Global Aeroengine Composites Market Size, Share, Trends, & Growth Forecast Report – Segmented By Aircraft (Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, Helicopter, and Military Aircraft), Application (Fan Blades, Fan Case, Outlet Guide Vanes, Shrouds, and Others), Composite (Polymer Matrix Composites, Ceramic Matrix Composites, and Metal Matrix Composites), & Region - Industry Forecast From 2024 to 2032

Global Aeroengine Composites Market Size (2024 to 2032)

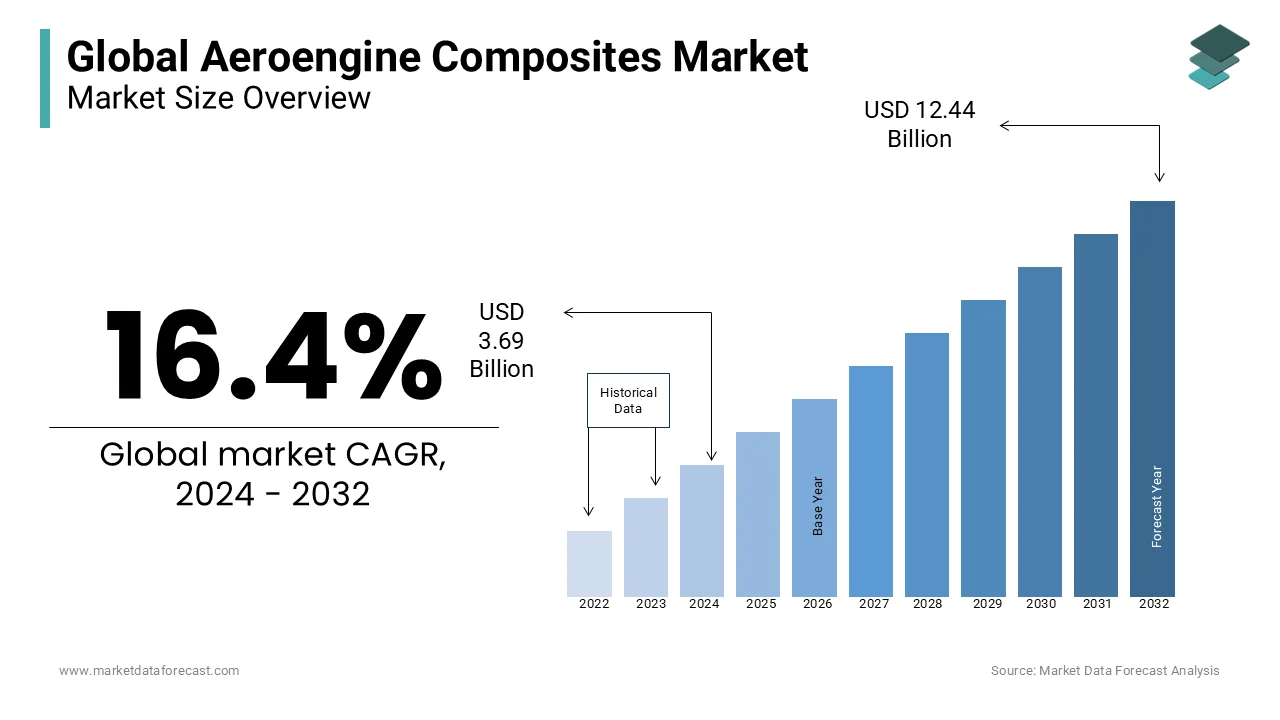

The global aeroengine composites market was worth USD 3.17 billion in 2023. The global market is expected to reach USD 3.69 billion in 2024. This value is further estimated to be growing at a CAGR of 16.4% from 2024 to 2032 and worth USD 12.44 billion by 2032.

Companies are increasing the use of composite materials in aircraft engines because they need to reduce the total weight of an aircraft and improve its operability in a wide range of operating areas.

The design and manufacturing solutions of composite engines for aircraft allow engineers to develop powerful components quickly and safely for aircraft engines. This allows original equipment manufacturers to meet the requirements of schedule, strength, weight, durability, initial performance manufacturing, and field repair of the most demanding applications.

MARKET DRIVERS

As the demand for next-generation Aeroengine Composites increases, aircraft production speeds increase, which leads to higher market revenues. As manufacturers need to reduce the total weight of an aircraft and improve its operability in a wide range of operating environments, they are increasing the use of composite materials in aircraft engines. As a result, innovation in the market is rising, and many players are investing significant amounts in R&D to manufacture aircraft engine components using different composite materials. Aero engines are now a small part of the global aircraft composites market, but they are expected to grow at an impressive rate over the next five years.

The higher penetration of modern aviation engines such as LEAP, GEnx, GE9x, and Passport 20 is a significant growth engine in the market, along with higher production speeds for the next generation of A350XWB, B787, and F-35 composite-range aircraft. Furthermore, the constant demand for low-fuel engines, the increase in fan diameter for the new variant engines, the introduction of low-fuel variants of the best-selling aircraft with the highest composite content; A320neo and B737 max increase, and even more, the growth of composite materials in aviation engines is strengthening.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

16.4% |

|

Segments Covered |

By Aircraft, Application, Composite, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Albany, Safran Aerospace Composites, CFAN, Meggitt PLC, GKN Aerospace (Melrose Industries), GE Aviation, FACC AG, and Triumph Group Inc. |

SEGMENTAL ANALYSIS

Global Aeroengine Composites Market Analysis By Aircraft Type

Wide-body airplanes will continue to be the engine of market growth during the forecast period. Next-generation aircraft programs, The A350XWB, and the B787 have increased production rates and the diffusion of compounds in the latest aircraft variants, such as the B777x, is leading the telegraph aircraft sector. On the other hand, the narrow-body segment of aircraft is likely to witness the highest growth rate in the foreseen years with the increasing adoption among low-cost carriers worldwide.

Global Aeroengine Composites Market Analysis By Composite Type

PMC is supposed to remain the most dominant compound type in the global market in the next five years. PMC is mainly used to develop all significant composite parts of engines, such as fan blades and fan housings. Carbon epoxy compounds are a perennial PMC option used mainly in the market. The CMC segment is expected to show the highest growth rate in the global aero-engine composites market in the next five years. Most of this growth is attributable to the significant increase of the LEAP engine, which has integrated several components of the CMC.

Global Aeroengine Composites Market Analysis By Application

Fan blades and box boxes make up most of the global aero-engine composites market and are expected to remain the primary application for the next five years. Next-generation engine models such as GEnx, GE9X, Pratt GTF, LEAP-1A, LEAP-1B, and LEAP-1C include fan blades and fan housings made of composite materials for sale. The development of new composite applications for engines by replacing existing metal parts further demonstrates the growth of the market for aero-engine composites. During the last decade, interest in using ceramic matrix compounds in various engine applications, such as covers, combustion jackets, and nozzles, has increased.

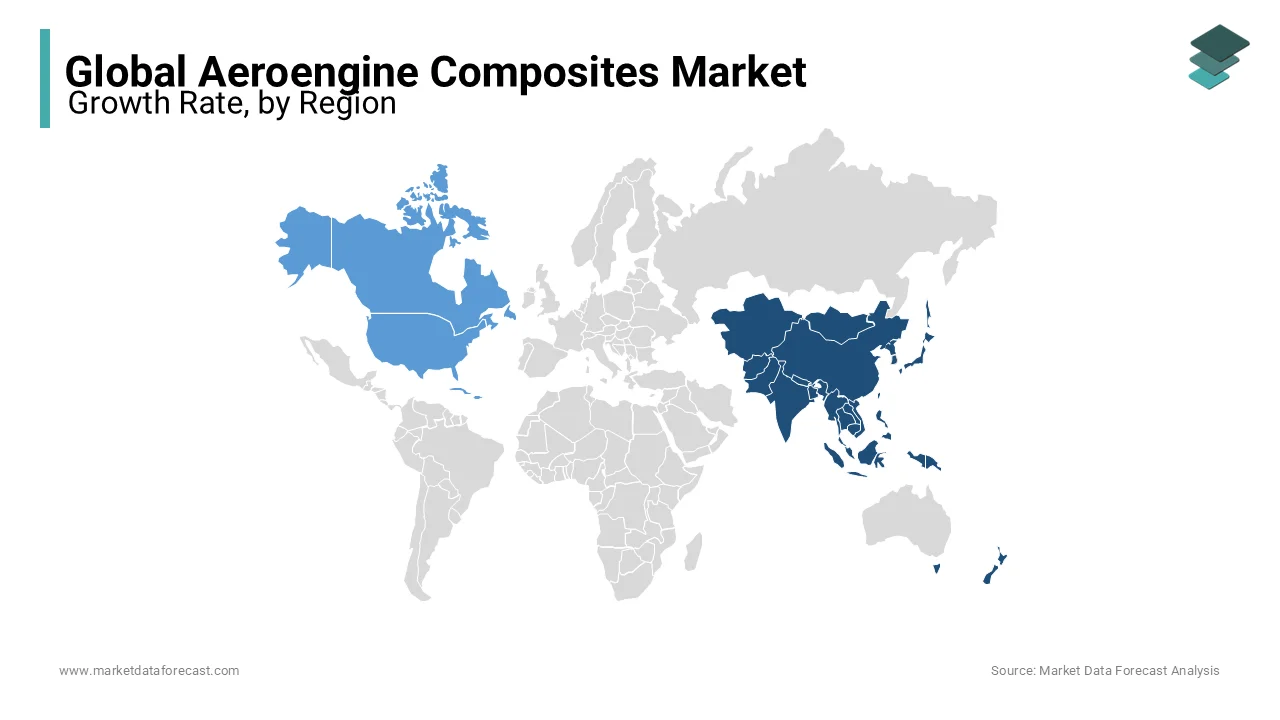

REGIONAL ANALYSIS

Regarding geography, the Asia Pacific aeroengine composites market is now the fastest-growing market in the world. The high growth rate in this region is due to the increasing purchase of engines that use these compounds. Furthermore, in the commercial sector, more than a third of the two aerospace giants that combine Airbus and Boeing will be available to customers in the Asia Pacific.

North America's aero-engines composites market is foreseen to maintain its largest share during the forecast period due to the presence of the world's largest aircraft manufacturer, Boeing. Therefore, the United States is expected to remain a growth engine for this local market during the forecast period, driven by major engine manufacturers, such as GE Aviation, CFM International, and Pratt & Whitney.

KEY MARKET PARTICIPANTS

Key players in the Aeroengine Composites Market include Albany, Safran Aerospace Composites, CFAN, Meggitt PLC, GKN Aerospace (Melrose Industries), GE Aviation, FACC AG, and Triumph Group Inc.

Rolls-Royce and Pratt & Whitney are expected to increase the use of compounds in engine models in the coming years. Over the years, engine manufacturers have developed significant internal compound manufacturing capabilities.

RECENT HAPPENINGS IN THE MARKET

-

AirAsia announced in June 2019 that it would convert 253 A320-200neo orders into larger A321-200neo aircraft.

-

GE is working on a fourth-generation composite blade for the GE9X. This new engine will be the most significant engine made by GE and is designed exclusively for the Boeing 777X aircraft.

-

In October 2019, India delivered its first fighter plane in Rafale, and the remaining 35 jets are expected to be delivered in mid-2022. This jet is powered by an M88 engine with a gondola and nozzle made of the structural compound.

DETAILED SEGMENTATION OF THE GLOBAL AEROENGINE COMPOSITES MARKET INCLUDED IN THIS REPORT

This research report on the global aeroengine composites market has been segmented and sub-segmented based on the aircraft type, composite type, application, and region.

By Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- Military Aircraft

- Helicopter

By Composite Type

- Polymer Matrix Composites

- Ceramic Matrix Composites

- Metal Matrix Composites

By Application

- Fan Blades

- Fan Cases

- Outlet Guide Vanes

- Shrouds

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary drivers for the growth of the Aeroengine Composites Market globally?

The primary drivers include the increasing demand for fuel-efficient aircraft, advancements in composite material technology, the rising need for lightweight materials to reduce aircraft weight, and the growing focus on reducing emissions and improving environmental sustainability in the aviation industry.

What types of composite materials are most commonly used in aeroengines?

The most commonly used composite materials in aeroengines are carbon fiber composites, ceramic matrix composites (CMCs), and polymer matrix composites (PMCs). Carbon fiber composites are valued for their high strength-to-weight ratio, CMCs for their high-temperature resistance, and PMCs for their versatility and cost-effectiveness.

What are the challenges facing the Aeroengine Composites Market?

Challenges include high manufacturing costs, technical difficulties in production and repair, limited availability of raw materials, and stringent regulatory requirements. Overcoming these challenges requires ongoing research and development, investment in new manufacturing technologies, and collaboration across the aerospace industry.

What future trends are expected in the Aeroengine Composites Market?

Future trends include the development of more advanced composite materials with higher performance characteristics, increased automation in composite manufacturing processes, greater use of 3D printing technologies, and a stronger focus on sustainability and recycling of composite materials. The market is also expected to see greater collaboration between aerospace companies and material science experts to push the boundaries of what composites can achieve in aeroengines.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]