Europe Road Freight Transportation Market Size, Share, Trends & Growth Forecast Report – Segmented By End-User Industry, Truckload Specification, Truckload Specification, Distance, Temperature Control, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Road Freight Transportation Market Size

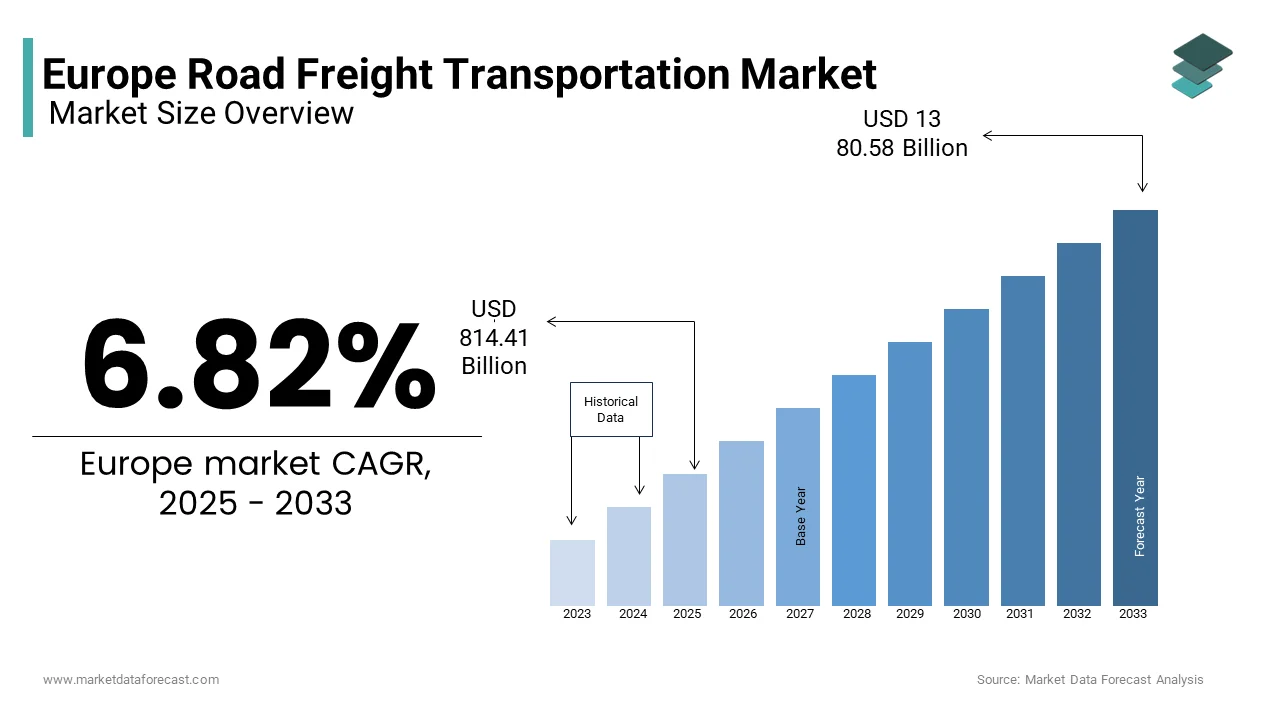

The Europe road freight transportation market size was valued at USD 762.41 billion in 2024 and is anticipated to reach USD 814.41 billion in 2025 from USD 1380.58 billion by 2033, growing at a CAGR of 6.82% during the forecast period from 2025 to 2033.

According to the Eurostat, road freight accounts for approximately 75% of all inland freight transport in Europe, which is indicating its dominance over other modes like rail and air. This mode of transportation is critical for industries ranging from manufacturing to retail, offering flexibility, cost-effectiveness, and door-to-door delivery capabilities. Key drivers of the regional market include the rise of e-commerce, cross-border trade within the EU, and advancements in digital logistics solutions. However, challenges such as rising fuel costs, regulatory compliance under the EU Green Deal, and driver shortages persist. As Europe transitions toward sustainable practices, the road freight industry is evolving to meet environmental and operational demands.

MARKET DRIVERS

Exponential Growth of E-commerce in Europe

Eurostat reports that online retail sales in Europe grew by 30% between 2019 and 2023, with over 60% of consumers preferring home deliveries facilitated by road freight. The European E-commerce Report highlights that last-mile delivery, which relies heavily on road transport, accounts for nearly 40% of total logistics costs. This surge in demand has led to increased investments in fleet modernization and route optimization technologies. Additionally, the European Investment Bank notes that SMEs, which constitute 99% of European businesses, rely on road freight for their supply chain needs due to its flexibility and accessibility. As consumer expectations for faster and more reliable deliveries grow, road freight remains indispensable for meeting these dynamic requirements.

Integration of Advanced Technologies such as IoT, AI and Telematics into Road Freight Operations

The European Union Agency for Cybersecurity (ENISA) reports that over 50% of logistics companies have adopted IoT-enabled tracking systems to enhance real-time visibility and operational efficiency. These technologies enable predictive maintenance, reduce fuel consumption, and optimize load planning, contributing to cost savings and sustainability. The European Commission highlights that smart logistics initiatives, supported by Horizon Europe funding, are accelerating digital transformation in the sector. Furthermore, the rise of autonomous trucks and platooning systems is expected to revolutionize long-haul transportation, reducing labor costs and improving safety. This technological evolution positions road freight as a leader in innovation within the broader transportation industry.

MARKET RESTRAINTS

Stringent Regulatory Environment

One significant restraint to the European road freight transport market is the stringent regulatory framework imposed by the EU Green Deal and emissions reduction targets. The European Environment Agency reports that road freight accounts for approximately 25% of the EU’s total CO2 emissions from transport, prompting stricter regulations on vehicle emissions and fuel efficiency. Compliance with these standards requires substantial investments in eco-friendly fleets and alternative fuels, which many small and medium-sized logistics providers cannot afford. The European Investment Bank estimates that transitioning to low-emission vehicles could increase operational costs by up to 30%, creating financial barriers for smaller players. Additionally, the lack of harmonized regulations across member states complicates cross-border operations, further hindering market growth.

The Shortage of Skilled Labour

Another restraint is the persistent shortage of skilled truck drivers, exacerbated by an aging workforce and unattractive working conditions. The International Road Transport Union (IRU) highlights that Europe faces a shortfall of over 400,000 drivers, with countries like Germany and the UK being particularly affected. Eurostat reports that the average age of truck drivers in Europe is 47, with fewer young people entering the profession due to long hours, low pay, and limited work-life balance. This labor gap disrupts supply chains and increases operational costs, as companies are forced to offer higher wages or outsource logistics. The driver shortage not only threatens the efficiency of road freight but also limits its capacity to meet growing demand.

MARKET OPPORTUNITIES

Green Logistics and Alternative Fuels

The adoption of green logistics and alternative fuels presents a significant opportunity for the Europe road freight market. The European Commission reports that investments in electric and hydrogen-powered trucks are projected to grow at a CAGR of 15% through 2030, driven by incentives under the EU Green Deal. Programs like the Connecting Europe Facility (CEF) provide funding for sustainable transport infrastructure, encouraging logistics companies to transition to low-emission vehicles. Eurostat highlights that over 60% of logistics firms are exploring renewable energy options to reduce their carbon footprint and comply with regulatory mandates. This shift not only enhances environmental sustainability but also reduces long-term operational costs, positioning green logistics as a transformative force in the market.

Expansion of Cross-Border Trade

Another promising opportunity lies in the expansion of cross-border trade within the EU single market. The European Commission reports that intra-EU trade accounts for over 60% of total EU exports, with road freight being the primary mode of transport. The removal of customs barriers and harmonized regulations under the single market framework have streamlined cross-border logistics, boosting demand for international road freight services. Additionally, the European Investment Bank highlights that emerging markets in Eastern Europe, such as Poland and Romania, are experiencing rapid industrialization, creating new opportunities for road freight operators. By leveraging digital tools like blockchain for customs clearance and real-time tracking, logistics providers can enhance efficiency and tap into this growing demand.

MARKET CHALLENGES

Volatility of Fuel Prices

One major challenge is the volatility of fuel prices, which significantly impacts operational costs and profitability. The European Energy Agency reports that diesel prices, which account for nearly 30% of road freight expenses, have fluctuated by over 20% annually in recent years due to geopolitical tensions and supply chain disruptions. This unpredictability forces logistics companies to absorb higher costs or pass them on to customers, affecting competitiveness. The European Commission highlights that small and medium-sized enterprises (SMEs), which dominate the road freight sector, are particularly vulnerable to these fluctuations. Additionally, the lack of widespread adoption of alternative fuels exacerbates reliance on traditional diesel, making the industry susceptible to price shocks and hindering long-term financial stability.

Growing Complexity of Urban Logistics and Congestion

Another significant challenge is the increasing complexity of urban logistics and congestion in metropolitan areas. Eurostat reports that over 80% of Europe’s population resides in urban regions, leading to heightened demand for last-mile deliveries. However, strict urban access regulations, such as low-emission zones and time-restricted deliveries, create operational hurdles for road freight operators. The European Environment Agency highlights that traffic congestion costs the EU economy approximately EUR 100 billion annually, with road freight bearing a significant share of these losses. Furthermore, the lack of dedicated urban logistics infrastructure, such as micro-distribution centers, compounds inefficiencies. These challenges not only increase delivery times and costs but also undermine customer satisfaction, posing a threat to the sector’s growth.

SEGMENTAL ANALYSIS

By End-User Industry

The wholesale and retail trade segment dominated the market by accounting for 35.5% of the European market share in 2024. The domination of the segment is primarily driven by the booming e-commerce sector, which relies heavily on road freight for last-mile deliveries. The European Retail Forum highlights that over 70% of online purchases in Europe are delivered via road transport, underscoring its critical role in supporting retail operations. Its importance lies in providing flexible and cost-effective solutions for transporting goods directly to consumers, making it indispensable for the retail industry.

The manufacturing segment is another major segment and is anticipated to register a promising CAGR of 5.5% over the forecast period owing to factors such as the increasing demand for just-in-time delivery and supply chain optimization in industries like automotive and electronics. Eurostat reports that over 60% of manufacturers rely on road freight to ensure timely delivery of raw materials and finished goods. Its importance lies in enabling seamless production processes and reducing inventory costs, positioning it as a key driver of innovation in the market.

By Truckload Specification

The Full-Truck-Load (FTL) segment led the market by capturing 60.7% of the European market share in 2024. The lead of the FTL segment in the European market is attributed to its cost-effectiveness and suitability for long-distance and high-volume shipments. Eurostat highlights that industries like manufacturing and oil and gas prefer FTL for its ability to minimize handling and ensure faster delivery. Its importance lies in optimizing logistics for bulk shipments, making it a cornerstone of the market.

The Less-than-Truck-Load (LTL) segment is likely to witness the fastest CAGR of 6.4% over the forecast period due to the rise of e-commerce and small-scale shipments, which require flexible and consolidated transport solutions. Eurostat reports that over 50% of SMEs utilize LTL services to reduce costs and improve delivery efficiency. Its importance lies in catering to the diverse needs of small businesses and enhancing supply chain agility.

By Distance

The long haul held 66.8% of the European market share in 2024. The growth of the long haul segment is primarily attributed to the high volume of cross-border trade within the EU single market, which relies on long-distance transportation. The European Commission highlights that over 70% of international freight movements are facilitated by long-haul road transport. Its importance lies in connecting distant markets and ensuring seamless trade flows across Europe.

The short-haul segment is anticipated to progress at the fastest CAGR of 4.5% over the forecast period owing to the increasing demand for urban logistics and last-mile deliveries, particularly in densely populated areas. Eurostat reports that over 80% of short-haul freight involves delivering goods to urban centers, driven by the rise of e-commerce. Its importance lies in addressing the unique challenges of urban distribution and enhancing customer satisfaction.

By Temperature Control

The non-temperature-controlled freight segment accounted for the dominating share of 71.2% of the European market in 2024. The domination of the segment in the European market is attributed to its versatility and lower operational costs compared to temperature-controlled transport. Eurostat highlights that industries like manufacturing and retail rely heavily on non-temperature-controlled solutions for transporting solid goods. Its importance lies in providing cost-effective and scalable logistics for a wide range of products.

The temperature-controlled freight segment is predicted to register the highest CAGR of 7.12% over the forecast period owing to the increasing demand for perishable goods, such as food and pharmaceuticals, which require precise temperature management. Eurostat reports that over 50% of temperature-controlled freight involves transporting fresh produce and medical supplies. Its importance lies in ensuring product quality and safety, making it vital for industries with stringent storage requirements.

COUNTRY ANALYSIS

Germany

Germany dominated the European market by holding 25.4% of the European market share in 2024. The domination of Germany in the European market is driven by its central geographic location, robust manufacturing base, and extensive road network, which facilitate both domestic and international freight. The European Investment Bank highlights that Germany’s strategic position as a logistics hub enables seamless cross-border trade within the EU. Additionally, investments in digital logistics and green technologies further solidify its dominance in the market.

The UK is another key regional segment for road freight transport in the European market. The strong retail and e-commerce sectors that rely heavily on road freight for last-mile deliveries is one of the key factors propelling the UK market growth. The British Retail Consortium reports that over 70% of goods consumed in the UK are transported via road, underscoring its critical role in the supply chain. Despite Brexit-related challenges, the UK remains a key player due to its advanced logistics infrastructure and focus on innovation.

France is anticipated to register a prominent CAGR during the forecast period in the European market. The growth of the French market is driven by its extensive road network and strategic role in connecting Northern and Southern Europe. The European Commission reports that France’s investments in sustainable transport solutions, such as electric trucks and hydrogen-powered vehicles, have positioned it as a pioneer in green logistics. Additionally, its thriving agricultural and manufacturing sectors further boost demand for road freight services.

KEY MARKET PLAYERS

CMA CGM GROUP, TURNERS (SOHAM) LTD, DB SCHENKER (DEUTSCHE BAHN GROUP (DB GROUP)), A.P. MOLLER - MAERSK, DEUTSCHE POST AG (DHL GROUP), WINCANTON PLC, DSV (DSV PANALPINA), KUEHNE+NAGEL, PRIMAFRIO, UNITED PARCEL SERVICE OF AMERICA, INC. These are the market players that are dominating the European road freight transportation market.

MARKET SEGMENTATION

This research report on the European road freight transport market size is segmented and sub-segmented into the following categories.

By End-User Industry

- Agriculture, Fishing, and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the European road freight transport market?

The Europe road freight transportation market size was valued at USD 814.41 billion in 2025.

What market drivers are driving the European road freight transport market?

The Exponential growth of e-commerce in europe and the Integration of advanced technologies such as IoT, ai, and telematics into road freight operations are the market drivers that are driving the European road freight transport market.

Who are the market players that are dominating the Europe road freight transport market?

CMA CGM GROUP, TURNERS (SOHAM) LTD, DB SCHENKER (DEUTSCHE BAHN GROUP (DB GROUP)), A.P. MOLLER - MAERSK, DEUTSCHE POST AG (DHL GROUP), WINCANTON PLC, DSV (DSV PANALPINA), KUEHNE+NAGEL, PRIMAFRIO, UNITED PARCEL SERVICE OF AMERICA, INC. These are the market players that are dominating the Europe road freight transportation market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]