Global Insulin Pens Market Size, Share, Trends & Growth Forecast Report By Product Type, Application, Distribution Channel and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Insulin Pens Market Size

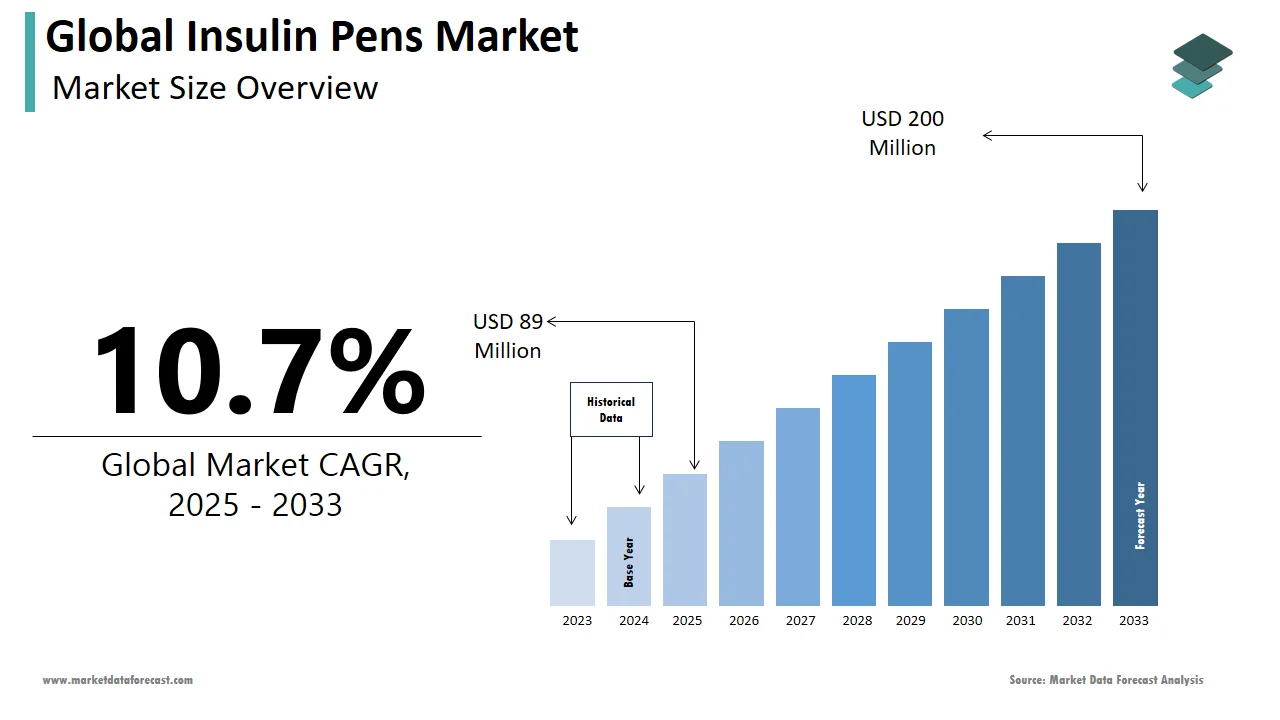

The size of the global insulin pens market was worth USD 80 million in 2024. The global market is anticipated to grow at a CAGR of 10.7% from 2025 to 2033 and be worth USD 200 million by 2033 from USD 89 million in 2025.

Insulin pens are one of the fastest-growing segments in the healthcare domain. This can be attributed to the rise in the geriatric population suffering from diabetes. Moreover, as diabetes is a lifestyle disease, people become more conscious and get in-house treatment. Check the sugar levels in the blood, and increasing personalized health care also propels the demand for insulin pens. Insulin can be used to infuse insulin into the body on its own without any expert help. This helps alleviate the scariness in patients suffering from hyperglycemia. Currently, the world population is experiencing an income rise and witnessing technological advancements, and this aspect is driving the population's awareness of better healthcare products.

Insulin pens provide more accurate, simpler, and more convenient insulin administration than a vial and syringe. It finds its use in delivering insulin into the fatty tissue under the skin using a short, thin, disposable needle. These pens are of two types; disposable pen, which contains a cartridge prefilled with insulin, discarding the entire stylus once used, and reusable pen with a replaceable insulin cartridge. Demand for insulin pens increases yearly as they are user-friendly and can be disposed quickly. Apart from all these factors, the insulin pen has more comfort and quality than regular syringes.

MARKET DRIVERS

The global insulin pens market growth is driven by factors such as an increasing number of people who have diabetes and a rise in various diseases such as HIV and Hepatitis.

Increasing demand for personalized medicine is also a factor propelling the application of the market. An insulin pen uses to increase the life span and reduce the scariness of hyperglycemia. Typical diabetic patients of all age groups and growing research and development activities are accelerating market growth. The rise in income earned by a person and technological advancements in the manufacturing market of insulin pen is surging the growth. Besides, growing awareness of these drugs' use evaluates the market's growth. Technological advances due to emerging market players and rising awareness of needlestick injuries make the process more accurate and faster, like the incorporation of smartphones and internet technologies, which are favored over conventional insulin syringes and needles. Also, the development of smart insulin pens has resulted in a good rise in market rates since these pens can record the time and amount of insulin delivered, calculate appropriate insulin doses, provide an insulin usage report which can be downloaded, and are linked to intermittent scan continuous glucose monitoring (CGM) data.

Demand for insulin pens is high among diabetic patients compared to traditional vial and syringe technologies.

People with diabetes are more satisfied with insulin pens, based on current ADA standards of care than with the vial and syringe technique because these pens have many features like the ability to read the dosage scale more than twice, their convenience in using, safety, and helping the people stick to their insulin therapy routine. Since they feature prefilled and interchangeable needle functions, the preference for insulin pens remains intact in the global market. Equipped with an auto shield needle and insulin, it provides more precision during dosing. In addition, the insulin pen has a relatively more significant number than the syringe to ensure quality and comfort. As the demand for insulin pens increases, the need for insulin needles in the world market will continue to increase. Further, due to various other benefits like the ability to adjust and deliver exact doses, the discreet and convenient nature of the pens, small and slim needle locks to reduce fear and pain, especially for the elderly and children, time-saving and precisely preset doses using a dial is foreseen to drive the market growth.

MARKET RESTRAINTS

The lack of proper knowledge of the dosage levels in undeveloped countries is majorly hindering the growth of the insulin pen market.

Furthermore, fluctuations in the availability of raw materials may also impede the growth rate of the insulin pens market. In addition, strict rules and regulations by the government regarding safety are degrading the market's growth rate. For example, there is a restriction for using all types of insulin through a single pen, wastage of insulin with each use, higher cost than the vial and syringe method, and lack of universal coverage by some insurers. Also, security problems related to injection pens and strict standards for developing new products inhibit the growth of the global insulin pens market.

COVID-19 Impact on the Global Insulin Pens Market

Covid-19 has disrupted every industry by disrupting the supply chains. Due to this pandemic, there is a change in the consumption behavior of diabetic patients; they have become more health-conscious, and many countries lack a personalized healthcare system. But the lockdowns and disrupted healthcare for chronic patients have created a considerable demand for the insulin pens market. Maintaining the daily diet routine and insulin injection is essential for diabetic patients, but due to covid standard regular syringes and health care are unavailable. E-commerce is preferred due to social distancing rules due to the COVID-19 pandemic scenario, leading to the increasing online availability of diabetes monitoring systems. It offers excellent opportunities for users preferring home delivery to avoid exposure to the virus. So, people have resorted to diabetic insulin pens for personalized healthcare. To maintain health and immunity during covid, diabetic patients have demanded proper healthcare for chronic diseases. Hence, COVID-19 has allowed the market to expand further.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.7% |

|

Segments Covered |

By Product Type, Application, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dickinson and Company, Becton, Novo Nordisk, Inc., VOGT MEDICAL, MedExel Co., Ltd., Owen Mumford Ltd, Perrigo Diabetes Care, and HTL-STREFA S.A., and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

Based on the product type, the reusable pens segment is anticipated to dominate the market since these work with disposable insulin, discarding once the insulin has been used, leaving the pen ready for the next cartridge, and allowing each pen to work only with one particular type of insulin.

The disposable pens segment is also foreseen to hold a significant market share, owing to their ease of one-time use, containing a prefilled supply of insulin, and discarding the entire stylus after use.

By Application Insights

Based on the application, the type 2 diabetes sector is to prophesied to grow steadily in sales, generating a value higher than U.S. $1,000 at the end of 2028. Type 2 occurs when the body can't make enough insulin or dysfunctional insulin, which cannot be cured, but controlled in more ways than Type 1 through exercise, medicine, and diet. Its symptoms may be unnoticed due to being slow, like weight and ethnicity.

On the other hand, the type 1 application segment will record a healthy CAGR during the forecast period. This occurs when the body attacks the pancreas's cells due to no insulin uptake. As a result, the Type 1 symptoms appear more quickly and are manageable by taking insulin to control blood sugar.

By Distribution Channel Insights

The hospital pharmaceutical sector registered the highest sales growth based on distribution channels at the end of 2024. The role of pharmacists is to give complete instructions to patients for improved use of insulin pens and to significantly decrease the rate of errors associated with inappropriate use of insulin pens. Hospital pharmacists contribute to the safe use of insulin by minimizing errors in administration, prescribing, dispensing, storage and communication.

Moreover, the ePharmacy segment shows a growth rate of the constant year up to 2033. As in conventional pharmacies, the manufacturing and sale of prescription and over-the-counter drugs are dealt with by the e-pharmacy business model. On the other hand, internet pharmacies accept online orders and mail the medications to the customer's address. E-Pharmacy is helping people living far from a traditional pharmacy, the elderly, and the disabled with a fast method of obtaining medicines straightforwardly.

REGIONAL ANALYSIS

Of all these regions, North America, particularly the united states, leads the market share with around 85% of the world insulin pens market. It can be attributed to the increased expenditure on health care and better technological advancements. Other factors include that people in the North American region are more prone to diabetes; this results from high consumption of processed foods and other lifestyle changes. In the North American insulin pen market, the United States accounted for almost 85% of market value in 2020. By 2025, the U.S. market will touch $113.4 million. The European and Japanese markets are mature and growing at a moderate pace. As a result, manufacturers now focus on the Asian market to meet the demand for these devices.

Next to North America, the European region has a more market share, and this is due to the health burden created by diabetes in the region. Diabetes is most common in the European region in almost everyone of every age. About 60 million people in Europe have diabetes; Germany leads the number of patients with a diabetic count. Hence Germany is one of the leading markets for insulin pen consumption. This is also a result of government policies as it is trying to provide quality health care to the people of Germany to reduce the burden caused by diabetes.

Asia Pacific insulin pen market is expected to grow at a CAGR of 7.0%, providing a lucrative space for the market to expand; this can be attributed to the senior population rise and lifestyle changes in these countries, especially China, India, Korea, Japan, and the Philippines.

In Latin America, the Middle East, and African countries, the personalized healthcare system needs to be better, resulting in a slower growth rate for the insulin pens market. But the region is registering a positive growth rate with the policies taken by the countries like Brazil, South Africa, Egypt, and Saudi Arabia.

KEY MARKET PARTICIPANTS

Some of the prominent companies leading the global insulin pens market profiled in the report are Dickinson and Company, Becton, Novo Nordisk, Inc., VOGT MEDICAL, MedExel Co., Ltd., Owen Mumford Ltd, Perrigo Diabetes Care, and HTL-STREFA S.A., and Others.

RECENT MARKET DEVELOPMENTS

- In October 2022, BIOCORP, a French manufacturer of innovative medical devices, and Merck KGaA, Darmstadt, a German science and technology company, signed an agreement for a specific version of the Mallya device supply, a Bluetooth-enabled clip-on device for injection pens, receiving C.E. marking for transferring the real-time information to companion software by collecting the dose and providing a specific time of each injection. The new version automatically tracks the injected doses and helps patients monitor their injections during treatment.

- In May 2022, Roche Diabetes Care India (DRC India) in Mumbai launched ACCU-FINE to make administering insulin easier, smoother, and virtually painless for people with diabetes with the help of quality pen needles, which are specially designed for this purpose.

- On January 17, 2020, the FDA approved the one-in-a-week injection of Ozempic that Novo Nordisk announced. This injection reduces the risk of cardiovascular events in patients with type II diabetes.

MARKET SEGMENTATION

This research report on the global insulin pens market has been segmented based on the product type, application, distribution channel, and region.

By Product Type

- Disposable

- Reusable

By Application

- Type 1 Diabetes

- Type 2 Diabetes

By Distribution Channel

- Online Pharmacies/ePharmacy

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Does this report include the impact of COVID-19 on the global insulin pens market.?

The global insulin pens market profiled in the report are Dickinson and Company, Becton, Novo Nordisk, Inc., VOGT MEDICAL, and MedExel Co., Ltd some of the key market players in the insulin pens market.

Which are the major players operating in the insulin pens market.?

As per our research report, the global insulin pens market is estimated to be worth USD 200 million by 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]