverse air quality challenges.

- In November 2024, Micronics Engineered Filtration Group expanded its aftermarket product line by acquiring Action Filtration, enhancing its offerings in replacement pleated filters and cartridge dust collector filters for air pollution control

MARKET SEGMENTATION

This research report on the global air filters market has been segmented and sub-segmented based on the type, end-user, and region.

By Type

- Cartridge Filters

- Dust Collectors

- HEPA Filters

- Baghouse Filters

- Others

By End-User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. How fast is the air filters market expected to grow?

The air filters market is projected to grow from USD 17.6 billion in 2025 to USD 32.58 billion by 2033, at a CAGR of 8%.

2. What factors are driving demand for air filters?

Stringent air quality regulations, rising respiratory diseases, and smart air filtration technologies.

3. What challenges does the market face?

High initial costs, limited awareness in rural areas, and disposal issues.

4. How is technology improving air filtration systems?

IoT-enabled smart filters enhance real-time air quality monitoring and energy efficiency.

5. Which regions present strong growth opportunities?

Asia-Pacific, Latin America, and Africa are key emerging markets.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]