Africa Margarine and Ghee Market Size, Share, Trends & Growth Forecast Report By Fat Content, Packaging, Price Segment, Distribution Channels, Retail Distribution Channels, And Country (KSA, UAE, Israel, Rest Of GCC Countries, South Africa, Ethiopia, Kenya, Egypt, Sudan And Rest Of MEA), Industry Analysis From 2024 To 2032

Africa Margarine and Ghee Market Size

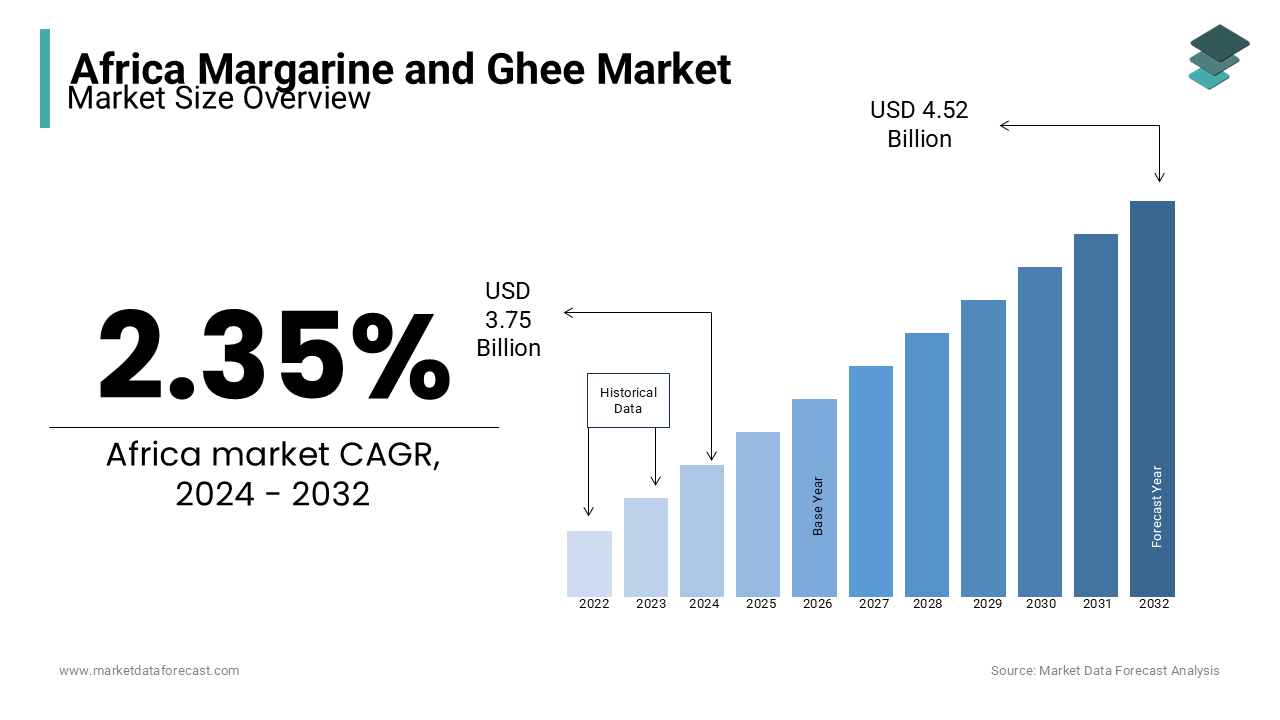

The Africa Margarine and Ghee Market Size was calculated to be USD 3.67 billion in 2023 and is anticipated to be worth USD 4.52 billion by 2032 from USD 3.75 billion In 2024, growing at a CAGR of 2.35% during the forecast period.

Margarine is widely used as a cost-effective alternative to butter in baking, cooking, and spreading that appeals to price-sensitive consumers in both urban and rural areas. Ghee is a clarified butter derivative that is integral to traditional cooking practices majorly in East Africa and North Africa.

Health considerations significantly influence purchasing behavior. For example, margarine products fortified with vitamins A and D address widespread micronutrient deficiencies. According to World Health Organization, vitamin A deficiency affects approximately 48% of children under five in sub-Saharan Africa. The growing popularity of plant-based margarine is linked to the rising adoption of vegan and dairy-free diets with reports showing a 10% annual increase in demand for such products in some urban centers.

Cold chain advancements are enhancing distribution efficiency which are crucial for temperature-sensitive ghee and margarine particularly in emerging markets. Smaller and affordable packaging also caters to low-income households.

MARKET DRIVERS

Health and Nutritional Awareness

Increasing awareness of health and nutrition is a significant driver of the Africa margarine and ghee market. Vitamin A deficiency affects 48% of children under five in sub-Saharan Africa according to WHO. Producers are innovating by incorporating vitamins A and D to provide high nutritional food products for the nutritionally vulnerable populations. Additionally, plant-based margarine is gaining traction among health-conscious consumers, particularly in urban areas, where veganism and dairy-free diets are on the rise. Reports indicate a 10% annual growth in demand for such products in cities like Nairobi and Lagos which further emphasizes the role of health-driven consumption patterns.

Urbanization and Changing Lifestyles

Rapid urbanization across Africa fuels the demand for convenience foods like margarine and ghee. By 2025, Africa’s urban population is expected to reach 60% with growing middle-class income that drives preferences for ready-to-use and versatile products. Urban households increasingly prefer margarine for its cost-effectiveness in baking and cooking. Meanwhile, ghee retains popularity in North and East African cuisines. Small and affordable packaging options and improvements in cold chain logistics enable efficient distribution even in informal markets. The combination of rising incomes and lifestyle shifts sustains steady market growth in both traditional and modern retail sectors.

MARKET RESTRAINTS

High Price Volatility of Raw Materials

The Africa margarine and ghee market is significantly impacted by fluctuations in the prices of key raw materials like edible oils and dairy. Palm oil is a major ingredient in margarine production which has experienced price volatility due to global supply chain disruptions and climate-related issues. For instance, as per the data from the World Bank, the global palm oil prices increased by over 40% in 2022. This is raising production costs and limiting affordability for price-sensitive African consumers. Similarly, ghee production is affected by unstable milk supplies in regions with inadequate dairy infrastructure by reducing consistency in product availability and affordability in low-income rural markets.

Inadequate Cold Chain Infrastructure

Inadequate cold chain logistics present a major restraint for the margarine and ghee market, particularly in sub-Saharan Africa. Without proper temperature-controlled storage and transport, these perishable products face spoilage risks in rural and underserved areas. According to the African Development Bank, only 3% of sub-Saharan Africa’s food is transported via cold chain systems. This challenge limits market penetration and raises costs for manufacturers and distributors. Additionally, power outages in regions with weak infrastructure further complicate cold storage which leads to losses and reduced consumer access, thereby hindering overall market growth.

MARKET OPPORTUNITIES

Expansion of Plant-Based and Specialty Products

The growing shift toward plant-based diets in Africa presents a significant opportunity for margarine producers. Urban consumers in markets like South Africa and Kenya, are increasingly adopting vegan and dairy-free lifestyles that drives demand for plant-based margarine. According to a 2022 survey by Veganuary, South Africa saw a 23% rise in plant-based product adoption within a year. Additionally, specialty ghee products, such as those infused with spices or tailored for lactose-intolerant consumers can cater to niche segments. Targeting these evolving preferences through innovation can help companies tap into new customer bases and differentiate in a competitive market.

Leveraging E-Commerce and Digital Channels

Africa's rapidly expanding e-commerce sector offers a valuable platform for margarine and ghee manufacturers to enhance reach and visibility. The African e-commerce market grew by 18% in 2023 with platforms like Jumia and Konga gaining popularity among urban consumers. Digital channels enable producers to showcase a diverse range of products and offer direct-to-consumer options by reducing reliance on traditional retail networks. Moreover, mobile money solutions like M-Pesa facilitate seamless transactions, even in underbanked regions. Companies are trying to connect with tech-savy consumers efficiently by investing in digital marketing and online sales companies.

MARKET CHALLENGES

Regulatory and Policy Hurdles

Complex and inconsistent regulatory frameworks across African countries pose significant challenges for the margarine and ghee market. Import restrictions, high tariffs on raw materials like palm oil and dairy products, and varying food safety standards increase costs for manufacturers and hinder cross-border trade. For example, the African Continental Free Trade Area (AfCFTA) aims to ease trade, but regulatory misalignments persist, delaying its full impact. Additionally, product labeling requirements and mandatory fortification policies in some regions require companies to adjust formulations and packaging, adding operational complexity. These hurdles slow market expansion and limit profitability, particularly for small and medium enterprises.

Consumer Perception and Education

A lack of awareness about the nutritional benefits of fortified margarine and ghee products remains a challenge in rural and low-income areas. Many consumers perceive margarine as less healthy than butter due to outdated information or misconceptions about trans fats. Despite regulatory efforts to reduce trans fats in margarine, consumer skepticism persists. A 2022 study by the Food and Agriculture Organization found that 42% of surveyed African households lacked knowledge of fortified food benefits. This knowledge gap limits the adoption of enhanced products by requiring extensive education campaigns to build trust and drive demand.

SEGMENTAL ANALYSIS

By Fat Content Insights

Common margarine holds the largest share in the global margarine market. This segment's dominance is attributed to its widespread use as a versatile and cost-effective alternative to butter in various culinary applications, including baking, cooking, and as a spread. Consumers often choose common margarine for its affordability and comparable taste to butter. Additionally, the product's longer shelf life and ease of storage contribute to its popularity among both households and the food service industry.

The reduced-fat margarine segment is experiencing the fastest growth in the global market, with a projected compound annual growth rate (CAGR) of approximately 7.27% from 2024 to 2029. This rapid expansion is driven by increasing health consciousness among consumers, leading to a preference for products with lower fat content. Reduced-fat margarine offers a healthier alternative for those seeking to decrease their intake of saturated fats without compromising on taste. Manufacturers are responding to this demand by innovating and introducing new formulations that cater to health-focused consumers that further propel the growth of this segment.

By Packaging Insights

The 250g margarine packaging segment holds a significant share in the global margarine market. This packaging size is popular among households due to its balance between quantity and convenience, catering to regular consumption without the risk of spoilage. Its affordability and suitability for daily use in cooking and baking make it a preferred choice for many consumers. Manufacturers often promote 250g packages as standard household units that aligns with typical family needs and storage capacities. This widespread acceptance underscores its importance in meeting consumer demand for practical and economical options.

The less than 250g margarine packaging segment is experiencing the fastest growth in the global market, with a projected compound annual growth rate (CAGR) of approximately 5.1% from 2023 to 2033. This surge is driven by increasing demand for portion-controlled and single-serving options, particularly among health-conscious consumers and smaller households. Smaller packaging reduces waste and allows for greater variety in consumer choices, enabling individuals to try different types without committing to larger quantities. Additionally, the rise in solo living arrangements and on-the-go lifestyles contributes to the preference for more convenient and smaller-sized margarine products.

By Price segment Insights

The mass-priced margarine segment holds the largest share in the global margarine market. This segment's dominance is primarily due to its affordability and widespread accessibility, making it a staple in many households, especially in price-sensitive regions. Mass-priced margarine serves as a cost-effective alternative to butter, appealing to consumers seeking economical options without compromising on functionality in cooking and baking. Its extensive distribution through supermarkets and local retailers further cements its leading position in the market.

The premium margarine segment is experiencing the fastest growth in the global market, with a projected compound annual growth rate (CAGR) of approximately 5.5% during the forecast period from 2018 to 2030. This rapid expansion is driven by increasing consumer demand for higher-quality products that offer superior taste, texture, and health benefits. Premium margarines often feature attributes such as organic ingredients, non-GMO certifications, and enhanced nutritional profiles to health-conscious consumers those are willing to pay a premium for perceived value. The growing trend towards healthier eating habits and the willingness to invest in premium food products contribute significantly to the accelerated growth of this segment.

By Distribution channels Insights

The retail distribution channel holds the largest share in the global margarine market. This channel's prominence is due to the widespread availability of margarine products in supermarkets, hypermarkets, convenience stores, and online platforms which makes them easily accessible to household consumers. Retail outlets offer a variety of margarine brands and types with diverse consumer preferences and price points. The convenience of purchasing margarine alongside other grocery items during regular shopping trips contributes to the dominance of the retail segment in the market.

The HoReCa (Hotel, Restaurant, and Catering) distribution channel is projected to grow at a compound annual growth rate (CAGR) of approximately 5.03% during the forecast period from 2024 to 2032. This growth is driven by the expanding food service industry by increasingly utilizing margarine as a cost-effective and versatile ingredient in various culinary applications. Margarine's longer shelf life and stability at room temperature make it a preferred choice for bulk usage in commercial kitchens. The demand for margarine through the HoReCa channel is expected to rise with the hospitality and catering sectors continue to expand globally.

By Retail Distribution Channels Insights

The retail distribution channel holds the largest share in the global margarine market. This channel's prominence is due to the widespread availability of margarine products in supermarkets, hypermarkets, convenience stores, and online platforms, making them easily accessible to household consumers. Retail outlets offer a variety of margarine brands and types, catering to diverse consumer preferences and price points. The convenience of purchasing margarine alongside other grocery items during regular shopping trips contributes to the dominance of the retail segment in the market.

The HoReCa (Hotel, Restaurant, and Catering) distribution channel is likely to have a compound annual growth rate (CAGR) of approximately 5.03% during the forecast period from 2024 to 2032. This growth is driven by the expanding food service industry where the demand to utilize margarine as a cost-effective and versatile ingredient in various culinary applications. Margarine's longer shelf life and stability at room temperature make it a preferred choice for bulk usage in commercial kitchens. The demand for margarine through the HoReCa channel is expected to rise as the hospitality and catering sectors continue to expand globally.

REGIONAL ANALYSIS

The African margarine market is projected to grow from US$ 4.41 billion in 2024 to approximately US$ 6.60 billion by 2029, exhibiting a compound annual growth rate (CAGR) of 8.40% during this period. This growth is driven by increasing urbanization, rising disposable incomes, and a shift towards convenient and affordable food products. Despite this expansion, Africa's share in the global margarine market remains relatively modest compared to leading regions like China, which is expected to generate US$4.72 billion in revenue in 2024.

In the ghee market, Africa's presence is less pronounced on the global stage. The global ghee market was valued at approximately US$3.36 billion in 2023 and is expected to reach around US$8.73 billion by 2032, with a CAGR of 11.2% from 2024 to 2032. However, specific data on Africa's contribution to this market is limited which indicates a relatively minor role in global ghee consumption and production.

Within Africa, countries such as South Africa, Nigeria, and Kenya are leading markets for margarine that is driven by their larger urban populations and developed retail sectors. These nations are experiencing increased demand for processed and packaged foods, including margarine, due to changing dietary habits and lifestyles.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major key Market players of the Africa Margarine and Ghee Market include Unilever PLC, Upfield, Seprod Limited, Golden Fry Margarine, Willowton Group, Promasidor, Bidco Africa, Siqalo Foods, Blue Band (Upfield subsidiary), and Parmalat Africa

The Africa margarine and ghee market is characterized by intense competition driven by both multinational corporations and regional players. Companies like Unilever PLC, Upfield, and Seprod Limited dominate the market with their well-established brands, extensive distribution networks, and innovation in product offerings. These multinational giants compete primarily on price, product quality, and nutritional fortification, targeting urban and semi-urban consumers. Products like Blue Band by Upfield and Flora by Siqalo Foods are widely recognized for their strong market presence.

Regional players such as Bidco Africa and Willowton Group leverage their deep understanding of local consumer preferences, offering competitively priced products that appeal to budget-conscious buyers. These companies often emphasize affordability and availability, making them popular in rural areas and among middle- and low-income households.

The market also sees competition from smaller producers and unorganized local manufacturers, particularly in the ghee segment, where traditional, artisanal products still have a niche audience. Rising consumer demand for healthier options has intensified competition, with players introducing fortified margarine and plant-based alternatives.

E-commerce and digital marketing are increasingly utilized for brand differentiation, targeting tech-savvy consumers. As urbanization grows and dietary trends evolve, the competitive landscape is expected to become even more dynamic, fostering product innovation and price wars

MARKET SEGMENTATION

This research report on the Africa Margarine and Ghee market is segmented and sub-segmented into the following categories.

By Fat Content

- Common margarine

- Reduced-fat margarine

- Low-fat margarin

By Packaging

- Less than 250 gr

- 250 gr

- More than 250 gr

By Price segment

- Mass

- Mid-priced

- Premium

By Distribution channels

- HoReCa

- Retail

By Retail Distribution Channels

- Supermarkets and hypermarkets

- Specialist retailers

- Convenience stores

- Independent small grocers

- Others

Frequently Asked Questions

1. How does the demand for margarine and ghee vary across Africa?

Demand varies by region, influenced by dietary preferences, cultural practices, income levels, and urbanization. Countries with higher urban populations tend to see higher consumption of margarine.

2. What is driving the growth of the margarine and ghee market in Africa?

Growth drivers include increasing urbanization, rising disposable incomes, expanding foodservice sectors, and growing awareness of margarine as a cost-effective butter alternative.

3. Which types of margarine are most popular in the African market?

Baking margarine, table margarine, and soft spreads are widely used, depending on consumer preferences and intended applications.

4. Who are the major players in the Africa margarine and ghee market?

Key companies include Unilever, Upfield, Bidco Africa, and local manufacturers specializing in regional flavors and preferences.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]