Global Actuator Market Size, Share, Trends & Growth Forecast Report - Segmented By Type, Motion, End-User Industry And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Actuator Market Size

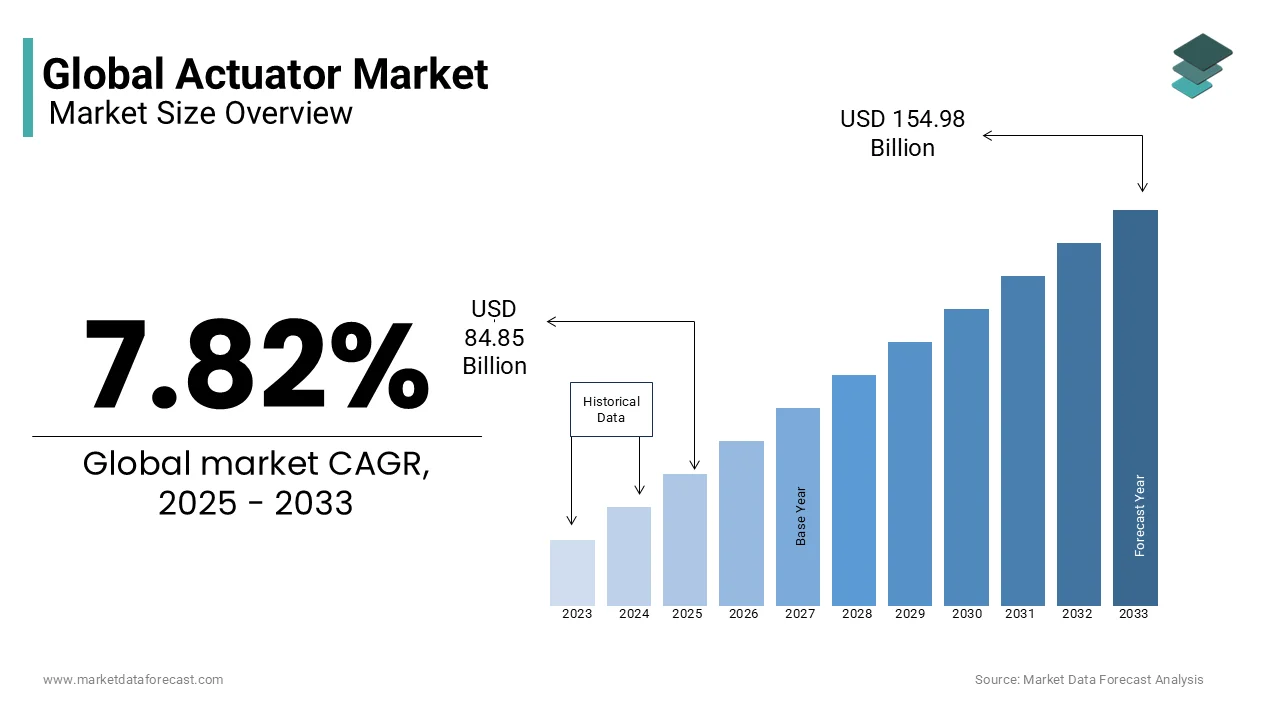

The global actuator market size was valued at USD 78.70 billion in 2024 and is anticipated to reach USD 84.85 billion in 2025 from USD 154.98 billion by 2033, growing at a CAGR 7.82% during the forecast period from 2025 to 2033.

Current Scenario of the Global Actuator Market

The actuator market includes the designs, manufactures, and sells devices used to control or move a mechanism or system. Actuators are essential components in various industries as they convert energy such as electric, hydraulic, or pneumatic into mechanical motion. These devices play a critical role in automation systems, robotics, automotive applications, aerospace, and manufacturing processes. In simple terms, actuators help machines perform specific tasks by pushing, pulling, rotating, or controlling other parts of a system. For example, an actuator might open a valve in an oil refinery or adjust the wing flaps of an airplane.

Actuators are widely used in everyday applications, from home appliances like washing machines to complex systems such as satellites. According to the International Energy Agency, electric motor systems account for nearly 50% of global electricity consumption, many of which rely on actuators for precise movement and control. Similarly, a report by the World Health Organization emphasizes that advanced medical devices including ventilators and robotic surgical systems depend heavily on actuators to ensure accurate and reliable operation. In the automotive sector, research published by the Society of Automotive Engineers (SAE) indicates that modern vehicles use between 80 to 120 actuators per car, supporting functions ranging from power windows to advanced driver-assistance systems (ADAS). These statistics underscore the widespread adoption of actuators in both industrial and consumer applications, showcasing their importance in improving efficiency, safety, and convenience across various fields. As technology continues to evolve, actuators are becoming smarter and more integrated into interconnected systems which is further expanding their relevance in daily life.

Market Drivers

Rising Demand for Renewable Energy Systems

The shift to renewable energy drives actuator market growth as actuators optimize solar and wind systems. In 2023, global renewable capacity hit 3,870 gigawatts, with solar and wind adding 510 gigawatts, as per the International Renewable Energy Agency. Actuators boost solar efficiency by 25% via sun-tracking, per the U.S. Department of Energy. U.S. wind energy reached 434 billion kilowatt-hours in 2022, relying on actuators for turbine control, according to the Energy Information Administration. Policies like the U.S. Inflation Reduction Act, offering $369 billion for clean energy, spur investments, increasing actuator demand across these expanding sectors.

Growth in Aerospace and Defense Applications

Aerospace and defense growth propels the actuator market which is driven by aircraft production and military upgrades. In 2022, global aircraft deliveries totaled 1,263, per the Federal Aviation Administration. Modern aircraft use over 100 actuators for flight controls, per the U.S. Department of Defense. The department’s 2023 budget included $130.1 billion for R&D, advancing actuator technologies for drones and missiles. NASA reports a 15% rise in actuator use in spacecraft from 2018 to 2022, per its technical assessments. This sector’s steady expansion, fueled by government funding, ensures sustained actuator market growth.

Market Restraints

Environmental Concerns Over Hydraulic Fluids

Hydraulic actuators face restraints from environmental risks tied to fluid spills, curbing market growth. The U.S. Environmental Protection Agency estimates 16 million gallons of hydraulic fluid spill annually in the U.S., costing over $1 billion in cleanup. About 70% of spills occur in industrial settings, per the agency. The EU’s REACH regulations, enforced by the European Commission, raise compliance costs by millions yearly, pushing industries toward electric actuators. This shift and regulatory pressure limit hydraulic actuator adoption, slowing overall market expansion in eco-conscious regions.

High Energy Consumption in Manufacturing

Actuator production’s high energy use restricts market growth amid rising costs. The U.S. Energy Information Administration states industrial manufacturing consumed 32.5 quadrillion BTUs in 2022, with actuator plants using significant shares. A typical facility consumes 500,000 kWh yearly, per the U.S. Department of Energy. Global energy prices surged 26% in 2023, per the International Energy Agency, hiking production costs by 15%. This burden, especially in energy-scarce areas, discourages scaling actuator output, constraining market growth despite demand from other sectors.

Market Opportunities

Expansion of Electric Vehicle Production

Electric vehicle (EV) growth offers actuator market opportunities, as EVs depend on actuators for key functions. Global EV sales reached 14 million in 2023, per the International Energy Agency. Each EV uses 50-70 actuators, per the U.S. Department of Energy. U.S. EV production rose 40% to 900,000 units from 2021 to 2022, per the agency. The U.S. Inflation Reduction Act provides $7,500 tax credits per vehicle are accelerating adoption and actuator demand. This EV boom positions actuators as critical components in automotive innovation.

Advancements in Smart City Infrastructure

Smart city development creates opportunities for actuators in automation and traffic systems. The United Nations predicts 68% of people will live in cities by 2050, spurring infrastructure spending. In 2022, the U.S. Department of Transportation invested $60 billion in smart transport, including actuator-driven systems. These improve traffic efficiency by 20%, per the Federal Highway Administration. Global smart city investments hit $124 billion in 2023, per the International Data Corporation, amplifying actuator use in urban solutions and fostering market growth.

Market Challenges

Supply Chain Disruptions

Supply chain issues challenge the actuator market by delaying raw materials. In 2022, the U.S. Census Bureau reported a 12% drop in industrial metal imports due to shipping snarls. Aluminum prices, vital for actuators, rose 18% in 2023, per the U.S. Bureau of Labor Statistics. The Department of Commerce found 60% of U.S. manufacturers faced shortages in 2022, cutting output by 10-15%. Ongoing geopolitical tensions and logistics woes inflate costs, threatening market stability and growth.

Stringent Safety Regulations

Tightening safety rules challenge actuator makers with costly compliance. The Occupational Safety and Health Administration recorded 5,486 workplace deaths in 2022, with 20% tied to equipment failures. U.S. regulations demand a 30% failure rate drop by 2025, per the agency. The European Commission’s Machinery Regulation, effective 2023, adds $500 million in annual testing costs. These mandates strain budgets and slow innovation, reducing market agility and competitiveness in regulated regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.82% |

|

Segments Covered |

By Type, Motion, End-User Industry and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB (Zurich, Switzerland), MISUMI (Tokyo, Japan), TAMAGAWA SEIKI Co. Ltd. (Nagano, Japan), Moog Inc. (New York, U.S.), Eaton Corporation Inc. (Ohio, U.S.), Rockwell Automation, Inc. (Wisconsin, U.S.), SMC Corporation (Tokyo, Japan), Emerson Electric Co. (Missouri, U.S.), Parker Hannifin Corporation (Ohio, U.S.), Curtiss-Wright Corporation (North Carolina, U.S.). |

SEGMENT ANALYSIS

Actuator Market Analysis By Motion

The linear segment dominated the actuator market and held a 63.7% market share in 2024 because industries like manufacturing and automotive rely on it for precise movement. Its importance is in boosting efficiency in machinery. The U.S. Bureau of Labor Statistics says manufacturing employed 12.9 million workers in 2023 driving demand for linear actuators. The U.S. Department of Transportation reports 287 million vehicles were registered in 2023 needing linear motion for automation. This high usage in key sectors explains its top position.

The rotary segment grows fastest with a CAGR of 8.9% from 2025 to 2033. It expands quickly due to automation in robotics and energy systems needing rotational control. Its importance lies in operating valves and tools efficiently. The International Federation of Robotics states 3.2 million industrial robots were active globally in 2023 increasing rotary actuator use. The U.S. Energy Information Administration notes 19% of U.S. electricity came from automated systems in 2023 relying on rotary motion. This surge in automation and energy needs fuels its rapid rise.

Actuator Market Analysis By Type

The hydraulic segment captured a 37.3% market share in 2024. It is due to it provides strong force for heavy tasks in construction and mining. Its importance is in powering large equipment reliably. The U.S. Census Bureau reports construction spending hit $2 trillion in 2023 supporting hydraulic use. The U.S. Geological Survey says mineral production reached $93 billion in 2023 depending on hydraulic actuators. This demand from heavy industries secures its top spot.

The electric segment is the fastest-growing with a CAGR of 7.4% from 2024 to 2032. It rises due to demand for energy-efficient precise actuators in automotive and aerospace. Its importance is in cutting energy costs and enhancing control. The U.S. Department of Energy reports electric vehicle sales hit 1.2 million in 2023 needing electric actuators. The International Energy Agency says global electricity use grew 2.5% in 2023 pushing electric solutions.

Actuator Market Analysis By End-Use Industry

The automotive segment led the with a 25% market share in 2023. It dominates due to mass vehicle production and efficiency needs. Its importance is in improving vehicle systems and safety. The U.S. Department of Transportation reports 287 million vehicles were registered in 2023 using actuators. The Bureau of Economic Analysis says transportation equipment added $510 billion to GDP in 2023 showing its economic role. This scale of production and impact cements its leading position.

The aerospace and defense segment emerged as the fastest advancing category with a CAGR of 8.1% over the forecast period. It rises due to rising aircraft demand and defense budgets. Its importance is in ensuring flight precision and security. The U.S. Federal Aviation Administration says 8,300 commercial aircraft operated in 2023 needing actuators. The U.S. Department of Defense reports $750 billion in spending in 2023 boosting demand. This investment and growth drives its rapid expansion.

REGIONAL ANALYSIS

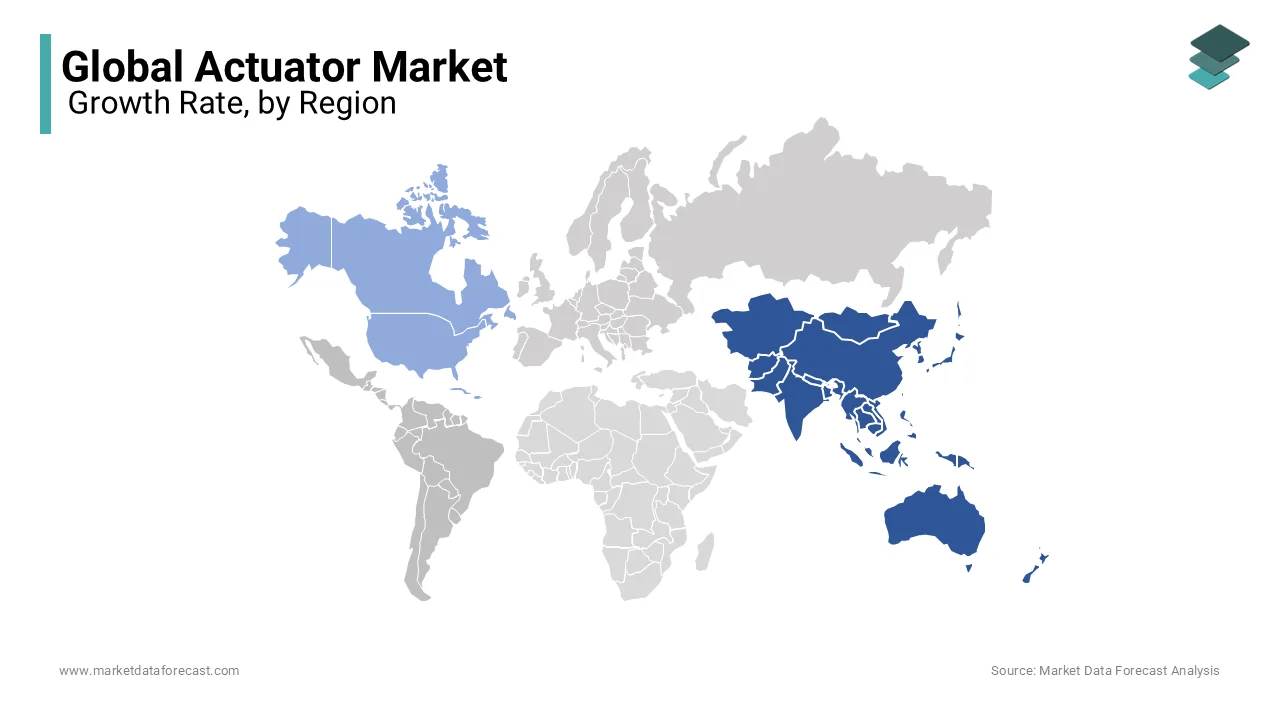

Asia-Pacific

Asia-Pacific led the actuator market with a 47.4% share in 2024 and is also grows fastest with a CAGR of 9.1% during the forecast period. It dominates due to rapid industrialization and automotive growth. Its importance is tied to economic scale and manufacturing. China’s National Bureau of Statistics reports industrial output grew 4.6% in 2023, boosting actuator demand. The International Trade Administration states Asia-Pacific produced 46 million vehicles in 2023, relying heavily on actuators for automation. This region’s vast population and infrastructure investments solidify its position as the market leader. Additionally, its rapid rise is driven by automation and urbanization. Its importance lies in meeting global manufacturing needs. The International Federation of Robotics says Asia installed 405,000 industrial robots in 2023, increasing actuator use. China’s National Bureau of Statistics notes high-tech manufacturing grew 7.5% in 2023 which is fueling demand.

North America

North America holds steady with a projected moderate growth rate through 2030. It benefits from advanced industries like aerospace and healthcare. The U.S. Census Bureau reports manufacturing output reached $2.5 trillion in 2023 and is sustaining actuator demand. The U.S. Federal Aviation Administration notes 8,300 commercial aircraft were active in 2023 and is relying on actuators. Investments in automation and defense will likely keep this region competitive, though it trails Asia-Pacific in growth pace.

Europe

Europe’s actuator market is expected to grow steadily and is driven by automotive and renewable energy sectors. The European Commission states 13.8 million people worked in manufacturing in 2023 and that is supporting actuator use. The International Energy Agency reports Europe added 50 gigawatts of wind capacity in 2023 needing actuators for turbines. Strict emission regulations and innovation will maintain moderate growth, but it lags behind Asia-Pacific’s surge.

Latin America

Latin America’s actuator market will see gradual growth, led by industrial and energy developments. The U.S. Energy Information Administration notes oil production hit 12 million barrels daily in 2023, using actuators in extraction. Brazil’s National Institute of Statistics reports manufacturing grew 2.1% in 2023, indicating modest demand. Emerging economies will drive limited but steady expansion through 2030, though global influence remains small.

Middle East and Africa

The Middle East and Africa will experience slow but consistent growth, fueled by oil and construction. The U.S. Energy Information Administration states the region produced 31 million barrels of oil daily in 2023, depending on actuators. The African Development Bank reports $80 billion in infrastructure spending in 2023, supporting actuator use. Growth will remain modest due to slower industrialization compared to Asia-Pacific.

Top 3 Players in the market

SMC Corporation

SMC Corporation, headquartered in Tokyo, Japan, is a leading manufacturer of actuators and pneumatic control equipment. The company offers an extensive range of products, including cylinders, valves, and air preparation equipment, serving various industries such as automotive, electronics, and healthcare. SMC's commitment to innovation and quality has solidified its position as a dominant player in the actuator market. By continually developing advanced automation solutions, SMC contributes significantly to the efficiency and productivity of global manufacturing processes.

Emerson Electric Co.

Emerson Electric Co., based in the United States, is a diversified global manufacturing and technology company. With a strong presence in the actuator market, Emerson provides a wide array of automation solutions, including electric and pneumatic actuators, catering to industries like oil and gas, chemical, and power generation. The company's focus on integrating cutting-edge technology with reliable performance has enhanced operational efficiency and safety across various sectors. Emerson's continuous investment in research and development underscores its commitment to advancing actuator technology and maintaining its leadership position.

Parker Hannifin Corporation

Parker Hannifin Corporation, headquartered in the United States, is a global leader in motion and control technologies. The company offers a comprehensive portfolio of actuators, including hydraulic, pneumatic, and electromechanical variants, serving industries such as aerospace, industrial manufacturing, and transportation. Parker's dedication to engineering excellence and customer-centric solutions has driven its growth and solidified its role as a key contributor to the actuator market. By focusing on energy efficiency and precision, Parker Hannifin enhances the performance and sustainability of industrial applications worldwide.

Top strategies used by the key market participants

Product Innovation and Diversification

Parker Hannifin Corporation focuses on continuous innovation and diversification in its actuator offerings, covering hydraulic, pneumatic, and electromechanical actuators. By catering to various industries, including aerospace, automotive, and industrial automation, the company ensures broad market coverage. Its R&D investments drive the development of high-efficiency and energy-saving actuators, enhancing reliability and performance. Advanced smart actuators with IoT integration have improved real-time monitoring and predictive maintenance, reducing downtime for industries. By prioritizing innovation, Parker Hannifin strengthens its market position and meets evolving customer demands, solidifying itself as a leader in motion and control technologies for global industrial applications.

Strategic Acquisitions and Partnerships

Emerson Electric Co. strengthens its position in the actuator market through strategic acquisitions and partnerships. By acquiring leading actuator manufacturers, the company expands its product portfolio and enhances technological expertise. These acquisitions allow Emerson to integrate advanced automation technologies into its actuator solutions, improving efficiency across industries such as oil & gas, water treatment, and power generation. Additionally, partnerships with industrial leaders enable Emerson to co-develop cutting-edge actuators tailored to specific market needs. This strategy not only increases its market share but also positions Emerson as a top innovator in actuator solutions, enhancing its global competitiveness.

Geographical Expansion

Sona Comstar, a key player in the actuator market, focuses on geographical expansion to strengthen its market presence. The company has expanded operations in high-growth regions like China, Japan, and South Korea, leveraging the rising demand for actuators in electric and hybrid vehicles. By establishing partnerships with automakers and local suppliers, Sona Comstar enhances its distribution network and customer reach. This expansion strategy diversifies its revenue streams beyond North America and Europe, reducing dependence on traditional markets. With a focus on emerging markets, Sona Comstar secures long-term growth opportunities and reinforces its competitive edge in the global actuator market.

Competitive Landscape

The actuator market is highly competitive, driven by rapid technological advancements and increasing demand across industries like automotive, aerospace, healthcare, and industrial automation. Major players focus on innovation to develop high-performance, energy-efficient, and smart actuators with IoT integration. Companies are investing heavily in research and development to enhance reliability, precision, and durability. Strategic acquisitions and partnerships help expand product portfolios and gain a stronger foothold in different regions.

Geographical expansion plays a crucial role in staying competitive. Companies are entering emerging markets with growing industrial sectors and increasing automation needs. Customization is another key strategy, allowing manufacturers to design actuators that meet specific market requirements. The rise of electric vehicles and industrial automation fuels demand for advanced actuators, creating opportunities for companies to develop sustainable and high-efficiency solutions.

Competitive pricing also influences market dynamics. Established brands compete with new entrants offering cost-effective solutions without compromising quality. Regulations regarding energy efficiency and environmental impact push manufacturers to develop eco-friendly actuators.

KEY MARKET PLAYERS

ABB (Zurich, Switzerland), MISUMI (Tokyo, Japan), TAMAGAWA SEIKI Co. Ltd. (Nagano, Japan), Moog Inc. (New York, U.S.), Eaton Corporation Inc. (Ohio, U.S.), Rockwell Automation, Inc. (Wisconsin, U.S.), SMC Corporation (Tokyo, Japan), Emerson Electric Co. (Missouri, U.S.), Parker Hannifin Corporation (Ohio, U.S.), Curtiss-Wright Corporation (North Carolina, U.S.). these are the market players tht are dominating the global actuator market

RECENT HAPPENINGS IN THIS MARKET

- In February 2025, Salvalco introduced the Nebula actuator, designed for use with inert gas propellants. This innovation enhances performance while reducing environmental impact, aligning with Salvalco’s commitment to sustainable solutions.

- In January 2025, Hitec released the SG20BL, a waterproof, brushless, high-torque actuator with a 20mm case size. This actuator sets a new standard in durability and performance for harsh environments.

- In February 2025, Igus launched the drylin® SHT actuator, a hygienic, self-lubricating, corrosion-resistant solution for the beverage production industry. This actuator ensures safe, low-maintenance operation and improved efficiency.

- In January 2025, FlowCon introduced upgraded versions of its B- and T-series electrical actuators. These improvements include settable control signals and full compatibility with the FlowCon Unimizer® valve range, enhancing versatility and precision.

- In February 2025, Fife unveiled two new guiding solutions: the SmartDrive Actuator and the GuideLine HR high-resolution digital sensor. These innovations improve accuracy and accommodate faster web speeds in automated web handling applications.

MARKET SEGMENTATION

This research report on the global actuator market is segmented and sub-segmented into the following categories.

By Motion

- Linear

- Rotary

By Type

- Hydraulic

- Pneumatic

- Electric

- Others

By End-Use Industry

- Aerospace & Defense

- Automotive

- Construction

- Chemicals

- Food & Beverages

- Healthcare & Pharmaceuticals

- Marine

- Mining

- Oil & Gas

- Power Generation

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]