Global AI Consulting Services Market Size, Share, Trends & Growth Forecast Report By Service Type (Digital Strategy and Transformation, Application Development, Analytics Consulting, Cognitive Integration, and AI Customization), Technology, End-User, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2024 to 2033

Global AI Consulting Services Market Size

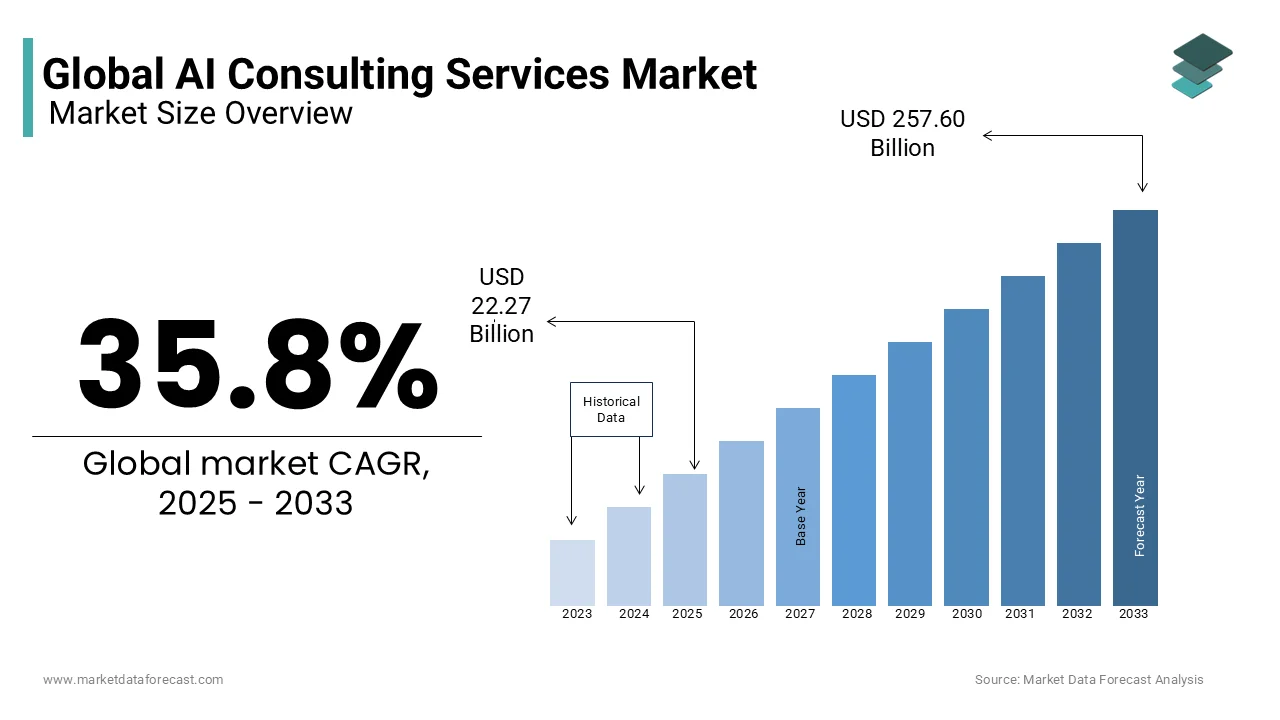

The global AI consulting services market size was valued at USD 16.4 billion in 2024. The global market is predicted to grow from USD 22.27 billion in 2025 to USD 257.60 billion by 2033, growing at a CAGR of 35.8% from 2025 to 2033.

The AI consulting services market is growing rapidly, as companies in nearly every sector are adopting artificial intelligence to drive efficiency, reduce costs, and create innovative solutions. AI consultants provide expertise in AI strategy, data engineering, machine learning model development, and system integration, guiding organizations through complex AI implementations. Key industries adopting these services include finance, healthcare, retail, and manufacturing, where AI applications streamline operations, enhance customer experiences, and drive insights. AI consulting services are increasingly sought to ensure ethical AI use, data privacy, and compliance with evolving regulations, especially in data-sensitive sectors like healthcare. Additionally, consultants play a critical role in guiding businesses through AI-related risks, such as algorithmic bias, to achieve fair and transparent outcomes. With demand growing, many consulting firms are enhancing capabilities by forming partnerships with leading technology providers to offer tailored AI solutions that align with specific business needs.

MARKET TRENDS

Rise of AI Ethics and Governance Consulting

AI ethics and governance have become critical as organizations prioritize ethical AI use, data privacy, and compliance. A 2023 Deloitte survey found that 62% of companies are concerned about ethical risks in AI, driving demand for consultants who specialize in risk management and regulatory compliance. These services help organizations design AI models that reduce bias, ensure transparency, and adhere to data privacy laws like GDPR. Many consulting firms now offer AI governance frameworks, helping clients implement AI in a way that aligns with societal expectations and regulatory standards, reducing legal risks and fostering trust among stakeholders.

Industry-Specific AI Solutions

As AI applications diversify, consulting services are increasingly industry-specific, tailored to solve unique challenges within sectors like healthcare, finance, and retail. For example, in healthcare, AI consultants work on diagnostic automation and patient data management solutions, with McKinsey estimating that AI could generate up to $360 billion in annual health benefits by 2030. Meanwhile, in finance, AI consulting focuses on fraud detection, risk assessment, and personalized client services. This trend highlights the need for sector-specialized expertise, as businesses seek consultants who understand both AI capabilities and industry regulations, ensuring effective, compliant AI implementations.

MARKET DRIVERS

Accelerated Digital Transformation Across Industries

The push for digital transformation has intensified, with over 70% of businesses globally either adopting or planning AI integration, according to a 2023 IBM report. AI consulting services are critical in helping companies navigate this shift from strategic planning to technology implementation. Consulting firms enable organizations to leverage AI in automation, predictive analytics, and customer experience enhancements. As digitalization becomes a competitive necessity, AI consultants guide organizations in aligning AI strategies with business goals, ensuring that digital transformation efforts result in measurable operational efficiencies and revenue growth.

Shortage of In-House AI Talent

A significant AI talent gap has fueled the demand for consulting expertise as companies struggle to find skilled professionals with AI-specific knowledge. According to the World Economic Forum, there is a shortage of 85 million skilled tech workers, a gap AI consulting firms help fill by providing expertise in machine learning, data engineering, and algorithm development. These firms offer immediate access to specialized skills that would be costly and time-consuming to build in-house, allowing organizations to fast-track AI projects while bridging the talent gap.

Increased Focus on Data-Driven Decision-Making

The rising value placed on data-driven insights is pushing organizations to adopt AI-driven analytics, with Gartner estimating that 80% of organizations will rely heavily on data by 2025. AI consulting firms are essential in designing and implementing analytics tools that transform vast datasets into actionable insights, improving decision-making and forecasting. In sectors like retail and finance, real-time data analysis enables adaptive strategies for customer engagement and market prediction, giving firms a competitive edge. AI consultants empower businesses to capitalize on data as a strategic asset, driving informed decisions and more personalized customer interactions.

MARKET RESTRAINTS

High Implementation Costs

The cost of implementing AI solutions remains a major restraint, especially for small- to medium-sized businesses. Developing and deploying AI technologies, along with associated consulting fees, can require significant investment, with PwC estimating that AI initiatives cost an average of $250,000 to $1 million per project. This high-cost limits accessibility for smaller firms that may lack the budget to afford specialized consulting, custom software, and infrastructure adjustments. As a result, cost challenges hinder broader market adoption, particularly in resource-limited sectors or regions, despite the potential efficiency gains AI could offer.

Data Privacy and Security Concerns

AI projects often require extensive data collection and processing, which raises privacy and security issues. In sectors like finance and healthcare, data sensitivity is paramount, with nearly 60% of businesses surveyed by Accenture expressing concerns over data security in AI. Consultants must address compliance with stringent regulations such as GDPR, HIPAA, and industry-specific data protocols. Breaches or misuse of sensitive data could lead to costly legal consequences, damaging trust and making organizations hesitant to proceed with AI projects that involve sensitive customer or business information.

Talent Shortage in AI Expertise

While the demand for AI consulting is high, a shortage of AI talent constrains market growth. According to LinkedIn's 2023 Workforce Report, AI and machine learning roles are among the hardest to fill, with a 74% talent gap worldwide. The limited availability of skilled professionals, including data scientists and AI engineers, can slow down consulting firms' capacity to take on new clients or projects, affecting service scalability. Additionally, high competition for talent drives up recruitment costs, making it challenging for consulting firms to expand their workforce quickly enough to meet market demand.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

AI consulting firms have a significant growth opportunity in emerging markets, where AI adoption is in the early stages but gaining momentum. Markets in Asia-Pacific, Latin America, and Africa are projected to see rapid AI growth, with AI investment in Asia alone expected to reach $200 billion by 2030 (IDC). By establishing local partnerships and tailored solutions for these regions, consulting firms can address region-specific challenges, such as limited AI infrastructure or regulatory nuances, positioning themselves to capture early market share and drive adoption in these high-growth areas.

Focus on AI-Driven Sustainability Initiatives

As sustainability becomes a core business priority, there is an opportunity for AI consulting firms to support green technology and sustainability initiatives. AI can optimize resource use, energy management, and supply chain efficiency, aligning with corporate social responsibility goals. According to McKinsey, companies embracing sustainable AI can reduce operational costs by up to 15%. Consulting firms can help organizations integrate AI for sustainable practices, from carbon tracking to predictive maintenance, which appeals to environmentally conscious clients and aligns with the increasing regulatory push for sustainability.

Integration of Generative AI Solutions

The rise of generative AI models, such as those used for content creation, customer support, and coding, represents an untapped market for consulting services. With Gartner predicting that by 2025, generative AI will account for 10% of all data produced, consulting firms can support businesses in adopting these tools for tasks like automated content creation, personalized marketing, and product design. By helping clients leverage generative AI effectively, consulting firms can guide organizations to improve productivity, foster innovation, and create new revenue streams, making generative AI an attractive opportunity for expanding consulting portfolios.

MARKET CHALLENGES

Rapidly Evolving Technology Landscape

The fast pace of AI innovation poses a significant challenge for consulting firms to stay updated with the latest advancements. New AI models, frameworks, and tools are continuously emerging, with OpenAI, Google, and others releasing significant updates annually. For consulting firms, this rapid change requires ongoing investment in training and technology upgrades to maintain expertise, which can be costly and time-intensive. Falling behind can impact a firm’s competitive edge and client trust, as clients increasingly expect cutting-edge AI solutions aligned with the latest developments.

Client Expectations for Quick ROI

Clients often have high expectations for swift returns on their AI investments, which can be difficult to meet due to the complexity and time required for successful AI implementations. A 2022 BCG survey found that 70% of AI initiatives take longer than expected to deliver measurable ROI. AI consulting firms face pressure to balance realistic timelines and cost estimates with client demands for rapid results. This expectation gap can lead to strained relationships if outcomes are slower or less dramatic than anticipated, impacting both client satisfaction and retention.

Complexity of Data Integration Across Systems

AI consulting projects frequently require integrating data from various legacy systems, which can be technically challenging and time-consuming. According to Deloitte, 55% of companies report that incompatible data systems slow down their AI initiatives. AI consultants must navigate this complexity to provide unified insights across platforms, which often involves custom data engineering and middleware solutions. The complexity of this integration can extend project timelines, increase costs, and add risks, especially in industries with strict data handling regulations, creating a barrier to seamless AI implementation for consulting clients.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.44% |

|

Segments Covered |

By Service Type, Technology, End-User and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Accenture, Deloitte, IBM, McKinsey & Company, PwC (PricewaterhouseCoopers), Boston Consulting Group (BCG), Booz Allen Hamilton, KPMG, Ernst & Young (EY) and Capgemini |

SEGMENTAL ANALYSIS

By Service Type Insights

The digital strategy and transformation led the market by capturing 35.3% of the global market share in 2024. Digital transformation is foundational to most AI implementations, helping businesses create clear, AI-driven strategies to enhance competitive positioning and streamline operations. With 90% of organizations worldwide engaging in digital transformation efforts (according to a 2023 IDC report), consulting services for digital strategy and transformation have become essential to guide AI adoption, particularly in structuring data governance, aligning AI with business goals, and ensuring regulatory compliance. These services are vital for large enterprises and smaller firms alike, as they enable seamless integration of AI technologies, increase efficiency, and support overall digital maturity.

The cognitive integration is predicted to register the fastest CAGR of 36.68% over the forecast period. This segment focuses on integrating AI systems with human-like cognitive capabilities such as natural language processing (NLP), computer vision and machine learning into existing business operations. The surge in demand is driven by industries like healthcare and customer service, where cognitive AI applications can greatly enhance user experiences and decision-making. According to Gartner, 50% of businesses are projected to adopt AI-driven cognitive technologies by 2026 to automate customer interactions and improve data analysis. Cognitive Integration is critical because it facilitates more sophisticated AI solutions, allowing companies to automate complex tasks, personalize customer interactions, and increase operational efficiency across sectors.

By Technology Insights

The big data analytics segment dominated the market and held 40.8% of the global market share in 2024. This dominance is due to the essential role big data analytics plays in the foundation of AI, enabling businesses to manage, analyze, and derive actionable insights from massive datasets. As organizations across sectors rely heavily on data-driven decision-making, big data analytics services are critical for building and scaling AI capabilities. With IDC reporting that global data generation is projected to exceed 175 zettabytes by 2025, consulting services focused on big data analytics are vital to helping organizations transform raw data into competitive assets, optimize processes, and uncover predictive insights.

The computer vision segment is projected to witness the highest CAGR in the global market over the forecast period. This growth is driven by high demand for AI applications in sectors like retail, healthcare, automotive, and manufacturing, where computer vision enables automation, quality control, and advanced imaging. For example, the adoption of computer vision in autonomous vehicles and medical imaging has created new market opportunities, with PwC estimating the technology could contribute $1.5 trillion to the global economy by 2030. The importance of computer vision lies in its ability to transform visual data into insights, automate complex visual tasks, and enhance product quality and safety across industries.

By End User Insights

The BFSI segment was the leading segment in the global market in 2024 and captured 30.9% of the worldwide market share. The dominance of BFSI segment is majorly driven by the industry's reliance on AI for fraud detection, risk assessment, customer analytics, and personalized financial services. AI consulting is crucial in helping BFSI firms implement predictive analytics, automate workflows, and comply with stringent regulatory requirements. According to a 2023 PwC report, 80% of financial institutions have adopted AI technologies to enhance operational efficiency. The sector's reliance on accurate decision-making and data security ensures BFSI remains a key driver of demand for AI consulting.

The healthcare segment is likely to register the highest CAGR in the global market over the forecast period. This growth of the healthcare segment is primarily fuelled by the increasing adoption of AI in diagnostics, patient care, and drug discovery. For example, AI-powered imaging solutions and predictive analytics improve diagnostic accuracy, while telemedicine platforms enhanced by AI streamline patient management. A 2022 McKinsey report highlights that AI could generate $360 billion annually in healthcare cost savings globally by 2030. Consulting services are vital in this sector to ensure compliance with strict data privacy laws like HIPAA while enabling organizations to harness AI to improve patient outcomes and operational efficiencies.

REGIONAL ANALYSIS

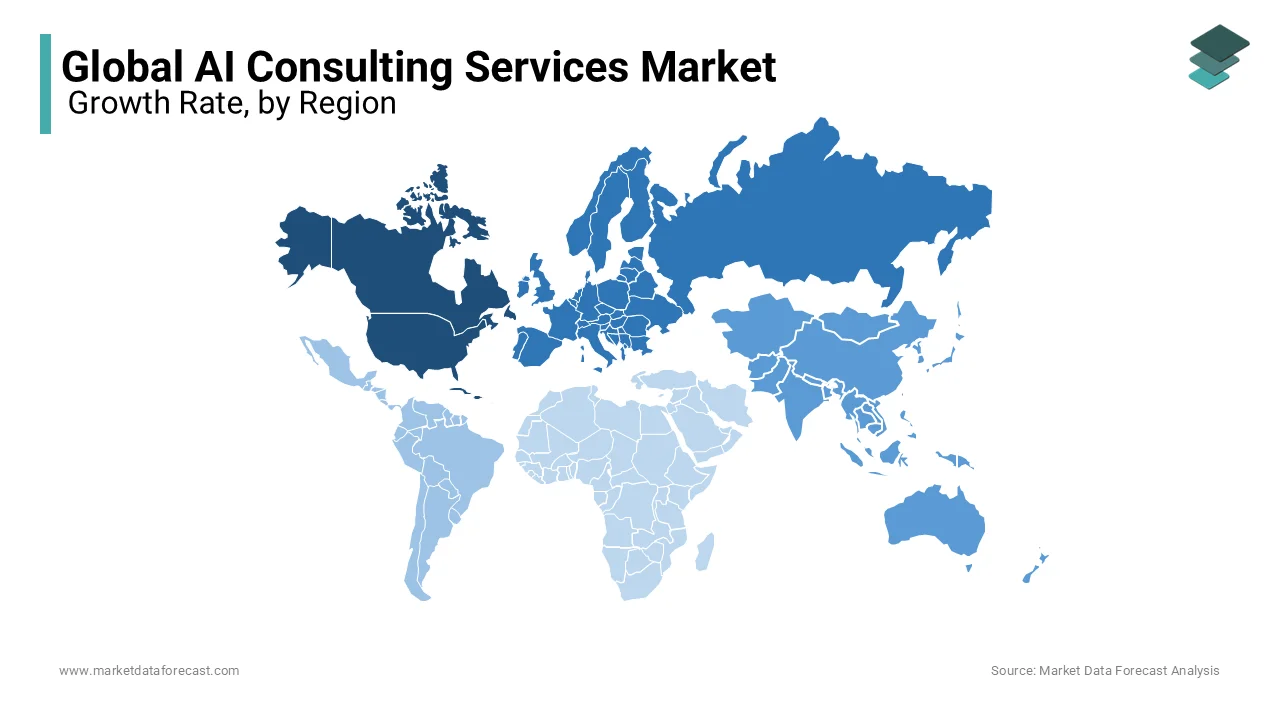

North America held the dominant share of 40.1% of the global market in 2024. The dominance of North America in the global market is driven by the United States, which serves as a global leader in AI innovation, supported by significant investments in research and development (R&D). According to the U.S. Department of Commerce, AI-related spending in the U.S. alone reached $64 billion in 2022, with industries such as healthcare, finance, and technology heavily leveraging AI solutions. The region benefits from a robust technological ecosystem, including Silicon Valley, and the presence of major tech giants like IBM, Microsoft, Google, and Amazon Web Services (AWS). These companies not only drive innovation but also set global standards for AI adoption. Additionally, favorable government policies, such as the National AI Initiative Act, have further accelerated AI development.

The Asia-Pacific region is estimated in registering a CAGR of 35.6% in the AI consulting services market during the forecast period. This rapid expansion is fueled by several factors, including the region's aggressive digital transformation initiatives, increasing adoption of AI across diverse sectors like manufacturing, healthcare, and financial services, and strong governmental support. For instance, China’s "New Generation Artificial Intelligence Development Plan" aims to make the country a global AI leader by 2030, with an estimated investment of $150 billion. Similarly, India’s National Strategy for Artificial Intelligence focuses on leveraging AI for social and economic development. According to the International Data Corporation (IDC), AI spending in Asia-Pacific is expected to exceed $100 billion by 2025. Countries like Japan and South Korea are also investing heavily in AI-driven automation and robotics, that further propel the market growth.

Europe, Latin America, the Middle East, and Africa are expected to witness steady growth in the AI consulting services market. Europe is witnessed to grow steadily in the next coming years with the stringent regulations like the General Data Protection Regulation (GDPR) and widespread adoption of AI in industrial automation. Germany and the UK are leading contributors, with the European Commission estimating that AI could add €2.7 trillion to the EU economy by 2030. In Latin America, Brazil stands out as a key player with the rising fintech adoption and digital banking initiatives, according to the Inter-American Development Bank. Meanwhile, the Middle East and Africa are gradually embracing AI, particularly through smart city projects and energy sector innovations. PwC estimates that AI could contribute $96 billion to the MENA economy by 2030.

KEY MARKET PLAYERS

Companies playing a major role in the global AI consulting services market include Accenture, Deloitte, IBM, McKinsey & Company, PwC (PricewaterhouseCoopers), Boston Consulting Group (BCG), Booz Allen Hamilton, KPMG, Ernst & Young (EY) and Capgemini.

COMPETITIVE LANDSCAPE

The global AI consulting services market is highly competitive, characterized by the presence of major players such as Accenture, Deloitte, IBM, McKinsey & Company, PwC, Boston Consulting Group (BCG), Booz Allen Hamilton, KPMG, Ernst & Young (EY), and Capgemini. These companies are leveraging their expertise in technology, strategy, and industry-specific solutions to capture significant market share. Accenture leads with its robust AI capabilities, including partnerships with tech giants like Microsoft and Google, enabling it to deliver scalable AI solutions across industries. Similarly, IBM stands out with its advanced AI platforms, such as Watson, which cater to healthcare, finance, and supply chain optimization.

McKinsey & Company and BCG focus on strategic AI consulting, helping businesses integrate AI into their core operations for enhanced efficiency and innovation. Meanwhile, the "Big Four" accounting firms like PwC, KPMG, EY, and Deloitte combine their auditing and advisory expertise with AI-driven analytics to offer tailored solutions. Booz Allen Hamilton specializes in government and defense AI applications, while Capgemini emphasizes AI-powered digital transformation.

The competition is further intensified by investments in R&D, mergers and acquisitions, and collaborations with startups to enhance AI capabilities. According to a report by Gartner, these firms collectively account for over 60% of the global AI consulting market revenue. However, the market remains fragmented, with smaller niche players also contributing innovative solutions. This dynamic landscape underscores the need for continuous innovation and adaptability to maintain leadership in the rapidly evolving AI ecosystem.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Companies like Accenture and IBM frequently partner with technology giants such as Microsoft, Google, and AWS to co-develop AI solutions. For instance, Accenture’s collaboration with Microsoft Azure enables it to deliver scalable AI platforms for enterprise clients. Similarly, IBM partners with healthcare organizations to leverage its Watson AI for predictive analytics and diagnostics.

Acquisitions and Expansions

Acquiring niche AI startups is a common strategy to enhance capabilities. For example, Deloitte acquired Root9B, a cybersecurity firm specializing in AI-driven threat detection, to bolster its AI portfolio. Capgemini acquired Altran Technologies, strengthening its expertise in AI and engineering services.

R&D INVESTMENTS

Firms invest heavily in R&D to develop proprietary AI tools. IBM spends over $5 billion annually on AI research, enabling innovations like natural language processing (NLP) and machine learning algorithms. McKinsey’s QuantumBlack unit focuses on advanced analytics and AI modeling.

Thought Leadership and Industry Reports

Publishing insights and reports positions firms as industry leaders. PwC’s annual AI studies, such as the "AI Predictions Report," provide valuable market forecasts, enhancing credibility.

Customized Solutions and Upskilling

Offering tailored AI solutions and training programs strengthens client relationships. For instance, EY launched an AI training academy to upskill employees and clients, fostering long-term partnerships.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Accenture, a global professional services company, acquired Flutura, an industrial AI company. This acquisition is anticipated to allow Accenture to deliver advanced data analytics solutions to manufacturing and energy clients, strengthening its market position.

- In May 2023, Deloitte partnered with NVIDIA to develop AI-powered solutions for industries such as healthcare and retail. This partnership is anticipated to enable Deloitte to integrate NVIDIA’s AI technology, enhancing its capability to provide scalable AI applications and solidifying its market presence.

- In April 2022, IBM launched the IBM Sustainability Accelerator, an initiative leveraging AI to support global environmental and sustainability projects. This launch is expected to strengthen IBM’s focus on AI for social good, expanding their expertise in AI-driven sustainability.

- In July 2023, McKinsey & Company acquired Iguazio, a machine learning and MLOps company. This acquisition is anticipated to allow McKinsey to offer end-to-end AI model deployment services, helping clients accelerate their time-to-market for AI projects.

- In September 2022, PwC introduced "Responsible AI" services to help clients manage AI risks and adhere to ethical standards. This service is expected to enhance PwC’s commitment to ethical AI, appealing to clients focused on compliance and governance.

- In March 2023, Boston Consulting Group (BCG) formed a partnership with DataRobot, an automated machine-learning platform provider. This partnership is anticipated to strengthen BCG’s predictive analytics capabilities, enabling faster AI implementation and insights generation for clients.

- In January 2023, Booz Allen Hamilton launched the Modzy platform for AI model deployment and monitoring aimed at the defense and government sectors. This launch is anticipated to enhance Booz Allen’s market presence in government AI services, particularly in secure environments.

- In June 2023, KPMG expanded its AI capabilities by acquiring SparkBeyond, a machine-learning technology company. This acquisition is expected to allow KPMG to deliver deeper insights and analytics-driven solutions, enhancing their value to clients in finance and healthcare.

- In December 2022, Ernst & Young (EY) invested in an AI-powered financial audit platform to improve audit accuracy and efficiency. This investment is anticipated to bolster EY’s position as a leader in AI-driven financial auditing, appealing to clients needing precise compliance tools.

- In August 2023, Capgemini launched an AI-based Intelligent Process Automation service focused on supply chain and logistics. This launch is expected to enable Capgemini to streamline client operations, strengthening its competitive edge in AI for process automation.

MARKET SEGMENTATION

This research report on the global AI consulting services market is segmented and sub-segmented based on the service type, technology, end-user and region.

By Service Type

- Digital Strategy and Transformation

- Application Development

- Analytics Consulting

- Cognitive Integration

- AI Customization

By Technology

- Big Data Analytics

- Predictive Analytics

- BI Implementation

- Computer Vision

- Others

By End User

- Retail

- BFSI

- Manufacturing

- Healthcare

- IT and Telecom

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global AI consulting services market?

The global AI consulting services market was valued at USD 16.4 billion in 2024 and is anticipated to be as big as USD 257.60 billion by 2033.

What is predicted CAGR of the global AI consulting services market?

The global AI consulting services market is estimated to grow at a CAGR of 35.8% from 2025 to 2033.

Which segment by service type is dominating the global AI consulting services market?

The digital strategy and transformation segment is the most dominant segment in the worldwide market currently.

Who are the key players in the AI consulting services market?

Accenture, Deloitte, IBM, McKinsey & Company, PwC (PricewaterhouseCoopers), Boston Consulting Group (BCG), Booz Allen Hamilton, KPMG, Ernst & Young (EY), and Capgemini are a few of the notable companies in the global market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]