Global Advanced Protective Gear and Armor Market Size, Share, Trends, & Growth Forecast Report by sector (Ancillary/Gloves, Head, Eye, and Respirators, Thermal Protective, CBRN (Chemical, Biological, Radiological, and Nuclear) Protective Gear, and Armor and Bullet Resistant Gear) & Region, Industry Forecast From 2024 to 2033

Global Advanced Protective Gear and Armor Market Size

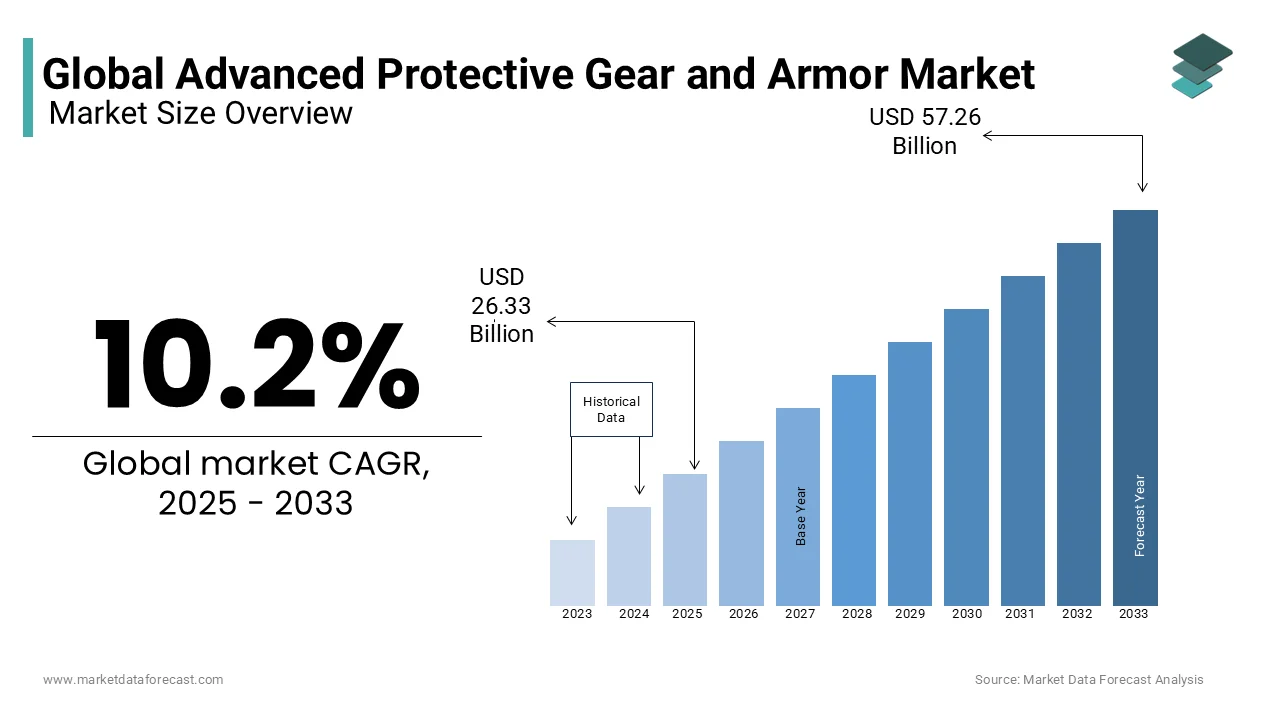

The global advanced protective gear and armor market was worth USD 23.89 billion in 2024. The global market is predicted to reach USD 26.33 billion in 2025 and USD 57.26 billion by 2033, growing at a CAGR of 10.2% during the forecast period 2025 to 2033.

The advanced protective gear and armor market has witnessed substantial growth in the last decade, driven by the rising demand from military, law enforcement, industrial, and sports sectors. The introduction of materials such as Kevlar, Dyneema, and carbon fiber composites has contributed to the development of lighter and more durable protective gear, significantly increasing adoption in high-risk environments. Defense, in particular, remains a key driver as modern threats continue to underscore the need for state-of-the-art protection solutions.

Increased competition has emerged, with industry leaders like 3M, Honeywell, and DuPont heavily investing in research and development to deliver innovative solutions. These advancements, such as body armor equipped with smart sensors and nanotechnology, offer real-time health monitoring alongside physical protection. Meanwhile, the entry of smaller players has further intensified the competitive landscape, particularly in specialized niches like wearable tech for athletes and industrial workers.

North America, Europe, and Asia-Pacific dominate the market, with the U.S. and China contributing significantly due to their extensive defense budgets and industrial capacities. Europe also plays a critical role, driven by stringent safety regulations and advanced military initiatives.

As of 2023, the global advanced protective gear market was valued at $12.7 billion, with a compound annual growth rate (CAGR) of 6.5% over the past decade. Escalating global security concerns and regulatory requirements are anticipated to continue driving market expansion.

MARKET TRENDS

Integration of Smart Technology

The integration of smart technology has emerged as a prominent trend in the advanced protective gear and armor market. Wearable sensors and IoT-enabled devices now facilitate real-time data monitoring, enhancing safety and operational efficiency. For instance, military and law enforcement personnel increasingly rely on smart vests that track vital signs, detect impact forces, and transmit location data, improving situational awareness. This trend is largely driven by the need for real-time communication in high-risk scenarios. The growing adoption of smart protective gear is particularly notable in North America and Europe, where projections indicate a 10% annual growth rate through 2028.

Lightweight and High-Performance Materials

The adoption of lightweight yet durable materials such as Dyneema, Kevlar, and graphene is reshaping the advanced protective gear landscape. These materials provide enhanced ballistic protection without compromising mobility, making them crucial for military and law enforcement applications. The global military body armor market, valued at $3.3 billion in 2022, plays a significant role in this trend. These modern materials also help reduce user fatigue, enhancing both comfort and endurance. In industrial settings, the shift toward lightweight protective gear is becoming increasingly common, allowing workers in hazardous environments to perform tasks with greater efficiency and safety.

Growing Demand in Civilian and Industrial Sectors

The demand for advanced protective gear in civilian and industrial sectors continues to grow, with industries such as construction, manufacturing, and sports adopting high-tech solutions to comply with safety regulations. In 2023, the industrial protective gear market reached a valuation of $5 billion, driven by the implementation of stricter global safety standards. For example, construction workers in Europe and North America now utilize protective wear equipped with sensors to monitor environmental conditions such as air quality and temperature. This trend is expected to persist as governments increasingly prioritize workplace safety, particularly in sectors like energy, mining, and heavy machinery.

MARKET DRIVERS

Increasing Military and Defense Spending

Global military spending has been a key driver in the advanced protective gear and armor market. Nations are increasingly allocating significant portions of their defense budgets toward modernizing protective equipment, prioritizing enhanced durability and safety. According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure reached $2.24 trillion in 2022, with major investments coming from the U.S., China, and India. This surge in defense budgets continues to boost the demand for advanced armor solutions, including ballistic vests, helmets, and body armor made from cutting-edge materials like carbon fiber and ceramic composites. In a practical application, the U.S. Army has introduced body armor systems that are 30% lighter than their predecessors, enabling soldiers to perform more efficiently in combat zones.

Rising Industrial Safety Regulations

The growing emphasis on workplace safety standards globally is another pivotal factor driving market growth. Governments in regions such as North America, Europe, and Asia are enforcing more stringent safety regulations across high-risk industries like construction, manufacturing, and mining. For example, the U.S. Occupational Safety and Health Administration (OSHA) has increased penalties for safety violations, leading to a rise in demand for advanced protective gear. The International Labour Organization (ILO) highlights that over 2.3 million work-related deaths occur annually, prompting industries to adopt more sophisticated safety equipment. In 2023, the industrial safety gear market saw a 7% growth, reflecting a greater focus on worker protection and regulatory compliance.

Technological Advancements in Material Science

Material science advancements are transforming the protective gear market. Innovations such as graphene, carbon nanotubes, and nanotechnology-enhanced fabrics are delivering lighter, stronger, and more flexible protective solutions. These materials offer superior protection against a range of threats—physical, chemical, and biological. The global nanotechnology market, valued at $1.76 billion in 2022, plays a crucial role in driving these innovations. For instance, modern firefighter suits now feature nanomaterials that enhance both heat resistance and flexibility. Similarly, military-grade armor now incorporates nanotechnology to improve protection while reducing weight, significantly enhancing mobility and endurance for personnel in active operations.

MARKET RESTRAINTS

High Cost of Advanced Materials

One of the primary challenges in the advanced protective gear and armor market is the high cost associated with cutting-edge materials like Kevlar, Dyneema, and graphene. While these materials offer superior protection and durability, their production costs remain high, driving up the overall cost of protective gear. For smaller organizations, particularly in low-income regions, the price point becomes a significant barrier to adoption. For instance, advanced military body armor can exceed $1,000 per unit, limiting its scalability in countries with more constrained defense budgets. Additionally, industries such as construction and manufacturing may hesitate to invest in more expensive protective gear, slowing the widespread adoption of innovative materials.

Stringent Regulatory Approvals

The regulatory approval process for advanced protective gear is both lengthy and complex, serving as a restraint on market growth. Protective equipment, especially in defense and industrial sectors, must meet rigorous national and international standards before deployment. For example, body armor used by law enforcement must pass stringent testing to comply with standards set by the National Institute of Justice (NIJ) in the U.S. Similarly, industrial protective gear must meet OSHA standards. While these certifications are essential for ensuring safety, they can significantly delay product time-to-market. The prolonged approval processes often result in lost revenue opportunities and slower market expansion for manufacturers.

Environmental Concerns and Sustainability Issues

The production and disposal of advanced protective gear pose environmental challenges, particularly due to the non-biodegradable nature of materials like plastics and composites. As industries and governments push toward more sustainable manufacturing practices, the environmental footprint of protective gear production is coming under increased scrutiny. The disposal of outdated body armor, especially within the military, adds to the growing concern over environmental waste. Moreover, the production processes for high-tech materials such as Kevlar and carbon fiber are energy-intensive, contributing to a larger carbon footprint. Companies are facing growing pressure to adopt eco-friendly practices, but transitioning to sustainable production methods presents significant cost and technological challenges, which are hampering the market’s growth.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion into emerging markets presents a significant growth opportunity for the advanced protective gear and armor industry. Regions such as Asia-Pacific, Latin America, and the Middle East are seeing increased investment in safety equipment across sectors including military, law enforcement, and industrial applications. Countries like India and Brazil are enhancing their defense budgets and workplace safety regulations, creating a surge in demand for modern protective solutions. A 2023 market report forecasts that the Asia-Pacific region will experience a compound annual growth rate (CAGR) of over 8% in the advanced protective gear market through 2030. These markets are increasingly adopting advanced technologies as economic expansion drives infrastructure development and regulatory reforms, offering lucrative opportunities for manufacturers to establish a strong foothold.

Rise of Green and Sustainable Materials

Growing environmental awareness is reshaping the protective gear and armor market, as the demand for eco-friendly solutions continues to rise. Manufacturers are exploring biodegradable and recyclable materials as alternatives to traditional, environmentally harmful products. The integration of natural fibers, bio-based composites, and sustainable polymers in the production of protective gear is gaining momentum. For instance, research into biodegradable ballistic armor made from renewable resources is underway, providing high-level protection while reducing environmental impact. In 2023, the market for sustainable protective materials grew by 5%, signaling increasing consumer and regulatory focus on environmentally responsible alternatives.

Increased Focus on Customization and Ergonomics

The growing emphasis on ergonomically designed and customizable protective gear presents another key opportunity for the market. Industries are seeking solutions tailored to specific needs, whether it's lightweight armor for law enforcement or chemical-resistant suits for industrial applications. Advances in 3D printing and flexible materials enable manufacturers to create custom-fit protective gear, enhancing both comfort and protection. For example, the U.S. military is leveraging 3D printing to produce personalized body armor, reducing fatigue and boosting operational efficiency. This trend toward customization is expected to accelerate, particularly in sectors such as sports, construction, and law enforcement, where personalized protective equipment enhances safety and performance.

MARKET CHALLENGES

Balancing Cost with Innovation

One of the key challenges in the advanced protective gear and armor market is balancing the high cost of innovation with the need for broader market accessibility. While cutting-edge materials like graphene and nanotechnology-enhanced fabrics offer superior protection, their development and manufacturing processes are expensive. This makes it difficult for manufacturers to make these advanced products affordable for a wider customer base. For instance, graphene-based armor remains in the early stages of development due to high production costs, limiting its market reach. Small and mid-sized companies, particularly in developing regions, face barriers to adopting such innovations. Reducing production costs without compromising on quality remains a critical challenge.

Supply Chain Disruptions

Supply chain disruptions, heightened by the COVID-19 pandemic and geopolitical tensions, present a significant challenge to the protective gear and armor market. The production of advanced protective gear depends on raw materials sourced globally, often from multiple countries. High-strength fibers like Kevlar and Dyneema, for example, rely on intricate supply chains. Any disruption in this chain can lead to delays and shortages, impacting sectors such as defense and industrial safety, where timely equipment availability is crucial. In 2021, global supply chain challenges delayed the delivery of military-grade armor to several nations, underscoring the market’s vulnerability to logistical disruptions.

Technological Obsolescence

Rapid technological advancements in protective gear and armor have led to concerns around obsolescence, posing a challenge for manufacturers and consumers alike. As new materials and innovations emerge, older models quickly become outdated, which can be costly for industries requiring frequent upgrades to meet evolving safety standards. Military organizations, for example, often face difficulties when transitioning to newer body armor systems, as legacy equipment may no longer offer adequate protection. This challenge extends to law enforcement and industrial sectors, where changing safety regulations necessitate continuous investment in updated protective equipment. Managing the lifecycle of these products to ensure they remain effective and compliant is a significant hurdle for manufacturers and end users.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.2% |

|

Segments Covered |

By Sector, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

TenCate Advanced Armor USA, Inc. 3M Company, Avon Rubber plc, DuPont de Nemours, Inc., L. Gore & Associates, Inc., Honeywell International Inc., Sioen Industries NV, Teijin Limited, Lakeland Industries, Inc., Ansell Limited, Alpha Pro Tech, Ltd., Kimberly-Clark Corporation, Point Blank Enterprises, Inc., Uvex group, Mine Safety Appliances Company, ArmorSource LLC, and BAE Systems plc. |

SEGMENTAL ANALYSIS

By Sector Insights

Ancillary/Gloves, Head, Eye, and Respirators

The Ancillary/Gloves, Head, Eye, and Respirators segment is led by respirators, which dominate the market with a 40% share and an anticipated compound annual growth rate (CAGR) of 6.2%. The heightened demand for respirators is primarily driven by stringent regulatory requirements in sectors such as construction, oil & gas, and healthcare, where worker safety is paramount. The global response to the COVID-19 pandemic has underscored the critical importance of respiratory protection, propelling long-term adoption across multiple industries. Manufacturers are now focusing on integrating advanced technologies, such as smart sensors and real-time air quality monitoring, to improve respirator performance. In 2023, Honeywell launched a new line of IoT-enabled respirators, offering real-time data on exposure to harmful substances, thereby enhancing both safety and efficiency. As organizations like OSHA and the European Agency for Safety and Health at Work continue to tighten safety regulations, the demand for respirators is expected to remain strong. With growing awareness of health risks in industrial settings, respirators are projected to maintain their position as the fastest-growing and largest component within the Ancillary sector.

Thermal Protective

The Thermal Protective segment is projected to grow at a CAGR of 5.9%, driven by the increasing demand for heat-resistant clothing across industries such as firefighting, oil & gas, chemical manufacturing, and metallurgy. The need for enhanced protection in high-temperature environments has spurred the development of advanced materials like Nomex and Kevlar, which offer superior thermal resistance and durability. Firefighter gear remains a critical driver in this segment, with emergency responders requiring robust thermal protection to safely operate in dangerous conditions. In 2023, DuPont introduced a new line of thermal protective clothing for firefighters, incorporating smart sensors to monitor temperature and exposure to harmful gases, thereby improving both safety and operational efficiency. Additionally, stricter safety regulations in North America and Europe, alongside rising industrial activity in emerging markets like Asia-Pacific, are contributing to the steady growth of this sector.

CBRN (Chemical, Biological, Radiological, and Nuclear) Protective Gear

The CBRN Protective Gear segment has experienced strong growth, driven by the increasing threat of chemical and biological warfare, as well as the rising need for biohazard protection. Countries with large defense budgets, such as the U.S., China, and Russia, are investing heavily in CBRN protective solutions, including suits, masks, and detection equipment, to safeguard military personnel from harmful agents. In 2023, the U.S. military introduced nanotechnology-based CBRN suits, which improved both the weight and durability of traditional protective gear while offering enhanced levels of protection. The COVID-19 pandemic also highlighted the importance of CBRN protection within healthcare and emergency response sectors, leading to increased investment in this area. As global demand for biosecurity measures continues to rise, particularly in response to pandemics and bioterrorism, the CBRN segment is expected to see sustained growth over the coming years.

Armor and Bullet Resistant Gear

The Armor and Bullet Resistant Gear segment is primarily driven by global military spending and the increasing need for advanced ballistic protection in military and law enforcement applications. Governments across the globe are actively investing in modernizing their protective equipment, with innovations in materials such as Kevlar, Dyneema, and carbon nanotubes resulting in lighter, stronger, and more flexible armor. Military forces, particularly in the U.S., NATO countries, and China, are prioritizing the development of next-generation body armor to enhance both mobility and protection for soldiers. In 2023, BAE Systems secured a major contract with the UK Ministry of Defence to supply state-of-the-art body armor, reflecting the ongoing demand for advanced protective solutions. Law enforcement agencies are also increasing their investment in bullet-resistant vests and tactical gear to combat rising threats from terrorism and active shooter incidents. The growing preference for modular and customizable armor solutions that offer scalable protection is expected to drive robust growth in this segment over the next decade.

REGIONAL ANALYSIS

North America: "The Heavyweight Champion of Protective Gear"

North America dominated the global advanced protective gear and armor market, capturing approximately 35% of the total revenue in 2023. The U.S. defense sector serves as the primary catalyst for growth, representing the largest consumer of advanced armor solutions. In 2022, U.S. military expenditure reached $877 billion, with a notable portion allocated to upgrading protective equipment, such as body armor, helmets, and ballistic vests. This trend continues to drive the North American market, supported by an annual military budget exceeding $50 billion dedicated to personal protection equipment.

Furthermore, heightened enforcement of industrial safety regulations by the Occupational Safety and Health Administration (OSHA) is spurring demand for protective gear in industries such as construction, oil & gas, and manufacturing. The North American market is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030, fueled by ongoing research and development (R&D) in smart protective gear. Recent innovations include sensor-embedded vests designed for firefighters and law enforcement, gaining rapid market adoption.

Europe: "Pioneering Safety with Precision and Sustainability"

Europe, the second-largest market for advanced protective gear and armor market. The market is projected to grow at a CAGR of 5.8% through 2030 in this region, fueled by increasing defense spending and a strong focus on sustainability. Leading countries such as Germany, France, and the U.K. are driving this growth, bolstered by stringent worker safety regulations and a commitment to advancing defense capabilities. Germany's proactive stance on industrial safety standards, with backing from the German Federal Institute for Occupational Safety and Health, has significantly elevated the demand for high-quality protective gear in sectors like manufacturing and engineering.

The European Union’s push for carbon reduction has sparked interest in eco-friendly protective gear made from sustainable materials. Several European Defense Agency-funded projects are now incorporating lightweight, sustainable materials into military-grade armor. In 2023, France further expanded its defense budget by 7%, emphasizing the procurement of advanced protective solutions. Europe’s focus on research and development (R&D) and green technologies positions the region as a leader in sustainable innovation for protective gear.

Asia-Pacific: "Rising Giants in Protective Innovation"

The Asia-Pacific region is emerging as a pivotal player in the global market, the region's growth is largely driven by countries such as China, India, and Japan. In 2022, China allocated $292 billion to military expenditure, positioning it as the world’s second-largest defense spender and a major consumer of advanced military armor.

Additionally, industrial safety standards are becoming more rigorous in countries like China and India, prompting higher demand for protective gear in construction and manufacturing sectors. India, for instance, has outlined plans to procure over 50,000 sets of body armor for its armed forces by 2024, with a focus on lightweight and advanced materials. Asia-Pacific is also investing in research and development (R&D) for smart and nanotechnology-enabled protective gear. With rising disposable incomes and a growing middle class, the region is witnessing increased demand for protective gear in consumer and sports sectors, contributing to a broader market expansion.

Middle East & Africa: "Navigating Challenges, Seizing Opportunities"

In 2023, the Middle East & Africa (MEA) region is poised to grow steadily driven by increased defense spending in countries like Saudi Arabia and the UAE. Saudi Arabia's military budget reached $61 billion in 2022, with significant investments in personal protection equipment for military personnel.

The oil and gas industries across the Middle East are also driving demand for protective gear, as companies seek to comply with stringent safety regulations. Similarly, in Africa, countries like South Africa and Nigeria are experiencing a surge in demand for industrial safety gear, fueled by growing mining activities. Despite challenges such as economic instability and limited access to cutting-edge technology, the region holds significant opportunities for growth, particularly in defense and energy sectors, where governments are looking to modernize their protective equipment.

Latin America: "A Growing Market Fueled by Safety Regulations"

Latin America, though a smaller player, is witnessing rapid growth with Brazil and Mexico at the forefront. Brazil, the region’s largest economy, recently approved a $2 billion defense budget aimed at upgrading its military equipment, including personal armor.

In the industrial sector, Latin American countries are tightening safety regulations in an effort to reduce workplace accidents. Construction and manufacturing sectors in Mexico are key drivers, with demand for lightweight, durable protective gear on the rise. However, economic volatility and political instability in some parts of the region could present challenges to market growth. Nonetheless, the region’s expanding industrial base and increasing regional economic development are creating opportunities for market players, especially in mining, energy, and agriculture sectors, where safety equipment is becoming increasingly critical.

KEY MARKET PLAYERS

The major palyers in the Global Advanced Protective Gear and Armor Market include ArmorSource LLC, Honeywell International Inc., Point Blank Enterprises, Inc., Teijin Limited, 3M Company, DuPont de Nemours, Inc., Avon Protection Systems, Inc., BAE Systems, Safariland Group, and Mitsui Chemicals, Inc.

COMPETITIVE LANDSCAPE

The advanced protective gear and armor market is characterized by intense competition, driven by increasing demand for innovative solutions across military, industrial, and law enforcement sectors. Industry leaders such as Honeywell, DuPont, and 3M dominate the market, capitalizing on their extensive research and development (R&D) capabilities to produce high-performance materials like Kevlar, Nomex, and Dyneema. These advanced materials offer superior protection by being lighter, stronger, and more durable, providing a distinct competitive advantage.

Competition within the market is further amplified by specialized firms such as Point Blank Enterprises and Safariland Group, which focus on developing ballistic armor and tactical gear specifically for military and law enforcement applications. In addition to these established players, smaller firms are making notable strides in niche markets by offering highly tailored or technologically advanced solutions, including sensor-embedded and smart protective gear designed for specific operational needs.

Emerging players, particularly from the Asia-Pacific region, are increasingly entering the market with cost-effective solutions, adding another layer of competition, particularly on pricing. Additionally, sustainability is becoming a crucial differentiator as companies shift towards eco-friendly materials in response to regulatory pressures and rising consumer demand for environmentally responsible products.

As the market continues to evolve, innovation remains paramount. Companies are facing growing challenges related to cost management and compliance with strict regulatory standards. Continuous investment in R&D, coupled with the ability to offer cutting-edge, cost-effective solutions, will be essential for maintaining a competitive edge in this dynamic landscape.

RECENT HAPPENINGS IN THE MARKET

The advanced protective gear and armor market has witnessed a series of notable developments, underscoring the sector’s dynamic growth and innovation:

- In March 2024, Honeywell International Inc. launched a new line of smart body armor integrated with IoT technology, specifically designed for military use. This innovation enhances real-time monitoring and situational awareness on the battlefield, reflecting the growing demand for smart protective solutions.

- In January 2024, DuPont expanded its Kevlar production facility in the U.S., boosting manufacturing capacity to meet the rising global demand for high-performance protective materials. This move strengthens DuPont’s position as a key supplier of advanced protective gear.

- In November 2023, 3M Company partnered with the U.S. Department of Defense to develop lightweight ballistic protection systems, reinforcing its presence in the defense sector and addressing the growing need for advanced, lighter armor solutions.

- In October 2023, BAE Systems secured a $500 million contract with the UK Ministry of Defence to supply next-generation combat helmets and body armor for military personnel, highlighting the ongoing modernization efforts in defense equipment.

- In September 2023, Safariland Group introduced a new modular armor system for law enforcement, allowing officers to customize protection levels based on specific mission requirements, demonstrating the company’s focus on flexibility and user adaptability.

- In August 2023, Point Blank Enterprises expanded its tactical equipment portfolio by acquiring ProtectTheForce, a smaller tactical gear company. This acquisition broadens the company’s offerings in the law enforcement and military sectors.

- In July 2023, Mitsui Chemicals developed a new eco-friendly polymer for industrial safety gear, aligning with the growing market emphasis on sustainability and environmentally conscious materials.

- In June 2023, Teijin Limited entered into a strategic partnership with the Japanese Defense Ministry to co-develop lightweight protective materials for military use, showcasing continued innovation in advanced materials for defense applications.

- In May 2023, Avon Protection Systems expanded its product line by launching a new respiratory protective equipment series, tailored specifically for first responders, reinforcing its market presence in critical safety equipment.

- In April 2023, ArmorSource LLC secured a contract with the U.S. Army to supply next-generation combat helmets, further solidifying its role as a leading supplier in military head protection.

MARKET SEGMENTATION

This research report on the global advanced protective gear and armor market has been segmented and sub-segmented based on the sector and region.

By Sector

- Ancillary/Gloves, Head, Eye, and Respirators

- Thermal Protective

- CBRN (Chemical, Biological, Radiological, and Nuclear) Protective Gear

- Armor and Bullet Resistant Gear

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key drivers of growth in the advanced protective gear and armor market?

Key drivers include the rising incidence of terrorist activities, increasing military expenditures by governments, advancements in materials science, and the growing need for personal protective equipment (PPE) in various industries, including defense, law enforcement, and industrial sectors.

How has technological advancement impacted the advanced protective gear and armor market?

Technological advancements have significantly impacted the market by improving the performance, durability, and comfort of protective gear and armor. Innovations in materials, such as ultra-high molecular weight polyethylene (UHMWPE) and advanced ceramics, have led to lighter, more effective armor solutions.

Which industries are the primary consumers of advanced protective gear and armor?

The primary consumers are the defense and military sectors, law enforcement agencies, and private security firms. However, there is also growing demand from the industrial sector, particularly in mining, oil and gas, and construction, where workers require robust protective gear.

What trends are expected to shape the future of the advanced protective gear and armor market?

Future trends include the integration of smart technologies, such as sensors and communication systems into protective gear, the development of multi-threat protection solutions, and the increasing use of sustainable and eco-friendly materials in product manufacturing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]