Global Ablation Devices Market Size, Share, Trends & Growth Forecast Report By Type (Laser Ablators, Radiofrequency Ablators, Microwave Ablators, Ultrasound Ablators, Electric Ablators, Hydrothermal Ablators and Cryoablators), Technology (Radiofrequency Ablation, Microwave Ablation, Cryoablation, High-Intensity Focused Ultrasound, Laser Interstitial Thermal Ablation and Others), Function, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2025 to 2033)

Global Ablation Devices Market Size

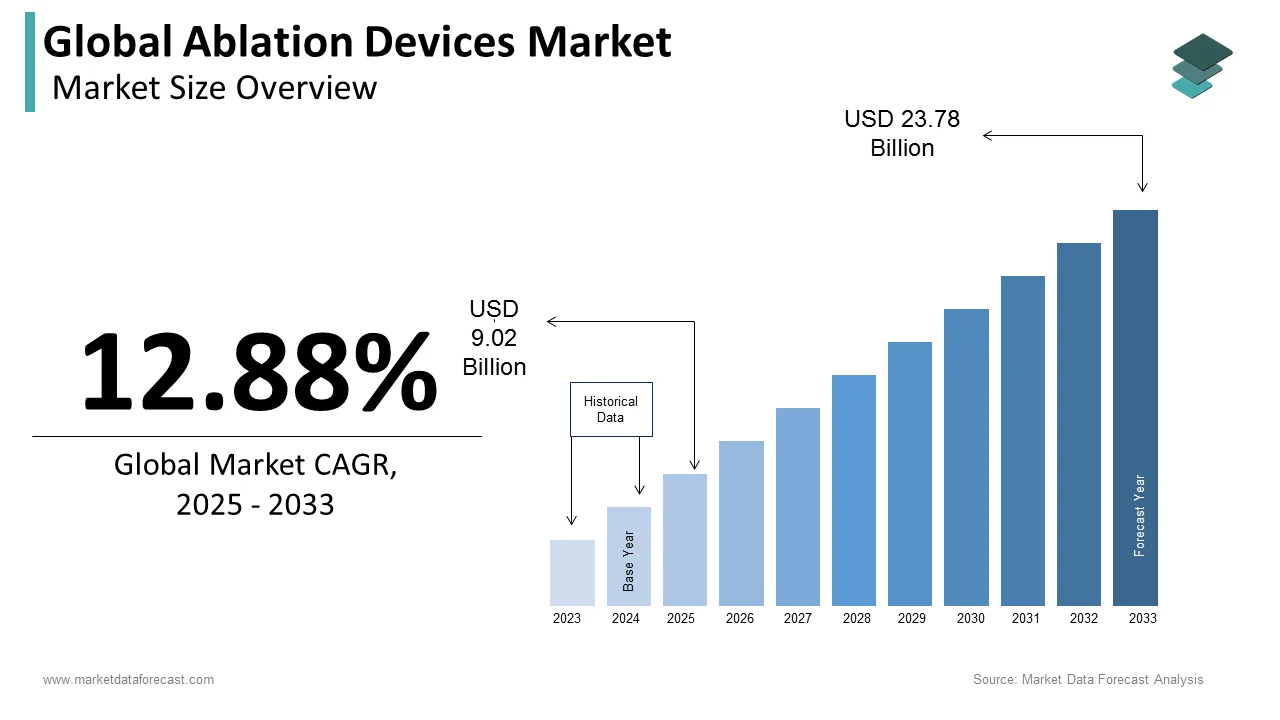

The global ablation devices market size was valued at USD 7.99 billion in 2024. The global market size is further estimated to be growing at a CAGR of 12.88% from 2025 to 2033 and be worth USD 9.02 billion in 2025 and USD 23.78 billion by 2033.

Ablation devices are integral to minimally invasive medical procedures, effectively treating conditions such as cardiac arrhythmias, cancerous tumors, and chronic pain. These devices utilize various energy sources such as radiofrequency, laser, ultrasound and cryoablation to precisely target and eliminate abnormal tissues. The increasing prevalence of chronic diseases, particularly cardiovascular disorders and cancer has heightened the demand for ablation therapies. For instance, the World Health Organization reports that cardiovascular diseases are the leading cause of death globally, accounting for approximately 17.9 million deaths annually. Advancements in ablation technology have led to the development of more efficient and safer devices, enhancing patient outcomes and reducing recovery times. The growing preference for minimally invasive procedures, which offer benefits such as reduced hospital stays and lower complication rates, further propels the adoption of ablation devices across various medical specialties.

MARKET TRENDS

Technological Advancements in Ablation Devices

Recent innovations have significantly enhanced the precision and safety of ablation procedures. For example, the development of pulsed field ablation (PFA) offers a non-thermal technique that selectively targets cardiac tissues, minimizing damage to surrounding areas. In February 2024, BioSense Webster, a division of Johnson & Johnson, received European CE approval for its VARIPULSE PFA platform, designed to treat symptomatic drug-refractory recurrent paroxysmal atrial fibrillation. Such advancements are expected to improve patient outcomes and expand the applications of ablation therapies.

Rising Demand for Minimally Invasive Procedures

There is a growing preference for minimally invasive treatments due to benefits like reduced hospital stays, quicker recovery, and fewer complications. Ablation devices play a crucial role in this trend, offering effective alternatives to traditional surgeries for conditions such as cardiac arrhythmias and cancerous tumors. The World Health Organization reports that cardiovascular diseases are the leading cause of death globally, accounting for approximately 17.9 million deaths annually. The increasing prevalence of such conditions underscores the need for efficient treatment options, further driving the adoption of ablation technologies.

MARKET DRIVERS

Growing Geriatric Population

The aging global population significantly increases the demand for ablation devices. According to the UN, the number of people aged 65+ is projected to double by 2050, reaching 1.5 billion. Older individuals are more prone to conditions like atrial fibrillation and cancer, which are treatable with ablation. For example, atrial fibrillation is present in over 10% of individuals aged 75 and above, driving the demand for cardiac ablation procedures.

Rising Awareness of Early Diagnosis and Treatment

Public health initiatives emphasizing early detection of chronic conditions have led to more ablation procedures. For example, increased use of imaging technologies detects smaller tumors or arrhythmias early, making minimally invasive treatments like ablation highly suitable. Campaigns from organizations like the American Heart Association promote early intervention strategies, indirectly boosting the adoption of ablation devices.

Integration of AI and Robotics in Ablation Procedures

The incorporation of AI and robotic systems enhances the precision and success rates of ablation procedures. For instance, robotics-assisted cardiac ablation systems, such as those from Stereotaxis, improve catheter navigation, reducing procedural risks. These innovations expand the market's capabilities, appealing to hospitals seeking advanced, outcome-oriented solutions.

MARKET RESTRAINTS

High Costs of Ablation Procedures and Devices

Ablation devices and their associated procedures are costly, limiting accessibility in low- and middle-income countries. For instance, the cost of cardiac ablation procedures can range from $15,000 to $30,000 in the U.S., making them unaffordable for many patients without insurance. The expense of advanced technologies, such as robotic systems and AI-assisted devices, further increases the financial burden on healthcare systems, potentially deterring widespread adoption despite their benefits.

Limited Availability of Skilled Professionals

Performing ablation procedures requires extensive training and expertise. A shortage of skilled professionals, particularly in emerging markets, constrains the adoption of these devices. According to a 2021 report by the European Society of Cardiology, there is an uneven distribution of cardiac electrophysiologists globally, with lower-income regions facing significant deficits. This shortage can lead to delayed treatment and limited utilization of advanced ablation technologies.

Regulatory Challenges and Approvals

Stringent regulations and lengthy approval processes for medical devices act as significant restraints for market growth. Ablation devices must meet high safety and efficacy standards imposed by organizations like the FDA and EMA. These processes often delay the commercialization of innovative devices, restricting market dynamics. For example, radiofrequency and laser-based ablation technologies often face prolonged clinical trials before clearance, delaying their availability to healthcare providers.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging economies, particularly in Asia-Pacific and Latin America, present significant growth opportunities for ablation device manufacturers. These regions are experiencing a rise in healthcare infrastructure development and an increasing prevalence of chronic diseases. For instance, India reports over 1 million new cancer cases annually, with projections indicating a 12% increase by 2025. By establishing a presence in these markets, companies can tap into a large, underserved patient population, thereby driving sales and market share.

Development of Multi-Functional Ablation Devices

Investing in the research and development of ablation devices capable of treating multiple conditions can enhance their utility and appeal. For example, creating devices that address both cardiac arrhythmias and tumor ablation can streamline treatment protocols and reduce costs for healthcare providers. This versatility not only meets diverse clinical needs but also positions manufacturers as leaders in innovation, potentially increasing their market competitiveness.

Integration of Artificial Intelligence and Robotics

Incorporating AI and robotic technologies into ablation procedures can improve precision, reduce procedure times and enhance patient outcomes. Robotic-assisted systems, such as those developed by companies like Stereotaxis, offer improved catheter navigation during cardiac ablation. The global surgical robotics market is projected to grow at a CAGR of 17.4% from 2021 to 2028, indicating a strong trend towards automation in surgery. By integrating these technologies, ablation device manufacturers can offer advanced solutions that meet the evolving demands of modern healthcare.

MARKET CHALLENGES

High Barriers to Market Entry

The ablation devices market demands significant investments in research, development, and compliance with regulatory requirements. New entrants face challenges in competing with established players due to high initial costs and stringent approval processes. For example, developing advanced technologies such as microwave ablation systems can cost millions of dollars, with clinical trials adding further expenses. This restricts innovation and slows market dynamism.

Limited Access in Rural and Remote Areas

Ablation devices and skilled professionals are often concentrated in urban centers, leaving rural populations underserved. In countries like India, over 70% of the population resides in rural areas, where access to specialized treatments is limited. This geographical disparity presents a challenge for equitable healthcare delivery.

Compatibility and Integration Issues

The integration of ablation devices with imaging and monitoring technologies can face compatibility issues. Hospitals using older systems often encounter challenges when implementing modern ablation devices, leading to inefficiencies. This slows the adoption of innovative technologies, particularly in budget-constrained settings.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.88% |

|

Segments Covered |

By Product, Technology, Function, End-User and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic PLC, Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson (Biosense Webster), CONMED Corporation, AngioDynamics, Inc., Smith & Nephew PLC, AtriCure, Inc., Stryker Corporation and Hologic, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The radiofrequency (RF) ablation devices segment dominated the market by accounting for 40.4% of the global market share in 2023. The dominance of the segment is attributed to their widespread application in treating cardiac arrhythmias, chronic pain, and certain cancers. RF ablation is favored for its precision, minimal invasiveness, and established safety profile. For instance, in the United States, RF ablation is a common treatment for atrial fibrillation, a condition affecting approximately 2.7 million Americans. The procedure's efficacy in reducing symptoms and improving quality of life underscores its leading position in the market.

The microwave segment is expected to experience the fastest CAGR of 10.14% over the forecast period in the global ablation devices market. This rapid expansion is driven by their ability to create larger and more uniform ablation zones, making them particularly effective in treating solid tumors in organs like the liver and lungs. The increasing incidence of cancer globally, with an estimated 19.3 million new cases in 2020, has heightened the demand for efficient ablation therapies. Microwave ablation's advantages, such as shorter procedure times and reduced risk of complications, contribute to its accelerated adoption in oncological treatments.

By Technology Insights

The radiofrequency ablation (RFA) segment led the market by capturing 40% of the global market share in 2023. RFA is widely used due to its well-established efficacy in treating arrhythmias, chronic pain, and cancer. Its minimally invasive nature, safety, and cost-effectiveness have contributed to its leadership position. For example, in cardiac care, RFA treats atrial fibrillation, impacting 37.5 million people worldwide, with over 90% procedure success in arrhythmia symptom relief. The widespread availability and strong clinical support of RFA sustain its dominance across diverse medical applications.

The High-intensity focused ultrasound (HIFU) is estimated to grow at the fastest CAGR of 13.24% over the forecast period owing to the non-invasive approach of HIFU and increasing use in oncology, particularly prostate and liver cancers. HIFU’s ability to target tumors with precision while preserving surrounding tissues has made it a preferred treatment option. The International Agency for Research on Cancer reports 1.4 million new prostate cancer cases annually, driving HIFU adoption. Enhanced imaging technologies have further improved its accuracy, making it a cutting-edge choice for non-invasive therapy and expanding its applications and appeal globally.

By Function Insights

The automatic segment dominated the market in 2024 owing to its cost-effectiveness, ease of use, and widespread adoption across various medical settings. These devices are designed to perform ablation procedures with minimal manual intervention, making them accessible in both developed and developing healthcare systems. For instance, in cardiac care, automatic ablation devices are extensively used for treating arrhythmias, contributing to their leading position in the market.

The robotic segment is projected to showcase the fastest CAGR in the global market over the forecast period. This rapid growth is driven by their ability to enhance precision, reduce human error, and improve patient outcomes during complex procedures such as cardiac arrhythmias and oncological surgeries. The integration of advanced robotics and artificial intelligence in these devices allows for more accurate targeting of abnormal tissues, leading to shorter recovery times and reduced operator fatigue. For example, systems like the Stereotaxis robotic navigation platform have demonstrated enhanced accuracy in catheter positioning for cardiac ablation, contributing to the accelerated adoption of robotic ablation devices in the medical field.

By End-User Insights

The hospitals and clinics segment led the market by commanding for 70.1% of the global market share in 2023. Their leadership is due to superior infrastructure, skilled professionals, and the ability to manage complex procedures, including cardiac and oncological ablations. For instance, cardiac arrhythmia treatments like atrial fibrillation are primarily performed in hospital settings due to the need for advanced imaging, monitoring systems, and post-operative care. Additionally, hospitals often serve as referral centers, handling higher volumes of patients and ensuring access to cutting-edge ablation technologies. This established framework reinforces their dominant position in the market.

The ambulatory surgical centers segment is estimated to witness the highest CAGR over the forecast period due to the increasing demand for outpatient, minimally invasive procedures that reduce costs and recovery time. ASCs cater to patients seeking efficient treatments without extended hospital stays. For example, procedures like radiofrequency ablation for varicose veins or microwave ablation for small tumors are frequently performed in ASCs. Their rise is further supported by advancements in portable ablation technologies, which enable effective care outside hospital settings, driving their rapid adoption in the global market.

REGIONAL ANALYSIS

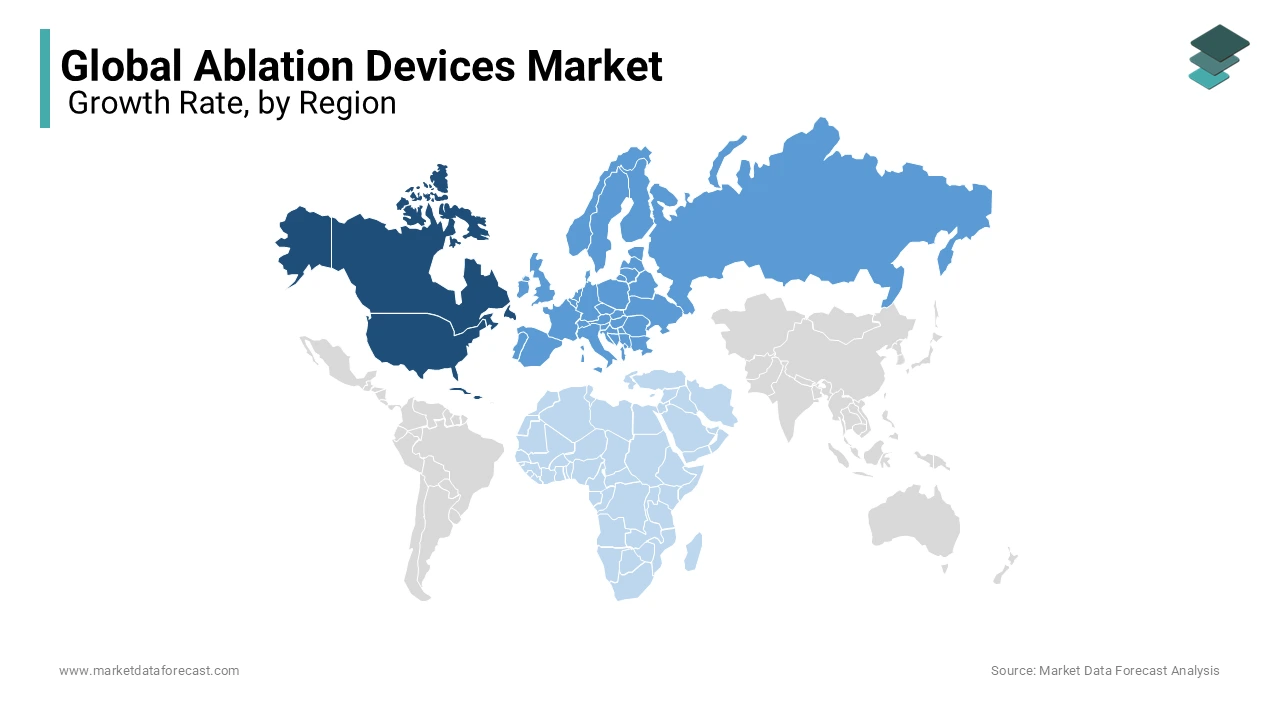

North America dominated the market by accounting for 39.8% of the global market share in 2023. The United States is the major player in North America, supported by advanced healthcare infrastructure, a high prevalence of chronic diseases, and early adoption of cutting-edge ablation technologies. For example, the increasing use of radiofrequency ablation for treating cancer and cardiac arrhythmias has significantly boosted demand. Additionally, favourable reimbursement policies and continuous research in minimally invasive procedures contribute to the region's sustained growth and dominance in the global market.

Europe is a notable regional segment in the global ablation devices market and is predicted to showcase a healthy CAGR during the forecast period. Leading countries such as Germany, the United Kingdom, and France drive the region’s growth due to their well-established healthcare systems and robust adoption of minimally invasive treatments. Factors such as a growing elderly population and rising healthcare investments in technologically advanced equipment further propel the market. Europe's stable economic environment and government initiatives supporting innovation in medical devices ensure its continued relevance in the global market.

Asia-Pacific is the fastest-growing region and is estimated to register a CAGR of 14.12% over the forecast period. Countries such as China, India, and Japan are leading this growth, with China emerging as a significant player due to its rapidly expanding healthcare sector and high prevalence of lifestyle-related diseases. India’s healthcare advancements, coupled with rising medical tourism and government support for infrastructure development, further bolster the region’s prospects. The increasing affordability and awareness of minimally invasive techniques drive the adoption of ablation devices, making the Asia-Pacific region a hotbed for market expansion.

Latin America holds a smaller market share of the worldwide market over the forecast period. Brazil and Mexico are the primary contributors to growth, with increasing healthcare expenditure and a rising demand for advanced medical technologies. However, economic disparities and limited access to advanced healthcare facilities in certain parts of the region pose challenges. Despite these obstacles, improving medical infrastructure and greater awareness of ablation treatments are expected to support growth in the coming years.

The market in the Middle East and Africa is estimated to grow at a moderate CAGR in the global market during the forecast period. Growth in the MEA region is primarily driven by the United Arab Emirates, Saudi Arabia, and South Africa. These countries are witnessing improvements in healthcare infrastructure and increasing investments in advanced medical technologies. However, political instability in some areas and restricted access to cutting-edge treatments limit the market’s rapid expansion. The government's efforts to prioritize healthcare development may drive gradual growth over time.

KEY MARKET PLAYERS

Companies playing a key role in the global ablation devices market include Medtronic PLC, Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson (Biosense Webster), CONMED Corporation, AngioDynamics, Inc., Smith & Nephew PLC, AtriCure, Inc., Stryker Corporation and Hologic, Inc.

RECENT HAPPENINGS IN THE MARKET

- In August 2022, Medtronic acquired Affera Inc., a company specializing in cardiac mapping and navigation systems. This acquisition is anticipated to expand Medtronic's cardiac ablation portfolio and enhance its capabilities in treating arrhythmias.

- In May 2024, Abbott launched the TactiFlex Ablation Catheter, designed to improve the safety and effectiveness of cardiac ablation procedures. This product launch is expected to bolster Abbott’s presence in the electrophysiology market.

- In September 2024, Johnson & Johnson announced the acquisition of V-Wave Ltd., a company developing heart failure treatments. This move is expected to strengthen J&J's MedTech division and enhance its partnerships with cardiologists and heart failure specialists.

- In June 2022, CONMED acquired In2Bones Global, Inc., a company specializing in extremity implants and instrumentation. This acquisition expanded CONMED's orthopedic product offerings and improved its competitive standing in the surgical devices market.

- In April 2021, AtriCure received FDA approval for the EPi-Sense® System for persistent atrial fibrillation treatment. This approval is anticipated to boost their offerings in the cardiac ablation market and improve patient outcomes.

- In February 2022, Stryker acquired Vocera Communications, a company specializing in digital care coordination and communication. This acquisition is expected to enhance Stryker’s capabilities in patient care and hospital efficiency.

- In November 2021, Hologic acquired Bolder Surgical, a company developing advanced vessel-sealing devices. This acquisition expanded Hologic’s surgical portfolio, particularly in minimally invasive procedures, strengthening their market presence.

MARKET SEGMENTATION

This research report on the global ablation devices market is segmented and sub-segmented based on product, technology, function, end-user and region.

By Product

- Laser Ablators

- Radiofrequency Ablators

- Microwave Ablators

- Ultrasound Ablators

- Electric Ablators

- Hydrothermal Ablators

- Cryoablators

By Technology

- Radiofrequency Ablation

- Microwave Ablation

- Cryoablation

- High-Intensity Focused Ultrasound

- Laser Interstitial Thermal Ablation

- Others

By Function

- Automatic

- Robotic

By End-Users

- Hospitals And Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the ablation devices market?

The global ablation devices market was worth USD 7.99 bn in 2024 and is expected to be grow USD 9.02 bn in 2025.

What is the expected CAGR of the global ablation devices market?

The global ablation devices market is anticipated to grow at a CAGR of 12.88% from 2025 to 2033.

Which region is expected to be the fastest growing regional segment in the global market?

Over the forecast period, the Asia-Pacific region is estimated to witness the highest CAGR among all the regions in the worldwide market.

Who are the key players in the global ablation devices market?

Medtronic PLC, Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson (Biosense Webster), CONMED Corporation, AngioDynamics, Inc., Smith & Nephew PLC, AtriCure, Inc., Stryker Corporation and Hologic, Inc. are a few of the companies playing a key role in the global ablation devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]