3D Motion Capturing Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Hardware, Software, and Services), System (Optical 3D Motion Capture Systems and Non-optical 3D Motion Capture Systems), Application (Biomechanical Research and Medical, Media and Entertainment Engineering, Industrial Applications, and Education) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2024 to 2032

Global 3D Motion Capturing Market Size

The 3D Motion Capturing Market was valued at USD 218.87 million in 2023. It is projected to grow to USD 248.20 million by 2024 and further expand to reach USD 678.74 million by 2032, exhibiting a robust CAGR of 13.40% during the forecast period.

Motion capturing systems are essential for creating realistic animations in films and video games by enabling seamless integration of human-like movements. According to University of Miami study report in healthcare, these systems are used for biomechanical analysis and rehabilitation therapy that prominently enhances the patient outcomes by up to 30% in some cases. Sports applications leverage motion capture for performance analysis by allowing athletes to refine techniques with precision. Robotics and virtual reality (VR) sectors also utilize motion capture to develop lifelike simulations and improve machine learning algorithms for humanoid robots. The increasing accessibility of wearable sensors and camera-based systems has democratized 3D motion capture technology by fostering innovation in both large-scale productions and smaller, independent projects. The market is poised for sustained growth with the industries continue to integrate motion capture for enhanced functionality.

MARKET DRIVERS

Increased Adoption in Entertainment and Gaming

The entertainment and gaming industries are major factors driving the growth rate of the 3D motion capturing market. Approximately 85% of blockbuster films released in 2023 utilized motion capture for visual effects. Gaming studios rely on motion capture to develop lifelike character movements, enhancing player engagement. Filmmakers are increasingly adopting motion capture to reduce production timelines and costs while achieving superior quality with advancements in virtual production,. The growing popularity of VR and AR gaming further accelerates demand for 3D motion capture systems by enabling responsive and immersive environments.

Rising Use in Healthcare and Biomechanics

Healthcare and biomechanics applications are rapidly expanding with the growing need for precise movement analysis. Motion capture systems are used for gait analysis, injury rehabilitation, and surgical planning. According to the University of Miami, 2023 studies have shown that using motion capture in rehabilitation can improve recovery outcomes by 20–30. Biomechanical research benefits from the technology’s ability to capture real-time, high-accuracy movement data that aid in the development of better prosthetics and orthotics. This increased focus on improving patient care through advanced motion analysis tools is propelling the market forward.

MARKET RESTRAINTS

High Initial Costs and Complexity

The high initial costs of 3D motion capturing systems act as a significant restraint, especially for small and medium-sized enterprises. Advanced optical systems those are equipped with high-speed cameras and sensors costs upwards of $100,000 which makes them inaccessible for many users. Furthermore, the technology requires skilled professionals for setup and operation is expected to increase overall implementation costs. In 2022, 40% of surveyed small studios cited affordability as the main barrier to adopting motion capture. The cost-prohibitive nature particularly limits the market growth, especially in emerging industries or regions with limited technological infrastructure.

Data Processing and Integration Challenges

Motion capturing generates vast amounts of data that require extensive processing and seamless integration with animation or analysis software. The lack of standardized formats and compatibility issues between hardware and software can lead to inefficiencies and increased project timelines. According to Deloitte studies, in 2023, approximately 25% of production delays in motion-capture-based projects stem from data integration issues. These challenges can discourage the adoption of new systems, particularly for industries where rapid output and ease of use are critical, such as live events or sports analytics. Overcoming these technical barriers remains essential for wider adoption.

MARKET OPPORTUNITIES

Expansion in Virtual Reality (VR) and Augmented Reality (AR) Applications

The growing VR and AR industries present significant opportunities for the 3D motion capturing market. Motion capture enhances immersive experiences in VR/AR by providing realistic body and facial movements. In 2023, the VR/AR market grew by 24% with applications expanding across gaming, training simulations, and virtual collaboration (IDC). The demand for natural user interfaces in these technologies drives innovation in portable and affordable motion capture solutions. Companies focusing on wearable motion capture suits and camera-free systems can tap into the surging adoption of VR/AR, especially in sectors like education, healthcare, and remote work environments.

Integration with AI and Machine Learning

Integrating motion capture data with AI and machine learning offers transformative opportunities. AI-driven analysis can streamline processes such as character animation, biomechanics assessments, and sports performance evaluation. In robotics, motion capture combined with AI improves the design and function of humanoid robots by enabling them to mimic human behavior with precision. McKinsey research in 2023 shows that incorporating AI in motion capture reduces data processing times by up to 40%. Companies investing in AI-enhanced motion capture systems stand to gain a competitive edge by delivering faster, smarter, and more adaptive solutions across multiple industries.

MARKET CHALLENGES

Limited Accessibility in Emerging Markets

The 3D motion capturing market faces challenges in penetrating emerging markets due to limited infrastructure and technical expertise. High equipment costs and insufficient training resources deter adoption in regions such as Southeast Asia and Africa where technological adoption is slower. According to a 2023 World Bank report, less than 20% of production studios in developing economies have access to advanced motion capture technologies. This gap restricts global market expansion with manufacturers struggling to scale operations in price-sensitive markets that lack robust tech ecosystems.

Sensitivity to Environmental Factors

Motion capture systems like optical-based ones are highly sensitive to environmental conditions such as lighting, reflections, and occlusions. For example, outdoor or non-controlled settings can lead to inaccuracies by requiring significant post-processing and manual corrections. A study by TechCrunch (2023) found that 30% of motion capture errors in dynamic environments were due to lighting inconsistencies. Addressing these issues with more adaptive and robust systems is essential for broader applications in real-world scenarios.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

13.40% |

|

Segments Covered |

By Type, System, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vicon Motion Systems Ltd., Qualisys AB, OptiTrack (NaturalPoint, Inc.), Xsens Technologies B.V., Northern Digital Inc. (NDI), Motion Analysis Corporation, Phasespace, Inc., Notch Interfaces, Inc., STT Systems, and Codamotion (Charnwood Dynamics Ltd.) |

SEGMENTAL ANALYSIS

By Type Insights

The hardware segment held the largest share, accounting for approximately 44.4% of the market in 2023. This segment includes essential components such as cameras, sensors, and accessories that are critical for capturing precise motion data. The dominance of hardware is attributed to the necessity of high-quality equipment to achieve accurate and reliable motion capture results, which are indispensable in applications across entertainment, sports, and medical fields. Investments in advanced hardware technologies enhance system performance, thereby driving the prominence of this segment in the market.

The software segment is esteemed to experience a compound annual growth rate (CAGR) of 13.5% during the period of 2024-2032 in the 3D motion Capturing market. This rapid expansion is driven by the increasing demand for sophisticated software solutions that facilitate real-time data processing, animation, and analysis. Advancements in software capabilities enable seamless integration of motion capture data into various applications, enhancing workflow efficiency and broadening the technology's accessibility. The growing emphasis on user-friendly interfaces and compatibility with other digital tools further propels the expansion of the market growth rate in next coming years.

By System Insights

The optical 3D motion capture systems segment was accounted in holding 60% of the 3D motion capturing market share in 2023. These systems utilize multiple high-speed cameras to capture precise and detailed movement data, which makes them essential in applications requiring high accuracy, such as film production, animation, and biomechanics. The superior precision and versatility of optical systems contribute significantly to their market dominance.

The non-optical 3D motion capture systems segment is projected to have a compound annual growth rate (CAGR) of 15.0% during the forecast period 2024 - 2032. This rapid expansion is driven by the increasing adoption of inertial and electromagnetic systems, which offer cost-effective and portable solutions compared to traditional optical setups. Non-optical systems are gaining popularity in fields such as sports science, rehabilitation, and virtual reality. The growing demand for wearable and real-time motion capture technologies further propels the growth of this segment.

By Application Insights

The media and entertainment segment held 35% of the global 3D motion capturing market share in 2023. This dominance is attributed to the extensive use of motion capture technology in film production, gaming, and virtual reality experiences by capturing realistic human movements enhances visual storytelling and user engagement. The industry's continuous pursuit of high-quality animations and special effects further cements this segment's leading position.

The engineering and industrial applications segment is projected to experience the fastest growth, with a compound annual growth rate (CAGR) of 14.5% from 2024 to 2030. This rapid expansion is driven by the increasing adoption of motion capture technology for design prototyping, ergonomic studies, and robotics development. Precise motion analysis facilitates the creation of more efficient and human-centric designs, which also improves both productivity and safety in this field. The integration of motion capture in industrial processes underscores its growing importance beyond traditional entertainment applications.

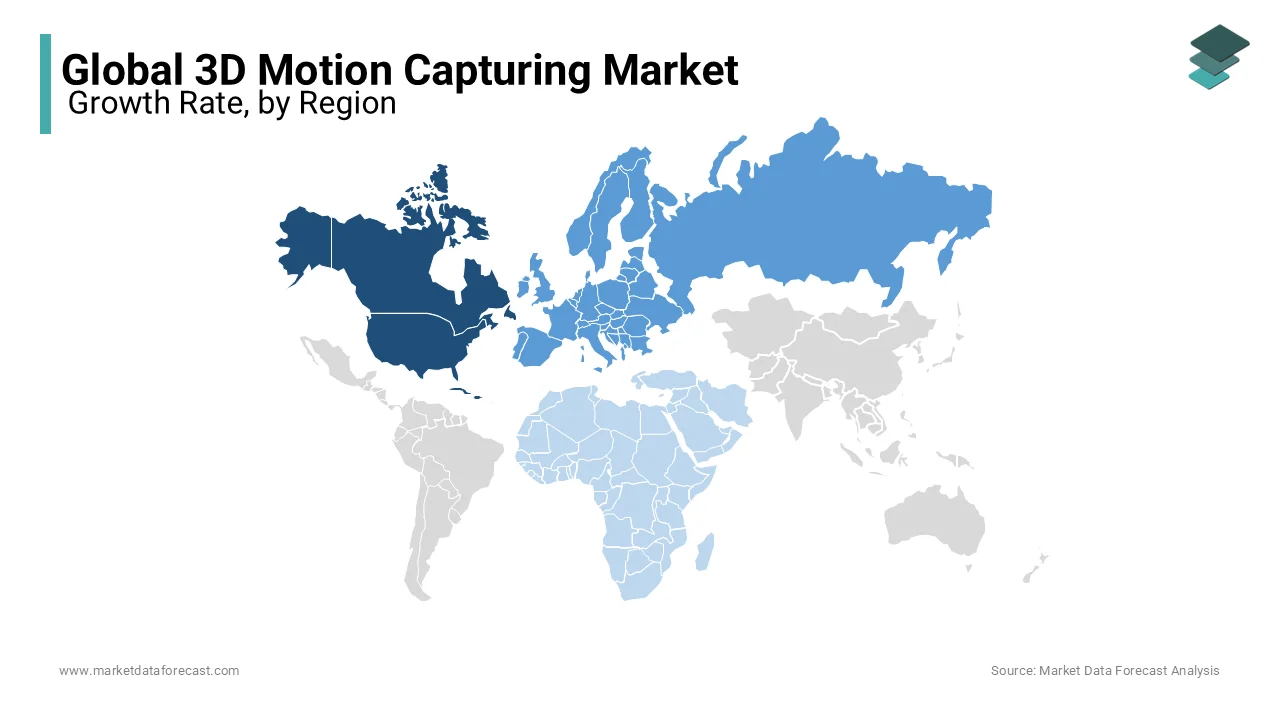

REGIONAL ANALYSIS

North America is dominating with 37% share of global 3D motion capturing market due to its well-established entertainment industry, encompassing film, television, and gaming. Major Hollywood studios heavily invest in motion capture technology for producing blockbuster movies and immersive video games. Furthermore, the region is home to industry leaders and advanced R&D facilities which drives innovation. The U.S 3D motion capturing market is expected to grow at a CAGR of 12.0% from 2024 to 2032. The rapid adoption of the various technological developments in healthcare and sports analytics is deemed to promote the growth rate of the market in US.

Europe is next in leading the prominent share of the market with the adoption of motion capture in diverse industries. Automotive and aerospace sectors leverage this technology for design prototyping and ergonomic studies whereas universities and research institutions integrate motion capture in education and biomechanics. Countries like Germany, France, and the U.K. are leading contributors, supported by government initiatives and private sector investments.

Asia-Pacific is projected to reach a CAGR of 14.5% from 2024 to 2032. The region's growth is driven by its thriving gaming and entertainment industries in emerging countries like China, Japan, and India. The technology's applications in healthcare for rehabilitation and surgical planning is augmented to boost the growth rate of the market. Increasing investments in virtual reality (VR) and augmented reality (AR) also boost adoption in the region.

Latin America is likely to showcase promising growth rate in 3D motion capturing market. The adoption of motion capture in media and entertainment is gaining momentum in Brazil and Mexico. Industrial applications such as motion analysis for safety and productivity in manufacturing are emerging as key growth drivers in this region. The market size is steadily increasing as awareness of motion capture technology spreads.

The Middle East and Africa hold a smaller share of the global market but are experiencing steady growth. The adoption of motion capture is driven by increasing investments in education, healthcare, and budding entertainment industries. For example, countries like South Africa and the UAE are exploring motion capture's potential in sports performance analytics and medical applications. Infrastructure challenges remain a barrier but gradual improvements are expected to support further adoption.

COMPETITIVE LANDSCAPE

The 3D motion capturing market is highly competitive, characterized by the presence of established players and emerging companies vying for market share through innovation and technological advancements. Industry leaders like Vicon Motion Systems, Qualisys, and OptiTrack dominate with their extensive portfolios of high-precision optical motion capture systems, catering to entertainment, sports, and medical applications. These companies leverage strong research and development capabilities to maintain a competitive edge, offering cutting-edge hardware and software solutions.

Emerging players, such as Notch Interfaces and Codamotion, are disrupting the market with portable, cost-effective, and user-friendly systems. They focus on accessibility, targeting smaller production houses, educational institutions, and independent creators. The increasing integration of AI and machine learning into motion capture systems is a significant trend, allowing companies to enhance data analysis, reduce processing time, and expand application areas.

Competitive differentiation often comes through partnerships and industry collaborations. For example, many companies partner with gaming studios, film production houses, and healthcare institutions to develop tailored solutions. Additionally, the rise of virtual and augmented reality applications has intensified competition, with players striving to meet the growing demand for immersive experiences. As technology evolves, competition in the market is expected to become even more dynamic and innovation-driven.

KEY MARKET PLAYERS

- Vicon Motion Systems Ltd.

- Qualisys AB

- OptiTrack (NaturalPoint, Inc.)

- Xsens Technologies B.V.

- Northern Digital Inc. (NDI)

- Motion Analysis Corporation

- Phasespace, Inc.

- Notch Interfaces, Inc.

- STT Systems

- Codamotion (Charnwood Dynamics Ltd.)

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Vicon Motion Systems Ltd. launched the Valkyrie motion capture system, offering high-speed, high-resolution cameras. This development is anticipated to enhance their product offerings and meet the growing demand for precise motion capture.

- In March 2023, OptiTrack (NaturalPoint, Inc.) introduced the Active Puck Mini, a compact tracking device. This product launch aims to cater to the increasing integration of motion capture in virtual reality applications.

- In April 2023, Qualisys AB released the Miqus Hybrid system, combining marker-based and markerless technologies. This product is expected to provide flexible solutions for a broader range of applications.

- In May 2023, Motion Analysis Corporation introduced the Kestrel digital camera series, enhancing system accuracy and efficiency. This release strengthens their position in high-precision motion capture systems.

- In June 2023, PhaseSpace, Inc. developed the Impulse X2E system, featuring enhanced LED tracking for real-time applications. This is anticipated to advance their real-time motion capture capabilities.

- In July 2023, Notch Interfaces, Inc. launched an updated motion capture suit, improving sensor accuracy and user comfort. This update is expected to enhance user experience and attract a broader customer base.

- In August 2023, STT Systems introduced a new range of inertial motion capture systems. This expansion diversifies their offerings and targets demand for portable solutions.

- In September 2023, Codamotion (Charnwood Dynamics Ltd.) released a software update for better third-party integration. This update is expected to improve workflow versatility for users.

- In October 2023, Noraxon USA Inc. partnered with a leading sports science institute to develop specialized motion capture solutions for athletic analysis. This collaboration aims to expand their reach in sports performance applications.

MARKET SEGMENTATION

This research report on the 3d motion capturing market is segmented and sub-segmented based on the type, system, application, and region.

By Type

-

Hardware

- Cameras

- Sensors

- Accessories

- Software

- Services

By System

- Optical 3D Motion Capture Systems

- Active 3D Motion Capture Systems

- Passive 3D Motion Capture Systems

- Non-optical 3D Motion Capture Systems

- Inertial 3D Motion Capture Systems

- Electromagnetic 3D Motion Capture Systems

- Motorized 3D Motion Capture Systems

By Application

- Biomechanical Research and Medical

- Media and Entertainment Engineering

- Industrial Applications

- Education

By Region

- North America

- Europe

- South America

- Asia-Pacific

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the 3D motion capturing market globally?

The primary drivers include the rising demand for realistic animations in gaming and movies, advancements in wearable technologies, the integration of AI in motion tracking, and increasing use in physical therapy and sports analysis. Additionally, the growth of virtual and augmented reality applications is creating a significant boost.

Which industries are the largest consumers of 3D motion capturing technologies?

Entertainment, especially gaming and filmmaking, leads the market. Healthcare follows, where motion capturing is used for biomechanics, rehabilitation, and physical therapy. Sports performance analysis, robotics, and academic research are other key areas.

What are the latest technological advancements in the 3D motion capturing market?

Recent advancements include markerless motion capturing systems, real-time data processing, and cloud-based platforms for motion data analysis. Improvements in sensor technology and AI integration are also enabling more accurate and efficient capturing.

What are the key market trends shaping the future of 3D motion capturing?

Emerging trends include increased adoption of markerless systems, growing demand for wearable motion capture solutions, and the rise of virtual reality and mixed-reality applications. The use of motion capturing in sports and healthcare is also expanding rapidly.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]