Global Agricultural Machinery Market Size, Share, Trends & Growth Forecast Report – Segmented By Automation, Machinery Type, Material Type, And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Agricultural Machinery Market Size

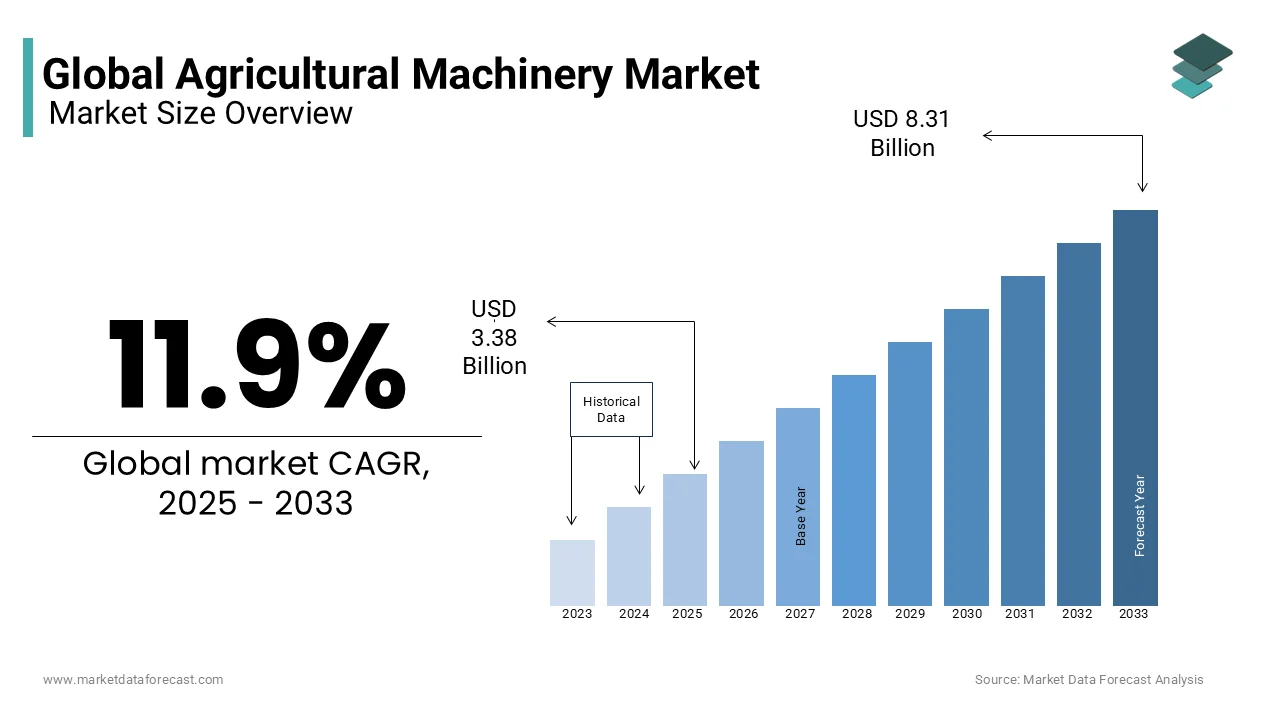

The global agricultural machinery market size was valued at USD 168.64 billion in 2024 and is anticipated to reach USD 178.05 billion in 2025 from USD 274.91 billion by 2033, growing at a CAGR 5.58% during the forecast period from 2025 to 2033.

Current Scenario of The Global Agricultural Machinery Market

The agricultural machinery market includes machines and tools that help farmers with tasks like planting harvesting and soil preparation. These machines make farming more efficient and less reliant on manual labor.

Farming covers a large part of the world’s land. According to the Food and Agriculture Organization of the United Nations around 38% of the global land area is used for agriculture. Many farmers are now using machines to improve productivity and reduce work time. The use of tractors has increased worldwide. The United States Department of Agriculture states that more than 80% of farms in the U.S. use tractors for fieldwork.

The market is divided into different types of equipment including tractors harvesters soil preparation and cultivation machines irrigation and crop processing equipment agriculture spraying equipment hay and forage machines and others.

Major companies in this market include Deere & Company AGCO Corporation Kubota Corporation CNH Industrial NV and Claas Group. These companies are continually innovating to maintain their market positions focusing on integrating advanced technologies like automation and data analytics into their machinery.

Farmers also face challenges like water shortages and soil degradation. The World Bank reports that about 70% of global freshwater is used for agriculture making efficient irrigation systems very important. Many new machines are designed to use less water and help farmers grow more food.

Market Drivers

Rising Global Food Demand

Growing population pressures fuel the agricultural machinery market as food needs escalate. The Food and Agriculture Organization forecasts a global population of 9.7 billion by 2050, requiring a 50% rise in food production. The U.S. Department of Agriculture notes that global grain output reached 2.8 billion metric tons in 2023, aided by machinery to meet demand. This driver is pivotal since manual methods can’t scale efficiently, with the FAO reporting mechanization increases yields by 30% in developing regions. Machinery ensures timely planting and harvesting, vital as arable land per person dropped 48% since 1960 per USDA data, sustaining food security worldwide.

Technological Advancements

Innovations like drones and AI in machinery drive market growth by enhancing farming precision. The U.S. Department of Agriculture states drone usage in U.S. agriculture grew 20% from 2020 to 2023, optimizing pesticide application. The Food and Agriculture Organization reports smart irrigation systems saved 25% of water in 2022 trials, addressing scarcity. These technologies are crucial, with the USDA noting 35% of large farms adopted AI tools by 2023, reducing costs by 15%. This driver supports sustainable farming amid climate variability, ensuring higher outputs with fewer resources, making advanced machinery essential for future agricultural resilience and profitability.

Market Restraints

High Initial Costs

Expensive machinery hampers market growth, especially for small farmers. The U.S. Department of Agriculture estimates a combine harvester costs $400,000 in 2023, out of reach for many. The Food and Agriculture Organization indicates only 10% of sub-Saharan farmers accessed loans in 2022, limiting purchases. This restraint curbs mechanization, as the USDA reports 85% of global farms are under 5 hectares, reliant on savings. High costs delay adoption, with the FAO noting a 20% productivity gap between mechanized and non-mechanized farms in 2022, perpetuating inefficiencies and restricting market expansion in poorer regions.

Lack of Skilled Operators

Insufficient training for complex machinery restricts market growth. The U.S. Bureau of Labor Statistics reports a 10% decline in agricultural training programs from 2019 to 2023. The Food and Agriculture Organization states 25% of Asian farmers lacked equipment operation skills in 2022, underutilizing investments. This challenge reduces efficiency, with the USDA noting a 12% output loss on farms with untrained workers in 2023. Without skilled operators, advanced machinery’s potential remains untapped, slowing market penetration, particularly in developing nations where education access lags, hindering the shift to modern farming practices.

Market Opportunities

Government Subsidies and Support

Subsidies boost machinery adoption, expanding market potential. The U.S. Department of Agriculture allocated $1.8 billion for equipment grants in 2023, aiding small farmers. The Food and Agriculture Organization reports Brazil’s 2022 subsidies lifted machinery use by 18% among rural households. This opportunity is significant, as the USDA notes subsidized farms increased yields by 15% in 2023. Financial support reduces barriers, with the FAO estimating 30% more farmers mechanized in supported regions by 2022. This drives market growth by enabling modernization, enhancing productivity, and aligning with global food security objectives across diverse economies.

Climate-Smart Agriculture

Demand for eco-friendly machinery offers market growth opportunities. The Food and Agriculture Organization projects climate-smart tools could cut emissions by 20% by 2030. The U.S. Department of Energy reports electric tractors reduced energy costs by 14% in 2023 trials. This trend is critical, with the USDA noting 55% of farmers faced drought impacts in 2022, needing adaptive tools. Sustainable machinery improves resilience, as the FAO states conservation tillage increased soil moisture by 18% in 2022. This opportunity aligns with environmental goals, driving demand for innovative equipment that supports long-term agricultural viability.

Market Challenges

Environmental Regulations

Strict regulations raise costs, challenging market growth. The U.S. Environmental Protection Agency states compliance added 10% to machinery expenses in 2023. The Food and Agriculture Organization reports 50% of new equipment in North America needed redesigns in 2022 to meet standards, delaying launches. This challenge slows expansion, as the USDA notes a 15% sales dip for non-compliant models in 2023. Manufacturers face innovation hurdles, with the EPA estimating 25% higher R&D costs for eco-friendly designs. Balancing regulation with affordability limits market reach, especially in high-compliance regions, affecting competitiveness.

Aging Farmer Population

Older farmers resist machinery, posing adoption challenges. The U.S. Department of Agriculture reports the average U.S. farmer age hit 57.5 in 2023, with 30% over 65. The Food and Agriculture Organization notes 35% of global farmers in 2022 were less likely to adopt tech due to age. This slows growth, as the USDA states mechanized farm numbers grew only 8% since 2020. Resistance stems from familiarity with traditional methods, with the BLS reporting a 5% drop in tech training uptake among older workers in 2023. This demographic shift curbs market progress, straining productivity gains.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.58% |

|

Segments Covered |

By Automation, Machinery Type, Material Type and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Deere & Compan, Kubota Corporation, Mahindra and Mahindra Limited, AGCO Corporation., Iseki & Co. Ltd, Escorts Limited, Daedong Industrial Co. Ltd, JCB, Tractors and Farm Equipment Limited, Sonalika. |

SEGMENT ANALYSIS

Agricultural Machinery Market Analysis By Automation

The manual segment dominated the agricultural machinery market and held 50.2% of the market share in 2024 to become the best performing category which was linked to its widespread use in developing regions. Its prominence is due to the affordability and accessibility for small-scale farmers who constitute a significant portion of global agriculture. According to the U.S. Department of Agriculture, 88% of farms worldwide are smallholdings under 2 hectares rely heavily on manual tools due to cost constraints. Furthermore, the Food and Agriculture Organization reports that manual equipment supports 70% of food production in low-income countries, underscoring its critical role in sustaining global food security.

On the other hand, the semi-automatic segment is swiftly expanding category and is predicted to register a CAGR of 7.8% from 2025 to 2033 owing to its balance of efficiency and cost-effectiveness. It enhances precision farming as well as reduces labour costs by 20%, as noted by the U.S. Department of Agriculture in 2023 studies. According to the Food and Agriculture Organization, semi-automatic machinery adoption increased crop yields by 15% in medium-scale farms in 2022 is driving its rapid uptake. Its importance lies in bridging the gap between manual and fully automatic systems, offering scalable solutions for modernizing agriculture while remaining affordable, particularly in emerging markets transitioning to mechanized farming.

Agricultural Machinery Market Analysis By Machinery Type

The Tractors segment came on top and led the machinery type category by commanding a 35.8% market share in 2024 due to their versatility across farming tasks like plowing and hauling. The U.S. Department of Agriculture states that tractors are used on 85% of U.S. farms and is reflecting their dominance in mechanized agriculture. Globally, the Food and Agriculture Organization estimates 28 million tractors were in use in 2022 and is supporting large-scale production critical for food supply chains. Their importance is evident in boosting efficiency, with the USDA reporting a 50% reduction in labor hours per acre compared to manual methods.

Whereas, the Agriculture robots segment is the fastest-growing one with a CAGR of 9.5% during the forecast period which is driven by automation trends and labor shortages. The U.S. Department of Agriculture notes a 25% increase in robotic harvesting adoption in 2023 and that is improving efficiency in high-value crops. The Food and Agriculture Organization reports robots reduced operational costs by 18% in pilot farms in 2022 which draws attent to their economic appeal. Their importance lies in precision agriculture, addressing the shrinking rural workforce down 30% since 2000 per USDA data while enhancing sustainability through optimized resource use in modern farming systems.

Agricultural Machinery Market Analysis By Material Type

The Structured steel segment maintained its dominance in the material type segment by holding a 40.1% market share in 2024 because of its durability and strength in heavy machinery. It is backed by extensive use in tractors and harvesters, with the U.S. Department of Agriculture noting that 70% of farm equipment frames are steel-based for longevity. The U.S. Bureau of Labour Statistics reports steel production for agriculture grew 5% annually since 2020, reflecting demand. Its importance lies in reliability, ensuring equipment withstands harsh conditions, critical for consistent agricultural output globally.

The Light alloys segment is quickly rising and is expected to have a CAGR of 8.2% from 2025 to 2033 influenced by demand for fuel-efficient, lightweight machinery. The U.S. Department of Energy states light alloy use in equipment cuts fuel consumption by 15%, appealing to cost-conscious farmers. The Food and Agriculture Organization notes a 20% rise in light alloy adoption in irrigation systems in 2022, enhancing portability. Their importance lies in supporting sustainable agriculture, reducing carbon emissions by 10% per unit per USDA 2023 findings, aligning with global environmental goals while maintaining performance in modern equipment designs.

REGIONAL ANALYSIS

North America

North America led the agricultural machinery market in 2024 and held 35.5% of the global share. The United States' robust agricultural sector with a production value of $360 billion is significantly contributing to this dominance. In 2024, U.S. agricultural exports were projected at $170.5 billion which is underscoring the sector's global importance, as per the USDA Economic Research Service. The comprehensive adoption of advanced machinery is evident, with over 90% of U.S. farms utilizing tractors and combines, enhancing efficiency and productivity, according to the USDA National Agricultural Statistics Service. This technological integration is pivotal in maintaining North America's leadership in agricultural machinery.

Asia-Pacific

The Asia-Pacific agricultural machinery market is witnessing rapid growth with a CAGR of 7.5% from 2025 to 2033. The increasing mechanization in agriculture and particularly in countries like India and China are the factors pushing the expansion of this segment.. According to the Food and Agriculture Organization (FAO), China has seen a significant rise in the use of agricultural machinery, with the number of tractors increasing from 1.6 million in 2000 to over 2.5 million in 2018. Similarly, India's tractor industry has grown substantially, producing over 900,000 units in 2021, as reported by the World Bank. This mechanization trend is essential to meet the food demands of the region's growing population and is showcasing the critical role of agricultural machinery in enhancing productivity.

Europe

Europe’s agricultural machinery market is influenced by sustainability initiatives and environmental regulations. The European Union’s Common Agricultural Policy (CAP) provides €387 billion (2021–2027) in subsidies, encouraging farmers to adopt precision farming and eco-friendly technologies. Germany, France, and Italy dominate the market, with Germany alone producing over $6 billion worth of agricultural machinery annually. Additionally, over 70% of European farms use some form of digital farming technology, such as GPS-guided tractors and automated harvesting systems and is improving efficiency and reducing environmental impact.

Latin America

Latin America’s market growth is driven by rising agricultural exports and increasing investments in technology. Brazil and Argentina, two of the largest agricultural producers, account for over $130 billion in annual agricultural exports. Brazil is the world's second-largest producer of soybeans and beef, necessitating heavy machinery adoption. Additionally, mechanization rates in Argentina’s agricultural sector have risen by 15% in the last decade, driven by government incentives and foreign investments in precision farming. The increasing use of drones and AI-powered irrigation systems further enhances productivity in the region.

Middle East & Africa

The Middle East & Africa region is experiencing rapid agricultural modernization due to rising food security concerns and government investments. Africa imports nearly $50 billion worth of food annually, driving local governments to invest in mechanized farming. In South Africa, agricultural machinery sales have increased by 12% in the past five years, with significant investments in irrigation systems and high-efficiency tractors. Meanwhile, Saudi Arabia has committed $10 billion to agricultural technology development as part of its Vision 2030 initiative, aiming to reduce food imports and boost local production. Egypt is also expanding its mechanization programs, increasing tractor imports by 20% in the last three years to support large-scale farming projects.

Top 3 Players in the market

Deere & Company

Deere & Company, commonly known as John Deere, leads the global agricultural machinery market with a substantial market share. Deere's extensive product line includes tractors, harvesters, and precision agriculture technologies, catering to diverse farming needs. The company's commitment to innovation is evident in its significant investment in research and development, enabling the integration of advanced technologies like autonomous machinery and data analytics into their equipment. This focus on technological advancement has solidified Deere's position as a leader in the market and contributes greatly to global agricultural productivity.

CNH Industrial N.V.

CNH Industrial N.V. is a prominent player in the agricultural machinery sector, holding a considerable share of the global market. In 2021, the company held 12.9% of the global agriculture equipment market. The company offers a wide range of agricultural equipment under brands like Case IH and New Holland Agriculture, serving various farming operations worldwide. CNH Industrial focuses on enhancing farm efficiency and sustainability through continuous innovation, including the development of alternative fuel-powered machinery and precision farming solutions. Their strategic initiatives aim to address the evolving needs of modern agriculture, thereby strengthening their market presence and contributing to the sector's advancement.

AGCO Corporation

AGCO Corporation is a key contributor to the global agricultural machinery market, offering a diverse portfolio of equipment through brands such as Fendt, Massey Ferguson, and Valtra. The company is recognized among the major companies operating in the agricultural machinery market. AGCO emphasizes technological innovation, integrating smart farming technologies into their machinery to enhance productivity and sustainability. Their commitment to providing comprehensive solutions for farmers worldwide has reinforced their position in the market, playing a vital role in advancing global agricultural practices.

Top strategies used by the key market participants

Technological Innovation and Digital Integration

Leading agricultural machinery manufacturers are heavily investing in technological advancements to enhance product efficiency and meet evolving agricultural demands. For instance, John Deere has developed autonomous tractors equipped with advanced sensors and AI capabilities, enabling precision farming and reducing the need for manual labor. This focus on innovation not only differentiates their products but also addresses the increasing need for sustainable and efficient farming practices.

Strategic Partnerships and Collaborations

Key players are forming strategic partnerships and collaborations. By partnering with technology firms, agricultural machinery companies can integrate cutting-edge technologies into their equipment, offering more value to customers and staying competitive in the market.

Market Diversification and Global Expansion

Agricultural machinery companies are diversifying their product lines and expanding into emerging markets to strengthen their global presence. For example, firms are introducing machinery tailored to the specific needs of different regions, addressing local agricultural challenges and preferences. This strategy not only broadens their customer base but also mitigates risks associated with market fluctuations in specific regions.

Competitive Landscape

The global agricultural machinery market is growing fast because of new technology and the need for better farming tools. The biggest companies in this market are John Deere, AGCO, Kubota, CNH Industrial, and Claas Group. They are always creating new and advanced machines, like tractors with smart technology and automation.

Big companies are also buying smaller companies to expand their business. For example, DynaTouch bought KioWare to make better kiosk solutions. New companies like Bonsai Robotics are also joining the market. They make self-driving machines to help farmers with tasks like picking fruit, which helps solve the farm labor shortage.

Government rules are also changing the market. In the U.S., the Federal Trade Commission (FTC) is suing John Deere, saying it has too much control over who can repair farm machines. Many farmers want the right to fix their own tractors without depending on the company

KEY MARKET PLAYERS

Deere & Compan, Kubota Corporation, Mahindra and Mahindra Limited, AGCO Corporation., Iseki & Co. Ltd, Escorts Limited, Daedong Industrial Co. Ltd, JCB, Tractors and Farm Equipment Limited, Sonalika. These are the market players that are dominating the global agricultural machinery market.

RECENT HAPPENINGS IN THIS MARKET

- In February 2025, AGCO Corporation showcased its latest innovations from brands like Fendt®, Massey Ferguson®, and PTx™ at the World Ag Expo in California and the National Farm Machinery Show in Kentucky. This exhibition exhibited AGCO’s commitment to advancing agricultural machinery solutions.

- In January 2025, AGCO Corporation received five AE50 awards from the American Society of Agricultural and Biological Engineers (ASABE) for its innovative agricultural products. These awards recognize AGCO's contribution to enhancing agricultural efficiency and sustainability.

- In January 2025, Deere & Co launched new autonomous tractors and industrial equipment at the CES trade show in Las Vegas. This launch aims to address labor shortages in agriculture and enhance precision farming through automation.

- In February 2025, the European Union announced plans to simplify regulations governing the Common Agricultural Policy (CAP), which allocates approximately €387 billion for farming subsidies and rural development. These reforms aim to reduce administrative burdens on farmers and improve efficiency.

- In February 2025, the UK implemented amendments to agricultural product regulations, extending transitional arrangements for imported agricultural goods until February 2027. This amendment provides stability for businesses adjusting to post-Brexit trade regulations.

MARKET SEGMENTATION

This research report on the global agricultural machinery market is segmented and sub-segmented into the following categories.

By Automation

- Fully automatic

- Semi-automatic

- Manual

By Machinery Type

- Tractor

- Soil Cultivation

- Planting

- Irrigation

- Fertilization

- Harvesting

- Hay Making

- Loader

- Agriculture Robots

By Material Type

- Structured steel

- Alloyed Steel

- Cast Materials

- Light Alloy

- Wearing Materials

- Structured Material

- Aluminum

- Iron

- Glass

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the currrent market size of the global agricultural machinery market?

The currrent market size of the global agricultural machinery marketwas valued at USD 178.05 Bn by 2025.

What market drivers are driving in the global agricultural machinery market?

Rising global food demand and technological advancements are the main market drivers in the global agricultural machinery market.

What challenges are faced by the global agricultural machinery market?

The environmental regulations and aging farmer population are the major challenges faced in the global agricultural machinery market.

Who are the market players that are dominated in the global agricultural machinery market?

Deere & Compan, Kubota Corporation, Mahindra and Mahindra Limited, AGCO Corporation., Iseki & Co. Ltd, Escorts Limited, Daedong Industrial Co. Ltd, JCB, Tractors and Farm Equipment Limited, Sonalika. These are the market players that are dominating the global agricultural machinery market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]