Global Agriculture Anti Transpirant Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Stomatal Closing Type, Film Forming Type, Reflectance Type And Growth Retardant), Application (Crops, Garden, Turf And Ornamental) And Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Agriculture Anti-Transpirant Market Size

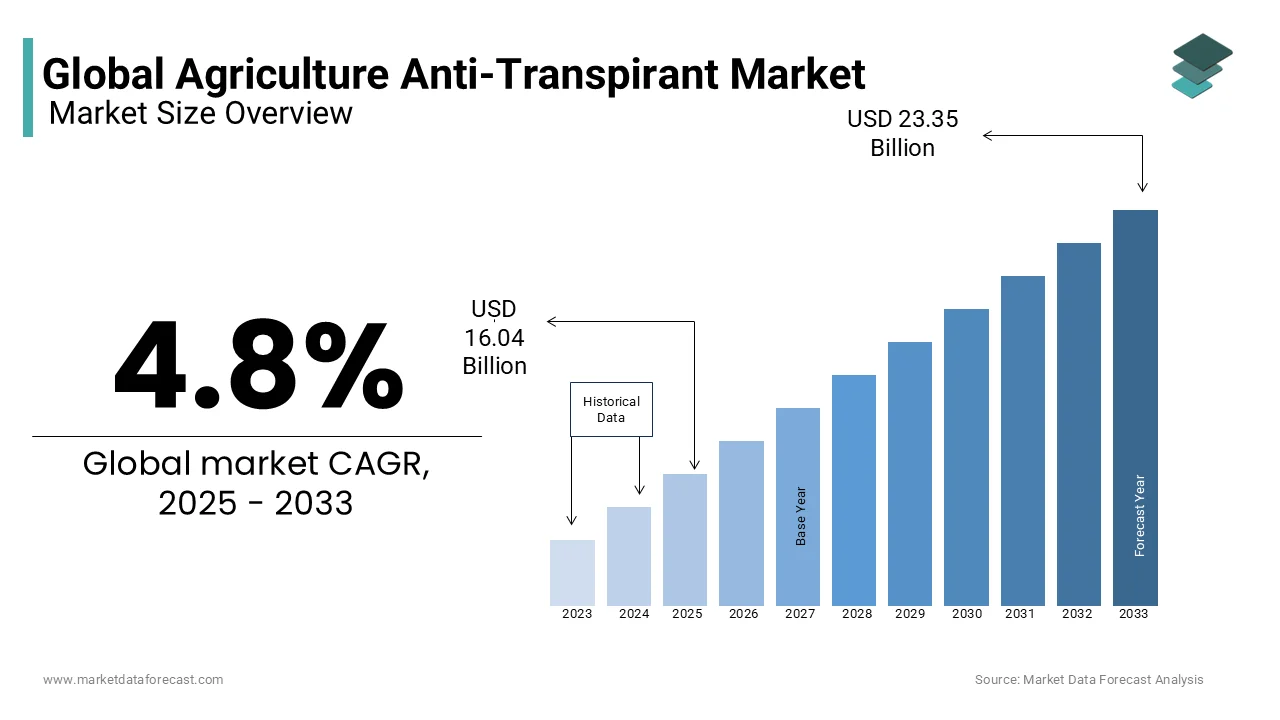

The global agriculture anti-transpirant market was valued at USD 15.31 billion in 2024 and is anticipated to reach USD 16.04 billion in 2025 from USD 23.35 billion by 2033, growing at a CAGR of 4.8% from 2025 to 2033.

Agriculture anti-transpirants are gaining prominence as a critical solution for mitigating water stress in crops, particularly in regions facing prolonged droughts and erratic rainfall patterns. According to the Food and Agriculture Organization (FAO), over 40% of global agricultural land is affected by water scarcity, underscoring the urgent need for innovative solutions like anti-transpirants. These compounds work by reducing water loss through transpiration, enabling plants to maintain optimal hydration levels during periods of limited water availability. The United Nations Environment Programme highlights that the use of anti-transpirants can enhance crop yields by up to 25% while conserving water resources, aligning with global sustainability goals. For instance, farmers in arid regions of India using film-forming anti-transpirants have reported a 30% reduction in water usage without compromising crop quality. Additionally, advancements in formulation technologies have expanded their application across diverse crops, from cereals to ornamental plants. Despite challenges such as high costs and limited awareness among small-scale farmers, the market is evolving with government incentives and research initiatives promoting water-efficient farming practices.

MARKET DRIVERS

Rising Incidence of Droughts and Water Scarcity

The increasing frequency and severity of droughts due to climate change are key drivers propelling the agriculture anti-transpirant market forward. According to the Intergovernmental Panel on Climate Change, approximately 55% of the world’s agricultural land is projected to face severe water stress by 2050, necessitating innovative solutions to conserve water resources. According to the United States Department of Agriculture, regions like California and Australia that are prone to prolonged dry spells, have witnessed a 40% increase in the adoption of anti-transpirants over the past decade. For instance, Australian wheat farmers using stomatal-closing anti-transpirants have achieved a 20% improvement in water-use efficiency while maintaining crop yields. Additionally, government initiatives promoting water conservation have accelerated their adoption, particularly in emerging markets. A study by the World Bank projects that investments in water-efficient technologies will grow by 18% annually in regions facing acute water scarcity. By enabling resilience against droughts, anti-transpirants not only safeguard agricultural productivity but also contribute to sustainable resource management.

Growing Demand for High-Yield Crops Amidst Limited Resources

The growing demand for high-yield crops amidst limited water and arable land resources is another major driver fuelling the expansion of the agriculture anti-transpirant market. According to the Organisation for Economic Co-operation and Development, the global population is expected to reach 9.7 billion by 2050, necessitating a 70% increase in food production. The African Development Bank highlights that sub-Saharan Africa, where water scarcity affects over 60% of farmland, has seen a 25% annual rise in the adoption of anti-transpirants to boost crop productivity. For example, Kenyan maize farmers using film-forming anti-transpirants have reported a 35% increase in yield while reducing irrigation requirements by 40%. Similarly, India’s Ministry of Agriculture notes that government subsidies for eco-friendly farming practices have spurred the use of growth retardant-based anti-transpirants, aligning with consumer expectations for sustainable agriculture. This shift toward resource optimization underscores the importance of anti-transpirants in ensuring food security and maintaining agricultural resilience.

MARKET RESTRAINTS

High Costs of Advanced Formulations

The prohibitive costs associated with advanced anti-transpirant formulations present a significant barrier to their widespread adoption, particularly among small-scale farmers. According to the World Bank, the initial investment required for high-performance anti-transpirants can exceed $50 per hectare, limiting accessibility in developing regions. The African Union Commission highlights that over 80% of smallholder farmers in sub-Saharan Africa lack the financial resources to invest in these solutions, relying instead on traditional water conservation methods. For instance, Ethiopian farmers perceive film-forming anti-transpirants as unaffordable despite evidence of their ability to reduce water usage by up to 30%. Additionally, operational costs, including labor and application equipment, exacerbate the issue; as noted by the United Nations Industrial Development Organization, annual expenses for anti-transpirant systems account for up to 20% of total production costs. These financial constraints hinder market penetration, particularly in regions where budget limitations dominate decision-making, ultimately slowing the transition toward water-efficient farming practices.

Limited Awareness Among Farmers

A pervasive lack of awareness about the benefits of anti-transpirants among farmers remains a formidable challenge for the market. According to the Food and Agriculture Organization, approximately 60% of farmers in developing regions rely on conventional irrigation techniques, often unaware of the advantages offered by modern anti-transpirant solutions. This knowledge gap is particularly pronounced in rural areas where educational outreach programs are scarce. The International Center for Agricultural Research in the Dry Areas highlights that misconceptions about the complexity and cost of anti-transpirants deter many farmers from adopting them. For example, Indian rice farmers perceive stomatal-closing agents as unnecessary investments, despite evidence of their ability to reduce water losses by up to 40%. A study by the Organisation for Economic Co-operation and Development reveals that less than 10% of rural households in South Asia have received formal training on integrated water management practices, including anti-transpirants. This low level of awareness not only stifles market growth but also perpetuates inefficiencies in water conservation, hindering both productivity and environmental sustainability.

MARKET OPPORTUNITIES

Integration with Precision Agriculture Technologies

The integration of anti-transpirants with precision agriculture technologies is a promising opportunity for the market. According to the United States Department of Agriculture, advancements in IoT-enabled sensors and AI-driven analytics enable real-time monitoring of soil moisture and plant hydration levels, enhancing the efficiency of anti-transpirant applications. For instance, European vineyards using smart irrigation systems combined with anti-transpirants have achieved a 30% reduction in water usage while improving grape quality by 20%. The Organisation for Economic Co-operation and Development projects that the global precision agriculture market will grow at a CAGR of 15%, creating a surge in demand for innovative anti-transpirant solutions. Additionally, investments in water-efficient farming technologies have doubled in the past five years, opening avenues for innovation in product development. By integrating with digital tools, anti-transpirants can drive sustainability, reduce operational costs, and meet the evolving demands of modern agriculture.

Expansion into Emerging Markets

The expansion of anti-transpirants into emerging markets offers immense potential for market growth. According to the African Development Bank, countries in sub-Saharan Africa and Southeast Asia are increasingly prioritizing sustainable agricultural practices to address water scarcity challenges. For example, Kenya’s Ministry of Agriculture reports a 25% annual increase in the adoption of film-forming anti-transpirants, driven by government incentives for water-efficient farming. Similarly, Vietnam’s focus on reducing water usage in rice paddies has spurred the use of stomatal-closing agents, which improve water-use efficiency by up to 50%. The International Food Safety Network highlights that investments in farmer education and infrastructure development have accelerated the adoption of these technologies in emerging economies. By capitalizing on this trend, manufacturers can position themselves as leaders in the global agricultural technology sector, driving long-term market expansion and contributing to sustainable farming practices worldwide.

MARKET CHALLENGES

Resistance to Behavioral Change Among Farmers

Resistance to behavioral change among farmers is a major challenge for the agriculture anti-transpirant market. According to the Food and Agriculture Organization, many farmers are reluctant to adopt anti-transpirants due to entrenched traditional practices and skepticism about their necessity. The International Center for Agricultural Research in the Dry Areas highlights that over 60% of small-scale farmers in South Asia and sub-Saharan Africa continue to rely on conventional irrigation methods, despite evidence supporting the benefits of anti-transpirants. For example, Indian cotton farmers perceive growth retardant-based solutions as ineffective investments, even though studies show they can reduce water losses by up to 40%. A study by the Organisation for Economic Co-operation and Development notes that cultural and educational barriers further compound this resistance, particularly in rural communities where access to training programs is limited. This reluctance to embrace innovative solutions not only stifles market penetration but also perpetuates inefficiencies in water management, hindering both productivity and environmental sustainability.

Supply Chain Disruptions and Logistical Barriers

Supply chain disruptions and logistical challenges is another significant hurdle for the agriculture anti-transpirant market, particularly in regions with underdeveloped infrastructure. According to the World Trade Organization, geopolitical tensions and transportation bottlenecks frequently disrupt the distribution of anti-transpirant formulations and application equipment across key agricultural markets. For instance, in conflict-prone areas like Sudan and Yemen, delays in the delivery of critical components have led to increased costs and reduced availability. The African Development Bank estimates that logistical inefficiencies account for up to 40% of operational costs for anti-transpirant systems, eroding profit margins. Furthermore, the perishable nature of certain formulations exacerbates the issue; a report by the United Nations Industrial Development Organization reveals that nearly 15% of products are compromised annually due to improper handling and storage. Climate-related events, such as droughts and floods, further strain supply chains, particularly in landlocked nations like Ethiopia and Chad. These logistical barriers not only inflate operational costs but also undermine the reliability of anti-transpirant services, impeding market growth and consumer trust.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.8% |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Miller Chemical & Fertilizer, Beijing Shenlanlin, Coastal AgroBusiness, Wilt-Pruf Products, Sumi Agro, PBI-Gordon Corporation, Bonide, Aquatrols, and Shanghai and Others. |

SEGMENTAL ANALYSIS

By Type

The film-forming anti-transpirants segment captured the leading share of 41.8% of the global market in 2024. The ability of film-forming anti-transpirants to create a protective layer on plant surfaces, effectively reducing water loss through transpiration is majorly driving the domination of the segment in the global market. According to the United States Department of Agriculture, film-forming solutions are widely adopted in regions like North America and Europe, where stringent water conservation regulations mandate their use. For instance, Californian almond growers using these anti-transpirants have reported a 35% reduction in water usage while maintaining crop quality. Additionally, advancements in biodegradable formulations have enhanced their compatibility with diverse crops, further solidifying their dominance. According to the International Center for Agricultural Research in the Dry Areas, the affordability and adaptability of film-forming anti-transpirants make them indispensable for both commercial enterprises and smallholder farmers, ensuring their continued importance in the market. As global demand for water-efficient solutions grows, the prominence of film-forming anti-transpirants is expected to persist.

The stomatal-closing anti-transpirants segment is predicted to register a promising CAGR of 23.3% over the forecast period owing to their ability to regulate stomatal openings, minimizing water loss without affecting photosynthesis. According to the African Development Bank, stomatal-closing solutions are gaining traction in regions like sub-Saharan Africa and Southeast Asia, where water scarcity poses a significant threat to agriculture. For example, Kenyan maize farmers using these anti-transpirants have achieved a 40% improvement in water-use efficiency while boosting yields by 25%. Additionally, government initiatives promoting sustainable farming practices have accelerated their adoption, particularly in emerging markets. The International Food Safety Network projects that investments in stomatal-closing anti-transpirants will surge by 30% annually in regions prioritizing climate-resilient farming practices.

By Application

The crops segment occupied the leading share of 50.7% of the global market in 2024 due to the growing need to conserve water in staple crops like wheat, rice, and maize, which are highly susceptible to water stress. The United States Department of Agriculture highlights that crop farmers in arid regions, such as Australia and India, have widely adopted anti-transpirants to mitigate the effects of prolonged droughts. For instance, Indian wheat growers using film-forming anti-transpirants have reported a 30% reduction in irrigation requirements while maintaining yield levels. Additionally, advancements in application techniques have expanded their use across high-value crops like fruits and vegetables, further solidifying their dominance. The International Center for Agricultural Research in the Dry Areas notes that the scalability and adaptability of anti-transpirants make them indispensable for both large-scale agribusinesses and smallholder farmers, ensuring their continued importance in the market. As global demand for sustainable farming practices grows, the prominence of crop-focused anti-transpirants is expected to persist.

The Turf and ornamental segment is anticipated to register a promising CAGR of 18.1% over the forecast period owing to the increasing urbanization and rising consumer awareness about the environmental impact of excessive water usage in landscaping. The International Federation of Organic Agriculture Movements emphasizes that turf and ornamental anti-transpirants are gaining traction in regions like North America and Europe, where households and municipalities seek eco-friendly solutions for water conservation. For example, U.S. golf courses using stomatal-closing agents have achieved a 40% reduction in water usage while maintaining turf quality. Additionally, government initiatives promoting green building practices have accelerated the adoption of anti-transpirants in urban landscaping, particularly in water-scarce areas. The African Development Bank projects that investments in turf and ornamental anti-transpirants will grow by 25% annually in emerging markets, driven by the need for sustainable living environments. This segment's rapid growth underscores its potential to address evolving consumer preferences, positioning it as a transformative force in the anti-transpirant market.

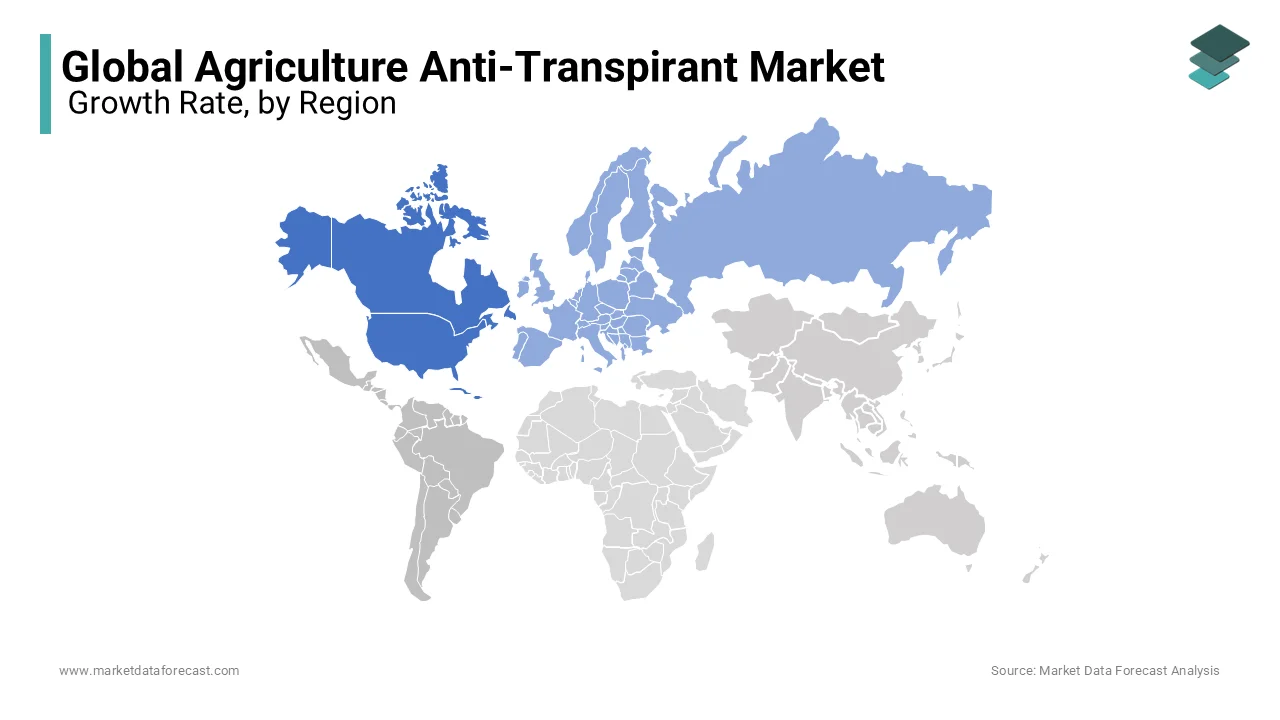

REGIONAL ANALYSIS

North America occupied 30.3% of the global agriculture anti-transpirant market share in 2024. The dominance of North America in the global market arises from its advanced agricultural infrastructure, extensive research and development capabilities, and strong regulatory framework promoting water conservation. The Organisation for Economic Co-operation and Development reports that widespread adoption of anti-transpirants in the region has significantly reduced water usage, aligning with national ecological goals. For instance, Californian almond farmers using film-forming anti-transpirants have achieved a 35% improvement in water-use efficiency while maintaining crop yields. Additionally, government subsidies for innovative technologies have encouraged the integration of precision tools, enhancing their efficacy. The World Health Organization highlights that North America’s strategic focus on innovation ensures its leadership in shaping industry trends, making it a hub for technological advancements and market growth.

Europe held substantial share of the global market in 2024 and is expected to play a key role in the global market over the forecast period. The stringent environmental regulations of Europe and commitment to reducing water usage in agriculture are propelling the European market growth. The European Food Safety Authority highlights that the adoption of anti-transpirants has surged by 20% annually, driven by policies aimed at achieving zero water wastage in farming. Investments in sustainable farming practices have positioned Europe as a leader in the global market. Additionally, the region’s robust agricultural research institutions have pioneered innovations in anti-transpirant formulations, further bolstering its market significance.

Asia Pacific is estimated to witness rapid growth over the forecast period in the global agriculture anti-transpirant market. The rapidly growing population and rising adoption of modern water conservation practices in this region are boosting the Asia-Pacific market growth. Countries like India and China are investing heavily in anti-transpirants to address water scarcity challenges in both agricultural and urban settings. For instance, Indian rice farmers using stomatal-closing agents have reported a 40% reduction in water losses while improving crop yields. The Asian Development Bank notes that the region’s focus on food security and export-oriented agriculture further boosts demand, making it a cornerstone of the global market.

Latin America accounts for a notable share of the global market over the forecast period owing to its extensive agricultural base and vulnerability to water stress caused by climate change. Brazil and Argentina lead the charge in adopting advanced anti-transpirants, supported by favorable policies and technological advancements. This strategic focus on protecting agricultural productivity ensures Latin America’s significance in the global market.

The market in Middle East and Africa is predicted to witness a prominent CAGR over the forecast period in the global market. The focus of Middle East and Africa on combating desertification and improving agricultural resilience are driving the regional market expansion. Morocco and South Africa are key players, leveraging eco-friendly anti-transpirants to promote sustainable farming. The Arab Center for Agricultural Studies highlights that government initiatives and international partnerships are bolstering market development, positioning the region as an emerging hub for innovation.

KEY MARKET PLAYERS

Some of the major players in the Agriculture Anti Transpirant market are Miller Chemical & Fertilizer, Beijing Shenlanlin, Coastal AgroBusiness, Wilt-Pruf Products, Sumi Agro, PBI-Gordon Corporation, Bonide, Aquatrols, and Shanghai. Are the market players that are dominating the global agriculture anti transpirant market.

MARKET SEGMENTATION

This research report on the global agriculture anti transpirant market is segmented and sub-segmented into the following categories.

By Type

- Stomatal Closing Type

- Film Forming Type

- Reflectance Type

- Growth retardant

By Application

- Crops

- Garden

- Turf and Ornamental. Crops

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global agriculture anti-transpirant market?

The global agriculture anti-transpirant market was valued at USD 16.04 billion in 2025 from USD 23.35 billion by 2033.

What market drivers are driving the global agriculture anti-transpirant market?

The rising incidence of droughts and water scarcity and growing demand for high-yield crops amidst limited resources are the major market drivers that are driving the agriculture anti-transpirant market.

Who are the market players that are dominating the global agriculture anti-transpirant market?

Miller Chemical & Fertilizer, Beijing Shenlanlin, Coastal AgroBusiness, Wilt-Pruf Products, Sumi Agro, PBI-Gordon Corporation, Bonide, Aquatrols, and Shanghai. Are the market players that are dominating the global agriculture anti transpirant market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]