Global 3D Cell Culture Market Size, Share, Trends & Growth Forecast Report By Product, Application, End-Users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global 3D Cell Culture Market Size

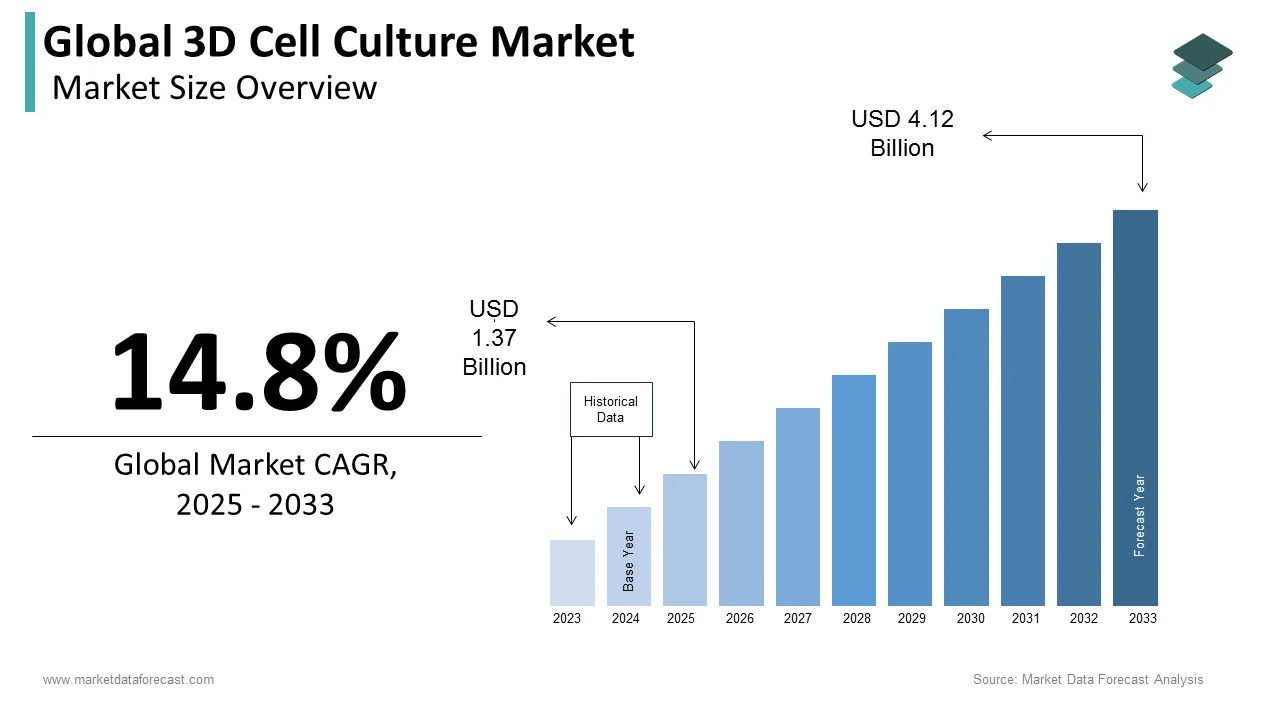

The global 3D cell culture market was valued at USD 1.2 billion in 2024. The global market is projected to grow from USD 1.37 billion in 2025 to reach USD 4.12 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 14.8% from 2025-2033.

MARKET DRIVERS

The rising adoption of 3D cell culture methods in drug discovery and development and the rising demand for personalized medicine primarily drives the 3D cell culture market growth. Accurate results and effective treatments can be formulated by growing individual cells and tissues unique to each patient in 3D cell culture models. In addition, the increasing prevalence of chronic diseases such as cancer, diabetes and heart disease highlights the need for the creation of novel drugs and therapies. 3D cell culture models can play a crucial role in this process by providing assistance, thereby leading to the growth of the market.

The surge in investments from governmental and non-governmental organizations boosts the growth rate of the 3D cell culture market. Companies have been investing heavily in the development of 3D cell cultures for cancer research. This is a positive development for the field as 3D cell culture has the ability to replicate in vivo characteristics, which is critical for the development of precision medicine and increases the chances of achieving positive research outcomes. Furthermore, the use of 3D culture for drug efficiency testing is expected to have a positive impact on cancer research and drive the 3D cell culture market growth. Researchers prefer 3D cell cultures over 2D cell cultures due to the superior results they provide, increasing investments from the key market participants in the 3D cell culture market and further supporting market growth.

Furthermore, rapidly evolving technology like 3D printing, microfabrication, and biomaterials are making it possible to make 3D cell culture models that are more complicated and lifelike, supporting the rise of the market. The rising focus on finding ethical ways of research which do not use animals as mediums for drug development is promoting market growth. Drug development procedures through animals have a high risk of hurting the animals in the procedure and are also difficult to test for human efficacy. Therefore, the advanced ways of 3D cell culture are expected to help replace this procedure supporting the growth of the market.

MARKET RESTRAINTS

Compared to standard 2D cell culture items, the price of 3D cell culture products including scaffolds, medium, and reagents can be much more expensive, which may prevent their use in some applications, leading to a drawback to the market growth. Additionally, the lack of standardization in 3D cell culture procedures and models can make it difficult to be compared with the results of various other research or laboratories and this can be a problem because comparing data can be useful in identifying patterns and trends, therefore, posing as a restraint to growth. Furthermore, the presence of multiple growth factors in scaffolds results in batch-to-batch variation, which impedes biological studies of signaling pathways and other investigations causing confusing results which can be difficult to decipher for less aware researchers. Therefore, the widespread adoption and commercialization of 3D cell culture may be hindered by the fact that many researchers and industry experts are unaware of the technology or its uses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.8% |

|

Segments Covered |

By Product, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

MIMETAS, Hamilton Company, CN Bio, Advanced BioMatrix, Merck KGaA, REPROCELL Incorporated, Thermo Fisher Scientific, 3D Biotek, Lonza AG, Corning Incorporated, TissUse, PromoCell, InSphero, and Synthecon., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the scaffold-based segment had the largest share of the global market in 2023 and is expected to showcase the highest CAGR over the forecast period. The growing adoption of regenerative medicine and tissue engineering applications where scaffold-based 3D cultures are crucial for creating functional tissues is one of the major factors propelling segmental growth. The growing demand for more accurate and predictive in vitro models for drug discovery and toxicity testing as scaffold-based cultures better recapitulate the complexity of native tissues, further driving segmental growth. Ongoing advancements in scaffold materials such as the development of biocompatible and biodegradable materials to enhance cell viability and functionality contribute to segmental growth.

The scaffold-free segment is predicted to occupy a considerable share of the global market during the forecast period. The ease of use and simplified protocols compared to scaffold-based cultures majorly drive segmental growth. Rising interest in organoid cultures and an increasing number of advancements in bioprinting and microfabrication technologies further boost the segment’s growth rate.

By Application Insights

Based on application, the cancer and stem cell research segment is expected to dominate the market during the forecast period. The growing prevalence of cancer, the rising need for more accurate and predictive models for drug discovery and testing and increasing interest in personalized medicine and precision oncology where 3D cell cultures can be used to create patient-specific models for drug screening and treatment majorly propel segmental growth. The growing number of advancements in stem cell research where 3D cultures can be used to generate more complex and functional tissues for regenerative medicine applications further boost segmental growth.

The tissue engineering and regenerative medicine segment are also expected to support the market's growth. The rising prevalence of chronic diseases and injuries that require tissue replacement or regeneration, advancements in bioprinting and scaffold materials and rising interest in cell-based therapies where 3D cell cultures can be used to generate large quantities of cells for transplantation contributes to the segmental growth.

By End User Insights

Based on the end user, the pharmaceutical & biotechnology companies segment accounted for a major share of the global 3D cell culture market in 2023. The segmental domination is likely to continue throughout the forecast period. The growing demand for more physiologically relevant cell models in drug discovery and rising emphasis on personalized medicine and the need for patient-specific models for drug screening and development. The growing adoption of 3D cell culture technologies by pharmaceutical and biotechnology companies as a cost-effective and efficient approach for early-stage drug testing and reducing drug attrition rates further boosts the segment’s growth rate.

On the other hand, the research institutes segment is predicted to witness a healthy CAGR during the forecast period and capture a substantial share of the global market. The growing adoption of 3D cell culture techniques in their studies due to the continuous advancements in 3D cell culture technologies and their applications, which is majorly driving segmental growth. The availability of funding for research projects focused on developing and utilizing 3D cell culture models and the increasing number of collaborations between research institutes and pharmaceutical companies further promote segmental growth.

REGIONAL ANALYSIS

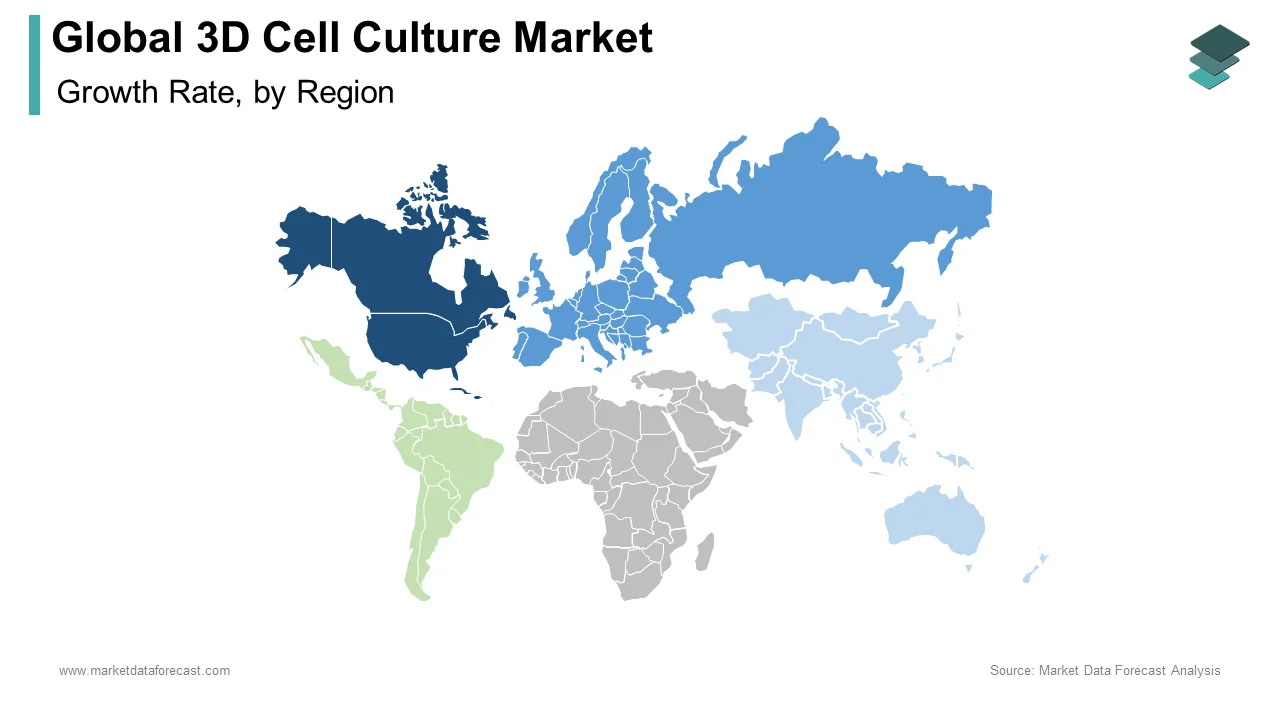

North America held the largest share of 40.8% of the worldwide market in 2023. The domination of the North American region is predicted to continue throughout the forecast period. The increased adoption of 3D cell culture models in the research and development activities in the pharmaceutical and biotechnology sectors, the presence of leading players and technology developers in the 3D cell culture market, strong support from government and regulatory bodies for the development and adoption of advanced cell culture technologies, rising demand for personalized medicine and increasing focus on precision oncology majorly drive the 3D cell culture market growth in North America. The availability of well-established healthcare infrastructure, advanced research facilities and a strong presence of pharmaceutical and biotechnology companies boost the growth rate of the North American market. The U.S. led the market in the North American market in 2023 and the U.S. market is also expected to grow at a healthy CAGR during the forecast period due to factors such as the presence of pharmaceutical and biotechnology companies and advanced research facilities.

Europe is another noteworthy regional market for 3D cell culture and is predicted to account for a substantial share of the worldwide market during the forecast period. The growing investments to conduct R&D activities by pharmaceutical companies and academic institutions and increasing adoption of 3D cell culture technologies in drug discovery, toxicology testing, and tissue engineering applications primarily propel the European market growth. The growing number of initiatives from the European governments to promote regenerative medicine and tissue engineering research and an increasing number of collaborations and partnerships between research organizations, market participants and regulatory bodies to promote innovation and standardization in the 3D cell culture field further promote the European market growth. Germany and the UK captured the leading share of the European market in 2023.

APAC is the most lucrative regional market for 3D cell culture worldwide and is anticipated to witness the fastest CAGR during the forecast period. The rapidly growing pharmaceutical and biotechnology sectors in countries like China, India and South Korea, the growing investments for stem cell research and regenerative medicine that use 3D cell culture technologies, increasing awareness, demand for advanced in vitro models for drug screening and personalized medicine and the growing number of initiatives from the governments of APAC countries to promote R&D in the life sciences industry majorly propel the regional market growth.

KEY PLAYERS IN THE MARKET

Some of the key market participants leading the Global 3D Cell Culture Market profiled in this report are MIMETAS, Hamilton Company, CN Bio, Advanced BioMatrix, Merck KGaA, REPROCELL Incorporated, Thermo Fisher Scientific, 3D Biotek, Lonza AG, Corning Incorporated, TissUse, PromoCell, InSphero, and Synthecon.

RECENT MARKET DEVELOPMENTS

- In January 2023, With the aim to stimulate layered tissue structures and help researchers in achieving an organotypic co-culture, scaffold-based technologies are being introduced by CD BioSciences, a biotechnology company mainly based in the US. Furthermore, the company aims to provide better 3D cell culture solutions with the help of these scaffold structures.

- In January 2023, STC-1010, a collaborative project between Brenus Pharma and InSphero AG, claims to be a first-in-class allogeneic cell vaccine against cancer and has received a €1.5 million grant from the Eurostars fund. In addition, the project plans on using a 3d cell culture to develop novel cell immunotherapy for colorectal cancer.

- In January 2023, "Best Use of Artificial Intelligence in BioTech 2022," an award that is granted by BioTech Breakthrough Awards to companies for exceptional efforts ad use of AI along with pursuing high-grade Biotechnologies, was presented to Known Medicine, a rising biotechnology company for its various achievements like building the world’s largest 3D cell culture dataset.

- In January 2020, Advanced BioMatrix acquired the System line of products from Lineage Cell Therapeutics. System kits are built on new hyaluronic acid technology. This acquisition involves shifting applied sciences and intellectual property for research and development purposes.

- In April 2019, MIMETAS announced the launch of its new laboratory associated with the 3D microfluidic cell culture device OrganoPlate. The start of the new laboratory provides MIMETAS with new dimensions for growth. The OrganoPlate bears the 3D cell culture under steady intromission.

- In March 2017, Greiner Bio-One united with Nano3D Biosciences to bring up a new perimeter in biotechnology by acquiring products from 3D cell culture. This collaboration works to oblige the physical utilization of growing cell cultures that offer benefits to increase exploratory outcomes.

MARKET SEGMENTATION

This research report on the global 3D cell culture market has been segmented and sub-segmented based on the product, application, end-user and region.

By Product

- Scaffold-based 3D Cell Cultures

- Hydrogels/ECM Analogs

- Solid Scaffolds

- Micropatterned Surfaces

- Scaffold-free 3D Cell Cultures

- Low Attachment Plates

- Hanging Drop Plates

- 3D Bioreactors

- 3D Petri Dishes

- Microfluidics-based

- Magnetic & Bio printed

By Application

- Cancer & Stem Cell Research

- Drug Discovery & Toxicology Testing

- Tissue Engineering & Regenerative Medicine

By End User

- Pharmaceutical & Biotechnology Companies

- Research Institutes

- Cosmetics Industry

- Other End Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key driving factors behind the growth of the 3D cell culture market?

Factors such as the need for more accurate and predictive models for research and drug discovery, advancements in cell culture techniques, the rising demand for personalized medicine and regenerative therapies majorly drive the 3D cell culture market growth.

Which end users are driving the demand for 3D cell culture technologies?

The key end users driving the demand for 3D cell culture technologies include pharmaceutical and biotechnology companies, research institutes, the cosmetics industry, and other sectors such as food and beverages, environmental testing, and agriculture.

What are the unique growth factors and trends in the North American 3D cell culture market?

The North American 3D cell culture market is driven by factors such as a well-established pharmaceutical and biotechnology industry, advanced research infrastructure, strong funding support, and the increasing demand for personalized medicine and regenerative therapies.

How is the 3D cell culture market evolving in Europe?

In Europe, the 3D cell culture market is experiencing growth due to factors such as increasing investments in research and development, the adoption of 3D cell culture models for drug discovery and toxicity testing, and regulatory pressures to reduce animal testing.

What are the growth opportunities and challenges in the Asia Pacific 3D cell culture market?

The Asia Pacific 3D cell culture market is growing due to factors such as a large population, increasing healthcare expenditure, expanding pharmaceutical and biotechnology industries, and a growing focus on research and development. However, challenges such as the need for skilled researchers and competition from established markets exist.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]