Global Smart Glass Market Size, Share, Trends, Growth Forecast Report – Segmented by Technology (Suspended Particle Display, Electrochromic, Liquid Crystal, Photochromic, Thermochromic), Application (Architecture, Transportation, Consumer Electronics), & Region - Industry Forecast From 2024 to 2032

Global Smart Glass Market Size (2024 to 2032)

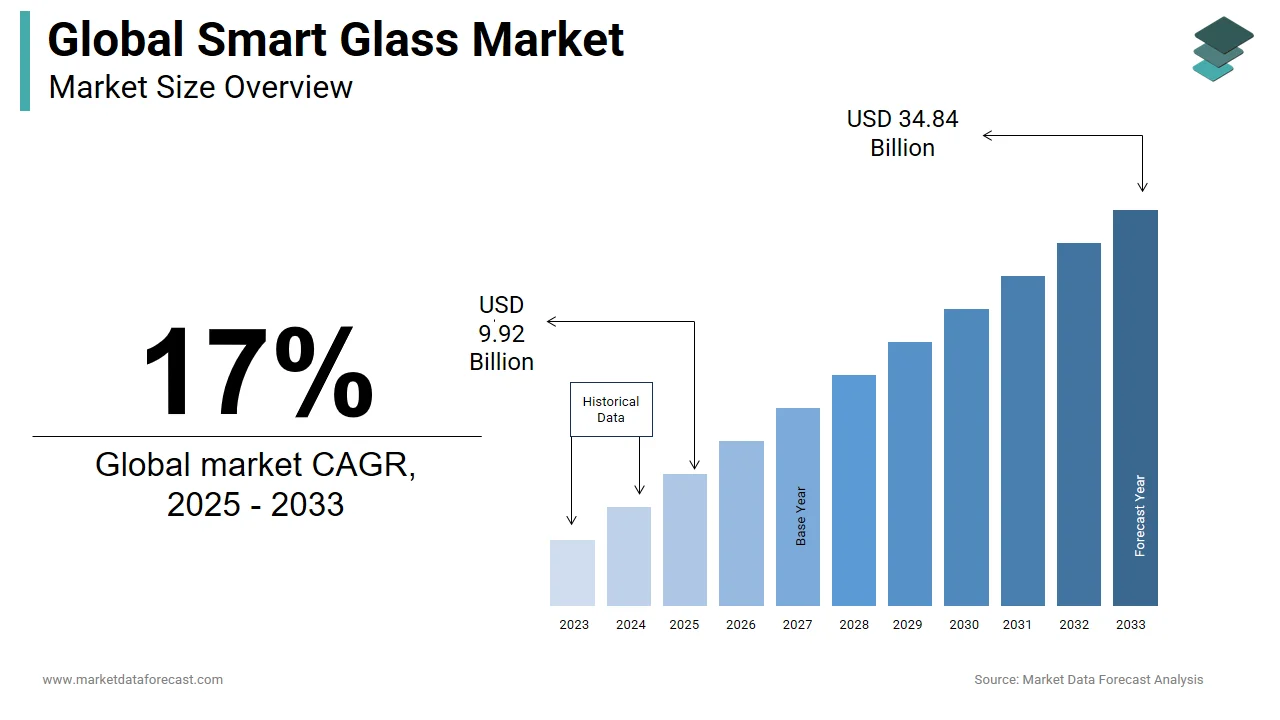

The global smart glass market was valued at USD 7.25 billion in 2023. The global market is expected to reach USD 8.48 billion in 2024 and USD 29.78 billion by 2032, growing at a CAGR of 17% during the forecast period.

Glass is produced by melting potash, lime, and silica at high temperatures, and various components are added to modify its properties. The smart glass includes advanced technology that can alter light transmission features based on external stimuli. These glasses have numerous applications, especially in the automotive sector, such as sunroofs, mirrors, windshields, skylights, windows, and doors. Smart glass works automatically or manually to control glare and the amount of heat and light. The smart glass can be changed depending on the temperature outside. However, constant UV rays can damage smart glass.

Current Scenario of the Global Smart Glass Market

Currently, electrochromic materials are offered as smart electrochromic lenses and electrochromic films. There are several reasons why electrochromic materials are ideal for smart windows. This is an emerging technology, as windows made of this material can be managed manually or with the help of automation systems, providing both comfort and energy control. The abilities and properties of these materials are well understood because of their increased implementation in automatic mirrors.

The smart glass business has registered various changes and advances on the verge of technology and applications. In general, smart glass is almost double to four times more expensive than conventional windows despite technological progressions. The high cost related to these glasses limits their rapid adoption globally. Manufacturers are struggling to quantify the return on investment for end-users, and therefore, its application has been mainly in the luxury and high-end sectors.

MARKET DRIVERS

Electrochromic smart glasses are the most recent and novel variants of smart glasses, which can be used in educational buildings, buildings, businesses, shops and residences, hotels, hospitals, laboratories and points of sale, commercial buildings, and residential to create partitions on your walls, windows, and skylights. An increase in architectural engineering investments in the architectural segment further contributes to growth by stimulating the development of the global smart electrochromic glass market. Aviation is also one of the main sectors where demand for electrochromic smart glass is expected to increase during the outlook period, which is contributing to the growth of the global electrochromic smart glass market.

Smart glass has found wide applications, particularly in the automotive industry, on sunroofs and on exterior and interior mirrors with automatic dimming. Intelligent glass installations are observed at major car manufacturers such as BMW and Mercedes. Mercedes-Benz offers its S-Class Coupé, as well as other variants of the S-Class, with the popular Magic Sky Control panoramic roof option, using SPD-SmartGlass technology. Some of the advantages associated with the SPD-SmartGlass are a reduction of heat within the vehicle, protection from UV rays, glare control, and reduction in noise and fuel usage. Smart glass is also touted for registration adoption in trains. For instance, in South Korea, a monorail train has an automatic fog-up window that works while passing nearby apartments. Glazing occurs when the light-transmitting properties of the window are changed by the application of voltage, heat, or light to the surface.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

17% |

|

Segments Covered |

By Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Smartglass International Limited, SAGE Electrochromics, Asahi Glass Corporation, View, Inc., Shenzhen Hongjia Glass Product Co, Dupont, Saint-Gobain SA, Guangdong Kangde Xin Window Film Co., Ltd, and Others. |

SEGMENTAL ANALYSIS

Global Smart Glass Market Analysis By Application

The electrochromic smart glass segment is expected to experience substantial growth due to unique facets, such as reduced response time to apply a glass effect with low voltage consumption and offer a high blocking rate of dangerous IR and UV rays. Growth can also be credited to rising applications of these glasses in end-user verticals like automotive and domestic sectors.

Global Smart Glass Market Analysis By Technology

The transportation segment registered a significant portion of the global smart glass market in 2018 and is foreseen to continue its trend during the anticipated years. Smart glass has become a primary choice for vehicle manufacturers when installing windows, mirrors, sunroofs, doors, and windshields. The growing need to reduce heat accumulation and limit the degree of display stimulates demand for products in this sector. The transportation mainly comprises the automotive, aviation, and marine industries. Of these, the automotive sector is considered the leading consumer of switchable glass and accounted for the principal portion of revenue in 2018. The smart glass technology features protection against UV rays and manages the heat within vehicles by restricting overall energy utilization.

REGIONAL ANALYSIS

North America has been the most exceptional region for this market in 2018 and is determined to develop further in the coming years. Strict government regulations and policies have resulted in the dominance of this regional market. In addition to the rise in overall energy savings, smart glasses also decrease maintenance costs, which promotes the expansion of the local market. The United States and European governments have planned to implement electronic equipment with smart glasses, which has been mentioned to their respective transportation departments.

Smart glass is becoming one of the most popular building materials in the North American region. One of the prominent aspects of its fame is its functioning as a versatile material in buildings that can be used for numerous purposes. Furthermore, smart glass has become pivotal in the commercial design sector because of its appearance.

KEY PLAYERS IN THE GLOBAL SMART GLASS MARKET

Some of the major companies operating in the global smart glass market include Smartglass International Limited, SAGE Electrochromics, Asahi Glass Corporation, View, Inc., Shenzhen Hongjia Glass Product Co, Dupont, Saint-Gobain SA, and Guangdong Kangde Xin Window Film Co., Ltd, and others.

RECENT HAPPENINGS IN THE GLOBAL SMART GLASS MARKET

-

In January 2018, Fisker introduced its new Fisker E-motion with an advanced four-segment SPD SmartGlass roof at CES 2018. In addition, the firm also envisions providing SPD-SmartGlass technology for the side windows of their new electric vehicles.

-

Spirit Lake Casino and Resort, an elegant restaurant in North Dakota, has installed smart glass to provide (customers) with spectacular views of the natural environment despite the problem of the sun's rays. The technology also helps the restaurant save money by reducing the cooling load due to weather conditions on sunny days.

DETAILED SEGMENTATION OF THE GLOBAL SMART GLASS MARKET INCLUDED IN THIS REPORT

This research report on the global smart glass market has been segmented and sub-segmented based on the application, technology, and region.

By Application

-

Architecture

-

Transportation

-

Consumer Electronics

By Technology

-

Suspended Particle Display

-

Electrochromic

-

Liquid Crystal

-

Photochromic

-

Thermochromic

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

How does smart glass contribute to energy conservation on a global scale?

Smart glass technologies help reduce energy consumption by controlling the amount of light and heat entering a building or vehicle, thereby reducing the need for artificial heating, cooling, and lighting.

What technological advancements are driving innovation in the global smart glass market?

Advancements in materials science, such as the development of electrochromic, thermochromic, and photochromic technologies, along with integration with IoT (Internet of Things) platforms for smart control and automation, are driving innovation in the smart glass market.

What are the key challenges hindering the widespread adoption of smart glass worldwide?

High initial costs, concerns regarding durability and reliability, and the complexity of integrating smart glass technologies with existing infrastructure are some of the key challenges hindering widespread adoption.

What are the emerging trends shaping the future of the smart glass market on a global scale?

Emerging trends include the integration of smart glass with IoT platforms for enhanced functionality, the development of self-tinting and self-cleaning smart glass solutions, and the increasing focus on sustainability and eco-friendly materials.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]