Global Agricultural Fumigants Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product Type (Phosphine, 1, 3-Dichloropropene, Methyl Bromide, Chloropicrin and Others), Crop Type (Oilseeds & Pulses, Cereals & Grains, Fruits & Vegetables, Turf & Ornamentals, and Others), Form (Soil, Liquid and Gaseous), Application (Soil and Wear House), Pest Control Method (Structural, arpaulin, Vaccum Chamber, Non-tarp fumigation by injection and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From 2025 to 2033

Global Agricultural Fumigants Market Size

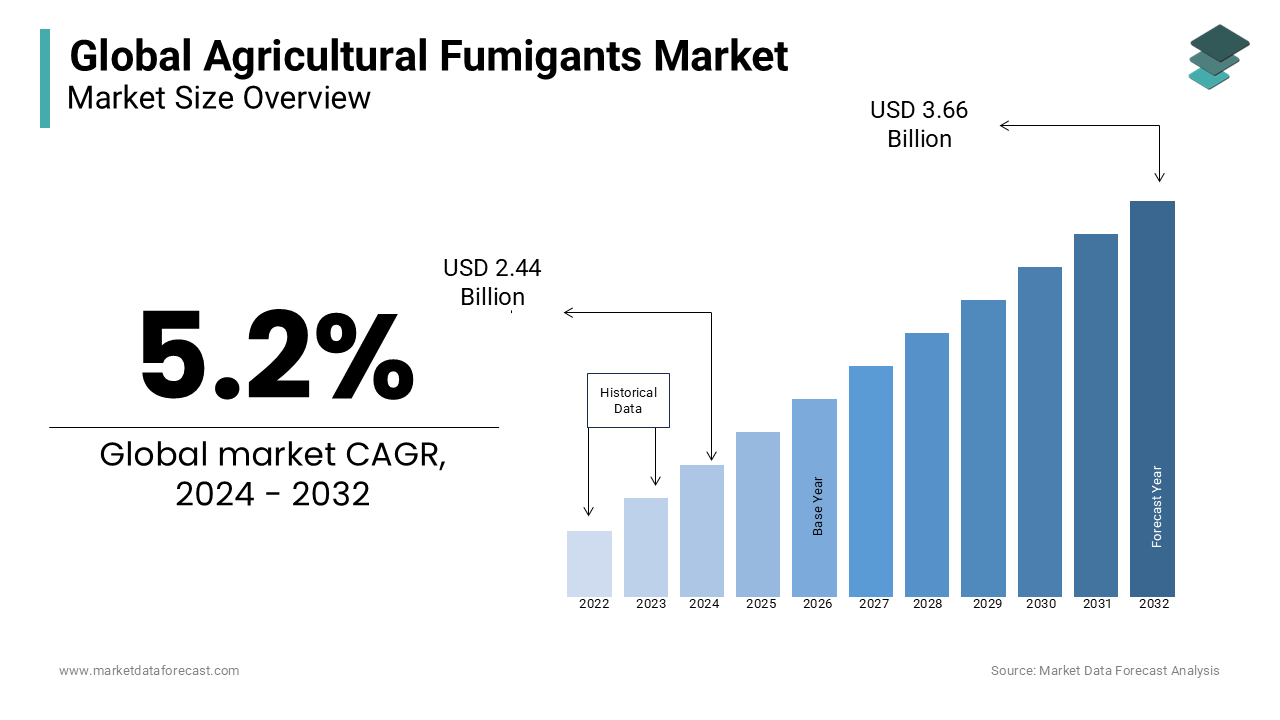

The global agricultural fumigants market was valued at USD 2.44 billion in 2024 and is anticipated to reach USD 2.57 billion in 2025 from USD 3.85 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033.

Agricultural fumigants are chemical products that protect food grains from the damage of pests and are mostly used in storage places and post-harvest processes. Also, these fumigants eliminate nematodes, bacteria, fungi, and pests in soil to enhance crop health and production.

Market Drivers

The primary factor contributing to the growth of the global agricultural fumigants market is the rising world population and its need for a continuous supply of food. The added advantage of soil fumigants, like increased quality and reduction in after-harvest damages, is also driving the global market growth. Also, the surge in non-agricultural activities and industrial vegetation management techniques to control weed production and remove fungi is another driving aspect propelling the agricultural fumigants market growth. The implementation of special incentives and subsidies to support farming by local governments around the world is encouraging farmers to invest more in crop protection mechanisms like fumigants.

In addition, there is a surge in the trend of precision agriculture and targeted pest control, which is acting positively for the growth of the global agricultural fumigants market. Also, with globalization, there is a spike in the exports of food products that should meet high-quality and phytosanitary standards. Besides, the fumigants are applied before crop planting to eliminate any pests from the previous crops. The flourishing need for eco-friendly products and sustainable farming is estimated to benefit the global agricultural fumigants market. In particular, the preference for integrated pest management (IPT) methods that can combine biological, chemical, and cultural practices can boost the sales of agricultural fumigants in the following years. The changing seasons and climatic conditions are leading to new types of pests and a surge in soil-borne diseases, which are propelling the adoption of fumigants among farmers worldwide. Moreover, the improving crop cultivation technologies coupled with more research and development activities to develop new products are likely to create promising opportunities for the agricultural fumigants market in the coming years.

Market Restraints

The major challenge to the global agricultural fumigants market is the concern related to the contamination of water and soil with the increased use of chemical products in cultivation. Also, the issues related to the health of the workers and the serious impacts on the atmosphere from the long-term use of fumigants are creating a negative influence on the global market. In addition, the stringent government policies to avoid the usage of some of the fumigants that can cause ozone layer depletion are pulling the market demand down. Besides, there is an expanding call for biological products in crop growth and pest control, which can have a negative impact on the sales of these fumigants.

The long-term usage of these components can develop resistance to pests that require new formulations, which can harm the useful microorganisms and bacteria in the soil. Also, supply chain disruptions and volatility in the prices of chemicals used in the production of fumigants can further challenge the demand for agricultural fumigants. Moreover, the complexity associated with the implementation of these products in farming, along with the questions among farmers about the ill effects of chemicals on biodiversity, are further likely to affect the profits in the global agricultural fumigants market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product Type, Crop Type, Form, Application, Pest Control Method, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Syngenta, BASF SE, UPL, Nufarm, Novozymes, Corteva Agriscience, Detia Degesch GmbH, ARKEMA, ADAMA, SGS SA, Trinity Manufacturing, Inc., Intertek, Tessenderlo Kerley, Inc., Solvay, Amvac Chemical Corp, Nippon Chemical Industrial Company Ltd, MustGrow Biologics, Douglas Products, DowDuPont, FMC Corporation, Isagro SPA, Lanxess, Ikeda Kogyo Co., and Bayer AG |

SEGMENTAL ANALYSIS

Global Agricultural Fumigants Market By Product Type

The 1, 3-dichloropropene products recorded a significant share of the worldwide market due to their characteristics like less vapor pressure and kH, high sorption coefficient, and high degradation. In addition, the chloropicrin product is expected to register the highest growth rate in the predicted period because of its applications in the place of methyl bromide and integration with 1,3-dichloropropene.

Global Agricultural Fumigants Market By Crop Type

Cereals and grains accounted for the majority portion of the global agricultural fumigants market due to the need for wheat, rice, maize, corn, etc., in daily food consumption.

Global Agricultural Fumigants Market By Form

Liquid form of fumigants registered the highest share in the global market. The advantages like simple usage and quick absorption, which can enhance crop health and pest control are majorly contributing to the adoption of this form. Similarly, the gaseous form is estimated to witness significant growth in the coming years.

Global Agricultural Fumigants Market By Application

The warehouse applications are supposed to rule the worldwide agricultural fumigants business owing to the requirement of these components to protect the stored foods from pests, fungi, insects, and rodents.

Global Agricultural Fumigants Market By Pest Control Method

Structural fumigation holds the majority share of the market due to its applications in the control of pests in soil and grains. However, the tarpaulin segment is likely to propel at a notable rate in the future based on their cost-affordability, performance, easy availability, and capability to avoid leakage of gases.

REGIONAL ANALYSIS

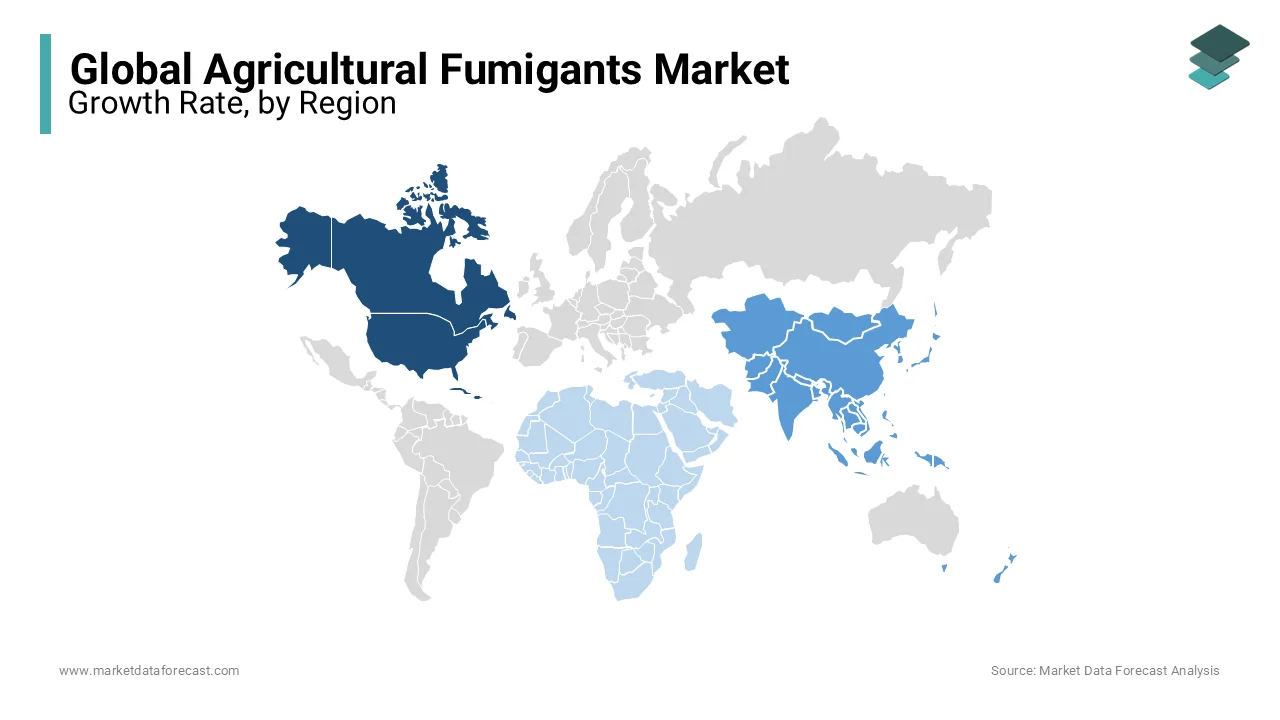

North America dominated the global agricultural fumigants market owing to the rising emphasis on food safety and supply among farmers. The United States is the leading contributor to this regional market because of the presence of key market players and the surging need for pest control in crop cultivation, followed by Canada and Mexico. In addition, the supportive government initiatives and research and development activities in North America are surging demand for agriculture fumigants in the area.

The Asia Pacific region is expected to record the highest growth rate in the global market owing to the increasing agricultural practices and food storage warehouses in nations like India, China, Australia, and Indonesia. China and India are the leading players in the Asia Pacific due to the spike in population, the adoption of technological processes in farming, and the use of cereals, pulses, grains, fruits, and vegetables in daily food intake. Further, the supportive initiatives from local governments and economic certainty are supposed to drive the market demand in this area.

Europe is also a considerable player in this market due to the presence of some of the notable players. The strict government regulations to encourage eco-friendly solutions are promoting the adoption of fumigants with less environmental impact in this area.

Latin America, with nations like Brazil and Argentina, is also a promising player in the global agricultural fumigants market. Government-regulated cultivation and the increasing demand for sustainable agriculture are driving the business in this locale. In addition, the surge in the cultivation of corn and soybeans and food storage methods is likely to boost the business scope in this region.

The Middle East and Africa region are relatively smaller markets for fumigants compared to the above. However, there is a huge untapped opportunity in this area because of the increasing population and the need for food products and storage solutions.

KEY MARKET PLAYERS

Syngenta, BASF SE, UPL, Nufarm, Novozymes, Corteva Agriscience, Detia Degesch GmbH, ARKEMA, ADAMA, SGS SA, Trinity Manufacturing, Inc., Intertek, Tessenderlo Kerley, Inc., Solvay, Amvac Chemical Corp, Nippon Chemical Industrial Company Ltd, MustGrow Biologics, Douglas Products, DowDuPont, FMC Corporation, Isagro SPA, Lanxess, Ikeda Kogyo Co., and Bayer AG. Some of the major key players involved in the agricultural fumigant market.

RECENT HAPPENINGS IN THIS MARKET

- In January 2023, BASF SE, a leading company in agricultural products, launched Axalion Active in Australia. This new insecticide controls harmful pests in the cultivation of fruits, vegetables, soybeans, cereals, legumes, cotton, and ornamentals.

- In October 2023, Godrej Agrovet collaborated with Nissan Chemical Corporation to introduce a novel pest control product for chili cultivators to offer protection during the flowering stage.

- In July 2023, Syngenta India launched two new products, Incipio and Simodis, to safeguard crops like cotton, paddy, and vegetables from different pests and improve crop production.

MARKET SEGMENTATION

This research report on the global agriculture fumigants market is segmented and sub-segmented based on product type, crop type, form, application, pest control method, and region.

By Product Type

- Phosphine

- 1, 3-Dichloropropene

- Methyl Bromide

- Chloropicrin

- Others

By Crop Type

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

- Turf & Ornamentals

- Others

By Form

- Liquid

- Solid

- Gaseous

By Application

- Soil

- Warehouse

By Pest Control Method

- Structural

- Tarpaulin

- Vacuum Chamber

- Non-tarp fumigation by injection

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the global agricultural fumigants market?

The global agricultural fumigants market is valued at USD 2.57 billion in 2025.

Which regions are leading in terms of market share for agricultural fumigants?

North America and Europe currently hold the largest market share for agricultural fumigants due to extensive use in crop protection and post-harvest pest control.

What are the key trends driving growth in the agricultural fumigants market in Asia Pacific?

In Asia Pacific, the increasing adoption of modern farming techniques, rising concerns over food safety, and growing demand for high-quality crops are driving the growth of the agricultural fumigants market.

What factors are hindering the growth of the agricultural fumigants market in Latin America?

In Latin America, factors such as regulatory challenges, limited access to fumigant alternatives, and concerns over worker safety are hindering the growth of the agricultural fumigants market.

How is the agricultural fumigants market in Egypt adapting to changing regulatory requirements for pesticide registration?

In Egypt, the agricultural fumigants market is witnessing increased efforts towards registration and approval of fumigant products, compliance with pesticide regulations, and promotion of safe and sustainable pest control practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]