AI in FinTech Market Size, Share, Trends & Growth Forecast Report By Component (Solution and Service), Application (Robotic Process Automation (RPA), Chatbots and Virtual Assistants, Fraud Detection and Prevention, Algorithmic Trading, Credit Scoring and Risk Assessment), Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Blockchain and Cryptocurrency), & Region, Industry Forecast From 2024 to 2033

Global AI in FinTech Market Size

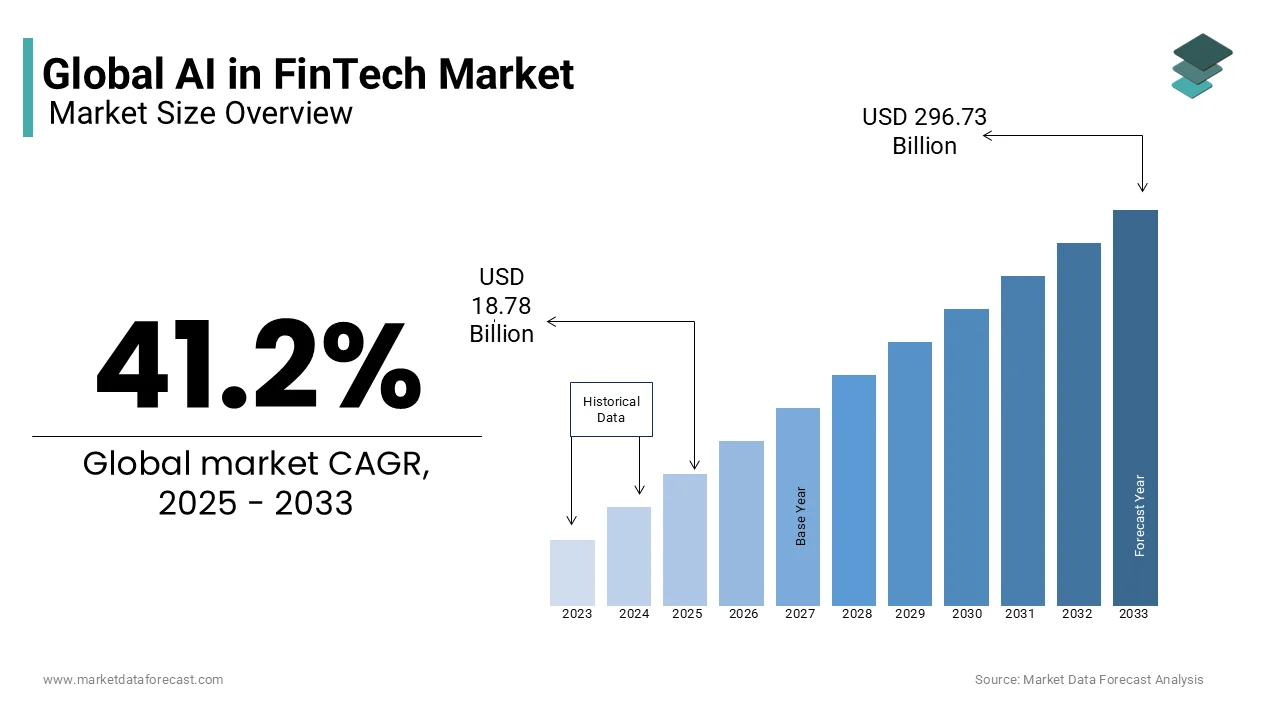

The size of the global AI in FinTech market was worth USD 13.3 billion in 2024. The global market is anticipated to reach USD 296.73 billion by 2033 from USD 18.78 billion in 2025, growing at a CAGR of 41.2% during the forecast period 2025 to 2033.

AI in FinTech refers to the integration of artificial intelligence (AI) technologies within financial technology systems. It involves using AI, such as machine learning algorithms and predictive analytics, to enhance financial services and processes. In FinTech, AI applications include credit scoring, fraud detection, risk assessment, personalized financial recommendations, algorithmic trading, and customer service automation. Its integration empowers FinTech companies to offer innovative, efficient, and personalized solutions, transforming the way financial services are delivered and experienced.

MARKET DRIVERS

The growing amount of data and increasing need for efficient data processing contributing to the global market growth.

The enhanced performance in customer service in the finance industry is boosting the adoption of AI and is one of the factors driving the growth of global AI in the fintech market. Artificial intelligence is growing more sophisticated, leading to the development of chatbots, virtual assistants and AI interfaces to communicate with clients. Furthermore, the chatbot takes advantage of a powerful sentiment analysis made feasible by artificial intelligence. The goal of this is to analyze the user's interaction with the fintech application or service, identify shortcomings and deal with such shortcomings. AI-driven chatbots provide simple and convenient communication between a bank and its customers. Likewise, basic complaints are handled by automated scripts. Certain banking organizations are expanding their clientele by utilizing chatbots.

The growing amount of data and increasing need for efficient data processing are fuelling the usage of AI to smoother the work processes, which is contributing to the global market growth. AI and machine learning have significantly helped banks and fintech by processing vast customer data, which enables timely service, product offerings, and enhancing customer relations. Financial institutions and insurance firms are increasingly utilizing machine learning in real-time target marketing to forecast the product propensity of their customers based on behavioral data. It assists in faster and more accurate decision-making in the credit valuation and loan process by effectively assessing credibility based on financial data. In addition, risk assessment and fraud detection capabilities were also enhanced by AI algorithms that analyze the previous data, and spot patterns and abnormalities. Security can be greatly improved by using AI-driven fraud detection systems that can identify fraudulent actions instantly.

The improved customer experience with the usage of AI is propelling the AI in fintech market. Companies were able to provide 24/7 support and quick response to client inquiries and problems. It has transformed the financial sector with personalized recommendations and offers customized to the customer's specific requirements and preferences. Furthermore, AI increases customer engagement with automated communication solutions that ensure clients are informed and pleased by sending them personalized messages and alerts. All these factors are boosting the expansion rate of the AI in fintech market.

MARKET RESTRAINTS

The use of AI in the FinTech market is currently without regulations which restricts the global market growth. Since artificial intelligence cannot be utilized for regulatory reporting, it differs from traditional and human-powered analytics in the financial services industry. This is because the propensity model cannot be taken out of the neural network and shown to the regulator. The obstacle to legal compliance could encourage financial institutions to disobey the law and commit corruption whether on purpose or accidentally. As a result, this is a significant barrier impeding the development of AI in the FinTech sector.

MARKET OPPORTUNITIES

Cloud-based firewalls are expected to offer numerous opportunities for the AI in fintech market. Urbanization, advancement and commercialization are the primary factors behind the market growth. In developing nations, chances for infrastructure development arise from small and medium-sized businesses' increasing knowledge of cloud-based firewalls. Other factors boosting the demand include industrial infrastructure growth, the prevalence of a small number of service providers, the rising use of centralized policy administration and easier installation, and the volume of organizational data sets. Moreover, the increasing spread of high-speed internet in developing economies would offer lucrative prospects to market participants. Furthermore, the market will continue to increase in the future due to the growing requirement to protect company networks from unauthorized and unusual attacks and the growing use of the services because of their smooth scalability.

MARKET CHALLENGES

AI investment in financial services has raised concerns about data security and transparency. AI's role in handling sensitive and confidential data necessitates additional security measures. Fintech companies are implementing robust data protection measures, including certifications, regulations, and security guidelines, to ensure customer data is handled effectively. Moreover, the shortage of qualified consultants to create artificial intelligence in fintech will limit the market's expansion. The growth will also be constrained by low awareness in developing nations and high deployment costs. The weak economies with weak infrastructure and lack of security concerns will further hinder the market growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

41.2% |

|

Segments Covered |

By Component, Application, Technology and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ant Financial, Square, Stripe, PayPal, Robinhood, Adyen, Revolut, Klarna, Wealthfront, Coinbase, Affirm, Betterment, SoFi, Plaid, ZestFinance, Kabbage, LendingClub, Fiserv, N26, and others. |

SEGMENTAL ANALYSIS

By Component Insights

The solution segment dominated the market and captured 68.4% of the global market in 2024 and is expected to continue the domination throughout the forecast period. Financial institutions can achieve a faster time-to-value by utilizing ready-to-use technologies that enable rapid deployment and integration. Solutions offer specialized services for tasks like fraud detection, credit scoring and chatbot implementation that are attractive to different Fintech sectors. The increasing utilization of cloud-based solutions improves affordability, scalability and accessibility.

The services segment is estimated to grow at a prominent CAGR during the forecast period owing to the increasing demand for AI consulting services in the finance industry.

By Application Insights

The fraud detection and prevention segment captured a share of 31.2% of the global AI in fintech market in 2024 and is expected to grow at a lucrative CAGR in the coming years owing to the growing threat landscape and strict laws and regulations. The use of AI in fraud detection and prevention is primarily fuelled by its efficacy in detecting and addressing fraudulent activity. Also, behavioral analytics, real-time fraud monitoring and machine learning-based techniques are gaining traction in fraud detection. The usage of AI and machine learning for fraud detection has significantly increased globally according to a poll conducted by SAS and ACFE.

The RPA segment is predicted to grow at a promising CAGR during the forecast period. RPA plays a dominating role in AI in FinTech market by reducing operational costs and enhancing efficiency in financial processes. Its dominance stems from the ability to streamline back-office operations, automate data entry, and ensure accuracy in transaction processing.

The chatbots and virtual assistants segment occupied a substantial share of the global market in 2024 and is anticipated to witness a healthy CAGR during the forecast period.

By Technology Insights

The machine learning (ML) segment stood as the leader in the global AI in fintech market in 2024 and the domination of the segment is expected to continue during the forecast period. The wide application across fintech verticals, capacity to manage intricate patterns and data, personalization and automation features are propelling the market share of machine learning. By helping fintech companies monitor regulatory compliance machine learning algorithms can help them avoid fines and penalties and maintain client trust.

REGIONAL ANALYSIS

North America is leading the AI in fintech market and is expected to witness an elevated growth rate during the forecast period. A major factor in the United States and Canada's high percentage of inventions originating from R&D is their strong focus on innovation. For example, Stripe has introduced a new identity verification tool to assist online merchants in preventing fraudulent payments. Users from more than 30 countries can safely have their identities verified by Stripe Identity using AI and ML technologies.

Asia Pacific AI in fintech market is predicted to have the largest CAGR. The high acceptance of digital payments and rising internet service penetration are driving this growth. APAC is now a promising market as a result of greater technological advancement. There are multiple prospects for the development of AI in the fintech industry due to the swift growth of domestic companies and the government's supportive policies.

Europe is anticipated to flourish with a considerable share of AI in fintech market during the forecast period. The business climate in Europe is driven by creativity, stability and technical advancements. It provides access to quality talent because of its highly educated populace, bilingualism among the majority of its citizens and its location as a hub for technology and finance. The European market presents an intriguing economic opportunity for Fintech companies which is evidenced by the numerous European nations like the Netherlands, Sweden, Denmark and Switzerland ranking first in the 2020 Global Innovation Index.

Latin America is in a transition phase and is expected to have a steady growth rate in the future. The financial payments sector is changing with nations like Mexico and Brazil emerging as fintech giants and adopting AI initiatives that are driving market competition. Fintech firms in Latin America receive 40 percent of investment capital which is leading the growth of fintech unicorns like Nubank and Konfio in Brazil, Argentina and Mexico.

The Middle East and Africa AI in fintech market are not fully matured but it also presents various opportunities for regional companies. The region faces challenges in utilizing digital banking and fintech adoption including a protective regulatory approach to capitalize on the potential opportunities ahead. Middle Eastern countries like Abu Dhabi, Bahrain, Dubai and Riyadh are aiming to establish fintech hubs to foster financial innovation. Moreover, Bahrain and Saudi Arabia have adopted a unified central bank strategy whereas the UAE's fintech is mostly built on the free zones of Abu Dhabi Global Market and Dubai International Financial Centre.

KEY PLAYERS IN THE MARKET

Companies playing a leading role in the global AI in fintech market include Ant Financial, Square, Stripe, PayPal, Robinhood, Adyen, Revolut, Klarna, Wealthfront, Coinbase, Affirm, Betterment, SoFi, Plaid, ZestFinance, Kabbage, LendingClub, Fiserv, N26, and others.

MARKET SEGMENTATION

This research report on the global AI in the fintech market has been segmented and sub-segmented based on component, application, technology and region.

By Component

- Solutions

- Services

By Application

- Robotic Process Automation (RPA)

- Chatbots and Virtual Assistants

- Fraud Detection and Prevention

- Algorithmic Trading

- Credit Scoring and Risk Assessment

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

- Blockchain and Cryptocurrency

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What role does AI play in fraud detection and prevention within the global fintech ecosystem?

AI-powered fraud detection systems use machine learning algorithms to analyze transactional data in real-time, identifying suspicious activities and preventing fraudulent transactions across diverse financial services globally.

What challenges does the adoption of AI pose for regulatory compliance in the fintech sector globally?

Regulatory compliance becomes complex due to the opaque nature of AI algorithms and concerns regarding data privacy and security. Global fintech companies need to ensure transparency, fairness, and accountability in their AI systems to comply with evolving regulations.

How does AI enable predictive analytics for financial forecasting in the global fintech landscape?

AI algorithms analyze historical and real-time financial data to generate accurate forecasts and insights, helping fintech companies globally make informed decisions regarding investment strategies, risk management, and market trends.

What future trends can we expect in the intersection of AI and fintech on a global level?

Future trends include the integration of AI with blockchain technology for enhanced security and transparency, the expansion of AI applications in regulatory compliance and cybersecurity, and the emergence of AI-driven personalized financial planning services catering to diverse consumer needs worldwide.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]