North America Wound Debridement Products Market Size, Share, Trends & Growth Forecast Report By Product Type (Hydrosurgical Debridement Devices, Low-Frequency Ultrasound Devices, Surgical Wound Debridement Devices, Mechanical Debridement Pads, Traditional Wound Debridement Devices, Larval Therapy), Application (Chronic Ulcers, Surgical Wounds, Traumatic Wounds, Burn Cases), End User (Hospitals, Ambulatory Surgical Centers, Specialized Clinics, Nursing Facilities, Others), and Country (U.S., Canada) – Industry Analysis From 2025 to 2033.

North America Wound Debridement Products Market Size

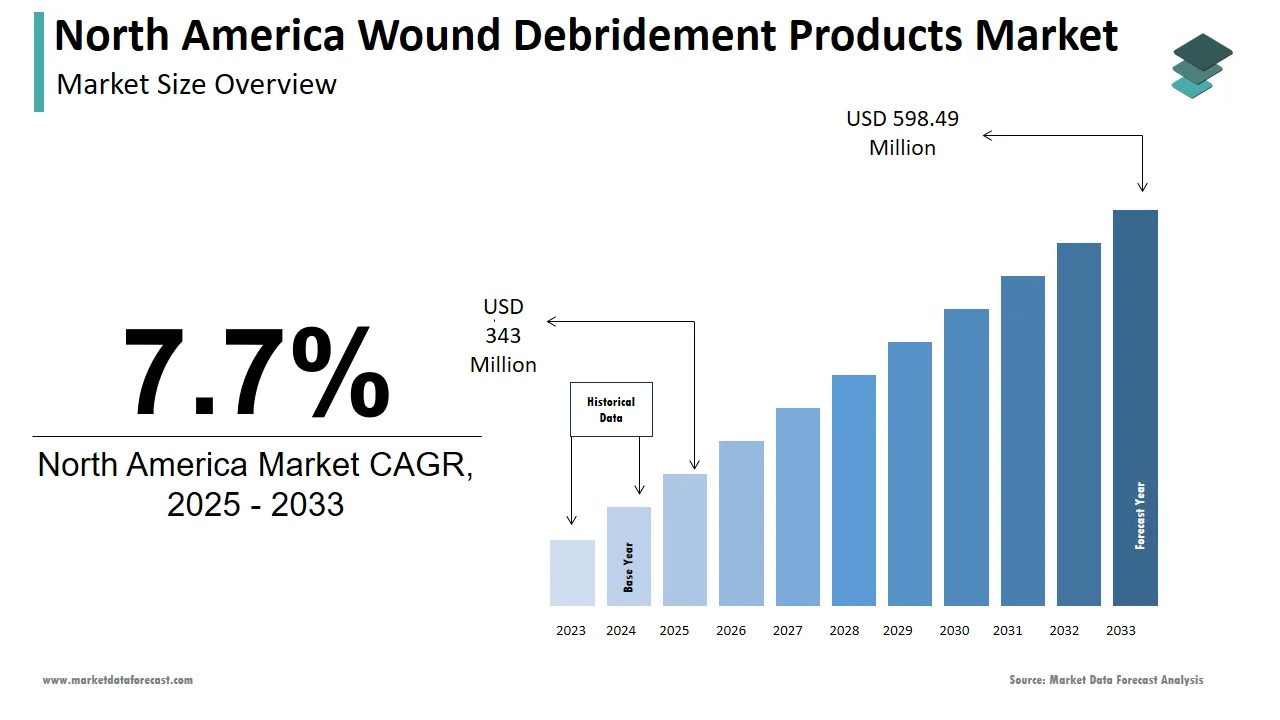

The size of the wound debridement products market in North America was valued at USD 318.57 million in 2024. This market is expected to grow at a CAGR of 7.7% from 2025 to 2033 and be worth USD 598.49 million by 2033 from USD 343 million in 2025.

The North America wound debridement products market has been experiencing steady growth over the past few years owing to the increasing prevalence of chronic wounds and advancements in wound care technology. According to the American Diabetes Association, over 34 million Americans suffer from diabetes, with approximately 25% of these individuals developing diabetic foot ulcers, a condition often requiring debridement. Chronic ulcers, including venous leg ulcers and pressure ulcers, affect nearly 6.5 million people across the U.S., as per data from the National Institutes of Health. Surgical debridement devices hold the largest share of the market, accounting for over 30% of total revenue in 2023, due to their widespread use in hospitals and surgical centers. Canada is also witnessing significant demand, particularly for low-frequency ultrasound devices, which are gaining traction due to their ability to reduce bacterial load in infected wounds. As per Statistics Canada, hospital admissions for chronic wound management have increased by 12% over the past five years, reflecting the growing burden on healthcare systems. The market is further supported by favorable reimbursement policies and rising awareness about advanced wound care solutions, making debridement products more accessible to patients.

MARKET DRIVERS

Rising Prevalence of Chronic Wounds in North America

Chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are a primary driver of the wound debridement products market in the North American region. According to the Centers for Disease Control and Prevention, chronic wounds affect over 8.2 million Americans annually, with diabetic foot ulcers alone contributing to 60% of these cases. The aging population exacerbates this issue, as individuals aged 65 and above are three times more likely to develop chronic wounds compared to younger demographics. For instance, a study published in the Journal of Wound Care estimates that the prevalence of venous leg ulcers among older adults has risen by 15% over the past decade. Additionally, the increasing incidence of obesity and sedentary lifestyles has heightened the risk of pressure ulcers, further driving demand for debridement solutions. Hospitals and long-term care facilities are increasingly adopting advanced debridement techniques, such as hydrosurgical and enzymatic methods, to improve patient outcomes. These factors collectively underscore the critical role of chronic wound prevalence in propelling market growth.

Technological Advancements in Debridement Devices

Technological innovations have revolutionized the wound debridement products market, enhancing the efficacy and accessibility of treatments. Low-frequency ultrasound devices, for example, have gained significant traction due to their ability to selectively target necrotic tissue while preserving healthy tissue. According to the American Academy of Dermatology, these devices have demonstrated a 30% reduction in healing time for chronic ulcers, making them a preferred choice among clinicians. Similarly, hydrosurgical debridement systems, which utilize pressurized saline streams, have seen a surge in adoption, with the U.S. market for these devices projected to grow significantly over the forecast period. A report by the Food and Drug Administration highlights that over 70% of hospitals now incorporate advanced debridement technologies into their wound care protocols. These advancements are supported by substantial investments in research and development, with leading companies allocating over $1 billion annually to innovate in this space. Such progress not only addresses unmet clinical needs but also positions North America as a global leader in advanced wound care solutions.

MARKET RESTRAINTS

High Costs Associated with Advanced Debridement Procedures

The high cost of advanced wound debridement procedures is one of the major barriers to market expansion in this region. According to the Healthcare Cost and Utilization Project, the average cost of a single session using hydrosurgical debridement devices exceeds $1,500, making it inaccessible for uninsured or underinsured patients. Even with insurance coverage, out-of-pocket expenses can deter individuals from opting for advanced treatments. This financial burden is further compounded by the rising costs of cutting-edge technologies, which are often passed on to healthcare providers and, ultimately, patients. For instance, a study by the American College of Surgeons reveals that hospitals spend approximately $10,000 per patient on chronic wound management, with debridement accounting for 40% of these costs. In Canada, provincial healthcare systems face similar challenges, as budgetary constraints limit access to advanced debridement solutions. As per Statistics Canada, wait times for specialized wound care services have increased by 18% over the past three years, hindering market growth and patient outcomes.

Limited Awareness and Training Among Healthcare Providers

Limited awareness and training among healthcare providers are further hindering the growth of the wound debridement products market in North America. Despite the availability of advanced technologies, many clinicians remain unfamiliar with their applications and benefits. According to a survey conducted by the Wound Healing Society, over 40% of primary care physicians lack sufficient knowledge about modern debridement techniques, such as low-frequency ultrasound and hydrosurgical systems. This knowledge gap is particularly pronounced in rural areas, where access to continuing medical education programs is limited. Additionally, the complexity of some devices requires specialized training, which is often unavailable or underutilized. For example, a report by the National Institutes of Health notes that only 30% of wound care nurses receive formal training in advanced debridement methods. These challenges hinder the adoption of innovative solutions, slowing market growth and limiting their potential impact on patient care.

MARKET OPPORTUNITIES

Growing Adoption of Minimally Invasive Debridement Techniques

The shift toward minimally invasive debridement techniques is a lucrative opportunity for the North American wound debridement products market. According to the American Academy of Wound Management, minimally invasive methods, such as enzymatic and autolytic debridement, now account for over 45% of all debridement procedures performed in North America. These techniques are preferred for their ability to reduce patient discomfort and minimize recovery times, making them particularly appealing for chronic wound management. For instance, enzymatic debridement agents have demonstrated a 25% faster healing rate compared to traditional surgical methods, as per data from the Journal of Clinical Dermatology. Canada is also witnessing a surge in the adoption of low-frequency ultrasound devices, which are increasingly used in outpatient settings due to their portability and ease of use. Additionally, advancements in product design, such as pre-packaged enzymatic solutions and disposable mechanical pads, have enhanced accessibility and convenience for healthcare providers. This trend aligns with broader healthcare goals of improving patient outcomes while reducing hospital stays, creating new avenues for market expansion.

Increasing Focus on Personalized Wound Care Solutions

Personalized wound care solutions are a significant opportunity for the wound debridement products market, offering tailored treatments that improve healing rates. As per the National Institutes of Health, personalized approaches, such as bioengineered debridement agents and patient-specific protocols, have reduced infection rates by 30% in clinical trials. The integration of precision medicine into wound care has gained momentum, with biomaterial-based debridement products accounting for 15% of the market’s revenue in 2023. Advances in 3D printing technology have further accelerated this trend, enabling the creation of custom debridement tools designed to match individual wound characteristics. For example, a study published in the Journal of Tissue Engineering highlights that 3D-printed debridement pads have improved tissue regeneration by 20% in burn cases. This focus on personalization aligns with evolving healthcare trends, fostering innovation and expanding the market’s reach across North America.

MARKET CHALLENGES

Limited Availability of Skilled Wound Care Specialists

The shortage of skilled wound care specialists is a major challenge to the growth of the North American wound debridement products market. According to the Wound Healing Society, there are fewer than 5,000 certified wound care professionals in the United States, a number that falls short of meeting the growing demand for advanced debridement procedures. This scarcity is particularly pronounced in rural areas, where access to specialized healthcare services remains limited. For example, a report by the Rural Health Information Hub reveals that only 25% of rural hospitals in the U.S. offer comprehensive wound care programs, leaving millions of patients underserved. Canada faces similar challenges, with provincial healthcare systems struggling to recruit and retain qualified wound care nurses. As per Statistics Canada, wait times for specialized wound care consultations have increased by 12% annually over the past five years, exacerbating the burden on healthcare systems. Without addressing this issue, the market risks stagnation, as even the most advanced debridement technologies cannot be utilized effectively without skilled practitioners.

Ethical Concerns Surrounding Larval Therapy

Ethical concerns surrounding larval therapy are further challenging the growth of the North American wound debridement products market. While maggot debridement therapy (MDT) has proven effective in removing necrotic tissue, its use often raises ethical objections among patients and caregivers. According to a survey conducted by the Ethics Committee of the American Medical Association, over 40% of patients express hesitation about undergoing MDT due to cultural or psychological barriers. This sentiment is particularly pronounced among elderly patients and those from conservative backgrounds, where the use of live organisms is viewed unfavorably. Additionally, regulatory bodies like the Food and Drug Administration have imposed strict guidelines on the sourcing and handling of medicinal maggots, increasing compliance costs for manufacturers. A report by the Biotechnology Innovation Organization notes that these ethical and regulatory hurdles have slowed the adoption of larval therapy, limiting its market penetration despite its potential benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Application, End User, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Smith & Nephew plc, Zimmer Biomet, DeRoyal Industries, Inc., Lohmann & Rauscher International, Arobella Medical, LLC, Bactiguard AB, MediWound Ltd., Misonix, Inc., Söring GmbH, BSN Medical, and Derma Sciences Inc., and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The surgical segment dominated the North America wound debridement products market by occupying 36.8% of the regional market share in 2024. The promising position of surgical segment in the North American market is driven by their widespread use in acute care settings, where rapid and precise removal of necrotic tissue is critical. According to the American College of Surgeons, surgical debridement accounts for over 60% of all debridement procedures performed in hospitals, underscoring its importance in wound management. The aging population further amplifies demand, as older adults are more susceptible to conditions requiring surgical intervention, such as diabetic foot ulcers and traumatic wounds. Additionally, advancements in device design, such as ergonomic scalpels and precision cutting tools, have enhanced the safety and efficacy of surgical debridement. Government initiatives promoting early intervention and timely treatment have also played a key role in sustaining the segment’s dominance. For instance, Medicare reimbursement policies cover 90% of surgical debridement costs, ensuring affordability for patients.

The low-frequency ultrasound devices segment is anticipated to progress at a CAGR of 9.98% over the forecast period owing to their ability to selectively target necrotic tissue while preserving healthy tissue, making them ideal for chronic wound management. According to the Journal of Wound Care, these devices have demonstrated a 35% reduction in bacterial load in infected wounds, significantly improving healing rates. The increasing prevalence of chronic wounds, such as venous leg ulcers and pressure ulcers, has further accelerated adoption. Canada’s healthcare system has embraced these devices, with provincial programs investing in training and infrastructure to support their use. A study by the Canadian Institute for Health Information highlights that hospitals using low-frequency ultrasound devices have reported a 20% decrease in wound-related readmissions. These factors position low-frequency ultrasound devices as the most dynamic segment in the market.

By Application Insights

The chronic ulcers segment was the largest segment in the North America wound debridement products market by accounting for 46.1% of the regional market share in 2024. The dominance of chronic ulcers segment in the North American market is driven by the high prevalence of conditions such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, which collectively affect over 8 million individuals in the United States alone, as per the Centers for Disease Control and Prevention. Diabetic foot ulcers, in particular, account for 60% of chronic ulcer cases, necessitating frequent debridement to prevent complications such as infections and amputations. The aging population further amplifies demand, as individuals aged 65 and above are five times more likely to develop chronic ulcers compared to younger demographics. Additionally, advancements in debridement technologies, such as enzymatic agents and low-frequency ultrasound devices, have enhanced treatment efficacy, making them more appealing to clinicians. Government initiatives promoting early diagnosis and intervention have also contributed to the segment’s leadership. For instance, Medicare covers 85% of debridement costs for chronic ulcers, ensuring accessibility for patients.

The burn cases segment is predicted to witness the fastest CAGR of 10.9% over the forecast period owing to the increasing incidence of burn injuries, particularly in industrial and domestic settings. According to the American Burn Association, over 486,000 burn injuries require medical attention annually in the U.S., with severe cases often necessitating surgical debridement to remove damaged tissue and promote healing. Advances in debridement techniques, such as hydrosurgical systems and mechanical pads, have significantly improved outcomes for burn patients, reducing recovery times by up to 30%. Canada has also witnessed a surge in demand, with provincial healthcare programs investing in specialized burn care units equipped with advanced debridement tools. A study published in the Journal of Burn Care & Research highlights that hospitals using modern debridement methods have reported a 25% reduction in infection rates among burn patients. These factors position burn cases as the most promising segment for future growth.

By End User Insights

The hospitals segment held the largest share of 45.5% of the regional market share in 2024. The leading position of hospitals segment in the North American market is attributed to their role as primary care providers for acute and chronic wounds, particularly among patients requiring surgical interventions. According to the American Hospital Association, over 60% of all debridement procedures are performed in hospital settings, driven by the availability of advanced medical infrastructure and skilled healthcare professionals. The prevalence of chronic conditions such as diabetes and cardiovascular diseases further amplifies demand, with hospitals treating nearly 70% of diabetic foot ulcer cases annually. Additionally, government initiatives aimed at reducing hospital readmissions have encouraged the adoption of advanced debridement technologies, such as hydrosurgical systems and low-frequency ultrasound devices. Medicare’s reimbursement policies, which cover up to 85% of debridement-related expenses, ensure affordability for patients while incentivizing hospitals to invest in cutting-edge solutions. Furthermore, hospitals’ ability to handle complex cases, such as burn injuries and traumatic wounds, reinforces their dominance in the market.

The ambulatory surgical centers (ASCs) segment is anticipated to progress at a promising CAGR of 11.8% over the forecast period due to the increasing preference for outpatient care models, which reduce costs and improve patient convenience. According to the Centers for Medicare & Medicaid Services, ASCs now account for over 30% of all outpatient surgeries in the U.S., with wound debridement procedures witnessing a 15% annual increase in these settings. Technological advancements, such as portable debridement devices and disposable mechanical pads, have made it feasible to perform minimally invasive procedures outside traditional hospital environments. Canada has also embraced this trend, with provincial healthcare programs investing in ASC infrastructure to alleviate the burden on hospitals. A study by the Canadian Institute for Health Information reveals that ASCs have reduced wait times for wound debridement by 20%, enhancing patient satisfaction. These factors position ambulatory surgical centers as the most dynamic segment in the market.

REGIONAL ANALYSIS

The United States held the dominating position by holding 84.7% of the North America wound debridement products market share in 2024. The growth of the U.S. in this market is driven by the country’s high prevalence of chronic wounds, advanced healthcare infrastructure, and robust investments in medical research. According to the American Diabetes Association, over 34 million Americans suffer from diabetes, with diabetic foot ulcers alone affecting 25% of this population. Chronic ulcers, including venous leg ulcers and pressure ulcers, affect nearly 6.5 million individuals annually, as per data from the National Institutes of Health. The aging demographic further amplifies demand, as older adults are disproportionately affected by conditions requiring debridement. Hospitals and ambulatory surgical centers play a pivotal role in shaping the market landscape, with Medicare covering 85% of debridement costs for eligible patients. Additionally, the presence of leading manufacturers and research institutions ensures continuous innovation, solidifying the U.S.’s dominance in the regional market.

Canada is a prominent market for wound debridement products in North America and is likely to account for a substantial share of the North American market over the forecast period. The Canadian market is driven by rising cases of chronic wounds and an aging population, which increase the demand for advanced debridement solutions. According to Statistics Canada, hospital admissions for chronic wound management have increased by 12% over the past five years, reflecting the growing burden on healthcare systems. Provincial healthcare programs have responded by investing in specialized wound care units and training programs for healthcare providers. Low-frequency ultrasound devices and enzymatic debridement agents are gaining traction, supported by Canada’s focus on improving patient outcomes. Additionally, partnerships between academia and industry foster innovation, with collaborative efforts driving the development of next-generation debridement products. While smaller in scale compared to the U.S., Canada’s strategic emphasis on accessibility and quality healthcare positions it as a key player in the regional market.

KEY MARKET PLAYERS

Companies playing a dominant role in the North America Wound Debridement Products Market profiled in this report are Smith & Nephew plc, Zimmer Biomet, DeRoyal Industries, Inc., Lohmann & Rauscher International, Arobella Medical, LLC, Bactiguard AB, MediWound Ltd., Misonix, Inc., Söring GmbH, BSN Medical, and Derma Sciences Inc., and Others.

TOP PLAYERS IN THE MARKET

The North America wound debridement products market is led by three key players: Smith & Nephew, Mölnlycke Health Care, and ConvaTec Group. These companies collectively contribute to a significant share of global market, leveraging their extensive product portfolios and technological expertise. Smith & Nephew dominates with its innovative enzymatic debridement agents, which are widely used for chronic ulcers and burn cases. Mölnlycke Health Care follows closely, offering advanced hydrosurgical systems and mechanical debridement pads that cater to diverse clinical needs. The company’s focus on expanding its product pipeline has resulted in a 9% year-over-year growth in its wound care segment. ConvaTec Group rounds out the top three, with a strong presence in larval therapy and bioengineered debridement solutions. Its commitment to research and development has enabled the launch of advanced biomaterial-based products, reinforcing its global standing.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America wound debridement products market employ a variety of strategies to strengthen their positions. Collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Smith & Nephew has partnered with leading research institutions to develop next-generation enzymatic debridement agents. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Mölnlycke Health Care, for example, acquired a startup specializing in portable debridement devices, enhancing its capabilities in ambulatory surgical centers. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. ConvaTec Group has invested heavily in establishing distribution networks across Canada, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving patient needs.

COMPETITION OVERVIEW

The North America wound debridement products market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Smith & Nephew, Mölnlycke Health Care, and ConvaTec Group dominating the landscape. These companies compete on the basis of product innovation, technological superiority, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as larval therapy and personalized debridement solutions. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for minimally invasive procedures and advancements in medical technology.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In February 2024, Smith & Nephew launched an enzymatic debridement gel designed for diabetic foot ulcers. This initiative aimed to address unmet clinical needs and expand its product portfolio.

- In March 2024, Mölnlycke Health Care acquired a startup specializing in portable hydrosurgical devices. This acquisition was anticipated to enhance its capabilities in outpatient settings.

- In May 2024, ConvaTec Group partnered with a Canadian healthcare provider to improve access to larval therapy in rural areas. This collaboration sought to address regional disparities in wound care.

- In June 2024, BSN Medical introduced a biodegradable mechanical pad for pressure ulcers. This innovation aimed to reduce long-term complications associated with traditional debridement methods.

- In August 2024, Medline Industries expanded its manufacturing facilities in the U.S. to meet the growing demand for enzymatic debridement agents. This investment was intended to enhance production capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the North America wound debridement products market has been segmented and sub-segmented into the following categories.

By Product Type

- Hydrosurgical Debridement Devices

- Low-Frequency Ultrasound Devices

- Surgical Wound Debridement Devices

- Mechanical Debridement Pads

- Traditional Wound Debridement Devices

- Larval Therapy

By Application

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

By End User

- Hospitals & Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]