Global Agricultural Adjuvants Market Size, Share, Trends, & Growth Forecast Report, Segmented By Type (Activator Adjuvants and Utility Adjuvants), Application (Insecticides, Herbicides, Fungicides and Others), Crop Type (Fruits & Vegetables, Cereals & Oilseeds and Others) And Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Agricultural Adjuvants Market Size

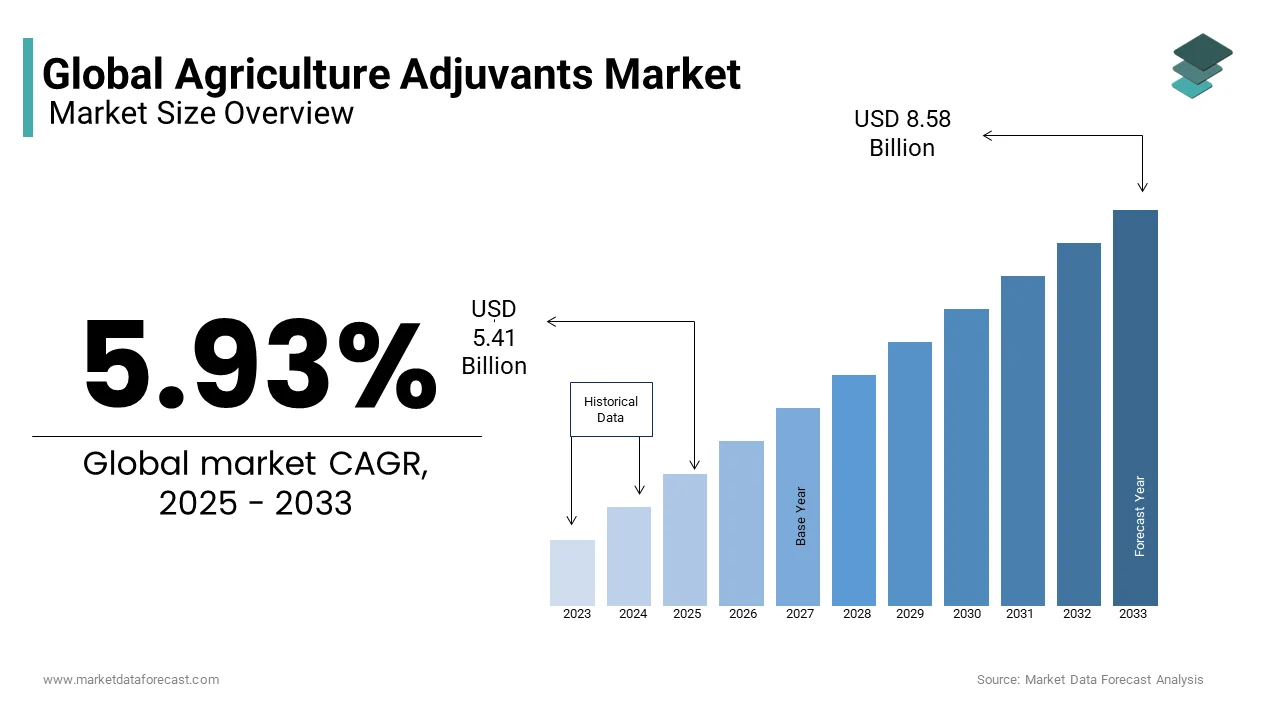

The global agricultural adjuvants market was valued at USD 5.11 billion in 2024 and is anticipated to reach USD 5.41 billion in 2025 from USD 8.58 billion by 2033, growing at a CAGR of 5.93% from 2025 to 2033.

Agricultural adjuvants are utilized to boost the efficiency of pesticides such as Insecticides, Herbicides, Fungicides, and other agents that are used to control or remove undesirable pests. Agricultural adjuvants consist of ammonium fertilizers, surfactants, and oils. They play a vital role in increasing the efficiency of agrochemicals, thereby enhancing the productivity of the crop. With the scarcity of land and water, increased importance is being put on the approval of innovative technologies that can help improve crop harvest. As such, Agricultural Adjuvants are witnessing a sizable demand since farmers are resolute to attain nutritious and high-quality crop production.

The growth of the global agricultural adjuvants market is majorly driven by factors such as growing awareness among farmers regarding agricultural adjuvants, innovative production practices, innovative farming equipment, and increasing occurrences of pests and diseases. Another key factor driving the market is the globally rising population, which leads to the need for an increase in crop harvest.

However, safer substitutes such as bio-farming and organic pesticides, unstable economies, and numerous health hazards linked with these adjuvants are the key factors hindering the growth of the market.

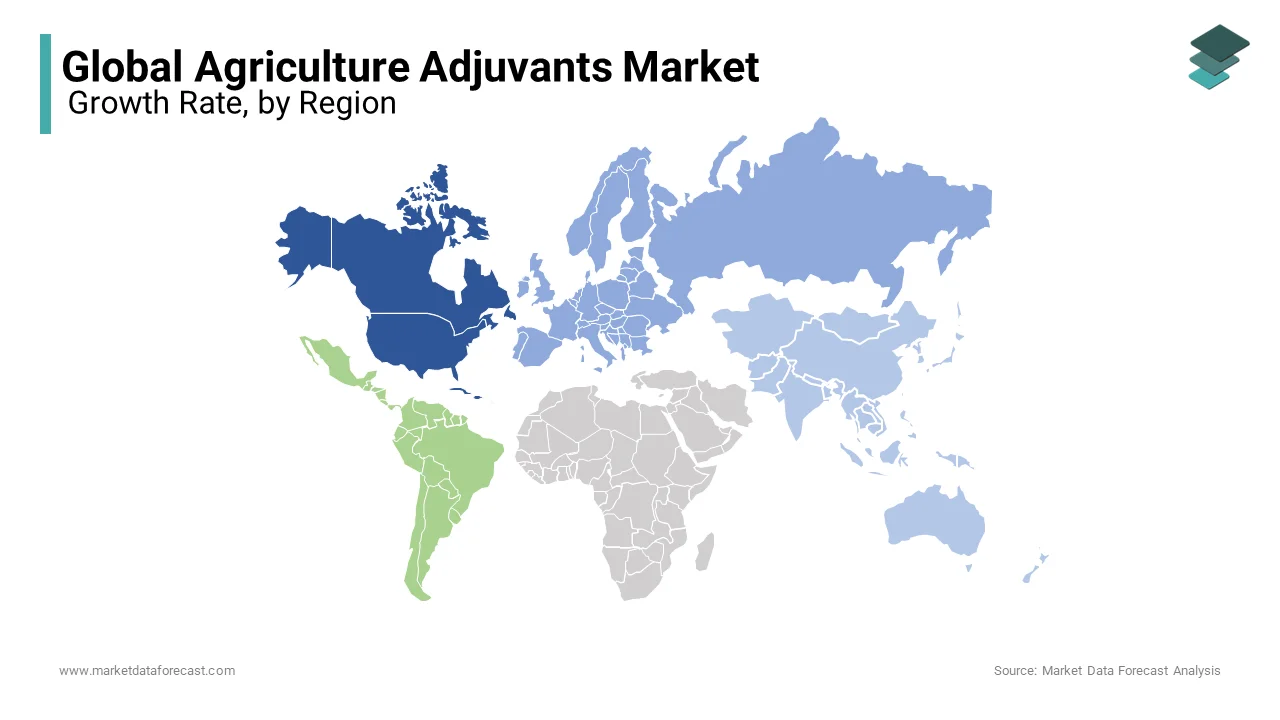

Agricultural adjuvants improve the efficacy and performance of pesticides, herbicides, and fertilizers by enhancing active ingredient absorption and reducing runoff. These additives reduce the overall volume of agrochemicals needed, improving cost efficiency and minimizing environmental impact. The market is divided into activator adjuvants, which increase the potency of active ingredients, and utility adjuvants, which aid application efficiency by improving spread ability and droplet size. Currently, activator adjuvants hold the largest share due to their compatibility with herbicides, which represent over 40% of adjuvant applications. North America dominates the market and the market growth for agricultural adjuvants in the North America is majorly driven by advanced agricultural technologies and high production rates of crops like corn and soybean. Meanwhile, rapid growth is anticipated in the Asia-Pacific region with the expanding agricultural lands and population-driven food demand.

MARKET TRENDS

Shift Toward Bio-Based Adjuvants

The agricultural sector is increasingly adopting bio-based adjuvants as these offer a lower environmental impact compared to synthetic alternatives. Bio-based adjuvants can reduce pesticide residues on crops and directly benefits soil and water quality. As per studies, bio-based solutions help decrease soil toxicity with some trials demonstrating up to a 20% reduction in chemical runoff. Furthermore, bio-based adjuvants contribute to enhanced biodegradability and this breaks down up to 30% faster than synthetic products. This shift not only aligns with sustainable farming practices but also supports biodiversity by minimizing harm to beneficial organisms in the soil and surrounding ecosystems.

Growth In Precision Agriculture Integration

The integration of adjuvants in precision agriculture is helping optimize chemical applications and thereby reduce waste and environmental contamination. By improving the accuracy of pesticide and herbicide applications, adjuvants enhance active ingredient adhesion and coverage. Precision agriculture combined with targeted adjuvants has been shown to reduce pesticide usage by up to 15-20% and contributes to more sustainable farming. Additionally, precision techniques reduce the risk of chemical drift to non-targeted areas, which is crucial for protecting nearby ecosystems and waterways. This efficiency also supports global food security efforts and helps farmers achieve high crop yields with minimized environmental impact.

MARKET DRIVERS

Rising Need for Higher Crop Yields

The global population is projected to hit 9.7 billion by 2025, which is rapidly growing need for higher crop yields to ensure food security. Agricultural adjuvants help enhance the efficiency of herbicides, pesticides, and fertilizers to support farmers in producing more food per acre. Adjuvants can increase crop yields by up to 20% by improving the absorption and retention of these chemicals. Adjuvants are essential for maximizing productivity and meeting the rising food demand while conserving resources in countries with limited arable land, such as India and China.

Decline in arable land

Global arable land is gradually decreasing due to urbanization, soil degradation, and climate change which is putting additional pressure on agricultural productivity. Between 2000 and 2020, the world lost nearly 100 million hectares of arable land. Adjuvants help farmers make the most of limited space by ensuring efficient application of agrochemicals and minimizing waste. They improve active ingredient distribution and reduce chemical runoff, thus maintaining soil health and boosting productivity per hectare. Adjuvants are vital in supporting agriculture on shrinking land resources by enhancing the efficacy of crop protection solutions.

Environmental and Regulatory Pressures

Environmental concerns and strict regulations are pushing the agricultural industry toward safer and more sustainable practices. Regulatory bodies such as the REACH of European Union have set stringent standards on agrochemical use to limit the harmful residues. Adjuvants can reduce the amount of chemical product needed, leading to lower residues in soil and waterways. Some adjuvants have shown the capability to decrease pesticide drift by up to 50% that help farmers meet regulatory requirements while reducing environmental impact. The adoption of eco-friendly adjuvants also aligns with consumer demand for sustainable agricultural practices and residue-free produce.

MARKET RESTRAINTS

High Cost of Bio-Based Adjuvants

They remain more costly than synthetic alternatives and deters widespread adoption while bio-based adjuvants are gaining popularity for their environmental benefits. Bio-based options can be up to 30-40% more expensive to produce which is primarily due to limited raw material availability and complex manufacturing processes. This cost factor is a significant barrier for small and mid-sized farms in regions where agricultural subsidies for sustainable products are limited. The high price point can impact profit margins of farmers and result in slowing the transition toward eco-friendly products despite growing awareness of sustainable practices.

Limited Awareness Among Farmers

In many developing regions, limited awareness about the benefits of adjuvants constrains market growth. Many farmers are unfamiliar with how adjuvants can improve pesticide efficiency, reduce runoff, and increase yields. For example, studies indicate that over 50% of smallholder farmers in regions like Sub-Saharan Africa and parts of South Asia have minimal knowledge of adjuvants and their applications. This knowledge gap restricts adoption as farmers often rely on traditional agricultural practices. The lack of accessible educational resources and training programs further hampers the potential for adjuvant use in these areas.

Environmental And Health Concerns of Synthetic Adjuvants

Synthetic adjuvants can pose environmental and health risks due to their chemical compositions which may contribute to soil contamination and water pollution. Certain adjuvants have been found to persist in the environment that affect non-target species and leading to issues like bioaccumulation. For instance, according to multiple studies, chemical residues from synthetic adjuvants can remain in soil and water bodies for extended periods which raises concerns about long-term ecosystem health. These environmental risks have led to stricter regulations in regions like the EU which limits the use of specific synthetic chemicals thereby restraining market growth.

MARKET OPPORTUNITIES

Growing Demand for Organic and Sustainable Farming

The increasing demand for organic and sustainably produced food provides significant opportunities for bio-based agricultural adjuvants. According to the Research Institute of Organic Agriculture (FiBL), the demand for organic food market is expected to multifold in the coming years and result in the increasing demand for agricultural adjuvants. Bio-based adjuvants that are derived from natural sources align with sustainable farming practices by improving soil health, reducing chemical residue, and supporting biodegradability. According to the studies of FiBL and IFOAM, bio-based adjuvants can reduce soil toxicity by approximately 20% and this aligns with both consumer demand for clean food and regulatory movements toward eco-friendly agricultural practices.

Precision Agriculture Technologies

The adoption of precision agriculture technologies presents opportunities for adjuvants that enhance targeted application of agrochemicals and minimize waste and environmental impact. Precision farming technologies, such as GPS-controlled spraying and drones, require specialized adjuvants to improve spray distribution, coverage, and retention. North America and Europe, where over 70% of farmers use precision agriculture are benefitting from adjuvants that reduce chemical waste by as much as 30% Precision-compatible adjuvants thus offer an appealing solution for farmers looking to optimize input efficiency and reduce costs in sustainable ways.

Rising Interest in Climate-Resilient Agriculture

Climate change has increased demand for resilient agricultural inputs that protect crops in extreme weather conditions. For instance, as per the research of the International Food Policy Research Institute (IFPRI), climate challenges such as drought reduce crop protection efficacy by up to 25%. Adjuvants that improve active ingredient absorption and adherence help reduce chemical runoff and loss under challenging conditions and enhance crop resilience. This rising need for climate-compatible products makes adjuvants designed for resilient farming a promising market opportunity, especially as the frequency of extreme weather events grows.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.93% |

|

Segments Covered |

By Application, Type, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AkzoNobel N.V., Adjuvant Plus Inc., Clariant International Ltd., Solvay SA, Helena Chemical Company, and Tanatex Chemicals. |

SEGMENT ANALYSIS

By Type Insights

The activator adjuvants segment dominated the market and captured 60.8% of the global market share in 2023. These adjuvants enhance the activity of agrochemicals such as herbicides, insecticides, and fungicides and makes them critical for effective pest and weed management. They improve active ingredient absorption, spreading, and retention on plant surfaces and result in the better protection and higher crop yields. Due to the extensive use of herbicides in agriculture, particularly in North America and Europe, activator adjuvants are in high demand. As per the studies of Agricultural Research Service, USDA, activator adjuvants can increase pesticide effectiveness by up to 25%.

On the other hand, the utility adjuvants segment is growing fastest-growing and is projected to witness a CAGR of 6.44% over the forecast period. Utility adjuvants aid in the application process by modifying factors such as droplet size, pH, and spread ability. They help reduce spray drift, improve tank-mix compatibility, and increase spray uniformity, which is especially beneficial in precision agriculture. The rise in precision farming and targeted spraying techniques is driving demand for utility adjuvants, as they help reduce chemical waste and environmental impact. An increase in the number of farmers adopt precision agriculture is likely to result in the rising demand for utility adjuvants segment and propel the segmental expansion.

By Crop Type Insights

The cereals and oilseeds segment had the largest share of 51.8% of the global market share in 2023. The dominance of the segment is due to the extensive cultivation of crops like wheat, corn, soybean, and canola, which are essential for global food and feed supplies. Cereals and oilseeds are prone to pest infestations and require effective crop protection to maintain high yields. For instance, as per FAO, adjuvants play a critical role in enhancing the efficacy of herbicides and pesticides used on these crops, which is particularly important given that cereals account for over 40% of total agricultural land worldwide. The high demand for cereals and oilseeds, especially in Asia-Pacific and North America, drives the continued dominance of cereals and oilseeds segment in the global market over the forecast period.

The fruits and vegetables segment is predicted to witness a highest CAGR of 7.14% over the forecast period owing to the increasing demand from consumers for fresh and high-quality produce of fruits and vegetables. Fruits and vegetables are essential for healthy diets and increasingly popular in both developed and developing regions. Precision agriculture techniques are often applied to these high-value crops, leading to an increased use of adjuvants that ensure effective, uniform pesticide and fertilizer applications. The usage of adjuvants has become crucial to maximize yield and quality while minimizing pesticide use due to the susceptibility of fruits and vegetables to disease and pest damage, which is further aiding the segmental growth.

By Application Insights

The herbicides segment held 45.6% of the global market share in 2023. Herbicides are extensively used to control weeds that compete with crops for nutrients, water, and sunlight. The demand for herbicide adjuvants is particularly high for crops such as corn, wheat, and soybeans, in which, weed control is essential for optimizing production. Adjuvants enhance the effectiveness of herbicides by improving leaf adhesion, absorption, and rain fastness, which reduces the need for multiple applications. According to Food and Agriculture Organization, weed management accounts for nearly 30% of crop protection activities in agriculture, which is another major factor boosting the expansion of the herbicides segment in the global market.

However, the fungicides segment is expected to be the fastest growing segment and witness a CAGR of 6.68% over the forecast period owing to the increasing prevalence of fungal diseases affecting high-value crops like fruits, vegetables, and cereals. Fungal infestations can cause significant yield and quality losses, leading to increased demand for adjuvants that enhance fungicide effectiveness. Adjuvants improve fungicide dispersion and coverage, which is especially important for crops prone to mold, mildew, and rust. As per International Plant Protection Convention, conditions are turning favorable to fungal diseases are expected to increase due to the increasing temperatures worldwide. In this situation, fungicide adjuvants have become essential for crop resilience and this facto is propelling the growth of the fungicides segment in the worldwide market.

REGIONAL ANALYSIS

North America holds a dominant position in the global agricultural adjuvants market and accounted for 33.8% of global market share in 2023. The market growth in this region is driven by extensive use of advanced agricultural practices and a high adoption rate of adjuvants in the U.S. and Canada. The North American market is predicted to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030, with the U.S. leading in both innovation and usage of agricultural adjuvants due to its large-scale cultivation of crops like corn and soybean. Additionally, increasing adoption of precision agriculture technology is boosting the demand for utility and activator adjuvants across North America.

Europe is a promising regional market for agricultural adjuvants worldwide. Strict regulations on pesticide usage, along with a growing focus on sustainable farming practices contributes to the steady demand for eco-friendly and bio-based adjuvants in this region. Germany, France and Spain are key markets in Europe for agricultural adjuvants and holding the majority of the share of the regional market. The strong regulatory environment of European Union, such as REACH compliance, pushes for the adoption of environmentally safe adjuvants that promotes innovation in bio-based adjuvants.

Asia-Pacific is the fastest-growing region in the global agricultural adjuvants market and is estimated CAGR of 6.88% over the forecast period owing to the increasing food demand and limited arable land, especially in rapidly growing economies like China and India. These countries are investing in advanced agricultural technologies to increase productivity, which drives the adoption of adjuvants. Over the forecast period, the growth of the Asia-Pacific market is also likely to be driven by the rising adoption of sustainable farming practices to improve crop yields and minimize environmental impact.

Latin America held a considerable share of the global market in 2023 and is expected to register a steady CAGR over the forecast period due to their large-scale production of soybeans, corn, and sugarcane. The favorable climate of Latin America for crop cultivation, combined with increasing agricultural exports, supports the adoption of agricultural adjuvants. Additionally, the region's focus on improving crop quality and yield aligns with growing adjuvant use, particularly for herbicides used in weed management on extensive agricultural lands.

The Middle East and Africa is predicted to grow at a CAGR of 4.8% over the forecast period. Factors such as an increasing need for efficient crop protection solutions due to challenges such as arid climates and water scarcity are driving the regional market growth. South Africa and Egypt lead the market in this region, as both countries focus on modernizing their agricultural sectors to meet rising food demands. The use of adjuvants here is gaining traction, especially in efforts to maximize crop output and improve resistance to environmental stresses.

KEY MARKET PLAYERS

The major companies dominating the global agricultural adjuvants market are AkzoNobel N.V., Adjuvant Plus Inc., Clariant International Ltd., Solvay SA, Helena Chemical Company, and Tanatex Chemicals.

DETAILED SEGMENTATION OF THE GLOBAL AGRICULTURAL ADJUVANTS MARKET INCLUDED IN THIS REPORT

This research report on the global agricultural adjuvants market has been segmented and sub-segmented into the following categories.

By Type

- Activator Adjuvants

- Surfactants

- Oil Adjuvants

- Utility Adjuvants

- Drift Control Agents

- Antifoam Agents

- Compatibility Agents

- Acidifiers

- Water Conditioners

- Others

By Crop Type

- Fruits & Vegetables

- Cereals & Oilseeds

- Others

By Application

- Insecticides

- Herbicides

- Fungicides

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

what is the size of agricultural adjuvants market?

The global agricultural adjuvants market was valued at USD 5.41 Bn in 2025 and is estimated to grow at a CAGR of 5.93% to reach USD Bn by 2033.

what is the CAGR of agricultural adjuvants market?

The agricultural adjuvant market is growing at a CAGR of 5.93% by the end of 2033.

what are the market key players of agricultural adjuvants market?

The major companies dominating the global Agricultural Adjuvants market are AkzoNobel N.V., Adjuvant Plus Inc., Clariant International Ltd., Solvay SA, Helena Chemical Company, and Tanatex Chemicals.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]