Global AI Training Dataset Market Size, Share, Trends, & Growth Forecast Report – Segmented by Type (Audio, Image/Video, and Text) Application (Automotive, BFSI, Government, Healthcare, IT, Retail and E-commerce, and Others) & Region - Industry Forecast From 2024 to 2032

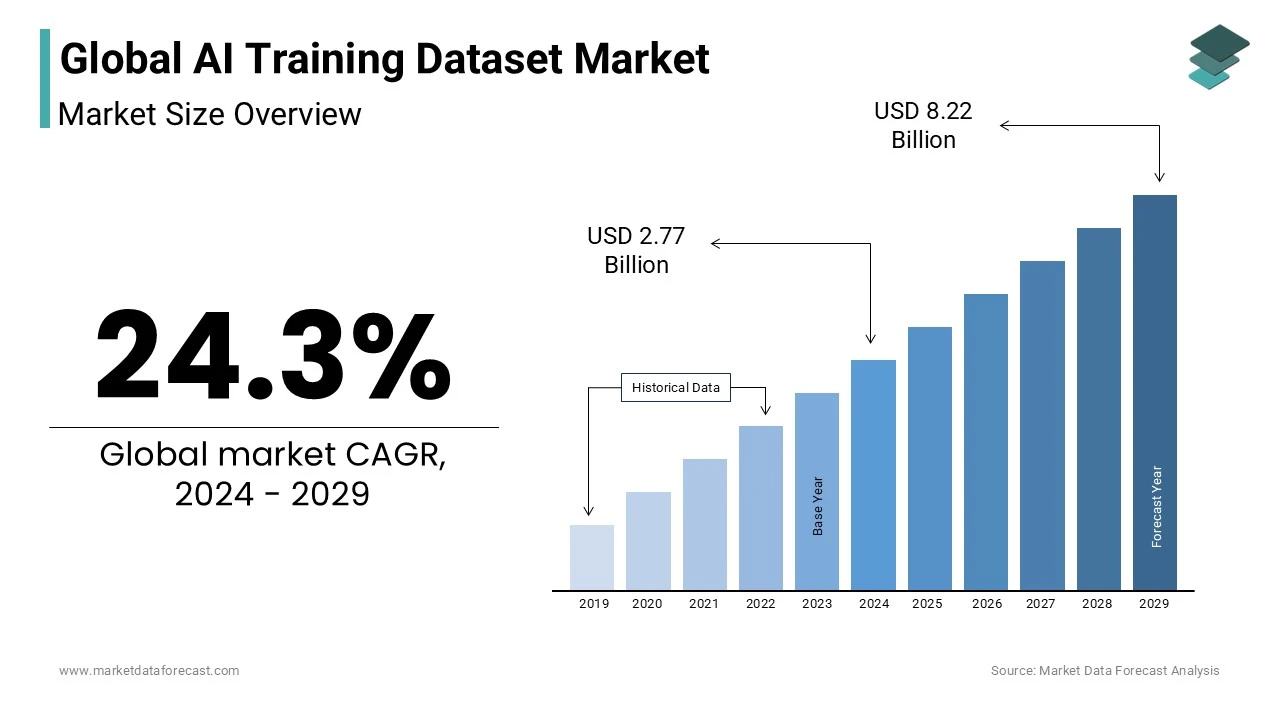

Global AI Training Dataset Market Size (2024 to 2032)

The global AI training dataset market was worth USD 2.23 billion in 2023. The global market is predicted to reach USD 2.77 billion in 2024 and USD 15.79 billion by 2032, rising at a CAGR of 24.3% during the forecast period.

Current Scenario of the Market

Presently, developers or creators have been training models by providing an abundance of content, most of it cropped from the internet for free without the permission of those who made the works or hold the rights to them. The AI training dataset market is swiftly gaining traction. Moreover, the recently formed Dataset Providers Alliance (DPA) is a significant boost for the market growth rate and will support ethical data sourcing in the AI system’s training which involves the security of the intellectual property rights of content owners and also, the rights for the individuals showcased in datasets. Moreover, the industry also continues to see the rise of generative AI which can exactly copy human activity and behaviour in the last few years has launched a protest from content creators and a series of copyright court cases against technology players such as Meta (META.O), Google, ChatGPT maker OpenAI, which the Microsoft supports.

MARKET DRIVERS

The growth of the AI training dataset market is driven by the progressive rise in its significance in healthcare, retail & e-commerce, BFSI and Manufacturing industries.

In addition, the increasing implementation of cloud computing will also propel the market expansion due to its extensible storage products making it simple to stockpile and handle big datasets. Also, the AI industry is witnessing a surge in the application of big data facilitated by technology to extract extremely complicated representations via a hierarchical learning framework. This requires the mining and extraction of expressive trends from large numbers of data.

Another factor influencing market growth is the industry’s continued domination in AI research. According to a 2024 study, in 2023, the market created 51 noteworthy machine learning models, at the same the academia added only 15. Further, there were also 21 significant models as a consequence of industry-academia partnerships in 2023, a new height. The systematic transition and the industry’s progressive command over the three major elements of AI research including highly trained researchers, big datasets and computing power.

The growth of the market is also fuelled by heightening investments in generative AI. Regardless of a drop in total AI private investment the previous year, financial support for generative AI increased, close to eight times to be valued at 25.2 billion from the figure in 2022. Key companies in the generative AI industry, including Inflection, Hugging Face, Anthropic and OpenAI, announced significant fundraising rounds.

MARKET RESTRAINTS

The exorbitant cost of training is a major restraint on the growth of the market. AI organisations rarely disclose the costs incurred in training their models. It is broadly accepted that these expenses go into millions of dollars and are increasing. For example, Sam Altman, the CEO of OpenAI, said that the cost of training GPT-4 was more than 100 million dollars. This rise in training expenditure has fruitfully excluded the conventional hubs of AI research which are Universities from creating their own sophisticated basic models. In the last few years, the projected training expenses related to select AI models that are tied to cloud compute rental fees and also lately it has surged greatly. For instance, in 2023, learning and tuition expenditures approximately for GPT-4 by OpenAI is 78 million dollars and Gemini Ultra by Google is 191 million dollars.

MARKET OPPORTUNITIES

Broadening applications of training datasets in various sector verticals are providing potential opportunities for the AI training dataset market. The gathering and allocation of a large quantity of visual and electronic information have been realised through a rise in social media, websites, applications and other online channels. Several organizations have utilised this data with tags and freely available web content to furnish their clients with high-quality solutions. Unstructured text-based information aggregated because of the growing consumption of electronic health record (EHR) systems is among the most important sources for clinical study. Over the estimation period, it is expected that rising usage in various industries will create huge potential for market expansion.

MARKET CHALLENGES

The absence of strong and standardised assessments for LLM obligation is hindering the further growth of the AI training dataset market. A new study published in 2024 discloses a considerable insufficiency of standardization in accountable AI reporting. Prominent developers, involving Anthropic, Google and OpenAI, basically evaluate their models opposite those in diverse responsible AI benchmarks. This custom or procedure hinders progress to systematically measure the dangers and restrictions of top AI models. Additionally, the latest launched Foundation Model Transparency Index displays that AI developers lack openness and clarity, particularly about the revelation of training data and approaches. This absence of transparency impedes efforts to further gain knowledge and analysis of the strengths and protection of AI systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

24.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amazon Web Services, Inc., Google, LLC (Kaggle), Microsoft Corporation, Appen Limited, Alegion, Scale AI, Inc., Cogito Tech LLC, Samasource Inc., Lionbridge Technologies, Inc., and Deep Vision Data. |

SEGMENTAL ANALYSIS

Global AI Training Dataset Market Analysis By Type

The text segment gained the top position with the maximum portion of the AI training dataset market. These datasets are comprehensively utilised in the IT sector for automation operations and activities, involving text categorisation, caption generation and speech recognition. In 2023, various surveys evaluated AI’s effect on labour, recommending that AI facilitates workers to execute jobs more rapidly and to enhance the quality of their performance. These studies also showed AI’s capability to fill the skill gap among workers with low- and high-skills. On the other hand, due to the wide variety of audio datasets accessible, the audio segment is anticipated to elevate its market share.

Global AI Training Dataset Market Analysis By Application

The IT segment continued its influence on the AI training dataset market. The demand for AI talent has risen greatly over swiftly than the supply throughout the past decade, creating higher competition for potential candidates. Apart from this, nondefense US government organizations assigned 1.5 billion US dollars to AI in 2021. In that same period, the European Commission intended to invest 1 billion euros or 1.2 billion US dollars. On the contrary, worldwide, the industry expended more than 340 billion US dollars on AI in 2021, largely surpassing public investment. Furthermore, superior-quality datasets assist IT companies in enhancing a variety of solutions, consisting of virtual assistants, data analytics, crowdsourcing, computer vision and others. The market’s heavy dependence on training datasets is a consequence of such situations.

REGIONAL ANALYSIS

North America completely dominates with the biggest portion of the AI training dataset market share. Dealers in the regional market are emphasising introducing the latest datasets to boost the acceptance of artificial intelligence technology in developing industries in North America. Besides this, the market is also driven by the sharp rise in the amount of AI laws in the United States. The quantity of AI-associated regulations in the country has surged substantially in recent times and throughout the past five years. In 2023, there were 25 laws related to artificial intelligence, which expanded from merely one in 2016. Alone IN 2023, the overall number of AI-related regulations increased by 56.3 per cent.

Europe is another key AI training dataset market. The regional market is driven by the high number of talented pools. The United Kingdom and Germany spearheaded in production of PhD, master’s and bachelors in IT, CE, CS and informatics graduates. According to a capita basis, Finland came on top in the generation of both PhD and bachelor’s graduates, at the same time Ireland dominated in the pass-out of master’s graduates.

KEY MARKET PLAYERS

- Amazon Web Services, Inc.

- Google, LLC (Kaggle)

- Microsoft Corporation

- Appen Limited

- Alegion

- Scale AI, Inc.

- Cogito Tech LLC

- Samasource Inc.

- Lionbridge Technologies, Inc.

- Deep Vision Data

RECENT HAPPENINGS IN THE MARKET

- In June 2024, it was reported that seven content-licensing traders of video, image, music and other datasets for applications in training the artificial intelligence systems have constituted the industry’s foremost trade group called the “Dataset Providers Alliance (DPA)”. Moreover, Germany-based data marketplace Datarade, Japanese stock photo provider Pixta, U.S. image licensing service vAIsual and music dataset company Rightsify are all the founding members of this group.

DETAILED SEGMENTATION OF THE GLOBAL AI TRAINING DATASET MARKET INCLUDED IN THIS REPORT

This research report on the global ai training dataset market has been segmented and sub-segmented based on the type, application, and region.

By Type

- Audio

- Image/Video

- Text

By Application

- Automotive

- BFSI

- Government

- Healthcare

- IT

- Retail and E-commerce

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Why is the AI Training Dataset Market important?

The AI Training Dataset Market is crucial because high-quality, diverse, and well-labeled datasets are the foundation of successful AI models. Without accurate and comprehensive data, AI systems cannot learn effectively, leading to poor performance and unreliable outcomes. The market facilitates access to these essential datasets, enabling organizations to develop robust AI solutions.

What are the key factors driving the growth of the AI Training Dataset Market globally?

The growth of the AI Training Dataset Market is driven by the increasing adoption of AI across industries, the rising demand for high-quality labeled data, advancements in AI technologies, and the need for diverse datasets to eliminate biases. Additionally, the proliferation of edge computing and IoT devices has created a surge in data generation, further fueling the market.

What types of datasets are most in demand in the AI Training Dataset Market?

The most in-demand datasets in the AI Training Dataset Market include image and video datasets for computer vision, text datasets for natural language processing (NLP), speech datasets for voice recognition, and structured datasets for predictive modeling. Industry-specific datasets, such as those for healthcare or finance, are also highly sought after.

How do businesses typically acquire datasets in the AI Training Dataset Market?

Businesses can acquire datasets through several channels in the AI Training Dataset Market, including purchasing from data vendors, using publicly available datasets, partnering with organizations for data sharing, or generating their own data. Increasingly, companies are also leveraging data marketplaces and platforms that offer ready-to-use, curated datasets for specific AI applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]