Global Medical Devices Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, IVD, MIS, Wound Management, Diabetes Care, Ophthalmic Devices, Dental Devices, Nephrology Devices, General Surgery Devices and Others), End-User & Region - Industry Analysis From 2025 to 2033

Global Medical Devices Market Size

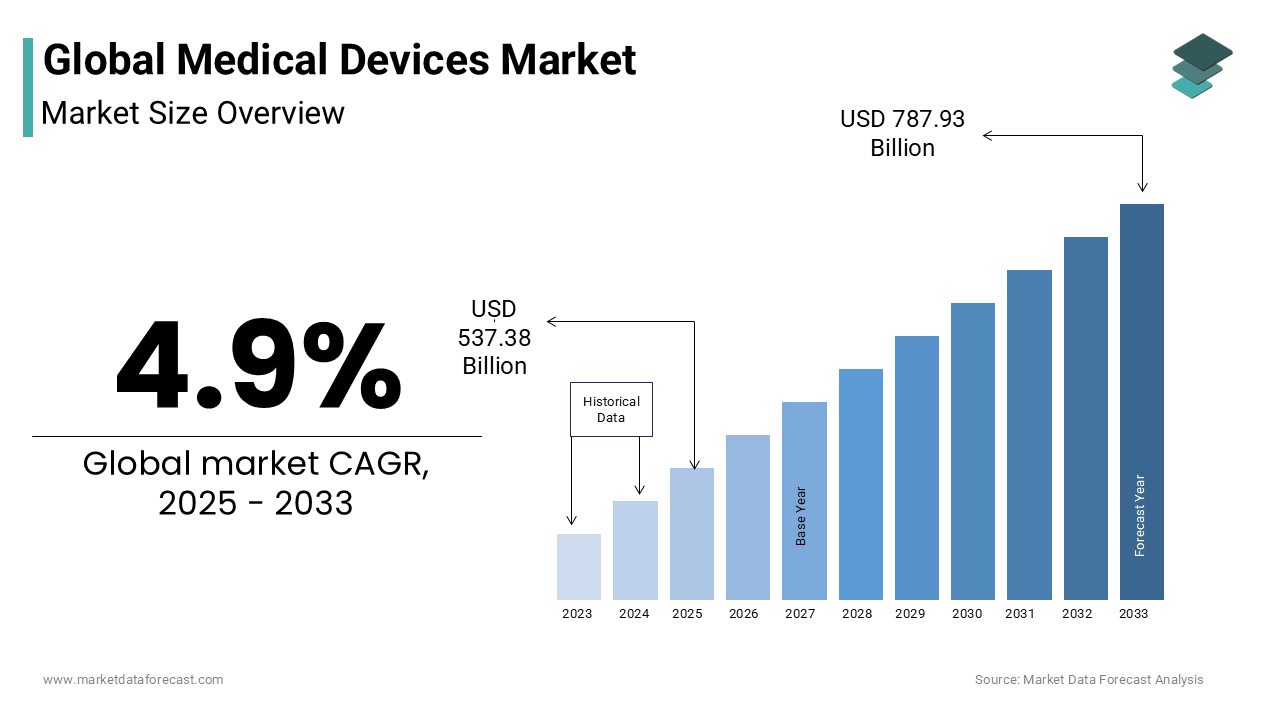

The size of the global medical devices market was valued at USD 512.28 billion in 2024. This value is further estimated to be growing at a CAGR of 4.9% from 2025 to 2033 and will be worth USD 787.93 billion by 2033 from USD 537.38 billion in 2025.

The global medical devices market has seen rapid growth over the past few years and the growth momentum is anticipated to continue further in the coming years due to factors such as increased healthcare demand, technological advancements, and rising chronic disease prevalence. North America currently leads the market due to strong healthcare infrastructure, high per capita spending, and a high rate of medical technology adoption. Europe is another key regional segment in the global medical devices market, with Germany, France, and the UK as major contributors. On the other side, the Asia-Pacific region is rapidly expanding, led by China and India due to rising healthcare investment and demand.

Companies such as Medtronic, Johnson & Johnson, Abbott Laboratories, and Siemens Healthineers are dominating the market worldwide and these companies dominate segments such as cardiovascular, diagnostics, and imaging devices. The integration of AI in diagnostics, wearable devices, and minimally invasive surgical tools are some of the recent notable trends in the global medical devices market.

The COVID-19 pandemic significantly impacted the market and boosted the demand for respiratory devices, diagnostics and telemedicine solutions. However, supply chain disruptions temporarily hindered production and distribution. During the forecast period, factors such as an increasing aging population, rising healthcare spending and ongoing innovations in remote monitoring and digital health are likely to continue to drive the medical devices market growth. Regulatory adjustments in markets like the U.S. and Europe are also shaping the competitive landscape, and compliance is a critical focus.

MARKET DRIVERS

Technological Advancements in the medical devices is one of the key market driving factors. Rapid advancements in medical technology have been reshaping the diagnostics, treatment and patient monitoring and further enhancing the efficiency and effectiveness of healthcare. For instance, advanced technologies such as Artificial intelligence (AI) and machine learning are enabling predictive diagnostics and personalized treatments, particularly in imaging and diagnostic devices. The usage of AI in the healthcare industry has been rising significantly over the past few years. According to our projections, AI in the healthcare market is estimated to be worth USD 421.18 billion by 2032, showcasing a CAGR of 49.8% between 2024 and 2032. Likewise, the intervention of advanced technologies is expected to continue to penetrate further in each of the medical segments and fuel innovation and continue to provide improved efficiency and efficacy in delivering better patient outcomes. Furthermore, the popularity of wearable health devices such as heart rate monitors and glucose monitors is surging exponentially due to the increased health awareness and demand for remote monitoring, which is considered another major technological advancement in the global medical devices market.

The growing prevalence of chronic diseases worldwide is further accelerating the growth rate of the global market. The growing aging population and increasing number of lifestyle-related conditions are directly resulting in the rising patient population of chronic diseases worldwide, which is promoting the demand for medical devices worldwide. Conditions such as cardiovascular diseases, diabetes, and respiratory issues require ongoing patient monitoring and intervention. According to the reports of the World Health Organization (WHO), chronic diseases are the leading cause of death globally and account for 41 million deaths annually. In response, the demand for monitoring devices, diagnostics, and therapeutic tools has increased as these devices are essential in managing long-term patient care and improving patient outcomes.

MARKET RESTRAINTS

Regulatory challenges are a significant restraint to the growth of the medical devices market. The manufacturers of medical devices face stringent regulatory requirements that vary across regions and impact the speed and cost of product development and market entry. For instance, In the United States, the approval process of the FDA for medical devices can take several months to years, based on the classification of the medical device. In Europe, the transition to the Medical Device Regulation (MDR), implemented in 2021, which has increased compliance requirements. This regulation is delaying market access for many companies. According to MedTech Europe, more than 50% of companies have reported delays due to MDR and reported that their new product rollouts were impacted by this. These regulatory hurdles directly create significant costs in the name of compliance and limit the ability of smaller companies to compete in the global space for medical devices.

High R&D costs are another major restraint hampering the growth of the global market. The development of advanced medical devices demands substantial investment in R&D, particularly for complex technologies such as artificial intelligence, robotics and minimally invasive surgical tools. For instance, according to Deloitte, top medtech companies allocate between 7% and 10% of their annual revenue to R&D. This high-cost structure limits market entry and growth for smaller manufacturers of medical devices that struggle to keep pace with leading players. As a result, this factor stifles innovation and narrows competition and restrains the medical devices market growth. This can be noticed more clearly in the emerging economies.

MARKET OPPORTUNITIES

Telemedicine and home healthcare are considered major opportunities in the global medical devices market. The shift towards remote healthcare is creating substantial opportunities for medical devices. This trend has accelerated further after the COVID-19 pandemic as it fueled the adoption of telemedicine worldwide. The demand for medical devices that support home-based monitoring and treatment is on the rise as healthcare delivery has started progressing beyond traditional settings. As per the estimations, the global home healthcare market is expected to be valued at USD 733.06 billion by 2032 by registering a CAGR of 9.5% from 2024 to 2032. This growth in home healthcare solutions is majorly driven by the increasing aging population and the rise in chronic diseases such as diabetes and cardiovascular conditions. Particularly, medical devices such as glucose monitors, wearable ECGs, and portable oxygen concentrators are seeing promising demand worldwide as these devices enable patients to manage health conditions from home and, therefore, reduce hospital visits and costs.

The adoption of AI in diagnostics and treatment is another significant opportunity in the global medical devices market. AI applications have been transforming the medical device landscape, particularly in imaging, diagnostics and robotic surgery. AI-driven diagnostic tools enhance accuracy and efficiency and allow for faster disease detection and personalized treatment plans. AI-integrated devices aid healthcare providers by interpreting complex data with greater accuracy, which is particularly important in fields such as oncology and cardiology. The adoption of AI in diagnostics and treatment is also receiving encouragement from various governments through favorable initiatives and investments. For instance, considerable funding for AI in healthcare was noticed by the governments of the U.S. and some countries in Europe in recent years.

MARKET CHALLENGES

Supply chain disruptions are a notable challenge to the medical devices market as they affect both manufacturing and distribution. The COVID-19 pandemic resulted in several vulnerabilities and led to shortages in critical components such as semiconductors that are essential for many medical devices. According to a survey by Deloitte, more than 75% of medtech companies reported moderate to severe supply chain disruptions during the COVID-19 pandemic and this impacted their production schedules and product availability. In addition, geopolitical tensions and trade restrictions, particularly between major manufacturing hubs such as the U.S. and China, have added further complexity to global supply chains. These disruptions increase lead times and fuel production costs and create delivery delays that can limit access to life-saving devices in critical markets.

Data security and privacy concerns are another significant challenge to the medical devices market. Data security has become extremely crucial in the medical devices market owing to the rise of connected medical devices and digital health platforms. These devices often collect and transmit sensitive patient data, making them attractive targets for cyberattacks. In fact, the U.S. FDA has recorded a 300% increase in reported cybersecurity incidents affecting medical devices since 2018. The manufacturers of medical devices must comply with data protection regulations, such as HIPAA in the U.S. and GDPR in Europe and ensuring this compliance is resulting in the additional costs and complexity to the manufacturers. These security risks also undermine patient trust and impede the adoption of digital health solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Market Players |

Medtronic, Stryker, Fresenius SE & Co. KGaA, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, General Electric Company, Siemens Healthineers AG, BD, Boston Scientific Corporation, Johnson & Johnson Services, Inc. |

SEGMENTAL ANALYSIS

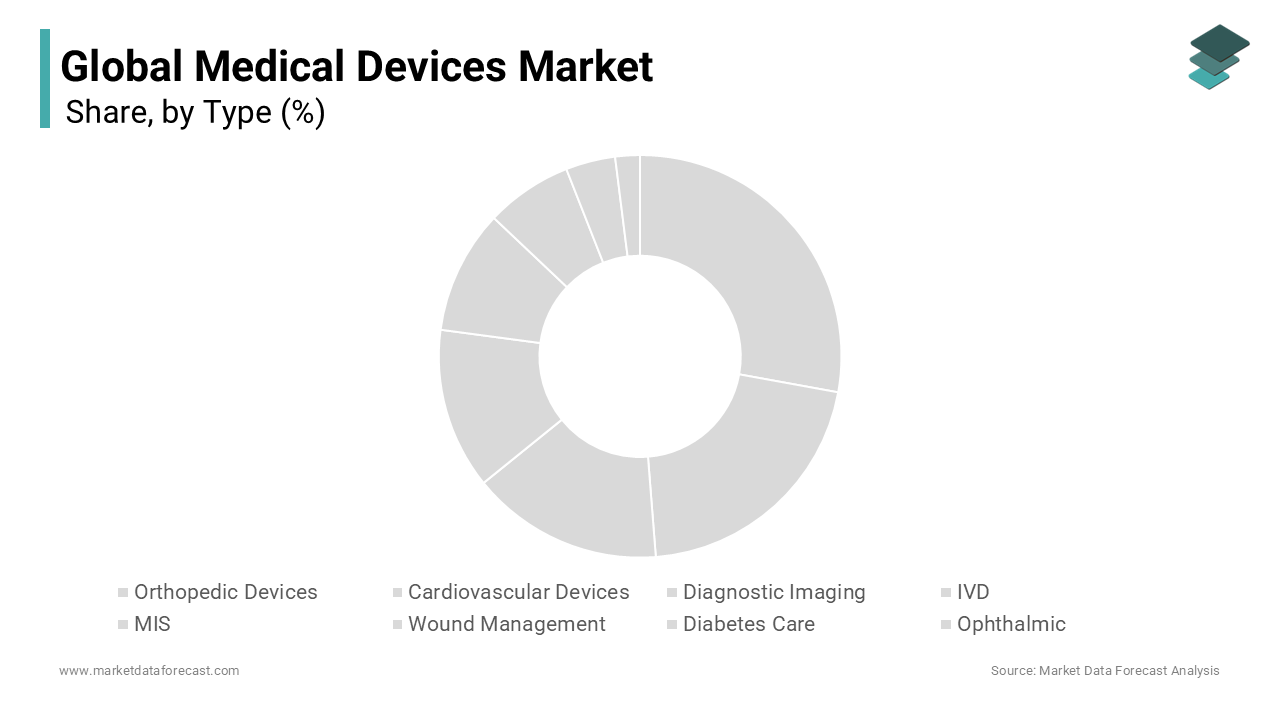

By Type Insights

Based on type, the diagnostic imaging segment has registered domination in the global medical devices market and accounted for 20.88% of the global market share in 2024. The growth of the diagnostic imaging segment is primarily driven by rising incidences of chronic diseases, such as cancer and cardiovascular conditions that require advanced imaging techniques for diagnosis and management. According to the statistics of the World Health Organization, chronic diseases are responsible for 71% of deaths worldwide. In addition, technological advancements are further contributing to the expansion of the diagnostic imaging segment in the global market. Technological developments such as AI-enhanced imaging have significantly improved the accuracy of imaging procedures.

The IVD segment is the fastest-growing in the medical devices market and is expected to register a CAGR of 6.8% over the forecast period. IVD includes lab-based tests for detecting diseases and infections and is considered as crucial in COVID-19 management. An increase in the need for personalized medicine and the rise in infectious diseases and chronic conditions that regular testing are majorly driving the growth of the IVD segment in the global medical devices market. The global push for early diagnosis and preventive care further supports this trend. Governments and healthcare providers worldwide are also investing in the infrastructure of IVD, which is another factor fueling the growth of the IVD segment in the global market. According to the CDC, early diagnostics can significantly reduce healthcare costs and improve patient outcomes and amplify the adoption of IVD across healthcare systems globally.

By End-User Insights

Hospitals and ASCs are the largest end-users in the global medical devices market, and they captured 60.7% of the global market share in 2023. The dominance of the hospitals and ASCs segment is majorly attributed to the high demand for advanced medical equipment in hospitals that handle complex and high-volume procedures. Hospitals rely on diverse medical devices that range from diagnostic imaging systems to surgical instruments to deliver comprehensive care. The rising number of hospital admissions, particularly for chronic conditions and surgeries is also contributing to the growth of the hospitals and ASCs segment. According to the American Hospital Association, more than 36 million inpatient admissions occur annually in the U.S. alone.

The clinics segment is expected to grow at the fastest CAGR of 6.2% over the forecast period. The rising popularity of outpatient care and preventive services offered in clinics, where diagnostics, routine check-ups, and minor procedures can be performed more cost-effectively than in hospitals is propelling the growth of the clinics segment in the global market. Clinics have also benefited from the rise in point-of-care testing and portable diagnostic device, allowingw them to provide moreonsite servicese. According to the Centers for Medicare & Medicaid Services, outpatient care expenditure in the U.S. has been growing at a steady rate. This is reflecting a shift towards more accessible healthcare options. The expanding footprint of specialized clinics, such as cardiology and dermatology further support demand of medical devices in the clinics segment and thereby driving the segmental expansion.

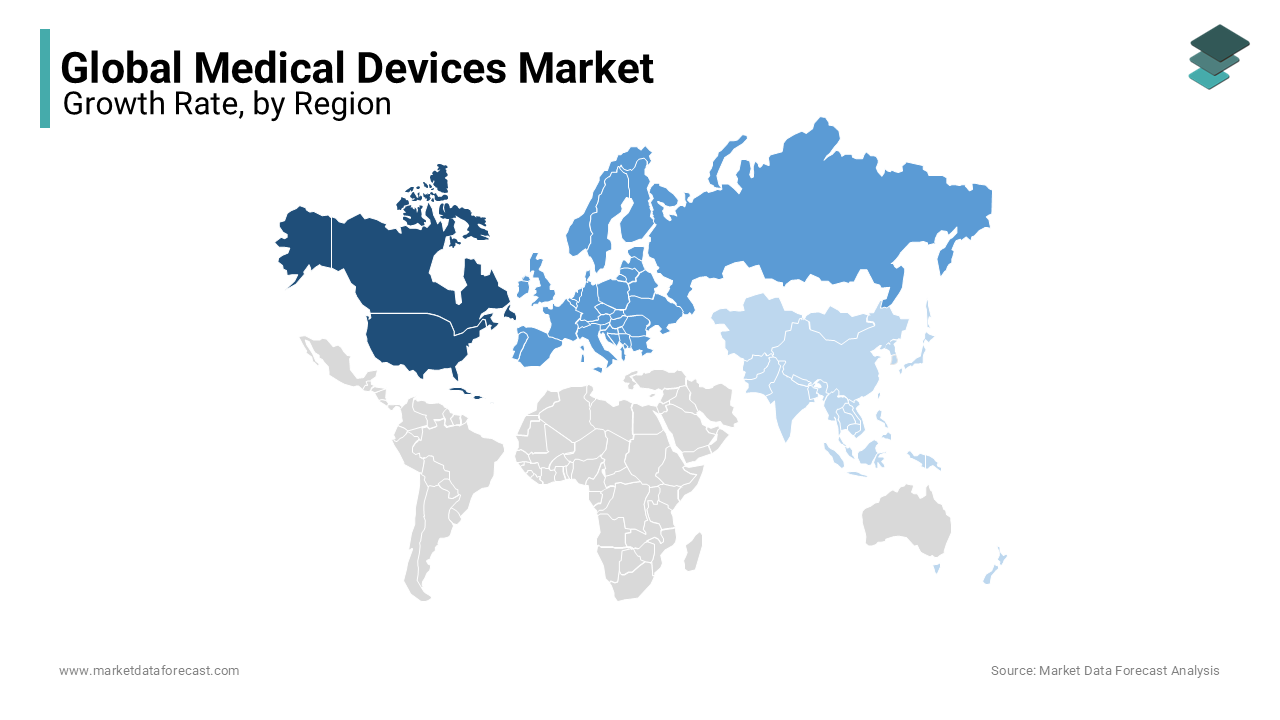

REGIONAL ANALYSIS

North America led the medical devices market and held 40.8% of the global market share in 2024. The dominance of North America is primarily credited to the availability of advanced healthcare infrastructure, high healthcare spending and a strong focus on R&D. The continued demand for cutting-edge devices, particularly in diagnostics and cardiovascular segments is further propelling the market growth in North America. The U.S., in particular, is a key driver in the North American market. In the U.S., the medical device industry valued at more than USD 150 billion and is being supported by government funding and technological innovation. Canada also contributes significantly to the North American market. The presence of well-established healthcare system in Canada is driving the medical devices market in Canada.

Europe was the second-largest regional segment in the global market and had 25.7% of global market share in 2024. The rising investments in AI-integrated medical devices and regulatory changes, such as the EU Medical Device Regulation (MDR) are driving the medical devices market growth in Europe. Germany, France, and the UK are key contributors to the European market. The growth of European medical devices market is driven by the high adoption rates of medical technologies, increasing aging population and rising chronic disease incidences. Germany leads in market share due to its strong manufacturing base, while France and the UK focus heavily on healthcare spending and innovation in medical devices.

Asia-Pacific is the fastest-growing regional market in the global medical devices market and is expected to grow at a CAGR of 7.2% over the forecast period. The rising demand for healthcare services, increasing healthcare spending and rapid urbanization in this region are fueling the demand for medical devices and driving the regional market growth. Increasing awareness and demand for devices like diagnostic imaging and patient monitoring are further expanding the Asia-Pacific market growth. China and Japan are major players in the region. The medical devices market in China is expanding rapidly due to growing healthcare access and domestic manufacturing capabilities. On the other hand, Japan leads in advanced medical technologies and is among the largest importers of medical devices. India is also emerging as a key market for medical devices. The government initiatives of India to improve healthcare access and support for local manufacturing under the "Make in India" initiative are supporting the Indian market growth.

The Latin American medical devices market is developing steadily. Brazil and Mexico are the largest markets in the Latin American region. The growing healthcare sector of Brazil and a push for improved healthcare infrastructure are propelling the demand for medical devices in Brazil. Mexico, with an expanding medical tourism sector, has also shown growth in medical device usage, especially in the orthopedics and cardiology segments. However, economic challenges and limited healthcare budgets in other parts of the region can constrain the growth of the Latin American market.

The Middle East and Africa hold a smaller share of the global market. However, this regional market is growing steadily. The UAE and Saudi Arabia lead the Middle Eastern market with the support from strong healthcare investments and the focus of MEA on becoming a medical tourism hub. South Africa is the main market in Africa and benefits from government efforts to enhance healthcare infrastructure. However, challenges such as limited healthcare funding and high device costs restrict broader market expansion in many parts of Africa.

KEY MARKET PLAYERS

Medtronic, Stryker, Fresenius SE & Co. KGaA, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, General Electric Company, Siemens Healthineers AG, BD, Boston Scientific Corporation, Johnson & Johnson Services, Inc. are a few of the leading companies operating in the global medical devices market.

RECENT HAPPENINGS IN THE GLOBAL MARKET

- In September 2024, Medtronic launched new software and hardware solutions within its AiBLE™ spine surgery ecosystem and enhanced the integration of AI and navigation in spinal surgeries. This launch, in partnership with Siemens Healthineers, aims to improve accuracy in spinal procedures.

- In January 2023, Stryker introduced the Q Guidance System for spinal and cranial surgeries and featured 3D navigation for enhanced precision. This system supports the expansion of Stryker in surgical robotics.

- In February 2023, Stryker acquired Vocera Communications for USD 3 billion to bolster its capabilities in clinical communication and enable more efficient workflows in hospitals and surgical centers.

- In May 2023, Fresenius partnered with Omnicell to improve medication management in dialysis facilities and to advance patient safety and operational efficiency through automated solutions.

- In June 2023, Philips launched the Philips CT 3500 scanner in the U.S. and Europe and optimized for high-speed imaging with lower radiation exposure for cardiovascular and oncological use.

- In September 2023, Philips entered a partnership with Hologic to enhance breast cancer screening with integrated imaging solutions and to improve diagnostic accuracy for early detection.

- In October 2023, Roche launched the Cobas 5800 molecular diagnostics system in multiple markets to support smaller labs with cost-effective and high-capacity diagnostic solutions.

- In January 2024, Roche acquired Stratos Genomics to expand its capabilities in next-generation sequencing oncology diagnostics.

- In March 2023, GE Healthcare launched the LOGIQ™ E10s, which is an AI-driven ultrasound system aimed at enhancing imaging quality and diagnostic precision in radiology and women’s health.

- In February 2024, Siemens Healthineers introduced the MAGNETOM Free. The Star MRI system is designed for high-quality imaging at reduced operational costs and targets both established and emerging markets.

- In March 2023, BD launched the BD UltraSafe Plus™ Passive Needle Guard to enhance safety in drug delivery to address the needs of healthcare providers for secure, user-friendly injection devices.

- In May 2023, Boston Scientific completed the acquisition of Apollo Endosurgery for $615 million to strengthen its portfolio in minimally invasive gastrointestinal treatments.

- In April 2023, Johnson & Johnson’s DePuy Synthes launched the VELYS™ Robotic-Assisted Solution for knee replacement surgery, focusing on improving precision and patient outcomes in orthopedic procedures.

DETAILED SEGMENTATION OF THE MARKET

This research report on the global medical device market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- IVD

- MIS

- Wound Management

- Diabetes Care

- Ophthalmic

- Dental

- Nephrology

- General Surgery

- Others

By End-User

- Hospitals & ASCs

- Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the worldwide market size of medical devices?

In 2024, the global medical devices market was worth USD 512.28 billion.

Which region is expected to lead the medical devices market in the coming future?

As per our research report, the North American region is expected to dominate the medical devices market during the forecast period.

By Device type, which segment will account for the major share in the global medical devices market?

Between 2024 and 2029, Analysts at Market Data Forecast predicted that the IVD segment is expected to occupy the majority of the share in the global medical devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]