Global Agrochemicals Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Fertilizers, Pesticides, Plant Growth Regulators and Adjuvants), Application (Crop Based and Non Crop Based) and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Industrial Analysis (2025 to 2033)

Global Agrochemicals Market Size

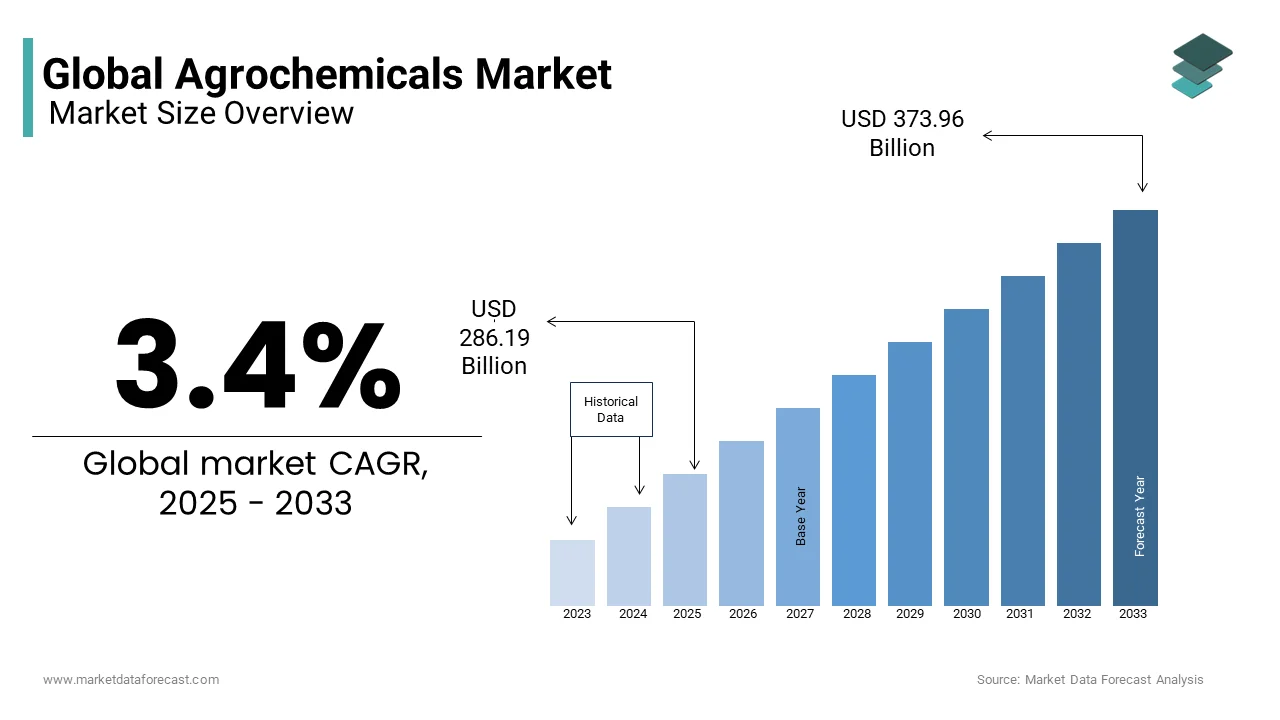

The global agrochemicals market was valued at USD 276.68 billion in 2024 and is anticipated to reach USD 286.19 billion in 2025 from USD 373.96 billion by 2033, growing at a CAGR of 3.4% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL AGROCHEMICAL MARKET

Agrochemicals consist of specialty chemical products such as synthetic fertilizers, pesticides, plant growth regulators, and adjuvants, which are employed in the agriculture industry.

With the shortage of land and water, there has been an increased emphasis on the acceptance of innovative technologies that can help increase crop harvest. As such, agrochemicals are observing a substantial demand since farmers are determined to attain nutritious and high-quality crop production. Agrochemicals’ task is to safeguard crops, increase crop yields, and sustain food and soil quality. Another important function of agrochemicals is to transform the growth progression of the plants.

The growth of the agrochemicals market is majorly driven by factors such as growing awareness towards the use of fertilizers and pesticides in key crop-producing countries, a wide range of pest control applications of agrochemicals, and decreasing arable land. Another major factor driving the market is the globally increasing population, which leads to the need for an increase in crop yield.

However, safer alternatives such as bio-farming and organic pesticides, volatile economies, and various environmental and health hazards linked with agrochemicals are the major restraining factors for the market.

Agrochemicals includes fertilizers, pesticides and plant growth regulators are pivotal in improving agricultural productivity and crop yields worldwide. Increasing demand for food due to population growth, urbanization, and shrinking arable land is driving the need for agrochemicals to optimize agricultural efficiency. The global agrichemicals market is expected to grow at a steady rate over the forecast period owing to the advancements in crop protection technologies, integrated pest management, and precision farming. Regionally, Asia-Pacific, particularly China and India, dominates the market due to large agricultural sectors, growing awareness of modern farming techniques, and government support for food security. However, North America and Europe are also key players due to their focus on innovative and sustainable solutions such as bio-based agrochemicals to meet stringent environmental regulations.

MARKET DRIVERS

Growing Food Demand and Limited Arable Land

The population is on the rise worldwide and is projected to reach nearly 10 billion by 2050, which is predicted to increase the food demand by 70%. However, arable land per capita is declining due to urbanization and land degradation. To maximize yields on available land, farmers increasingly rely on agrochemicals like fertilizers and pesticides. According to the reports of the Food and Agriculture Organization (FAO), fertilizer demand alone is growing by about 1.5% annually, primarily in high-demand regions such as Asia-Pacific. This reliance on agrochemicals is vital to bridging the yield gap, ensuring food security, and supporting the production of diverse crops.

Advancements in Agricultural Technology

The rise of precision farming techniques, including GPS-guided equipment, soil sensors, and drone-based crop monitoring that allow for more efficient use of agrochemicals. For example, targeted pesticide application can reduce chemical use by up to 90% in some cases. Similarly, sensors that monitor nutrient levels enable farmers to apply fertilizers precisely where needed, minimizing waste and environmental impact. These innovations not only help farmers save costs but also support sustainable farming practices by reducing excess chemical runoff, benefiting the ecosystem.

Rising Demand for Bio-Based Agrochemicals

Environmental concerns and regulatory pressures are driving a shift toward bio-based agrochemicals, which are derived from natural sources and generally pose lower risks to ecosystems. According to reports, bio-pesticides that are derived from plants, bacteria, and other natural sources are less harmful to pollinators like bees, whose populations are vital for 35% of global crop production. As a result, eco-conscious farmers and consumers are supporting bio-based alternatives, which align with sustainable farming practices and environmental goals, such as reducing reliance on synthetic chemicals and protecting biodiversity.

MARKET RESTRAINTS

Stringent Environmental and Regulatory Restrictions

Regulatory pressures, especially in regions such as the European Union and North America, are increasingly restricting the use of certain chemical pesticides and fertilizers due to environmental and health concerns. For instance, the EU has banned or restricted over 500 pesticides that were previously permitted, and their Green Deal aims to reduce chemical pesticide usage by 50% by 2030. Such regulations make it costly and time-consuming for agrochemical companies to comply and develop new products. Moreover, companies are frequently challenged by varying standards across countries, adding complexity to global market operations.

Rising Consumer Demand for Organic and Chemical-Free Products

An increasing number of consumers are choosing for organic, chemical-free produce due to the concerns such as over health and environmental impact. Global organic farmland has grown over 50% in the last decade, which is indicating the demand for organic products and decreasing reliance on synthetic agrochemicals. This shift impacts agrochemical sales as organic farming methods generally avoid synthetic pesticides and fertilizers, instead favoring natural alternatives. The preference for “clean-label” food products is pressuring food producers and retailers to limit or eliminate agrochemical-treated produce, further restraining conventional agrochemical demand.

High Costs Associated with R&D and Product Approval

Developing new agrochemicals, especially bio-based or environmentally safe options, requires significant investment in research and development. It takes about 10 years and nearly $300 million to bring a new pesticide product to market due to extensive testing and regulatory approval processes. Moreover, meeting stricter environmental standards often demands additional innovation and investment. This long and costly path deters smaller companies from entering the market and can constrain larger firms’ profitability, limiting product innovation and competition. High R&D costs, coupled with the long approval timelines, make it challenging for the industry to quickly adapt to evolving market demands and regulatory landscapes.

MARKET OPPORTUNITIES

Rising Focus on Crop-Specific Agrochemical Solutions

Crop-specific formulations designed for the unique needs of particular plants is a notable growth opportunity in the market. For instance, certain crops, such as citrus and grapes, require specific fungicides to combat unique diseases, while cereals benefit from nitrogen-optimized fertilizers. Customized solutions enable farmers to target the specific growth challenges of each crop, enhancing yield and minimizing chemical overuse. This targeted approach is particularly appealing in high-value crop segments, where farmers are willing to invest more in specialty solutions to protect their crops and optimize productivity. As the demand for these tailored agrochemical products grows, it presents an opportunity for companies to innovate and expand their product portfolios in line with crop-specific needs.

MARKET CHALLENGES

Environmental Impact and Public Perception

The environmental impact of agrochemicals such as soil degradation, water contamination, and harm to non-target organisms like bees, is increasingly scrutinized by both consumers and regulators. The UN estimates that pesticide runoff affects over 20% of global freshwater systems, posing risks to biodiversity and public health. This has led to a shift in public perception, with consumers increasingly favoring organic products and “clean” labels. Agrochemical companies are therefore challenged to balance product effectiveness with sustainability, making the transition to eco-friendly solutions while still meeting the growing food demand.

Climate Change and Its Effects on Crop Patterns

Climate change poses a significant challenge by altering weather patterns and crop productivity, directly affecting the effectiveness and application of agrochemicals. Extreme weather events like droughts and floods disrupt farming cycles, reduce crop resilience, and alter pest and disease patterns. For example, warmer temperatures are expanding the range of pests into previously unaffected regions, requiring new pest control measures. Additionally, changing rainfall patterns impact the timing and efficiency of agrochemical application, reducing their effectiveness and sometimes increasing the quantities required. Agrochemical companies must adapt to these shifts, which requires continuous research into climate-resilient formulations and adaptive pest management solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.40% |

|

Segments Covered |

Based on Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer Crop Science., Dow-DuPont, Syngenta AG, BASF SE, Agrium Inc., Monsanto Company, Israel Chemicals Ltd., Yara International ASA, Mosaic Company and Sociedad Química Y Minera S.A |

SEGMENTAL ANALYSIS

Global Agrochemicals Market By Type

By Type Insights

The fertilizers segment led the market and accounted for 66.2% of the global market share in 2023. Fertilizers are essential for enhancing soil nutrients, particularly nitrogen, phosphorus, and potassium, which are critical for crop growth and yield. Their dominance stems from their pivotal role in increasing food production to meet the demands of a growing global population. According to research studies, fertilizers contribute up to 50% of global crop yield increases, and with arable land per capita shrinking, farmers are increasingly dependent on fertilizers to maximize output on limited land. Fertilizers are especially crucial in regions with intensive agriculture, such as Asia-Pacific, which consumes the majority of global fertilizer production due to high crop demands.

However, the plant growth regulators (PGRs) segment is expected to witness the fastest CAGR of 8.12% over the forecast period. PGRs are substances that influence plant growth rates, flowering, and fruiting, thereby enabling farmers to optimize yields under varying environmental conditions. The growth in this segment is driven by the rising adoption of sustainable farming practices and the demand for higher-value crops. PGRs help mitigate the impacts of environmental stress on crops, a critical advantage as climate change increasingly affects agriculture. Additionally, with the increasing focus on maximizing efficiency, farmers are using PGRs to manage crop size and fruit quality more precisely, particularly in high-value sectors like horticulture and viticulture. As sustainability in agriculture gains momentum, PGRs are anticipated to play a growing role in optimizing resource use and enhancing crop resilience.

By Application Insights

The crop-based segment ruled the market by accounting for 83.7% of the global market share in 2023. This segment includes agrochemicals used in staple crops like cereals, grains, fruits, and vegetables, which are essential for human and livestock consumption. The primary driver behind the dominance of crop-based applications is the need to increase food production to meet rising global demand. With the United Nations projecting that food production must increase by around 70% by 2050 to feed a growing population, agrochemicals are crucial for maximizing crop yields. Crop-based agrochemicals, such as fertilizers and pesticides, significantly boost productivity, helping farmers address food security challenges and maintain stable food supplies.

On the other hand, the non-crop-based segment is gaining traction and is likely to register a CAGR of 6.68% over the forecast period. This growth is driven by rising interest in landscaping, recreational spaces, and ornamental horticulture, especially in urbanized areas and developed regions. With increasing urbanization, particularly in North America and Europe, demand for agrochemicals used in green spaces, sports fields, and public landscapes is rising as communities focus on aesthetic and environmental quality. Moreover, the trend toward home gardening, accelerated by a growing interest in self-sufficiency and green spaces, further contributes to the growth of this segment. Non-crop applications thus play an essential role in promoting urban greening and biodiversity, meeting the demands of city dwellers for well-maintained, green environments.

REGIONAL ANALYSIS

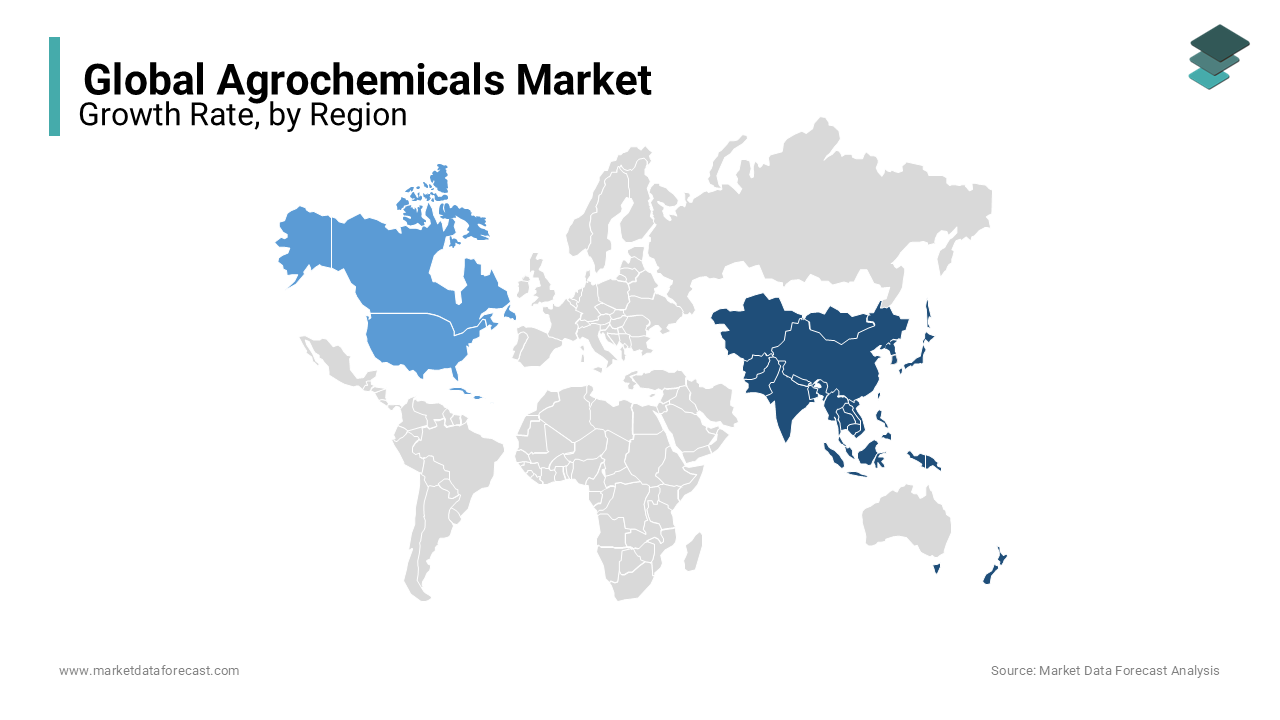

Asia-Pacific led the agrochemicals market and captured 40.8% of the global market share in 2023 due to its vast agricultural base, high food demand, and large populations, particularly in China, India, and Indonesia. The growth of the agrochemicals market in the Asia-Pacific region is majorly driven by government initiatives and policies focused on food security and productivity. For instance, India’s Pradhan Mantri Krishi Sinchai Yojana aims to enhance irrigation, while China’s policies emphasize agricultural self-sufficiency. The need to maximize yields on limited arable land, exacerbated by rapid urbanization, further drives agrochemical demand. As Asia-Pacific countries continue to adopt modern farming methods and technologies, the demand for fertilizers and pesticides is expected to remain robust, keeping the region at the forefront of the global agrochemicals market.

North America is another regional market for agrochemicals and accounted for a substantial share of the global market in 2023. The U.S. dominated the market in North America and is the regional leader due to its advanced agricultural infrastructure and high adoption of precision farming technologies. The rise in the consumer demand for sustainable farming practices and bio-based agrochemicals are boosting the regional market growth. Regulatory standards and consumer preferences are shifting towards environmentally friendly and organic products, prompting a trend towards bio-agrochemicals. This regional market is expected to benefit from ongoing technological advancements in precision farming, which enables more efficient and targeted use of agrochemicals, thereby addressing both productivity and sustainability concerns.

Europe accounts for a notable share of the global agrochemicals market. The growth of the European market is fuelled by the stringent environmental regulations that prioritize sustainable farming practices. The Green Deal of European Union that aims to reduce chemical pesticide usage by 50% by 2030 is favouring the regional market growth. Key markets like Germany, France, and Spain are transitioning towards bio-based agrochemicals as part of broader sustainability goals. The EU’s Common Agricultural Policy incentivizes organic farming, which is driving demand for biopesticides and organic fertilizers. Although strict regulations present challenges, the emphasis on bio-agrochemical adoption positions Europe for steady, sustainable growth aligned with evolving environmental standards.

Latin America is one of the fastest-growing regions in the global market. Brazil and Argentina are significant contributors, with extensive agricultural lands and high export demand for crops such as soybeans, coffee, and sugarcane. Brazil is a regional leader, given its large-scale farming operations and favorable climate that supports year-round crop production. The increasing global demand for Latin American agricultural exports is fueling agrochemical consumption as farmers intensify production. However, potential environmental regulations, particularly in Brazil, could impact future market dynamics as the region balances productivity with sustainability concerns.

The market in Middle East and Africa holds the smallest share of the agrochemicals market. Countries such as South Africa, Egypt, and Saudi Arabia invest in agrochemicals to boost food security and reduce reliance on imports. South Africa is a key market within Africa, while Egypt and Saudi Arabia focus on agricultural modernization to counter limited arable land and water scarcity. Despite infrastructure and climate challenges, government initiatives and growing investments in agriculture are expected to drive agrochemical demand. MEA’s market growth is seen as essential for addressing food security and agricultural productivity in the face of climate variability and resource constraints.

KEY MARKET PLAYERS

The global market for agrochemicals is extremely consolidated and streamlined owing to the domination of the market by a handful of companies. Some of the major companies dominating this market are Bayer Crop Science., Dow-DuPont, Syngenta AG, BASF SE, Agrium Inc., Monsanto Company, Israel Chemicals Ltd., Yara International ASA, Mosaic Company and Sociedad Química Y Minera S.A.

MARKET SEGMENTATION

This research report on the global agrochemicals market has been segmented and sub-segmented based on type, application and region.

By Type

- Fertilizers

- Nitrogenous

- Phosphate

- Potassic Based Fertilizers

- Pesticides

- Organophosphates

- Pyrethroids

- Biopesticides

- Others

- Plant Growth Regulators

- Auxins

- Cytokinins

- Others

- Adjuvants

- Activator Adjuvants

- Utility Adjuvants

By Application

- Crop Based

- Oil seeds

- Fruits & Vegetables

- Grains & Cereals

- Non-Crop Based

- Turf & Ornamental Grass

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region dominates the Global Agrochemical Market?

Asia-Pacific currently dominates the Global Agrochemical Market, holding the largest market share.

What is the anticipated CAGR (Compound Annual Growth Rate) for the Global Agrochemical Market?

The Global Agrochemical Market is expected to grow at a CAGR of 3.40% over the forecast period

In agrochemical market what products are consists?

By type, Type Insights and Application Insights are the global agrochemical market.

who are the key market players involved in the global agrochemical market?

Bayer Crop Science., Dow-DuPont, Syngenta AG, BASF SE, Agrium Inc., Monsanto Company, Israel Chemicals Ltd., Yara International ASA, Mosaic Company and Sociedad Química Y Minera S.A.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]