Global Agricultural Drones Market Size, Share, Trends and Growth Analysis Report – Segmented By Product (Hardware [Fixed Wing, Rotary Blade, Hybrid], Software [Data Analytics, Data Management, Imaging]), Application (Field Mapping, Variable Rate Application, Crop Scouting, Crop Spraying, Livestock, Agriculture Photography And Others) And By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Agricultural Drones Market Size

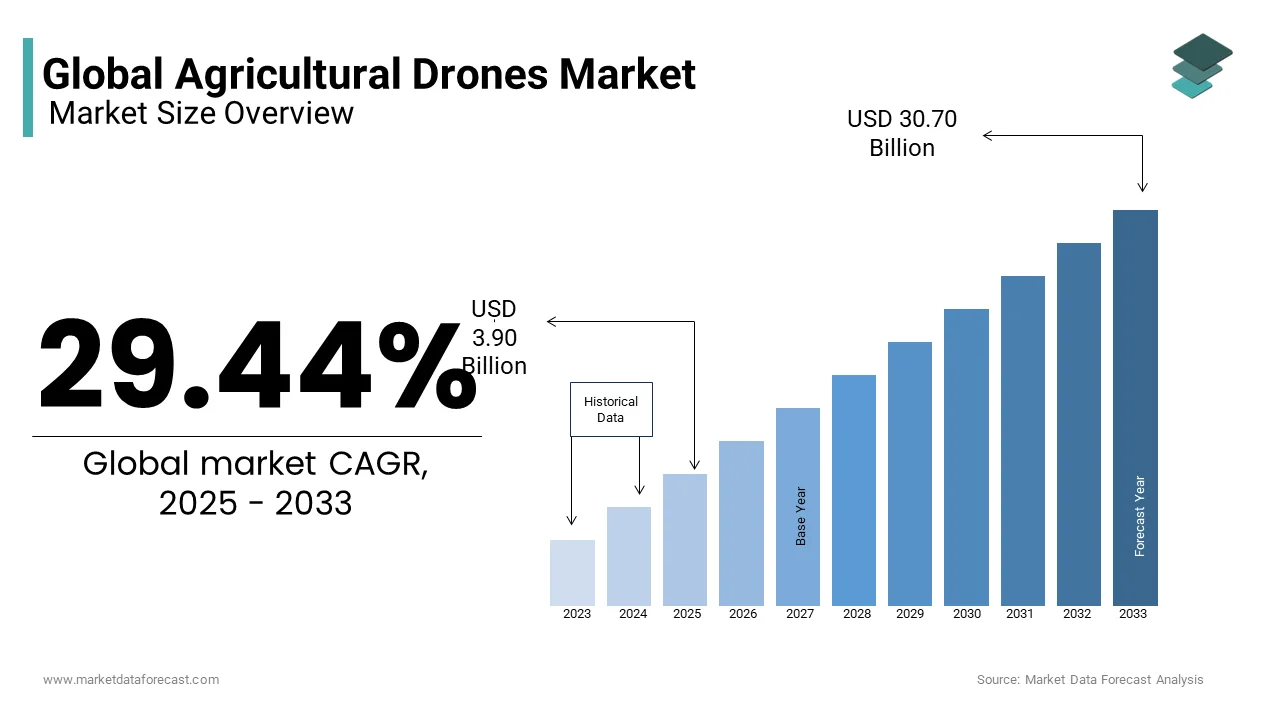

The global agricultural drone market was valued at USD 3.01 billion in 2024 and is anticipated to reach USD 3.90 billion in 2025 from USD 30.70 billion by 2033, growing at a CAGR of 29.44% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL AGRICULTURE DRONES MARKET

Agricultural drones use an automated process to make farming more productive, and they are about to become the new workhorses on farms. Drones provide a better, more flexible visualization. With the focus on productivity in agriculture spiraling upward in the farming sector, drones could be the answer to improved automation and precise control of farm monitoring and operations.

Robots are beginning to transform the way the agriculture sector functions, and the advent of agricultural drones could take that change to a whole new level.

Globally, farmers are adapting to drone availability, using aerial cameras to visualize plants. Video, specialized video, targeted video, and agricultural spraying systems are offered. Agricultural Drones use Technology for Spraying, Mapping, Pest Control, Seeding, Remote Sensing, and precision agriculture.

MARKET DRIVERS AND RESTRAINTS

The market is primarily driven by the increasing adoption of drones for crop spraying applications, resulting in an increase in the yield and reducing the wastage in spraying fertilizers & pesticides.

Also, farmers are increasingly implementing this technology in farming to gain better productivity and to increase the efficiency in the usage of water, land, and fertilizers. Moreover, technological advancements, including sensors, better materials, and imaging capabilities, are also expected to drive the agricultural sector. However, lack of awareness and a limited number of skilled professionals are restraining the growth of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

29.44% |

|

Segments Covered |

By Product, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Trimble Navigation Ltd., DJI Technology, 3D Robotics, PrecisionHawk, AeroVironment, Inc., Parrot SA, and DroneDeploy. |

SEGMENTAL ANALYSIS

Global Agricultural Drones Market Analysis By Product

The hardware segment consists of fixed-wing, rotary blade, and hybrid, whereas the software segment consists of data management, imaging software, and data analysis.

Global Agricultural Drones Market Analysis By Application

Hardware accounted for the majority of agricultural drone market share in 2016, owing to high-cost components such as fixed-wing, rotary blades, and hybrid UAVs. Hybrid UAVs will witness growth in the forecast period since they can perform long-distance tasks along with hovering over agricultural fields. Field mapping applications dominated the agricultural drone market size. Benefits such as increasing yield by analyzing and monitoring the crops are expected to support the segment growth over the forecast timeline. Crop scouting is expected to witness significant growth owing to its accuracy of fertilizer spraying.

REGIONAL ANALYSIS

North America's agricultural drone market size was over 30% of the global revenue in 2016. The rising trend of implementation of UAVs for enhanced productivity and increasing awareness of precision agriculture for crop scouting and field mapping is expected to drive industry growth in this region. APAC's agricultural drone market will benefit from growing adoption and technological developments. Companies are investing in the region to develop low-cost and effective UAVs for numerous applications in the agricultural sector.

KEY MARKET PLAYERS

Trimble Navigation Ltd., DJI Technology, 3D Robotics, PrecisionHawk, AeroVironment, Inc., Parrot SA, DroneDeploy. Some of the major players are dominating the global agriculture drone market.

MARKET SEGMENTATION

This research report on the global agriculture drones market is segmented and sub-segmented based on By Product, Application, and Region.

By Product

- Hardware

- Software

By Application

- field mapping

- variable rate application

- crop scouting

- crop spraying

- livestock

- agriculture photography

- others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle -East and Africa

Frequently Asked Questions

What is the current market size of the global agricultural drones market?

The current market size of the global agricultural drone market is valued at USD 3.90 billion in 2025.

What market drivers and restraints are in the global agricultural drones market?

The market is primarily driven by the increasing adoption of drones for crop spraying applications, resulting in an increase in the yield and reducing the wastage in spraying fertilizers & pesticides.

Who are the market players that are dominating the global agricultural drones market?

Trimble Navigation Ltd., DJI Technology, 3D Robotics, PrecisionHawk, AeroVironment, Inc., Parrot SA, DroneDeploy. These are the market players that are dominating the global agriculture drone market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]